This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-800-065

for the current year.

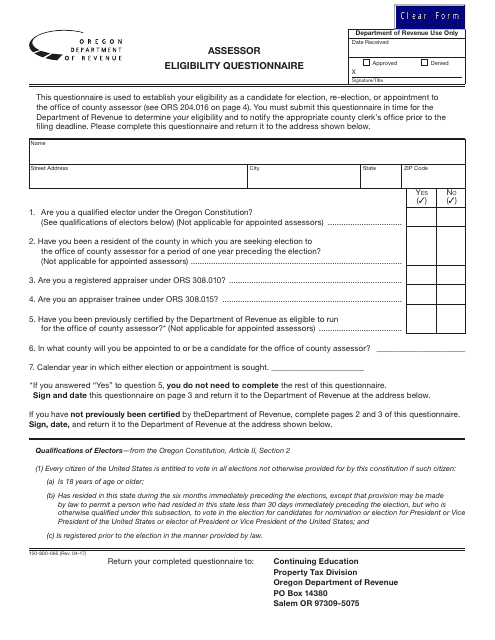

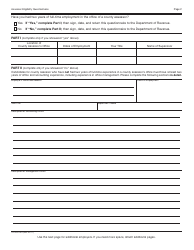

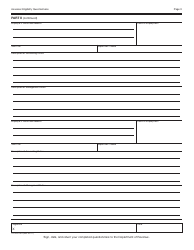

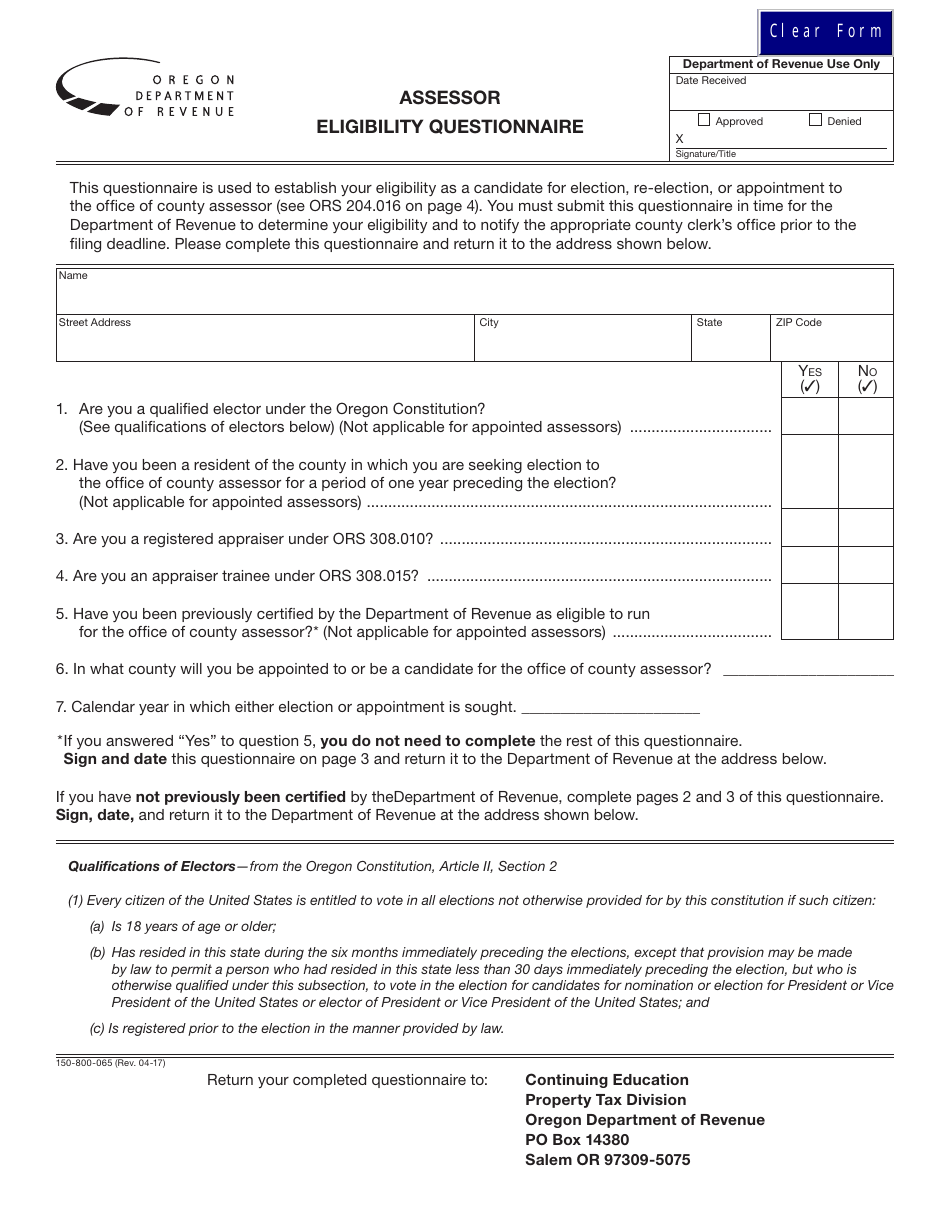

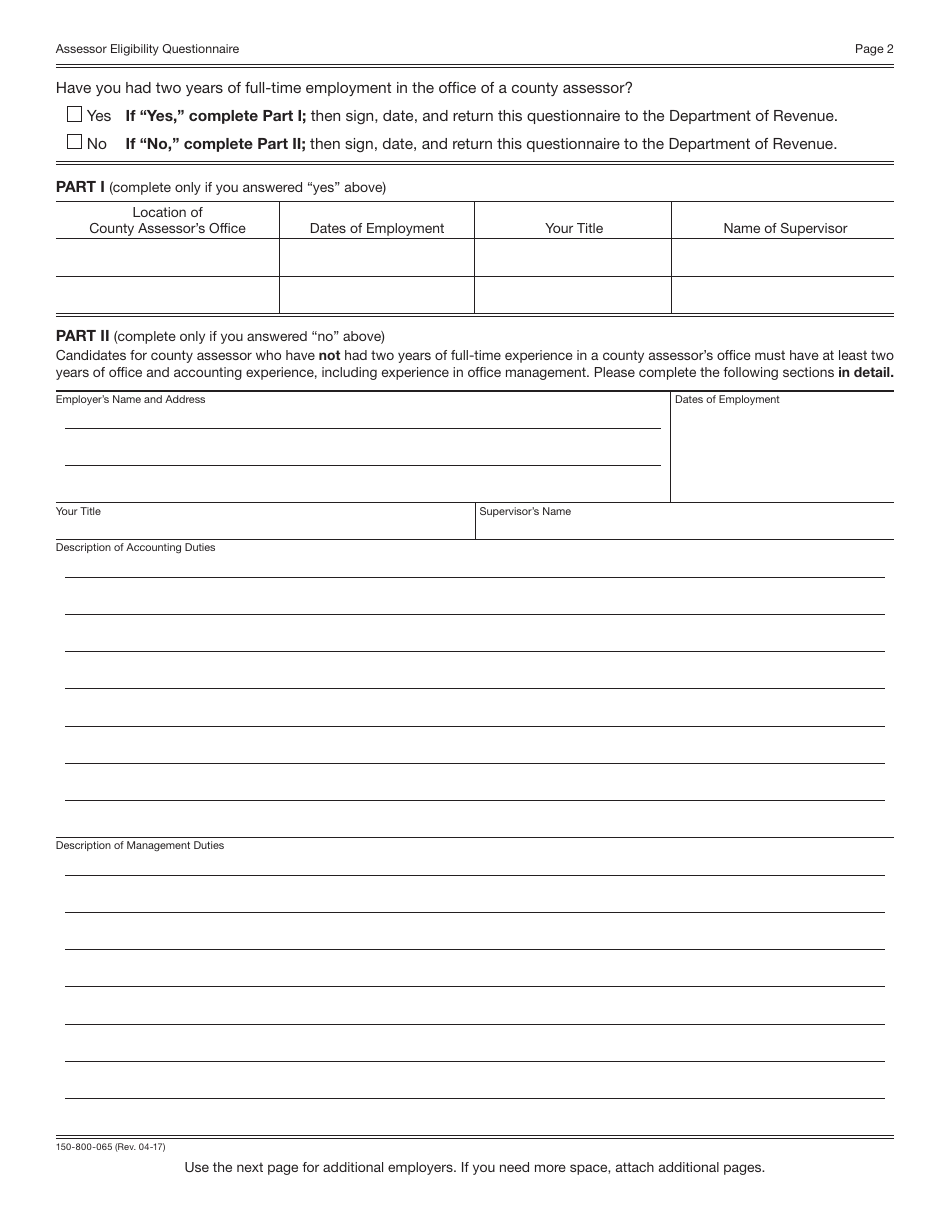

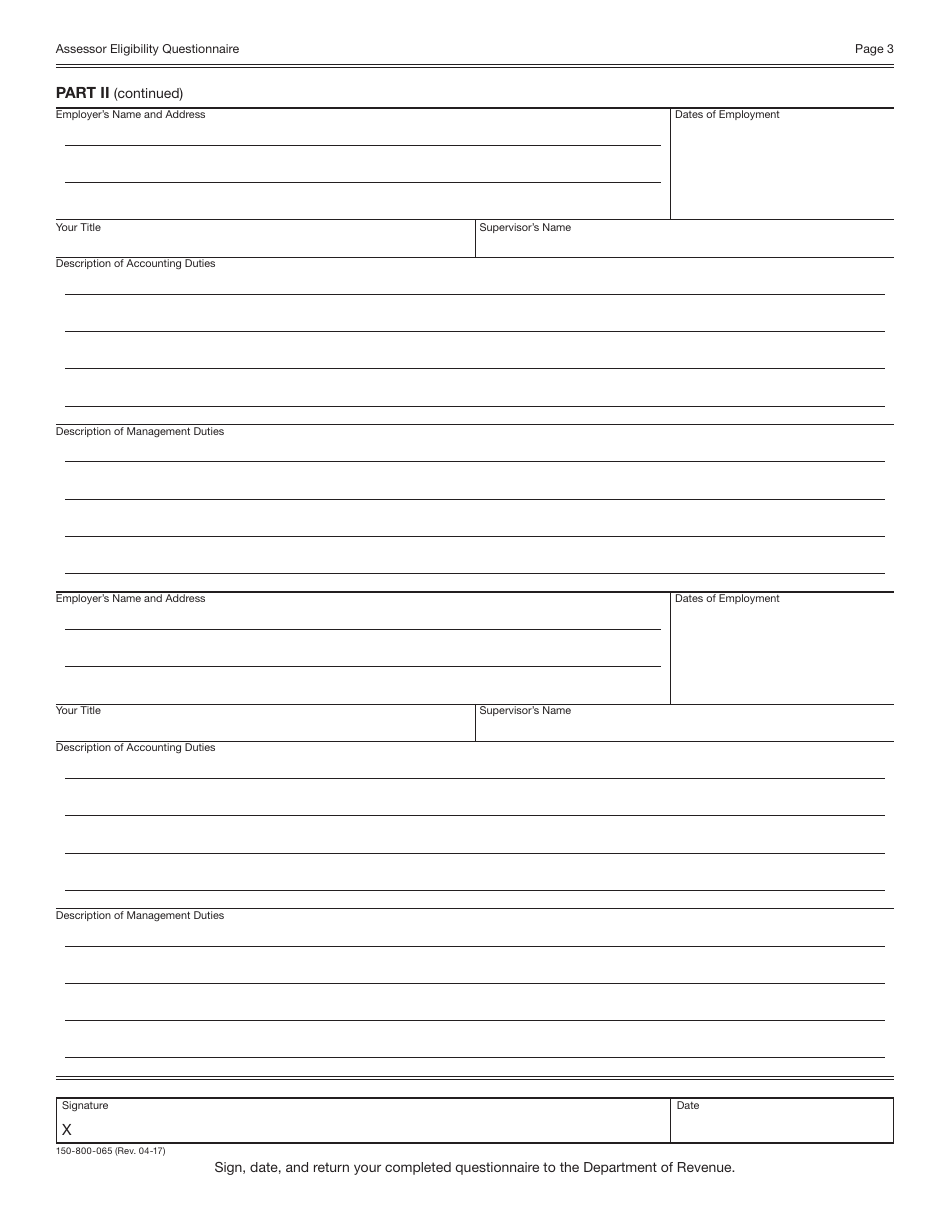

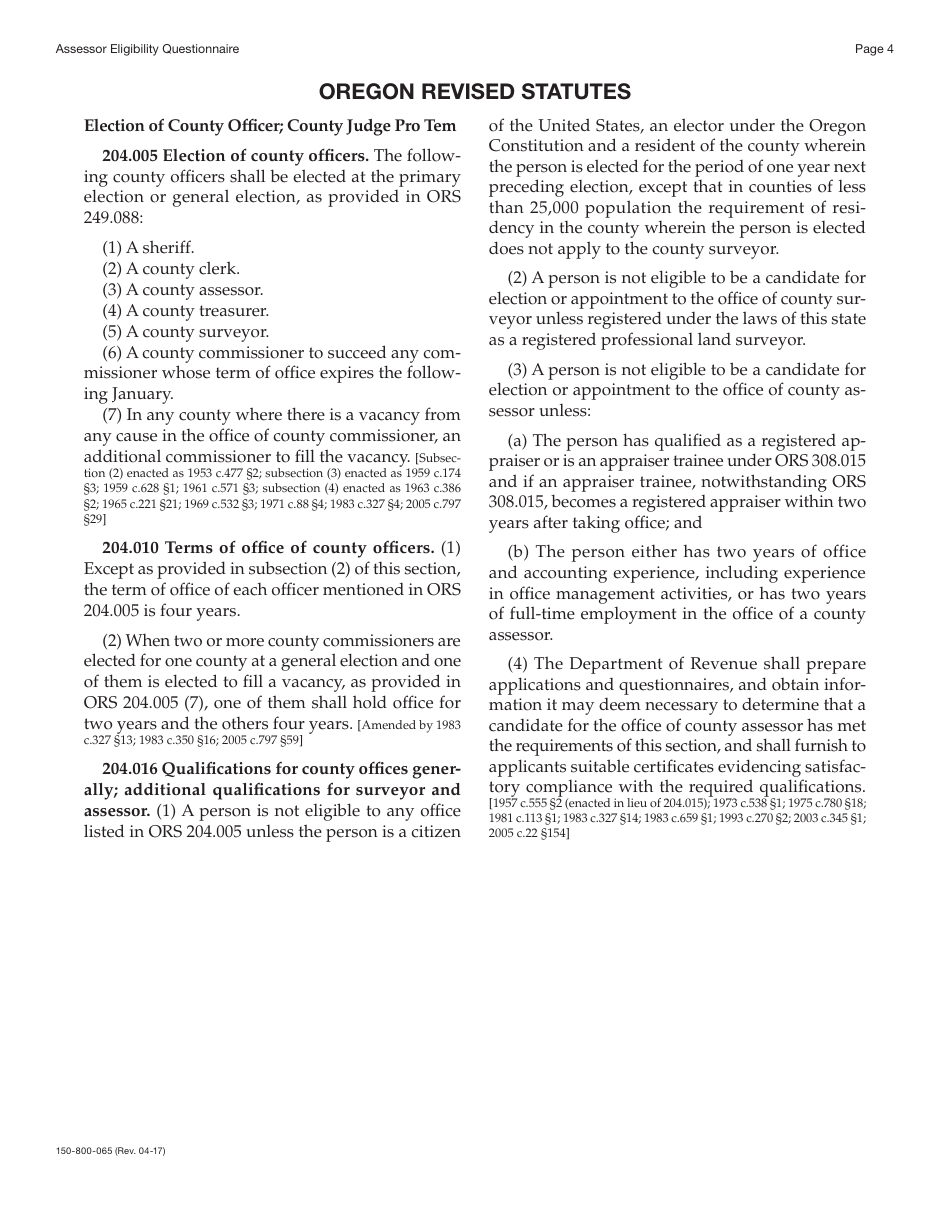

Form 150-800-065 Assessor Eligibility Questionnaire - Oregon

What Is Form 150-800-065?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-800-065?

A: Form 150-800-065 is the Assessor Eligibility Questionnaire in Oregon.

Q: Who is required to complete Form 150-800-065?

A: Assessors in Oregon are required to complete Form 150-800-065.

Q: What is the purpose of Form 150-800-065?

A: The purpose of Form 150-800-065 is to determine the eligibility of assessors in Oregon.

Q: Is Form 150-800-065 specific to Oregon?

A: Yes, Form 150-800-065 is specific to Oregon and is used for assessor eligibility in the state.

Q: Are there any fees associated with Form 150-800-065?

A: No, there are no fees associated with Form 150-800-065.

Q: What happens after I submit Form 150-800-065?

A: After you submit Form 150-800-065, it will be reviewed by the Oregon Department of Revenue to determine your eligibility.

Q: Can I appeal a decision made based on Form 150-800-065?

A: Yes, you can appeal a decision made based on Form 150-800-065 by following the appeals process outlined by the Oregon Department of Revenue.

Q: How often do I need to complete Form 150-800-065?

A: The frequency at which you need to complete Form 150-800-065 depends on the requirements set by the Oregon Department of Revenue. It is recommended to regularly check for any updates or changes to the eligibility questionnaire.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-800-065 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.