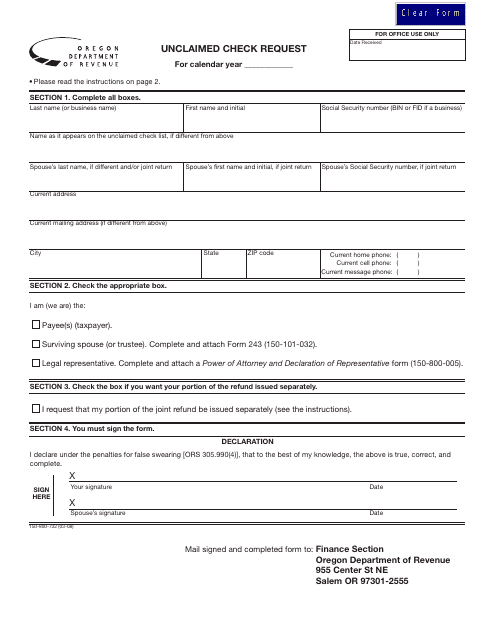

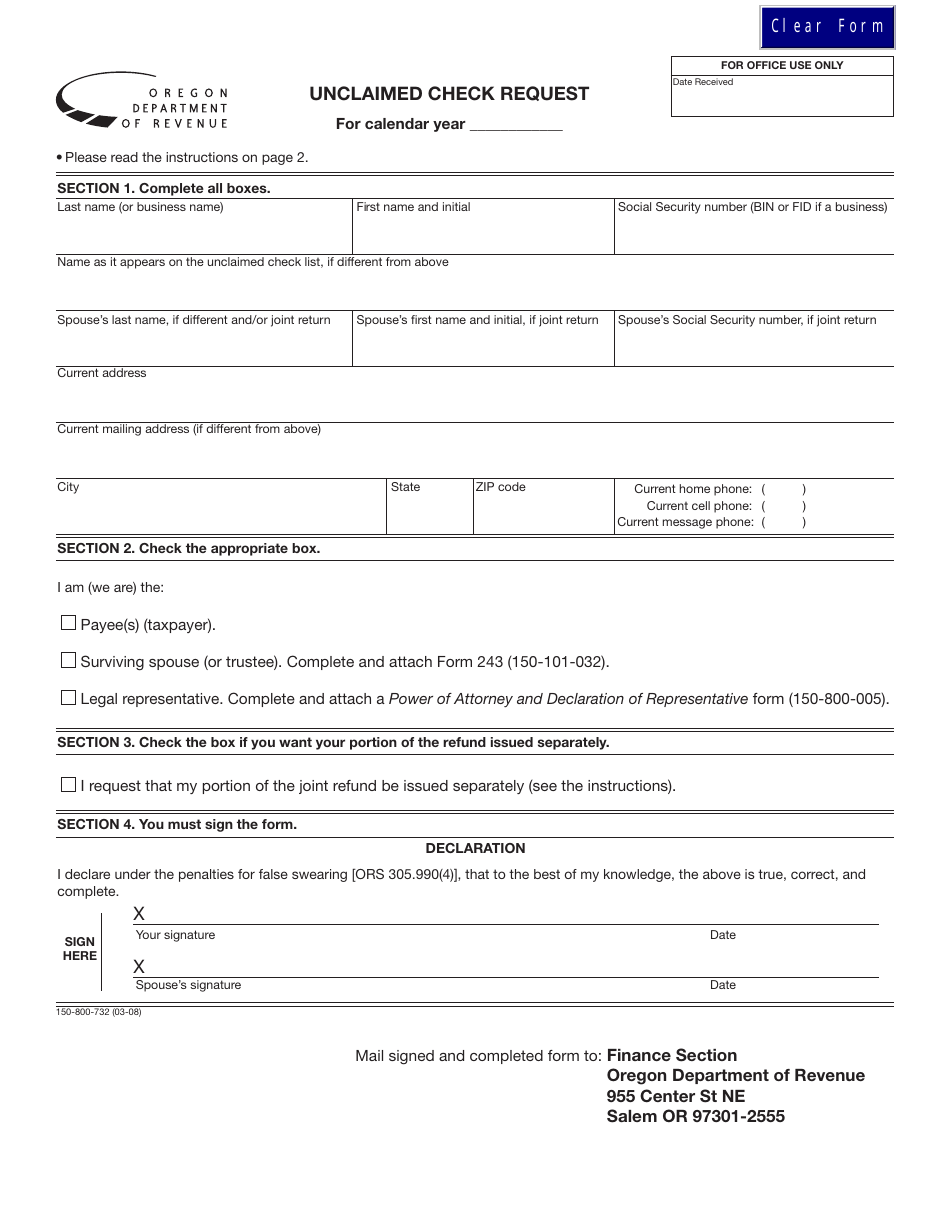

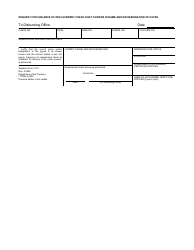

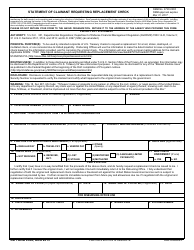

Form 150-800-732 Unclaimed Check Request - Oregon

What Is Form 150-800-732?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-800-732?

A: Form 150-800-732 is the Unclaimed Check Request form in Oregon.

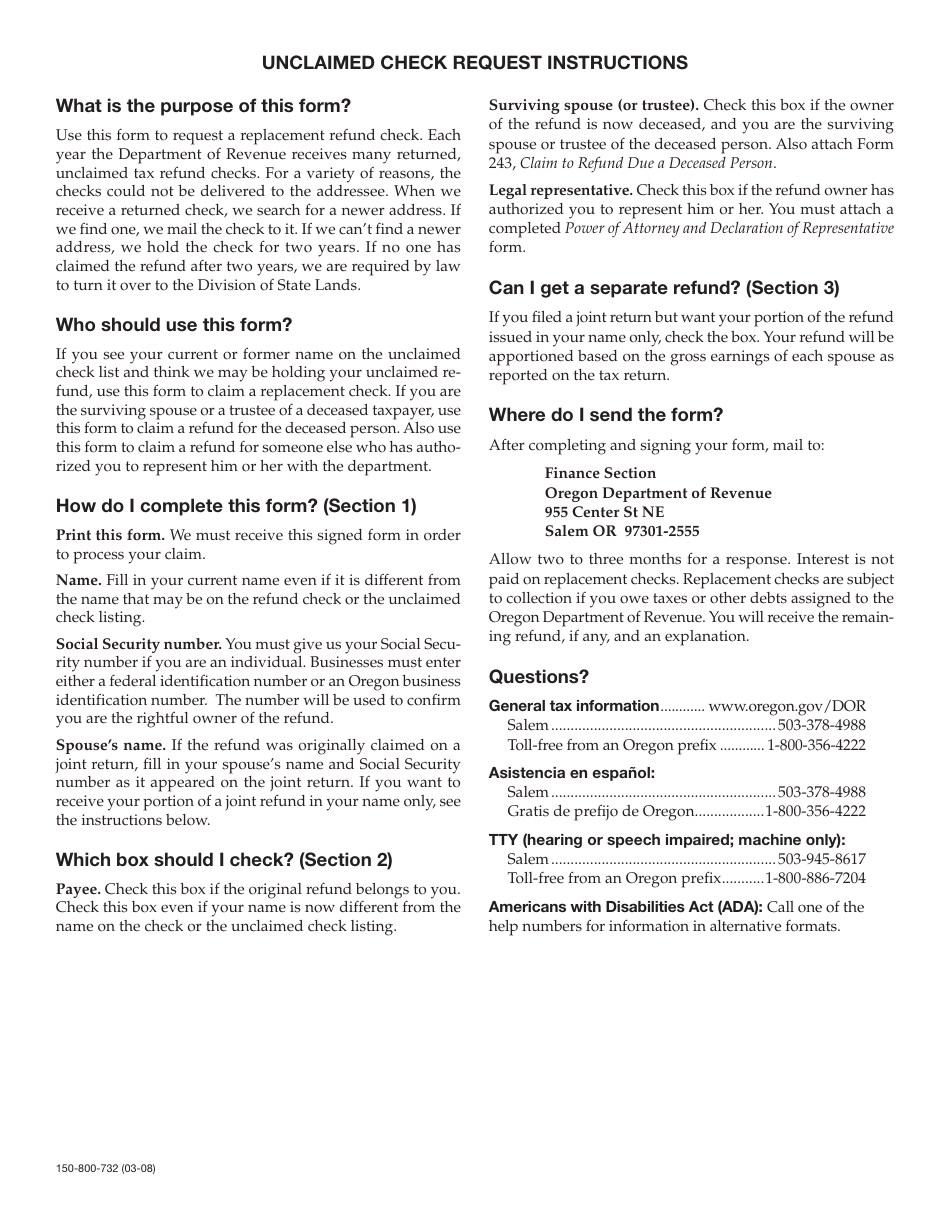

Q: What is the purpose of Form 150-800-732?

A: The purpose of Form 150-800-732 is to request a check that has been unclaimed in Oregon.

Q: Who can use Form 150-800-732?

A: Anyone who is entitled to an unclaimed check in Oregon can use Form 150-800-732.

Q: How do I fill out Form 150-800-732?

A: To fill out Form 150-800-732, you need to provide your personal information and details about the unclaimed check.

Q: Are there any fees associated with filing Form 150-800-732?

A: No, there are no fees associated with filing Form 150-800-732.

Q: What should I do if I have lost my unclaimed check?

A: If you have lost your unclaimed check, you should still file Form 150-800-732 and provide as much information as possible.

Q: How long does it take to receive the unclaimed check after submitting Form 150-800-732?

A: The processing time for the unclaimed check request may vary, but it typically takes a few weeks.

Q: Can I submit Form 150-800-732 electronically?

A: No, Form 150-800-732 must be submitted by mail.

Q: What if my request for the unclaimed check is denied?

A: If your request for the unclaimed check is denied, you may need to provide additional documentation or contact the Oregon Department of Revenue for further assistance.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-800-732 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.