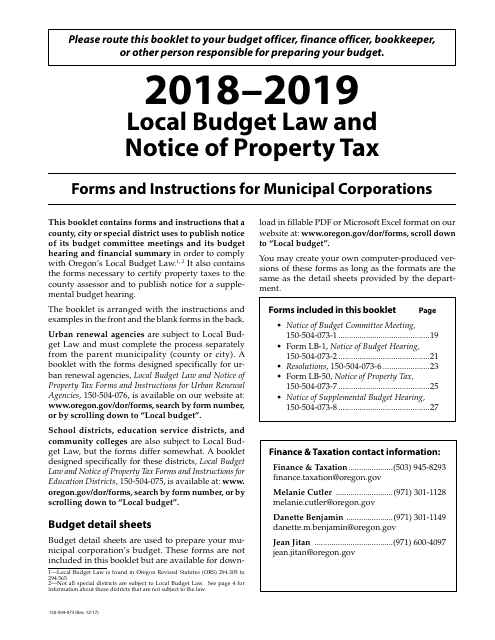

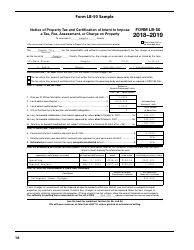

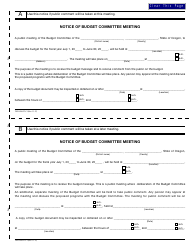

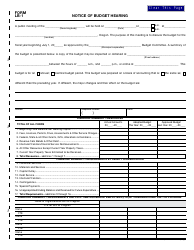

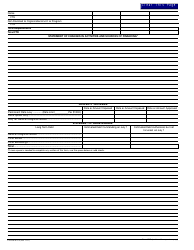

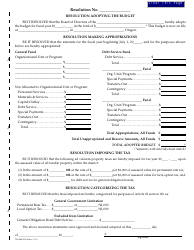

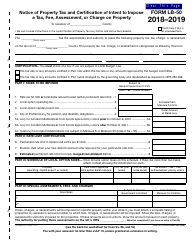

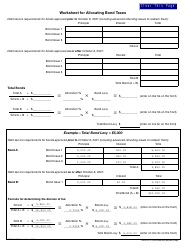

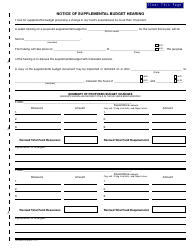

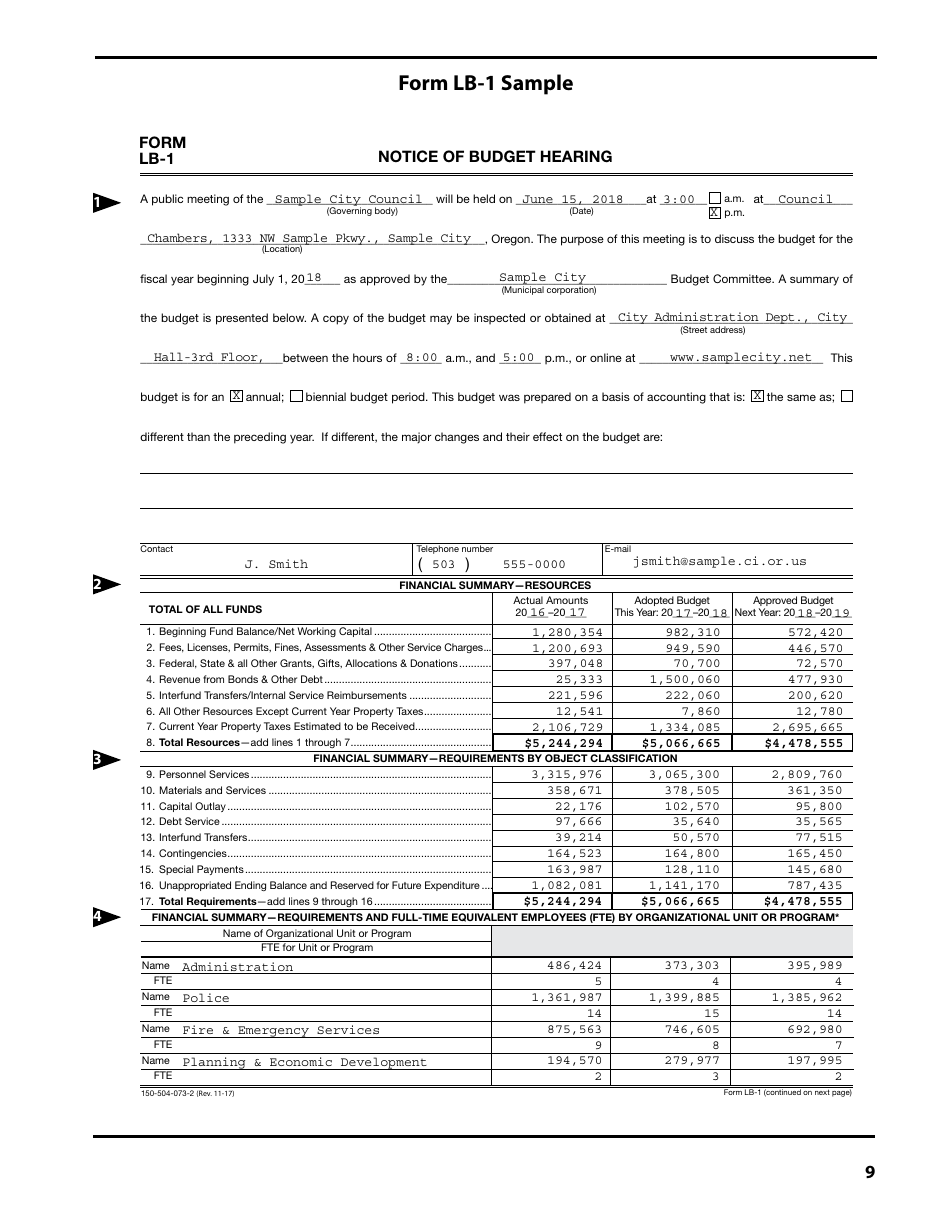

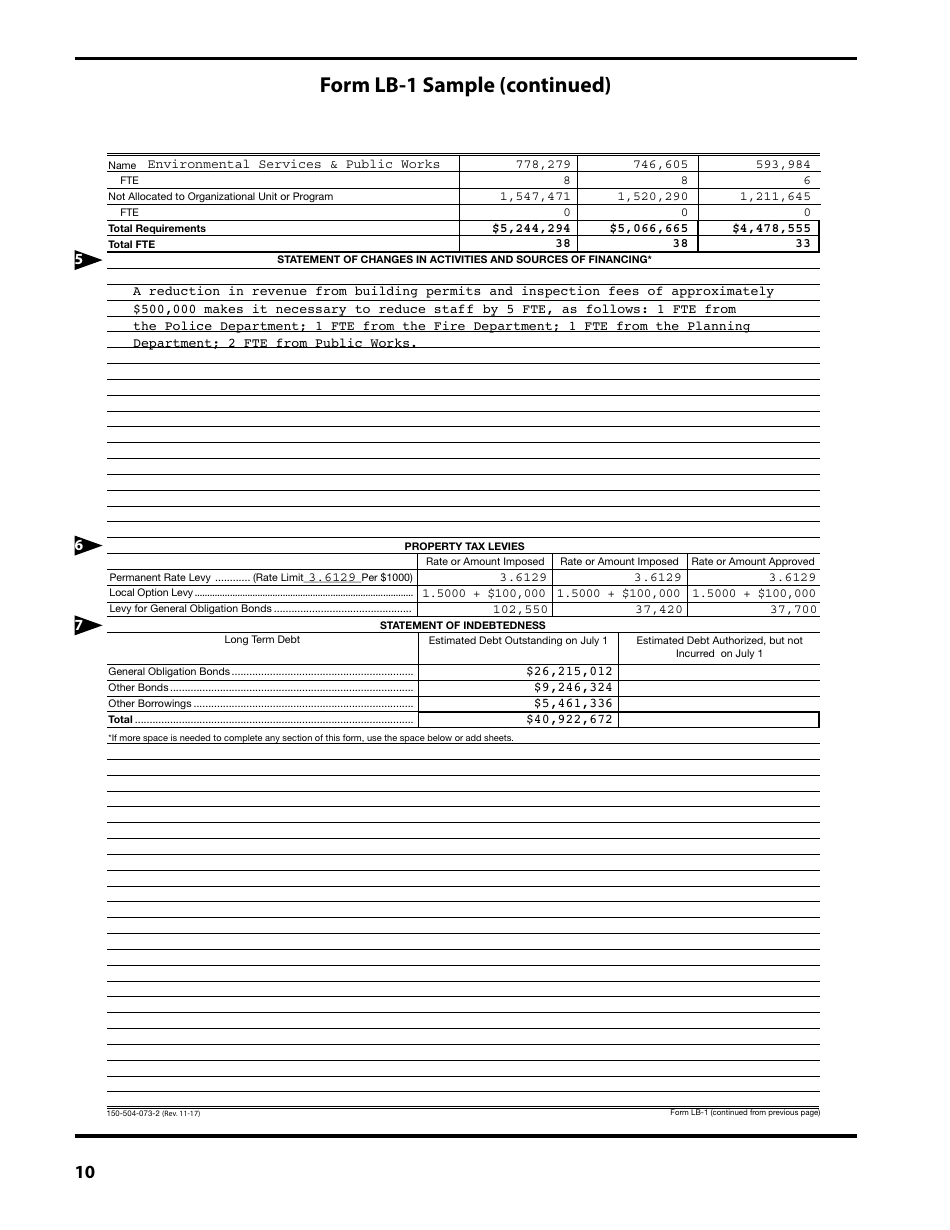

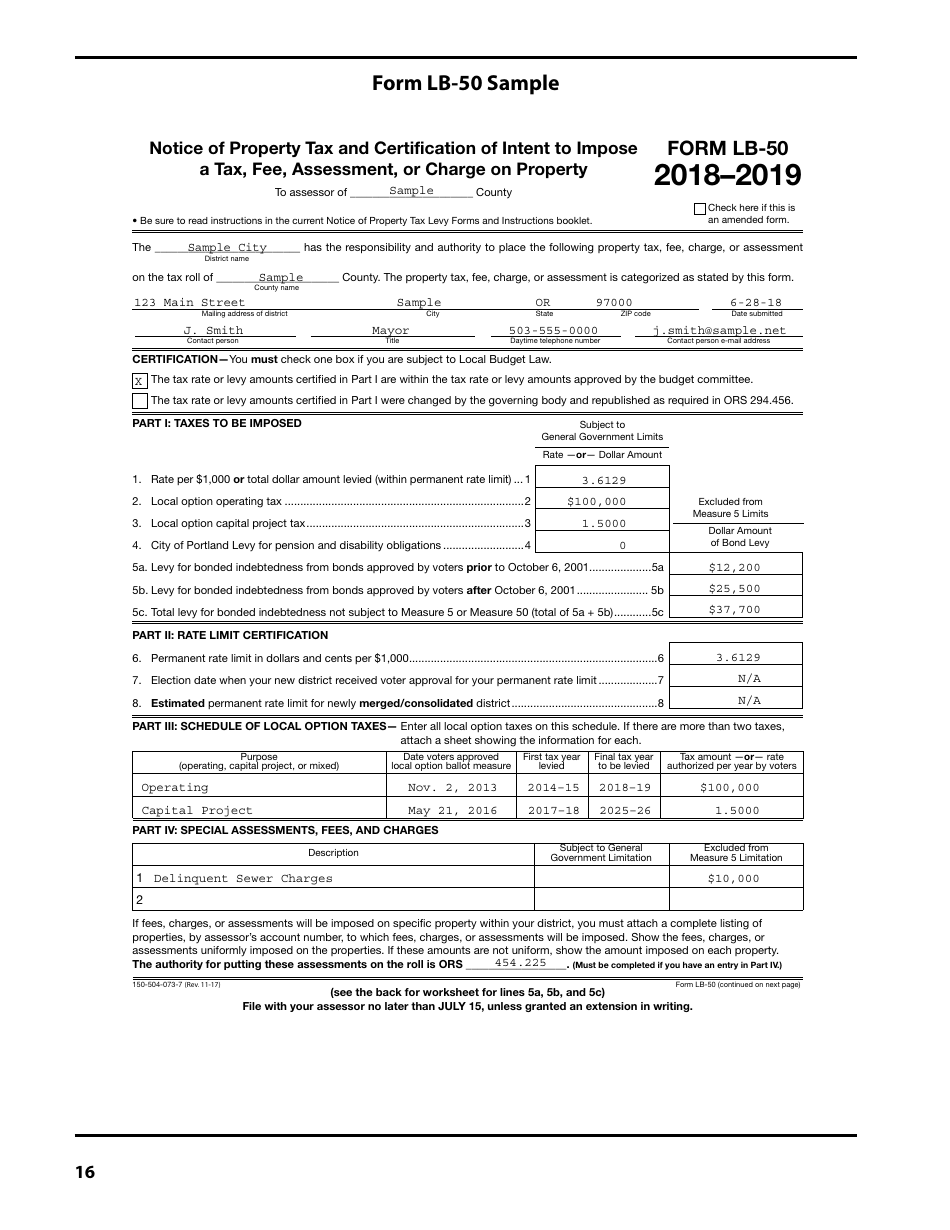

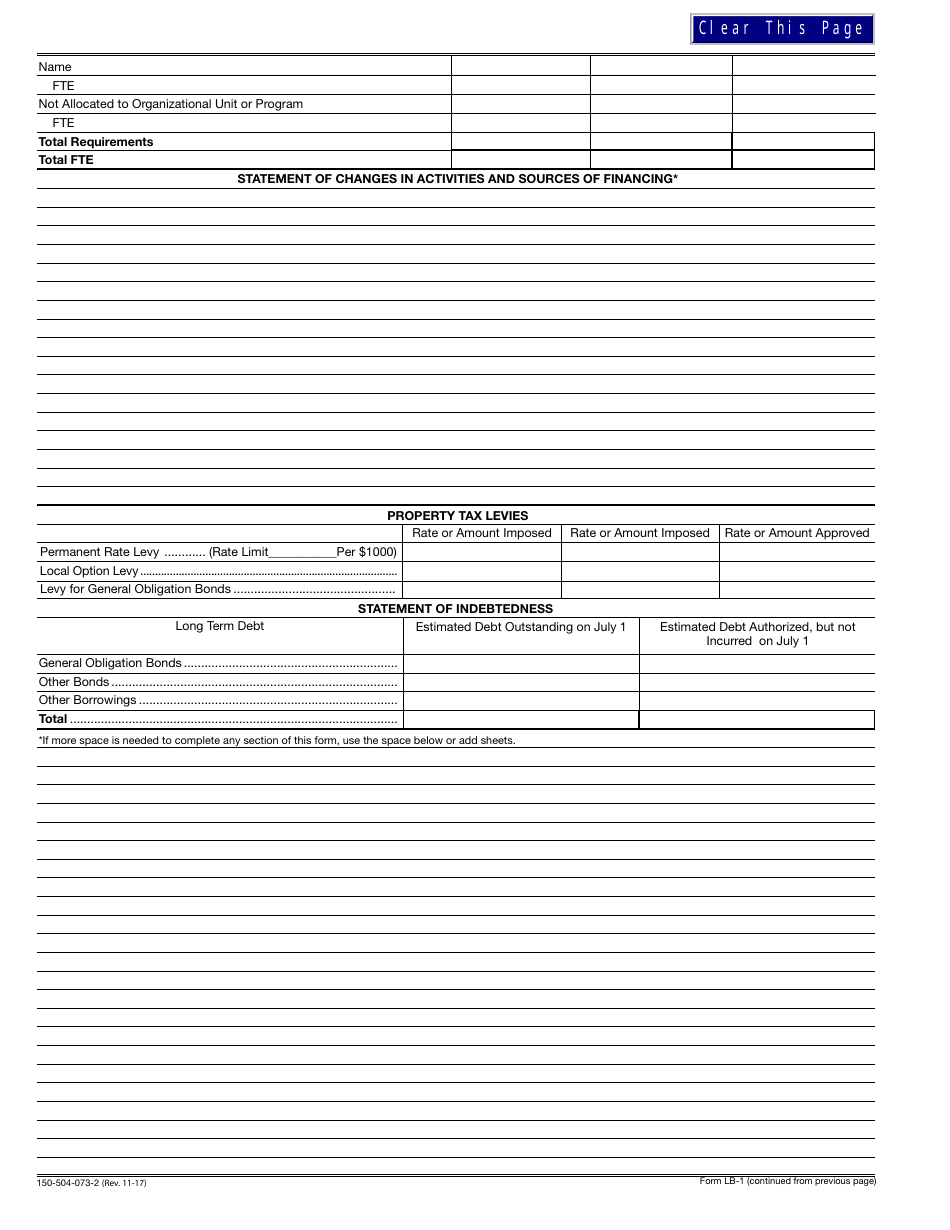

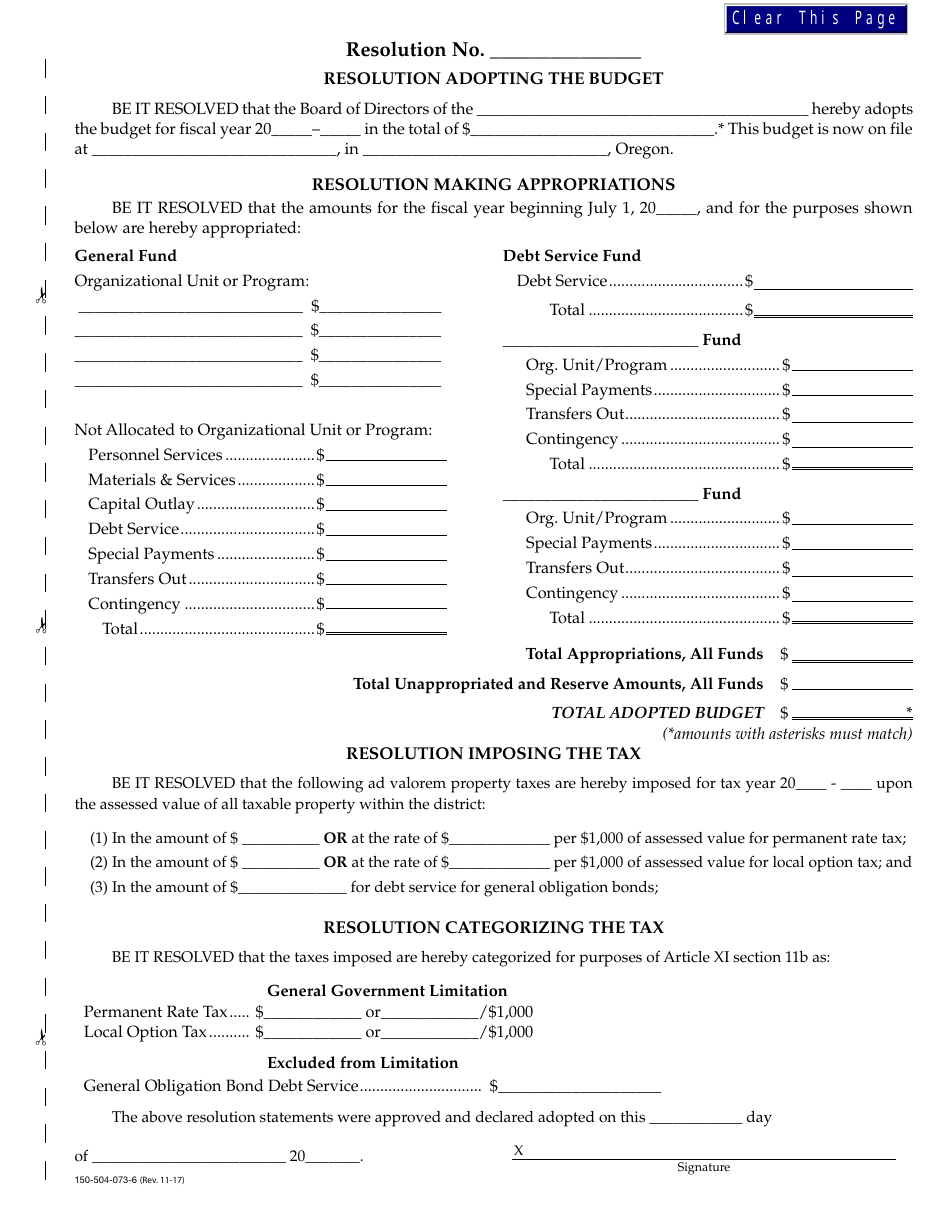

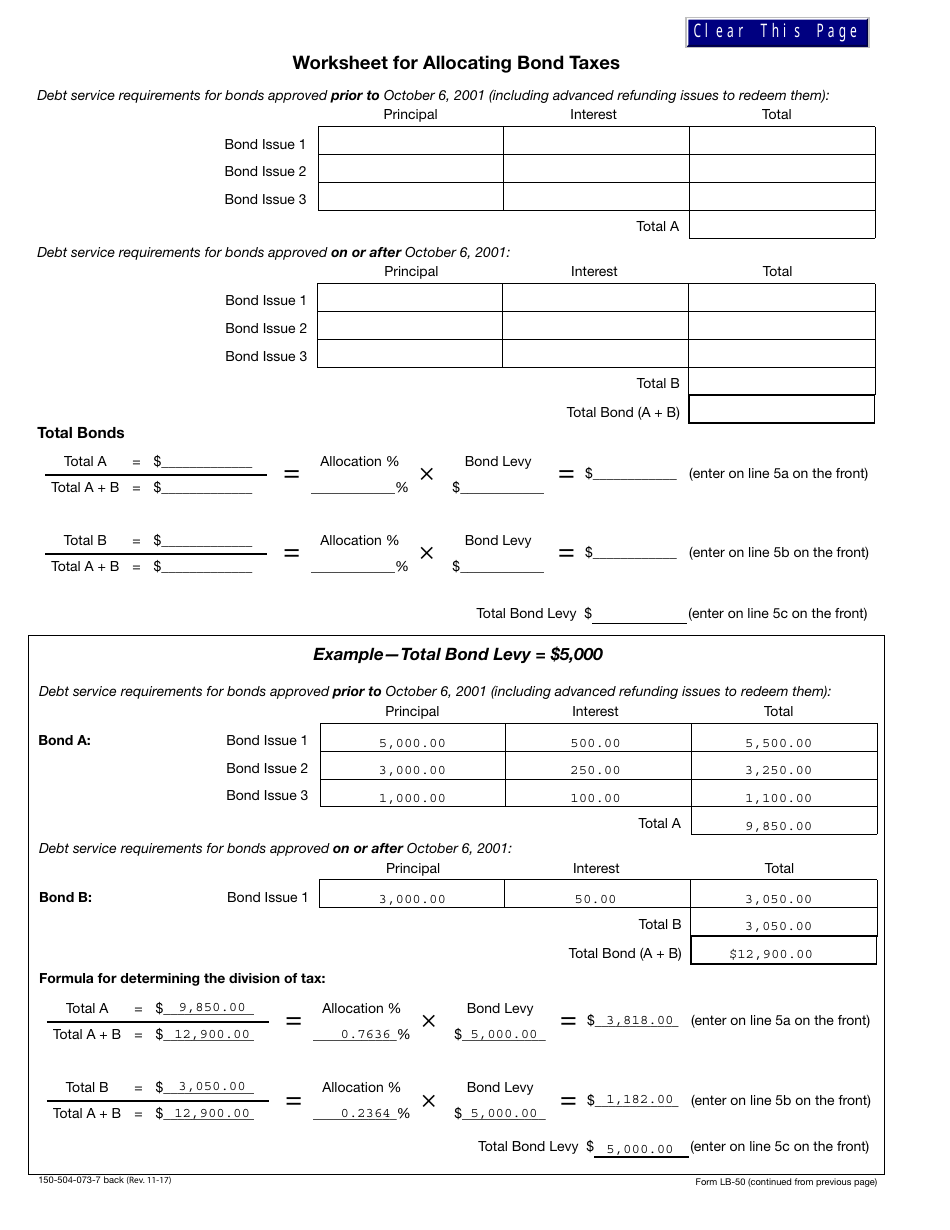

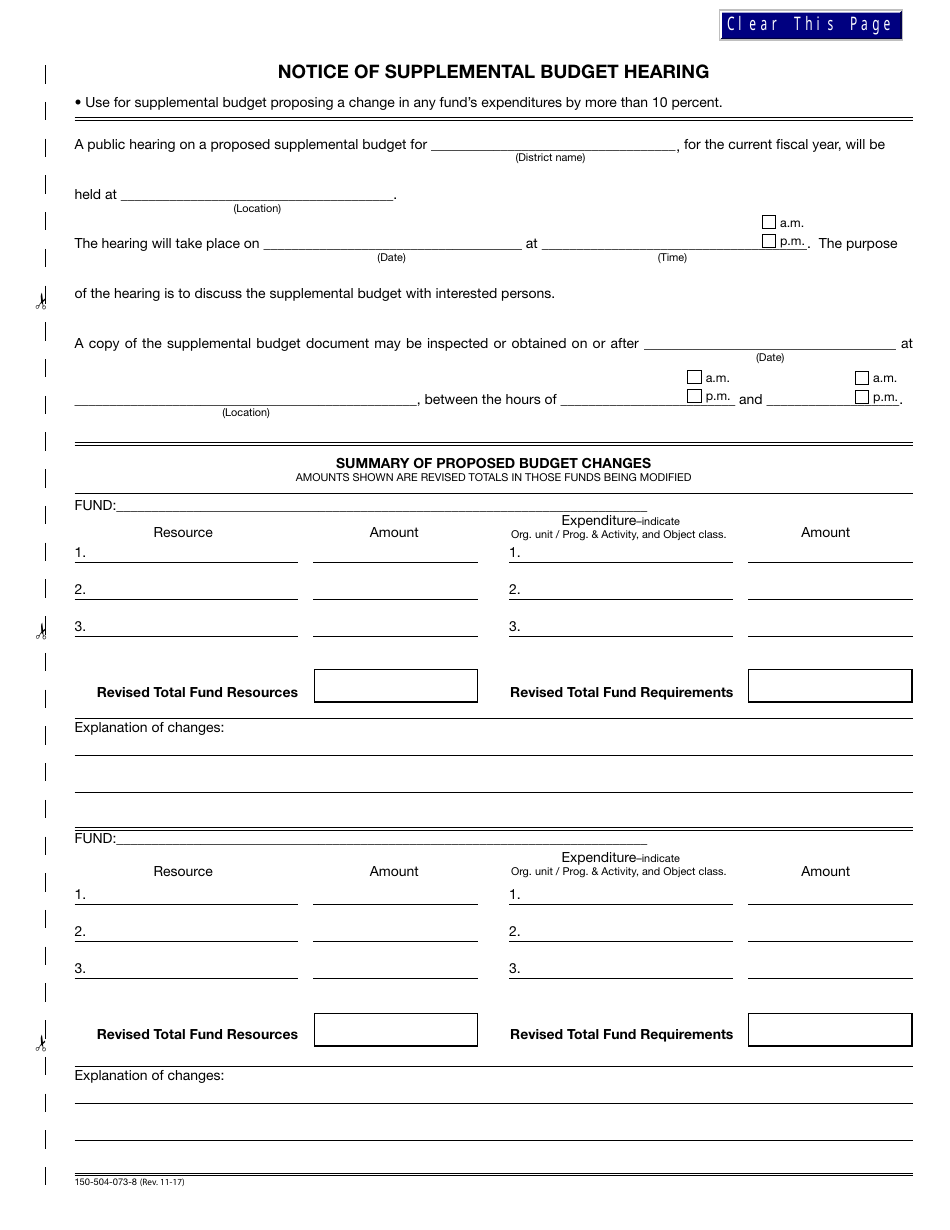

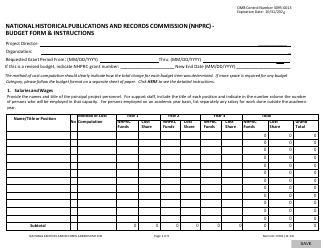

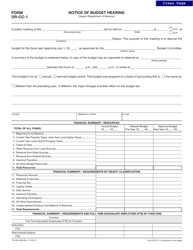

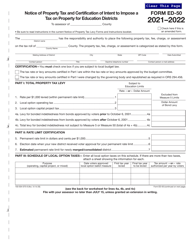

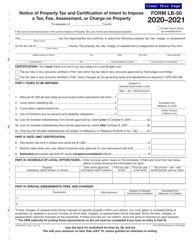

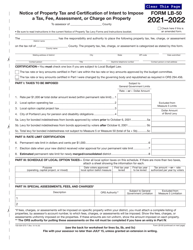

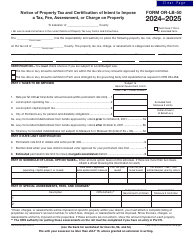

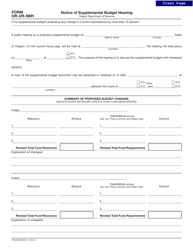

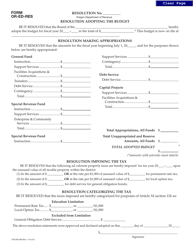

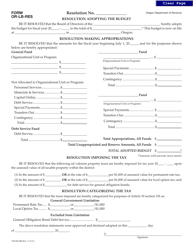

Form 150-504-073 Local Budget Law and Notice of Property Tax - Forms and Instructions for Municipal Corporations - Oregon

What Is Form 150-504-073?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-504-073?

A: Form 150-504-073 is the Local Budget Law and Notice of Property Tax form for Municipal Corporations in Oregon.

Q: Who uses Form 150-504-073?

A: Municipal Corporations in Oregon use Form 150-504-073.

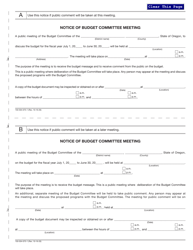

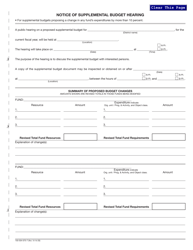

Q: What does Form 150-504-073 cover?

A: Form 150-504-073 covers the Local Budget Law and the Notice of Property Tax.

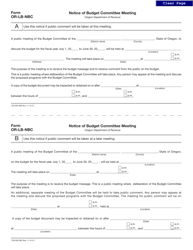

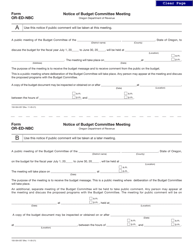

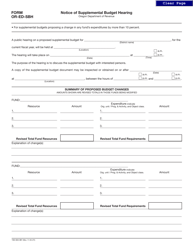

Q: What is the purpose of the Local Budget Law?

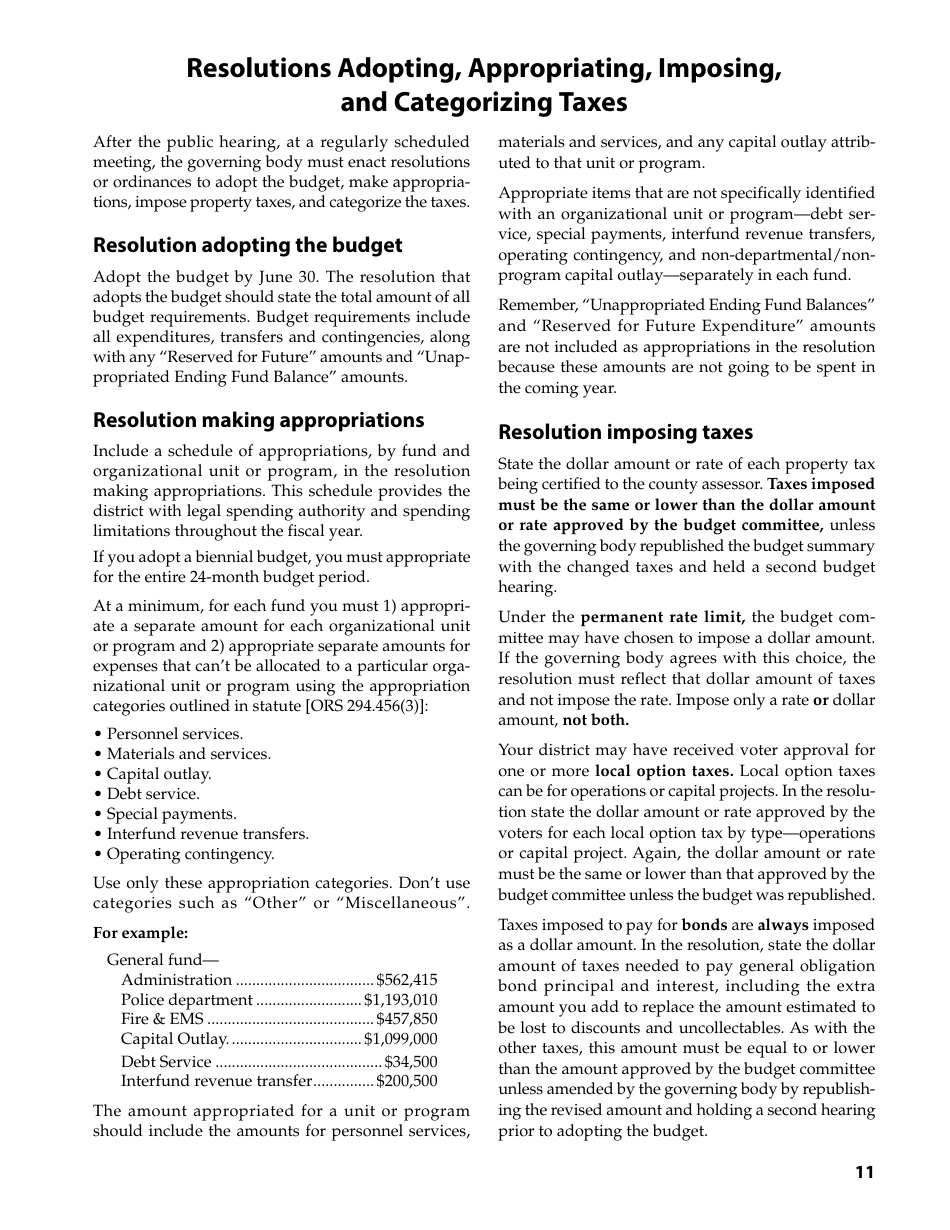

A: The purpose of the Local Budget Law is to establish budget limitations and requirements for municipal corporations in Oregon.

Q: What is the Notice of Property Tax?

A: The Notice of Property Tax is a document that provides information on the property tax assessment and the tax rates for a specific property.

Q: Who is responsible for completing Form 150-504-073?

A: The municipal corporation is responsible for completing Form 150-504-073.

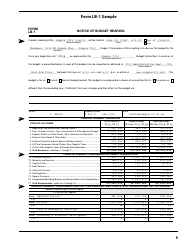

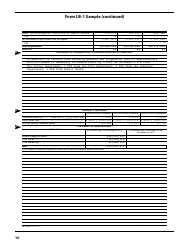

Q: Are there any instructions available for completing Form 150-504-073?

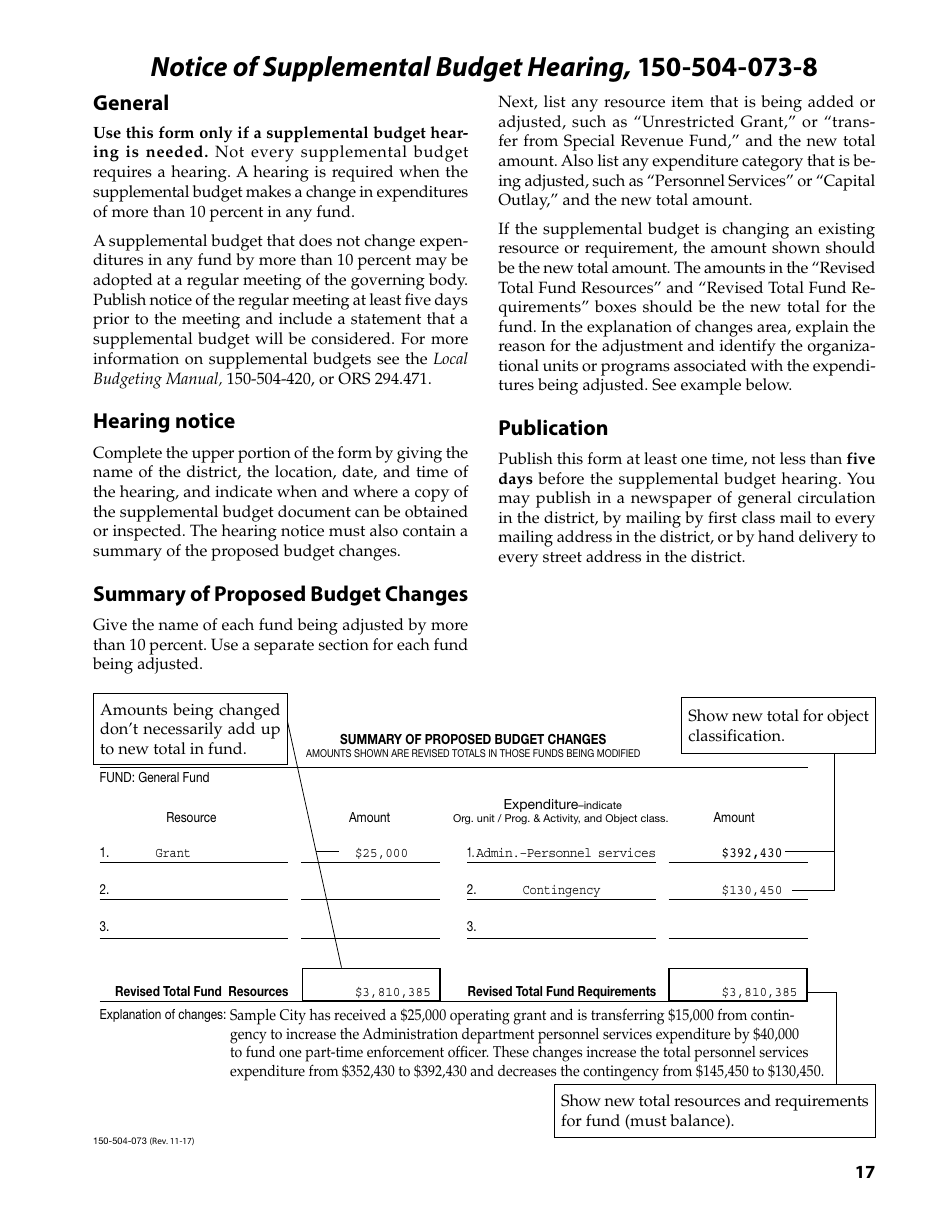

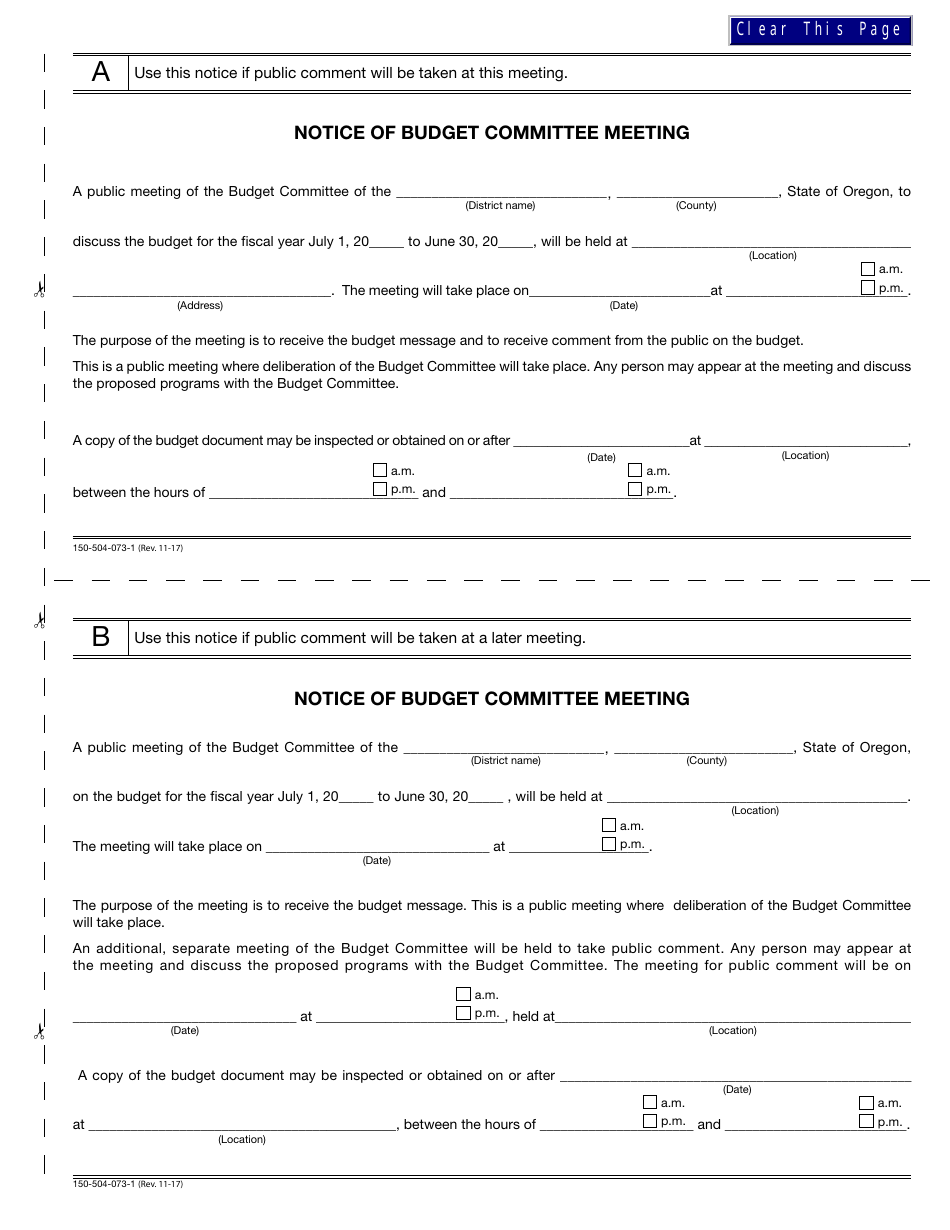

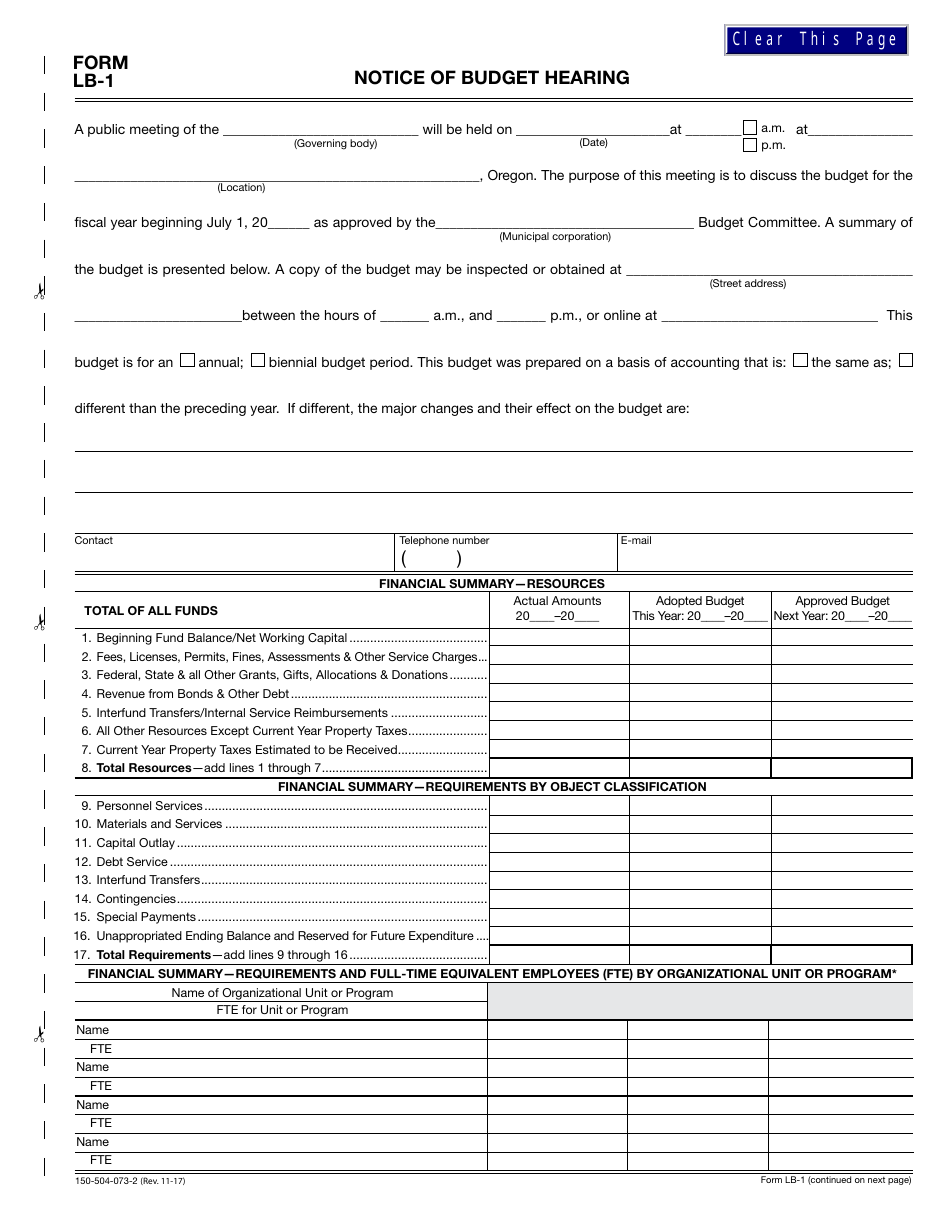

A: Yes, instructions for completing Form 150-504-073 are provided along with the form itself.

Q: Are there any specific deadlines for submitting Form 150-504-073?

A: Yes, specific deadlines for submitting Form 150-504-073 are outlined in the instructions.

Q: Does Form 150-504-073 only apply to municipal corporations in Oregon?

A: Yes, Form 150-504-073 only applies to municipal corporations in Oregon.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-504-073 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.