This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-490-019

for the current year.

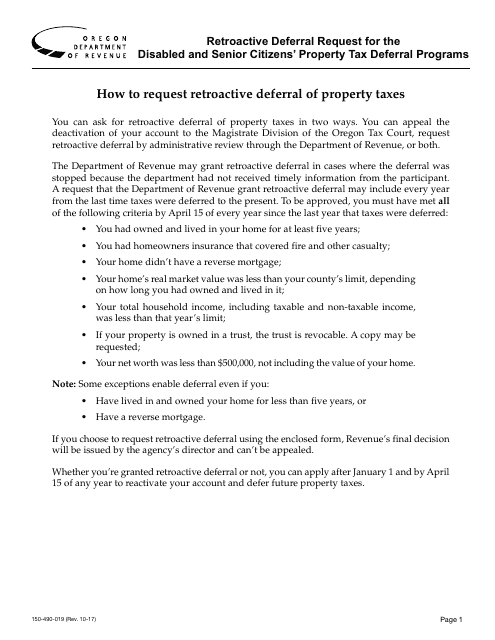

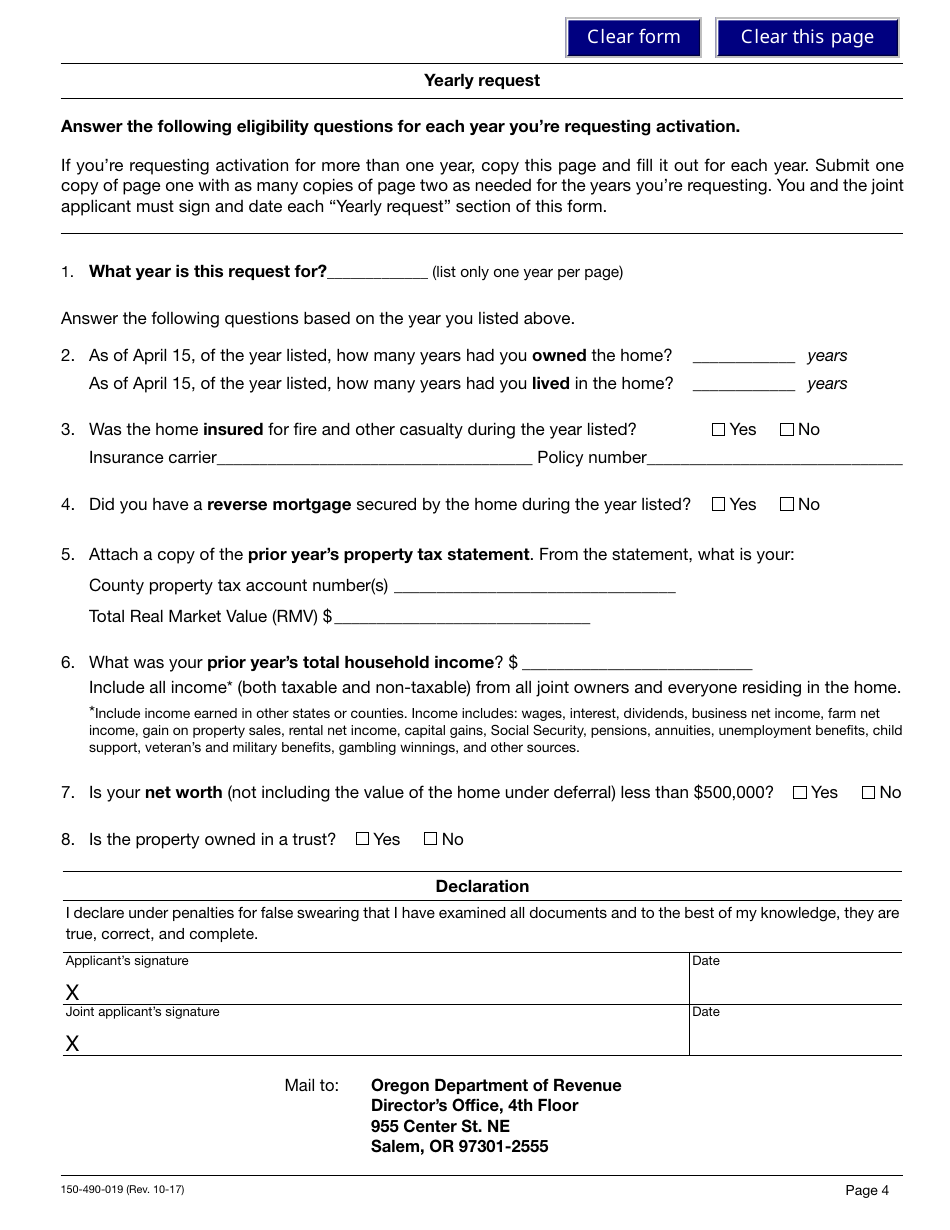

Form 150-490-019 Request for Retroactive Deferral for Disabled and Senior Citizens - Oregon

What Is Form 150-490-019?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

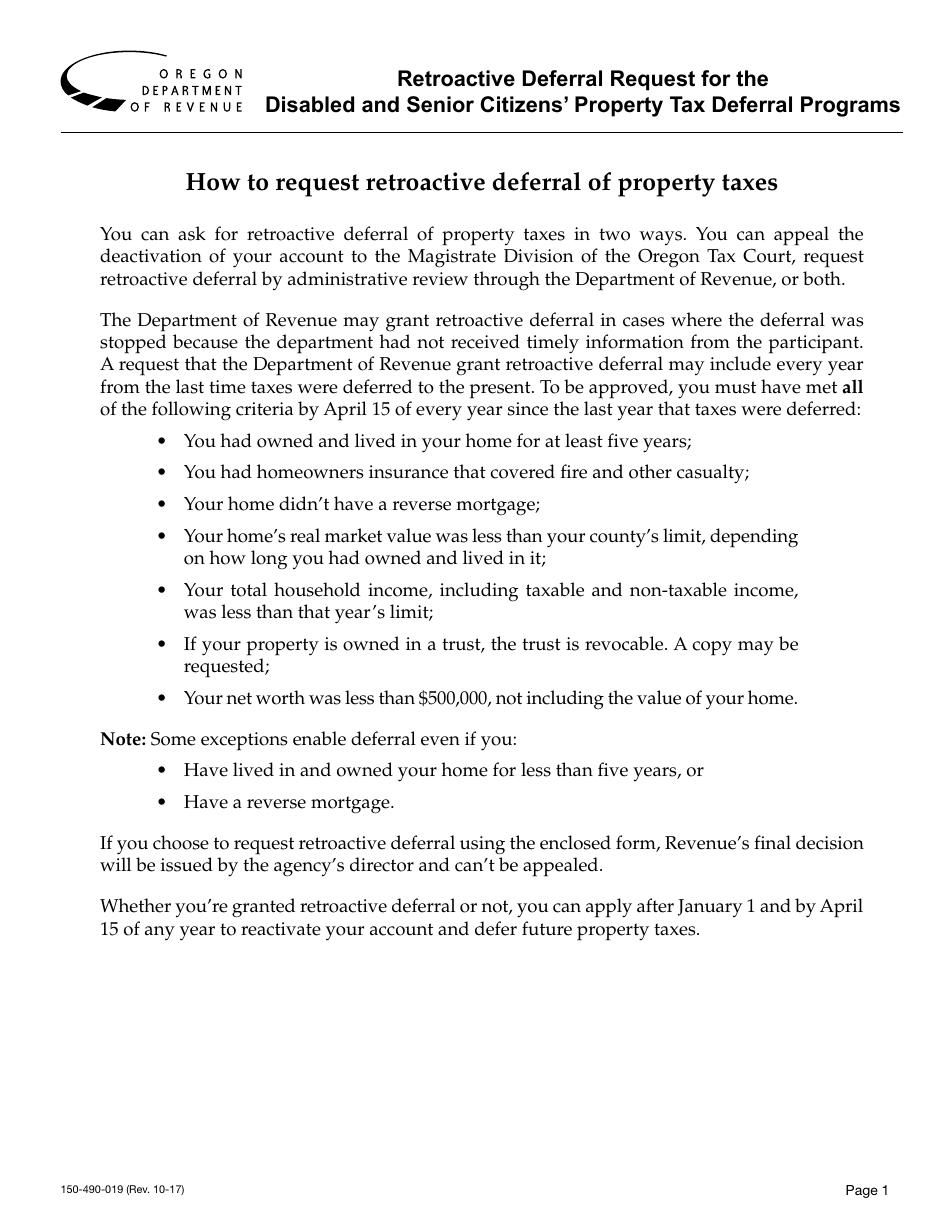

Q: What is Form 150-490-019?

A: Form 150-490-019 is the Request for Retroactive Deferral for Disabled and Senior Citizens in Oregon.

Q: Who can use Form 150-490-019?

A: Form 150-490-019 can be used by disabled and senior citizens in Oregon.

Q: What is the purpose of Form 150-490-019?

A: The purpose of Form 150-490-019 is to request retroactive deferral for disabled and senior citizens in Oregon.

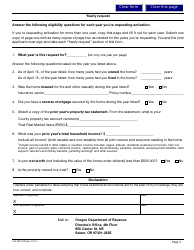

Q: What documents do I need to submit with Form 150-490-019?

A: You may need to submit documents such as proof of disability or age with Form 150-490-019.

Q: Is there a deadline for submitting Form 150-490-019?

A: Yes, there is a deadline for submitting Form 150-490-019. It must be filed within three years after the due date of the tax return for the year being claimed.

Q: How long does it take to process Form 150-490-019?

A: The processing time for Form 150-490-019 can vary. It is recommended to allow several weeks for processing.

Q: Can I appeal a denial of my Form 150-490-019 request?

A: Yes, if your request for retroactive deferral is denied, you have the right to appeal the decision.

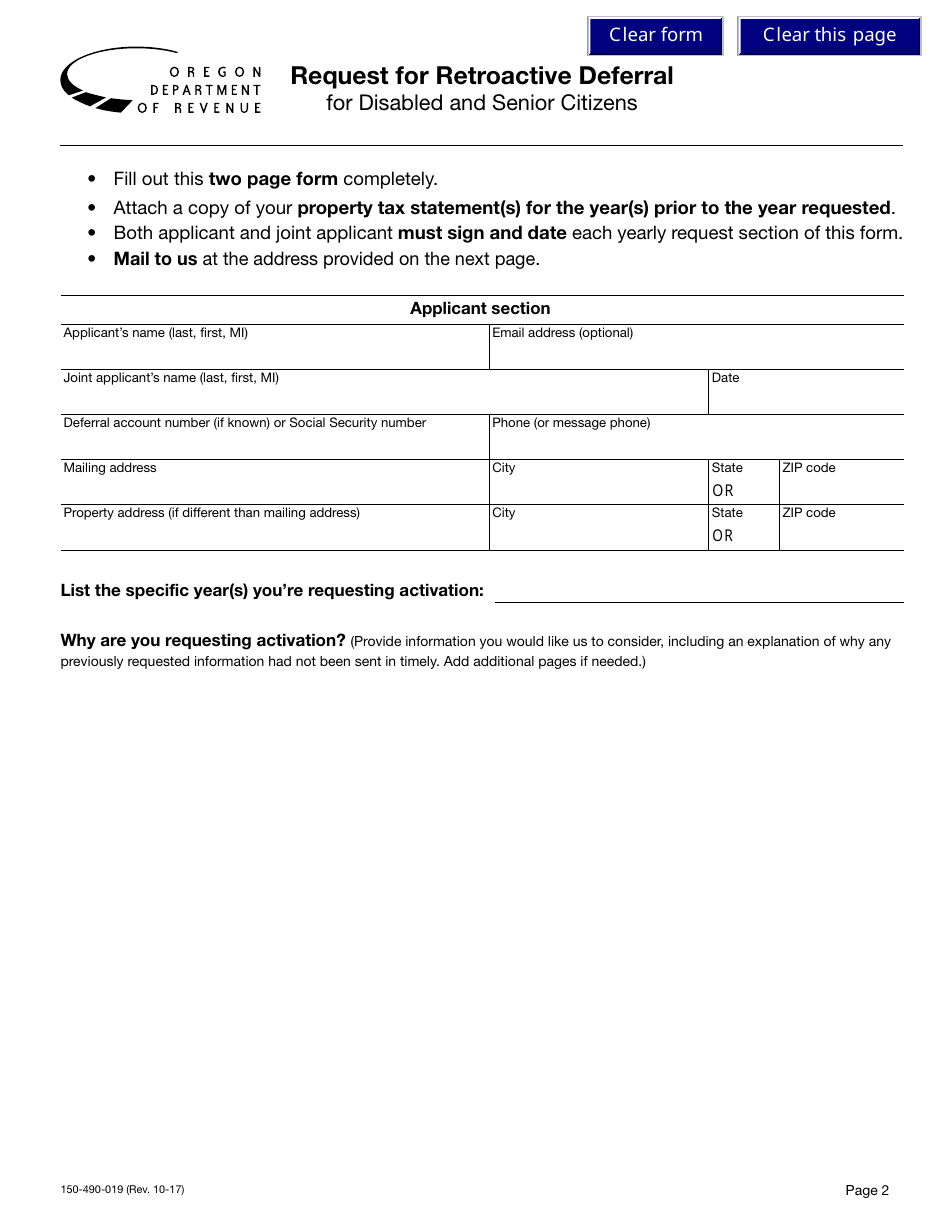

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-490-019 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.