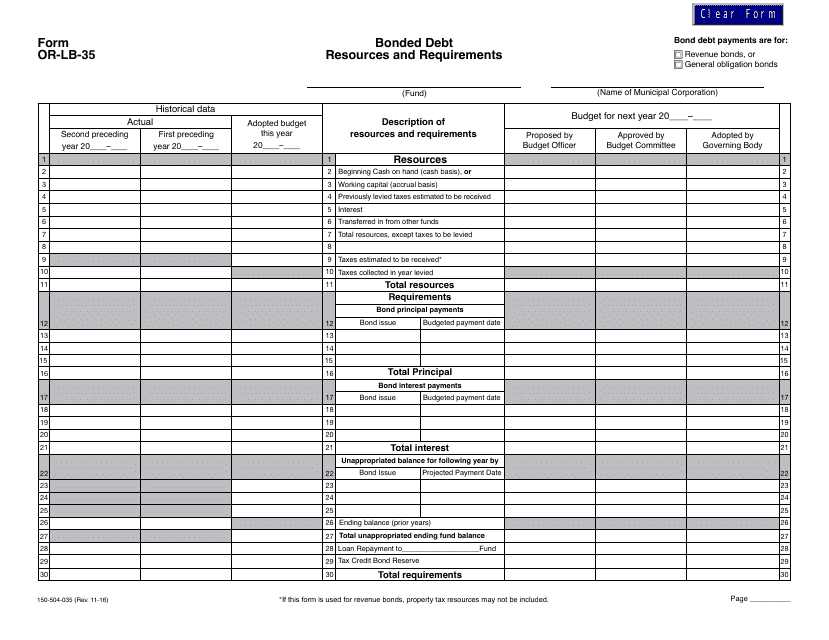

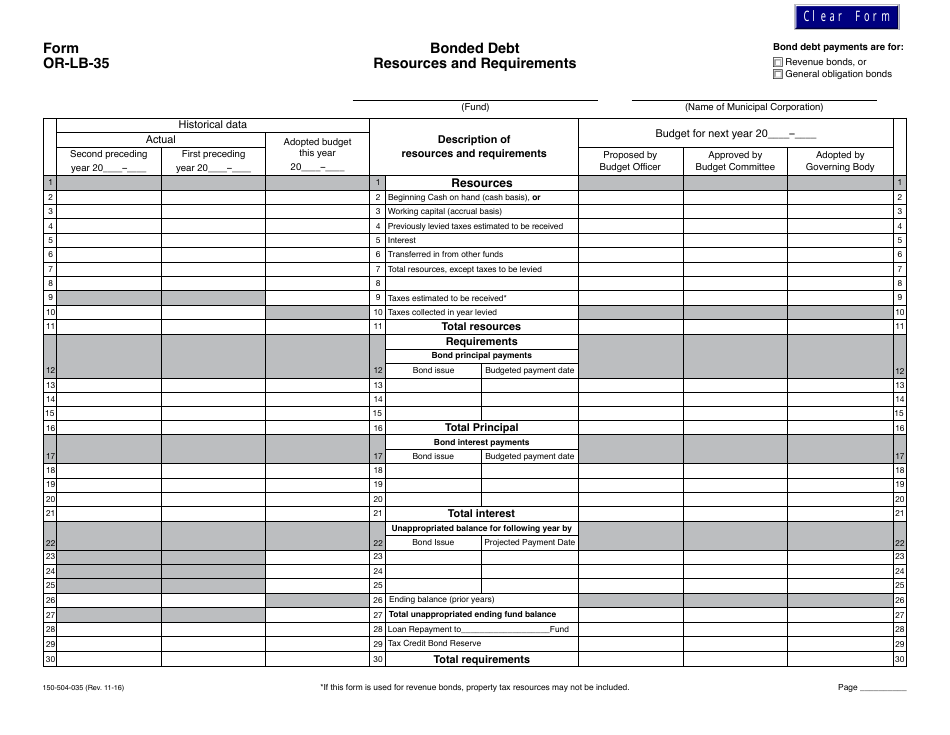

Form OR-LB-35 Bonded Debt Resources and Requirements - Oregon

What Is Form OR-LB-35?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-LB-35?

A: OR-LB-35 is a document that provides information on bonded debt resources and requirements in Oregon.

Q: What is bonded debt?

A: Bonded debt refers to debt that is incurred by states or municipalities by issuing bonds.

Q: Why does Oregon issue bonded debt?

A: Oregon issues bonded debt to raise funds for various public projects and infrastructure improvements.

Q: What are the resources available for bonded debt?

A: The resources available for bonded debt include taxes, fees, and other revenue sources.

Q: What are the requirements for bonded debt in Oregon?

A: The requirements for bonded debt in Oregon include compliance with state laws, approval from voters, and adherence to debt management guidelines.

Q: How is bonded debt managed in Oregon?

A: Bonded debt in Oregon is managed through strategic planning, budgeting, and regular monitoring of debt levels and repayment schedules.

Q: Are there any restrictions on bonded debt in Oregon?

A: Yes, there are certain restrictions on bonded debt in Oregon, such as debt limits and debt service requirements.

Q: What happens if Oregon fails to meet its bonded debt obligations?

A: If Oregon fails to meet its bonded debt obligations, it may result in credit rating downgrades and increased borrowing costs.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-LB-35 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.