This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-602-005

for the current year.

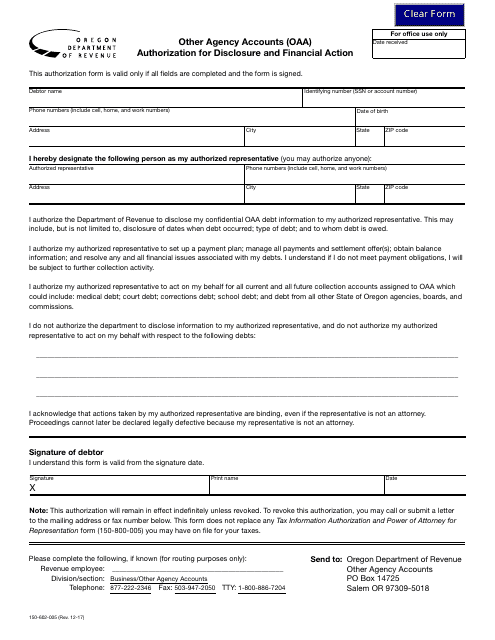

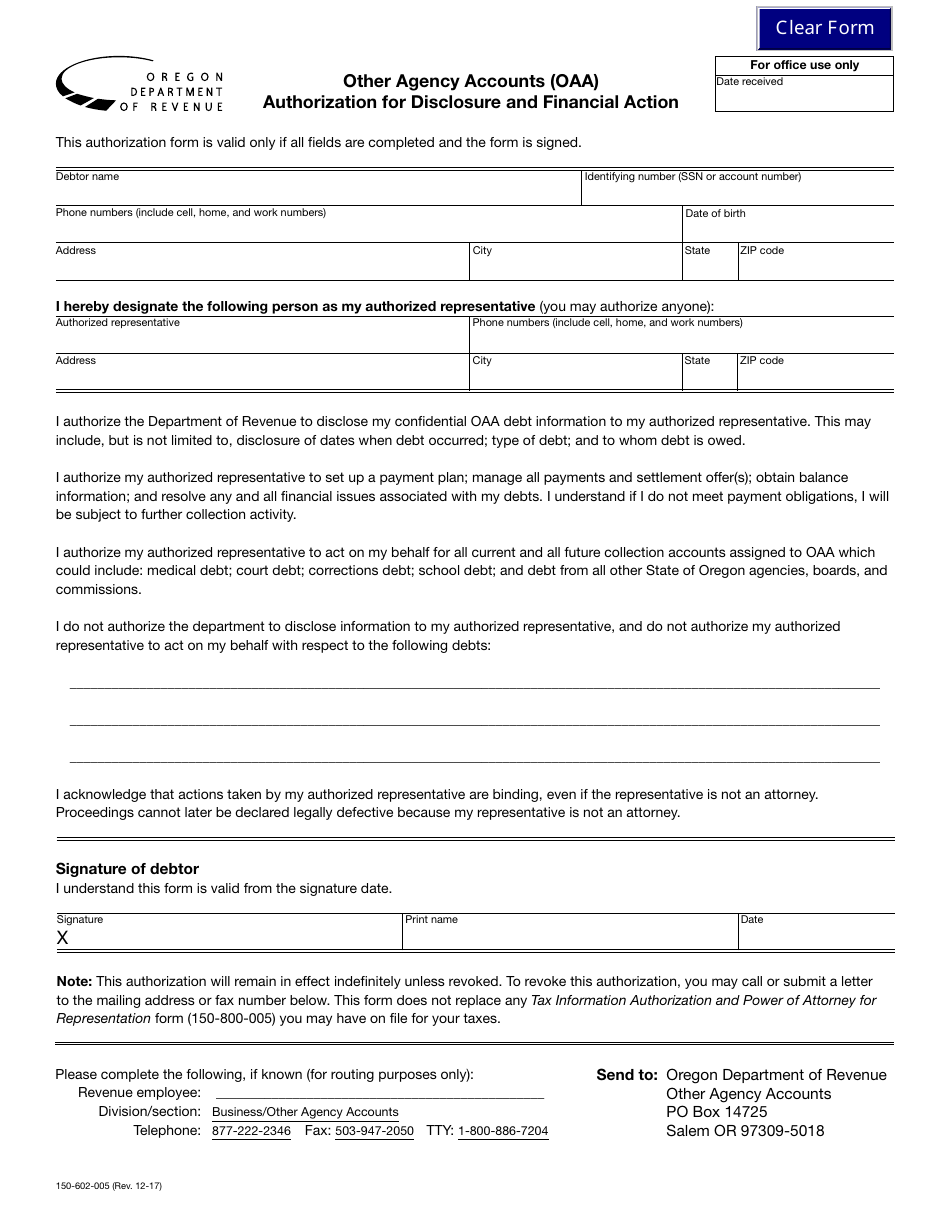

Form 150-602-005 Other Agency Accounts (Oaa) - Authorization for Disclosure and Financial Action - Oregon

What Is Form 150-602-005?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-602-005?

A: Form 150-602-005 is a document titled 'Other Agency Accounts (Oaa) - Authorization for Disclosure and Financial Action - Oregon'.

Q: What is the purpose of Form 150-602-005?

A: The purpose of Form 150-602-005 is to authorize the disclosure and financial action for Other Agency Accounts (Oaa) in Oregon.

Q: Who needs to fill out Form 150-602-005?

A: This form needs to be filled out by individuals or entities who wish to authorize the disclosure and financial action for Other Agency Accounts (Oaa) in Oregon.

Q: Is there a fee to submit Form 150-602-005?

A: No, there is no fee to submit Form 150-602-005.

Q: What information is required on Form 150-602-005?

A: Form 150-602-005 requires information such as the taxpayer's name, address, account information, and authorization details.

Q: Are there any supporting documents required with Form 150-602-005?

A: No, there are no supporting documents required with Form 150-602-005.

Q: What is the deadline to submit Form 150-602-005?

A: The deadline to submit Form 150-602-005 varies and depends on the specific circumstances. It is recommended to check the instructions provided with the form or consult with the relevant agency.

Q: Are there any penalties for not submitting Form 150-602-005?

A: Penalties for not submitting Form 150-602-005 may apply, such as the denial of certain financial actions or potential legal consequences. It is important to comply with the required authorization process.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-602-005 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.