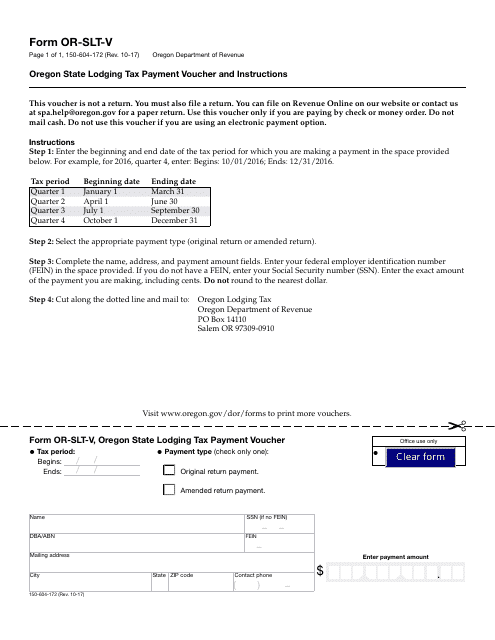

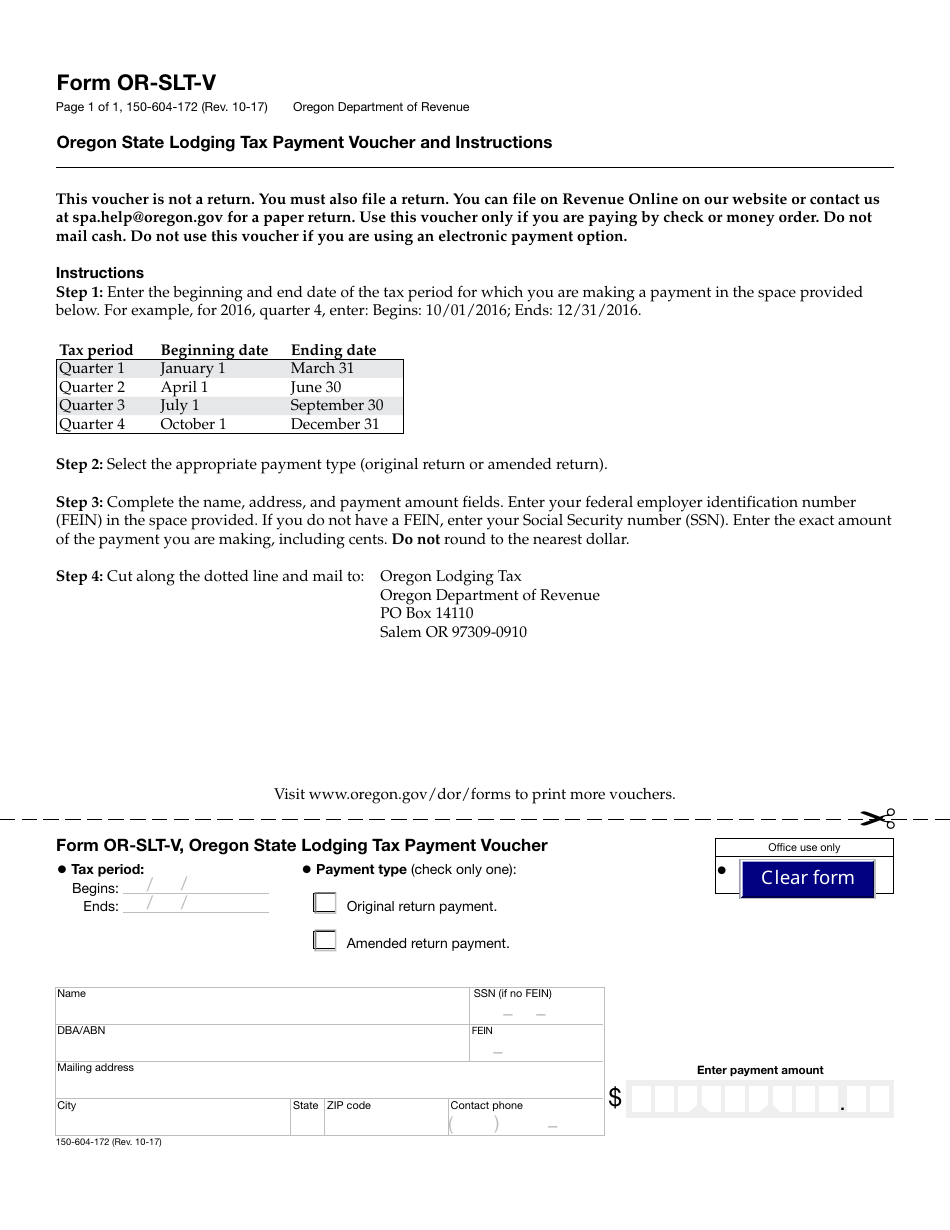

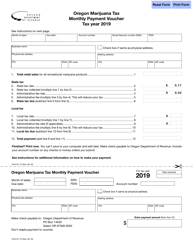

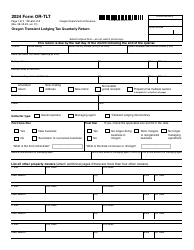

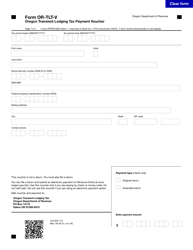

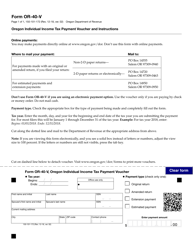

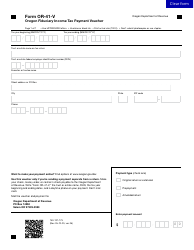

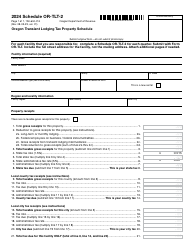

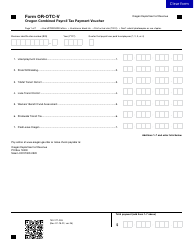

Form OR-SLT-V Oregon State Lodging Tax Payment Voucher and Instructions - Oregon

What Is Form OR-SLT-V?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the OR-SLT-V form?

A: The OR-SLT-V form is used to make lodging tax payments in the state of Oregon.

Q: Who needs to file the OR-SLT-V form?

A: Any individual or business that operates a lodging establishment in Oregon and is required to collect lodging taxes needs to file the OR-SLT-V form.

Q: How often do I need to file the OR-SLT-V form?

A: The OR-SLT-V form should be filed on a monthly basis.

Q: What information do I need to include on the OR-SLT-V form?

A: You will need to include your business information, total taxable lodging sales, the amount of taxes collected, and your payment information.

Q: When is the deadline for filing the OR-SLT-V form?

A: The OR-SLT-V form and payment are due by the last day of the month following the reporting period.

Q: What is the penalty for late filing of the OR-SLT-V form?

A: The penalty for late filing of the OR-SLT-V form is 5% of the tax due for each month or part of a month that the form is late.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-SLT-V by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.