This version of the form is not currently in use and is provided for reference only. Download this version of

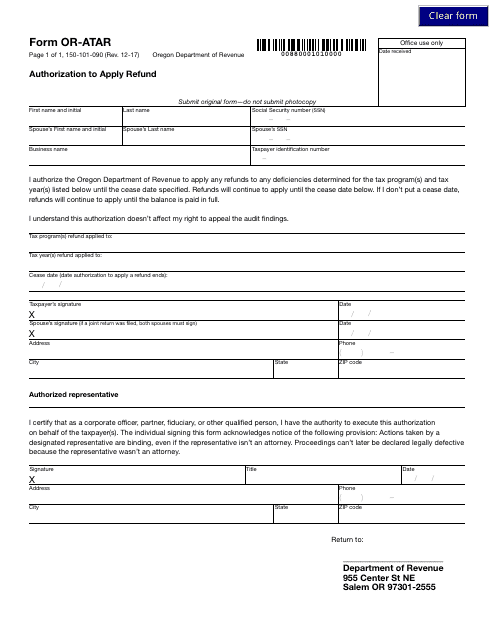

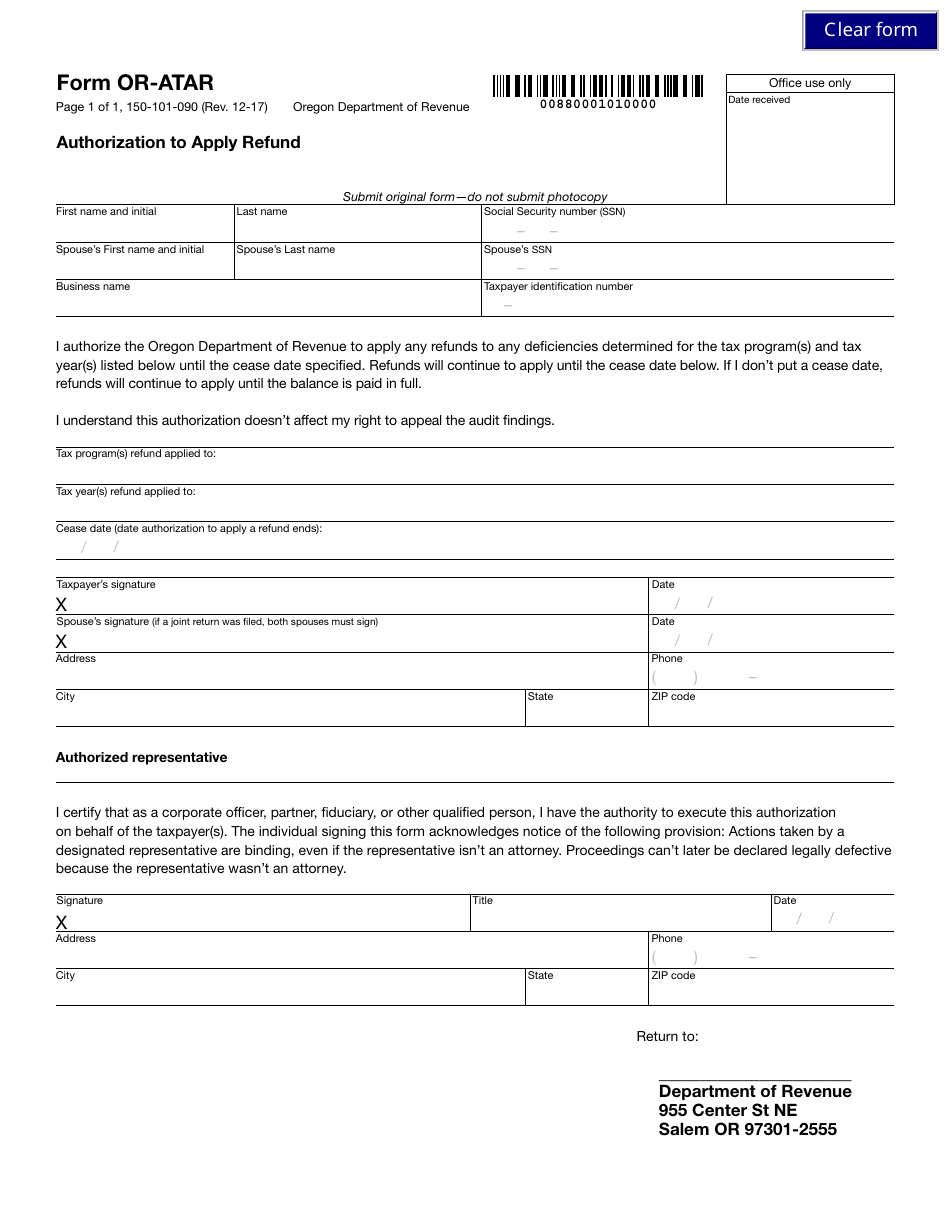

Form OR-ATAR

for the current year.

Form OR-ATAR Authorization to Apply Refund - Oregon

What Is Form OR-ATAR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-ATAR?

A: Form OR-ATAR is the Authorization to Apply Refund form in Oregon.

Q: What is the purpose of Form OR-ATAR?

A: Form OR-ATAR is used to authorize the Oregon Department of Revenue to apply a refund to another tax period or liability.

Q: Can I electronically file Form OR-ATAR?

A: No, Form OR-ATAR cannot be electronically filed. It must be printed, filled out manually, and mailed to the Oregon Department of Revenue.

Q: Is there a fee to file Form OR-ATAR?

A: No, there is no fee to file Form OR-ATAR.

Q: Are there any specific instructions to fill out Form OR-ATAR?

A: Yes, you should carefully read the instructions provided on the form and provide accurate information to ensure the proper processing of your request.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-ATAR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.