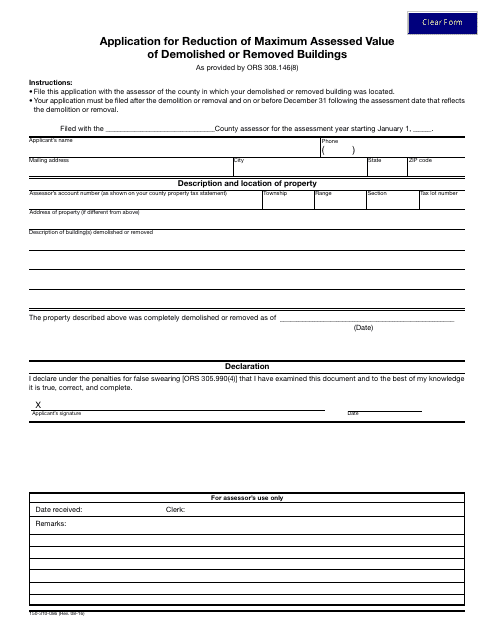

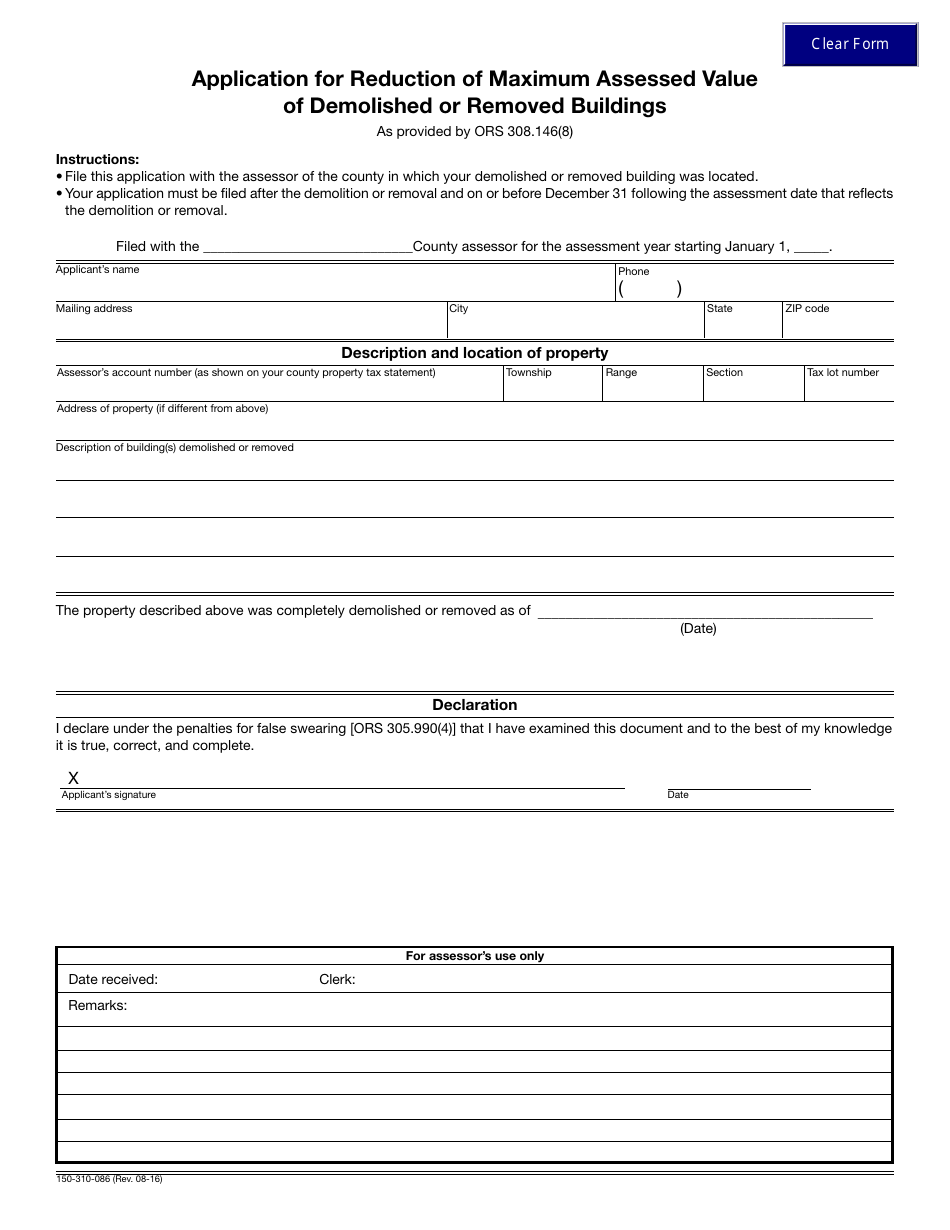

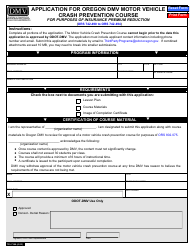

Form 150-310-086 Application for Reduction of Maximum Assessed Value of Demolished or Removed Buildings - Oregon

What Is Form 150-310-086?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 150-310-086?

A: Form 150-310-086 is the application for reduction of maximum assessed value of demolished or removed buildings in Oregon.

Q: What is the purpose of form 150-310-086?

A: The purpose of form 150-310-086 is to request a reduction in the maximum assessed value of buildings that have been demolished or removed.

Q: Who can use form 150-310-086?

A: Anyone who has demolished or removed a building in Oregon and wants to apply for a reduction in the maximum assessed value can use form 150-310-086.

Q: How does form 150-310-086 work?

A: Form 150-310-086 allows property owners to provide information about the demolished or removed building and request a reduction in the maximum assessed value based on that information.

Q: Are there any fees associated with form 150-310-086?

A: There are no fees associated with submitting form 150-310-086.

Q: When should I submit form 150-310-086?

A: Form 150-310-086 should be submitted within 30 days of the demolition or removal of the building.

Q: What happens after I submit form 150-310-086?

A: After submitting form 150-310-086, the Oregon Department of Revenue will review the application and determine if a reduction in the maximum assessed value is warranted.

Q: Can I appeal the decision on form 150-310-086?

A: Yes, if you disagree with the decision on form 150-310-086, you have the right to appeal the decision to the Oregon Tax Court.

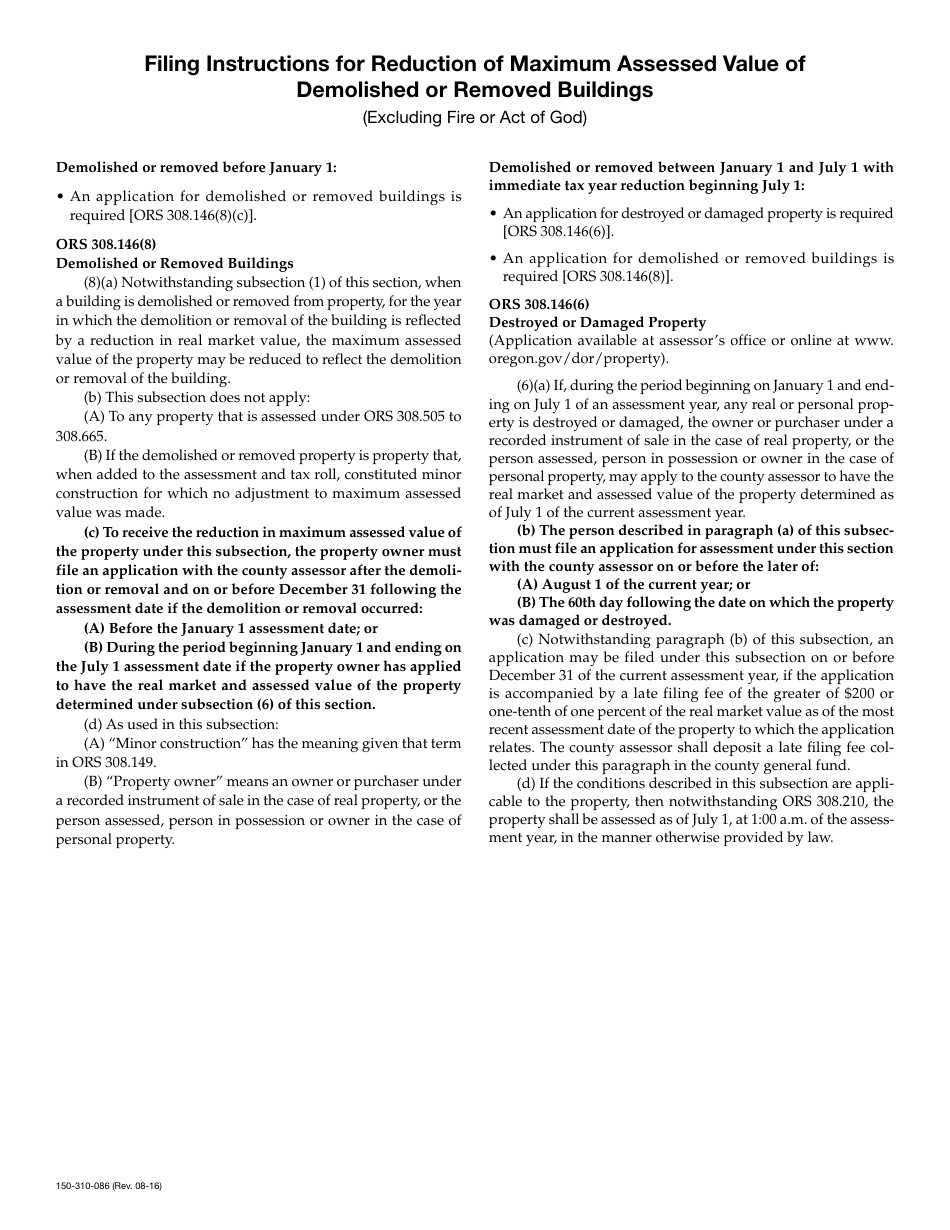

Q: Are there any other requirements or considerations for form 150-310-086?

A: Yes, you must include supporting documentation and meet certain criteria outlined in the form instructions to be eligible for a reduction in the maximum assessed value.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-310-086 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.