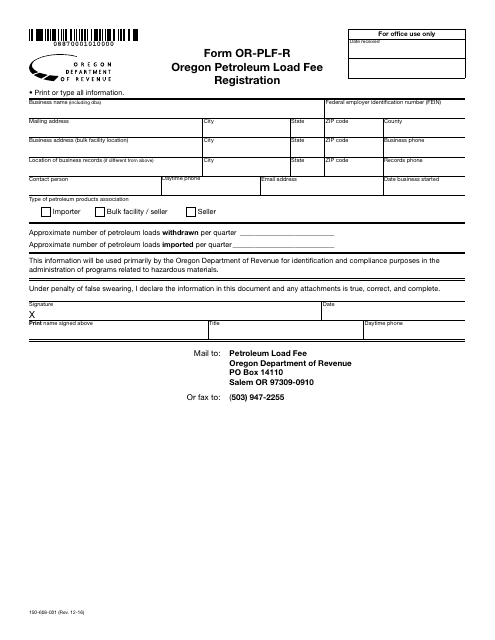

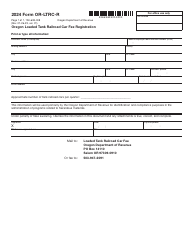

Form OR-PLF-R Oregon Petroleum Load Fee Registration - Oregon

What Is Form OR-PLF-R?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-PLF-R?

A: Form OR-PLF-R is the Oregon Petroleum Load Fee Registration form.

Q: What is the purpose of Form OR-PLF-R?

A: The purpose of Form OR-PLF-R is to register for the Oregon Petroleum Load Fee.

Q: Who needs to file Form OR-PLF-R?

A: Any person or entity engaged in the transportation or storage of taxable petroleum products in Oregon needs to file Form OR-PLF-R.

Q: What is the Oregon Petroleum Load Fee?

A: The Oregon Petroleum Load Fee is a fee imposed on the transportation or storage of taxable petroleum products within the state of Oregon.

Q: How often do I need to file Form OR-PLF-R?

A: Form OR-PLF-R needs to be filed annually, by the 15th day of the month following the end of the reporting period.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-PLF-R by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.