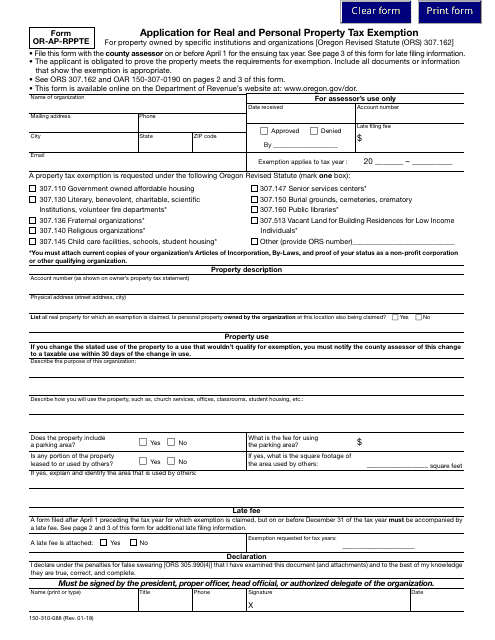

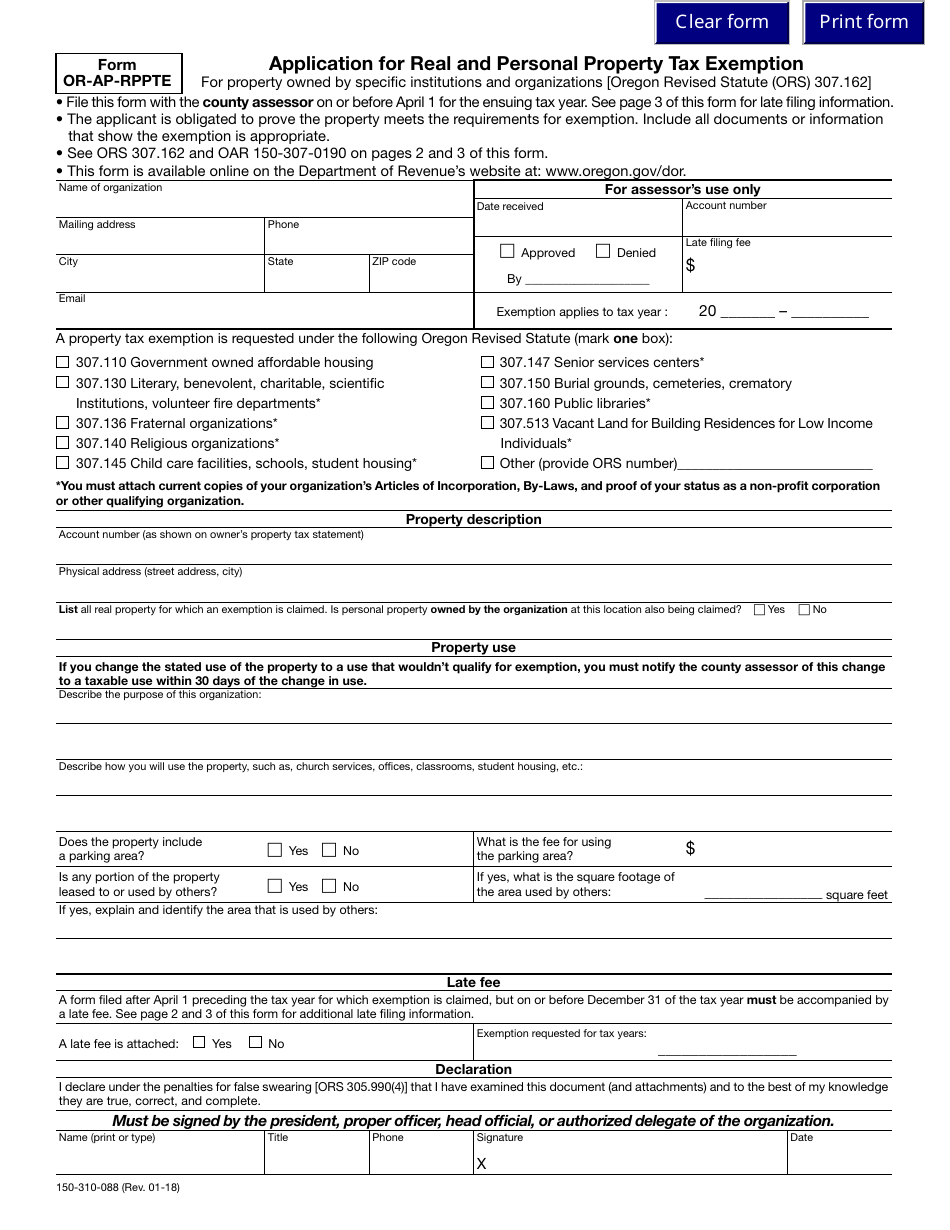

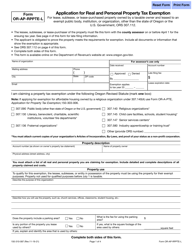

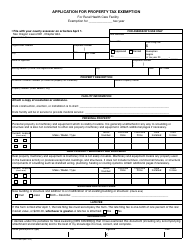

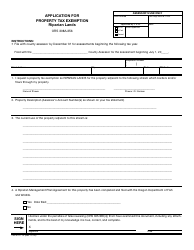

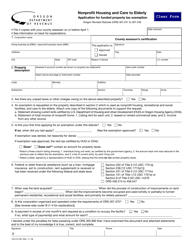

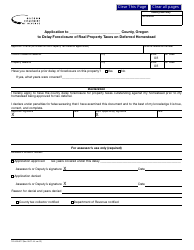

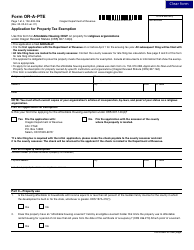

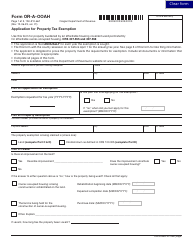

Form OR-AP-RPPTE Application for Real and Personal Property Tax Exemption - Oregon

What Is Form OR-AP-RPPTE?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-AP-RPPTE?

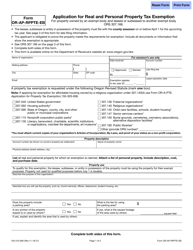

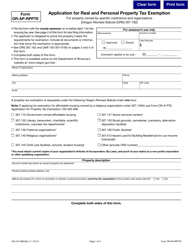

A: OR-AP-RPPTE is an application used in Oregon to apply for real and personal property tax exemption.

Q: Who can use OR-AP-RPPTE?

A: Any individual or organization seeking a property tax exemption in Oregon can use OR-AP-RPPTE.

Q: What is the purpose of the application?

A: The purpose of OR-AP-RPPTE is to apply for exemption from property taxes on real and personal property in Oregon.

Q: Are there any fees associated with the application?

A: No, there are no fees associated with submitting OR-AP-RPPTE.

Q: Are there any eligibility criteria for property tax exemption?

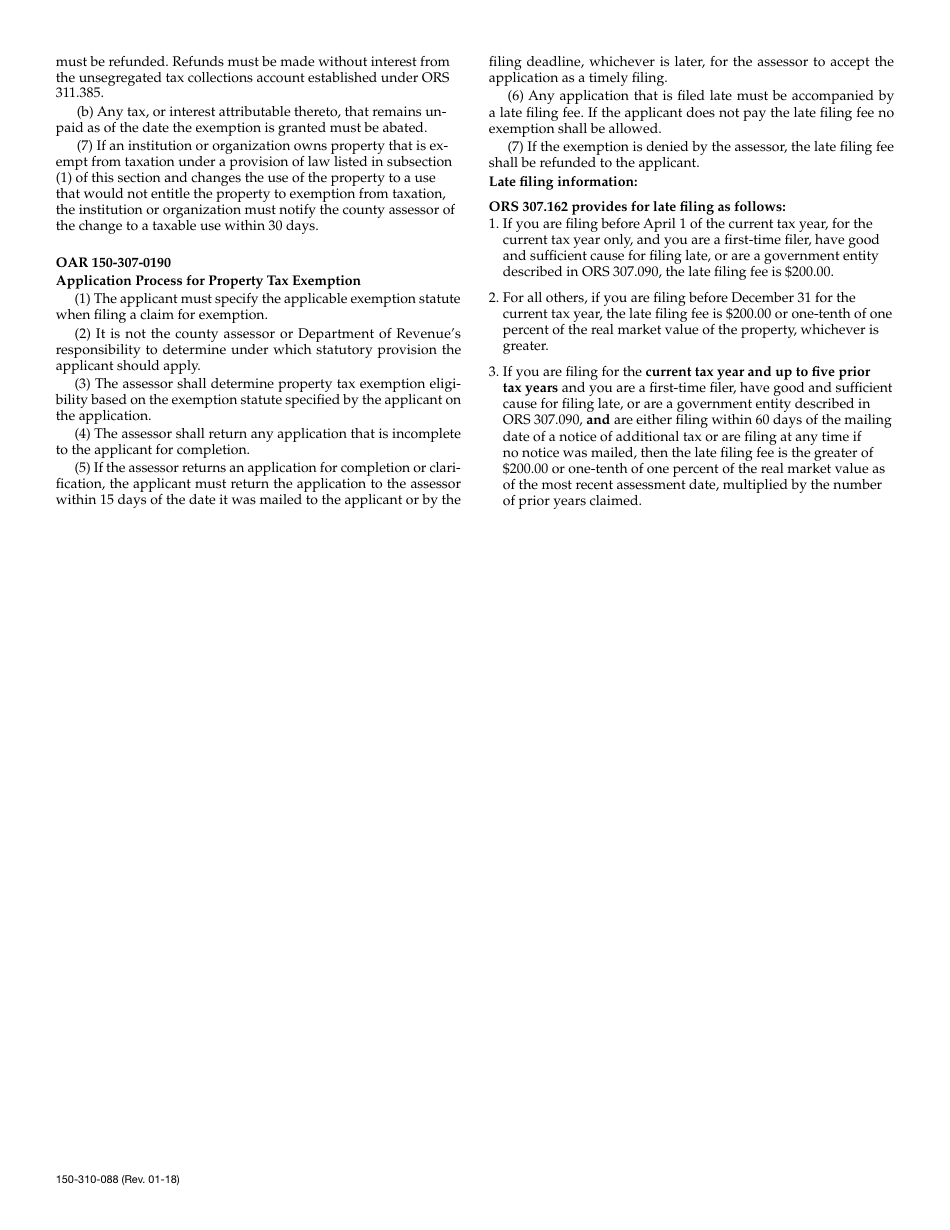

A: Yes, there are specific eligibility criteria outlined in the instructions of OR-AP-RPPTE.

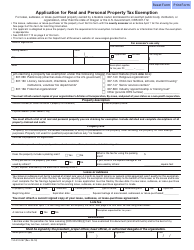

Q: How should I submit the completed application?

A: You can submit the completed OR-AP-RPPTE application by mail or electronically.

Q: How long does it take to process the application?

A: Processing times may vary, but you can expect a decision within a few weeks of submitting the application.

Q: What should I do if I have questions or need assistance with the application?

A: If you have questions or need assistance, you can contact the Oregon Department of Revenue for guidance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-AP-RPPTE by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.