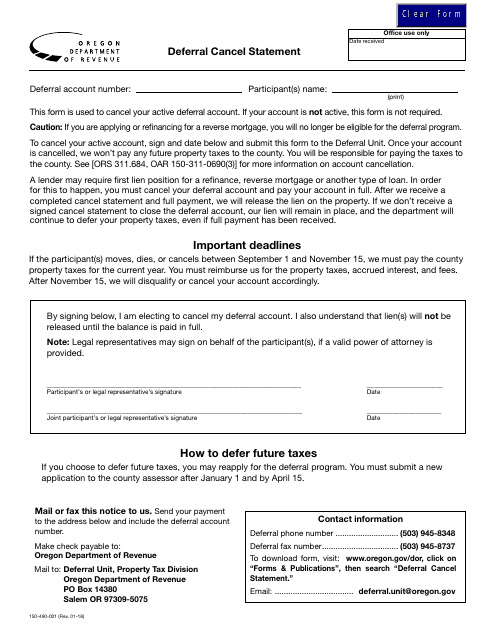

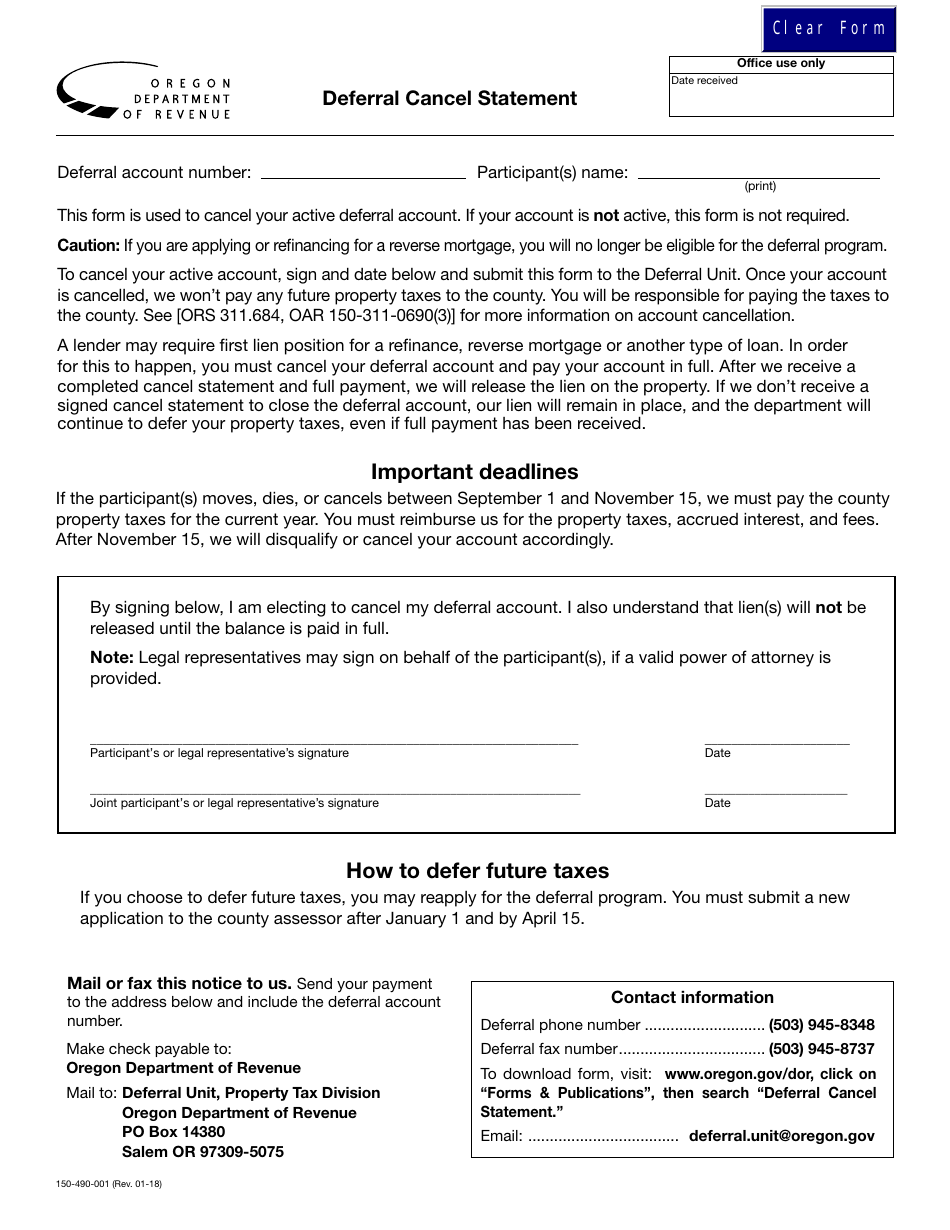

Form 150-490-001 Deferral Cancel Statement - Oregon

What Is Form 150-490-001?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-490-001?

A: Form 150-490-001 is the Deferral Cancel Statement used in Oregon.

Q: What is the purpose of Form 150-490-001?

A: The purpose of Form 150-490-001 is to cancel a deferral in Oregon.

Q: Who needs to use Form 150-490-001?

A: Form 150-490-001 is used by individuals or businesses who previously filed a deferral and now need to cancel it.

Q: Are there any fees associated with filing Form 150-490-001?

A: No, there are no fees for filing Form 150-490-001.

Q: When should I file Form 150-490-001?

A: You should file Form 150-490-001 as soon as you need to cancel a deferral in Oregon.

Q: What information is required on Form 150-490-001?

A: You will need to provide your name, address, Social Security number or business identification number, and the details of the deferral you wish to cancel.

Q: What happens after I file Form 150-490-001?

A: Once your form is processed, the deferral will be canceled and you will no longer be eligible for the deferral program.

Q: Are there any consequences for not filing Form 150-490-001?

A: If you do not file Form 150-490-001 to cancel a deferral, you may still be responsible for the deferred taxes and penalties.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-490-001 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.