Form 150-206-695 An Employer's Guide to Oregon Withholding and Transit Taxes for Sports and Entertainment Industries - Oregon

What Is Form 150-206-695?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

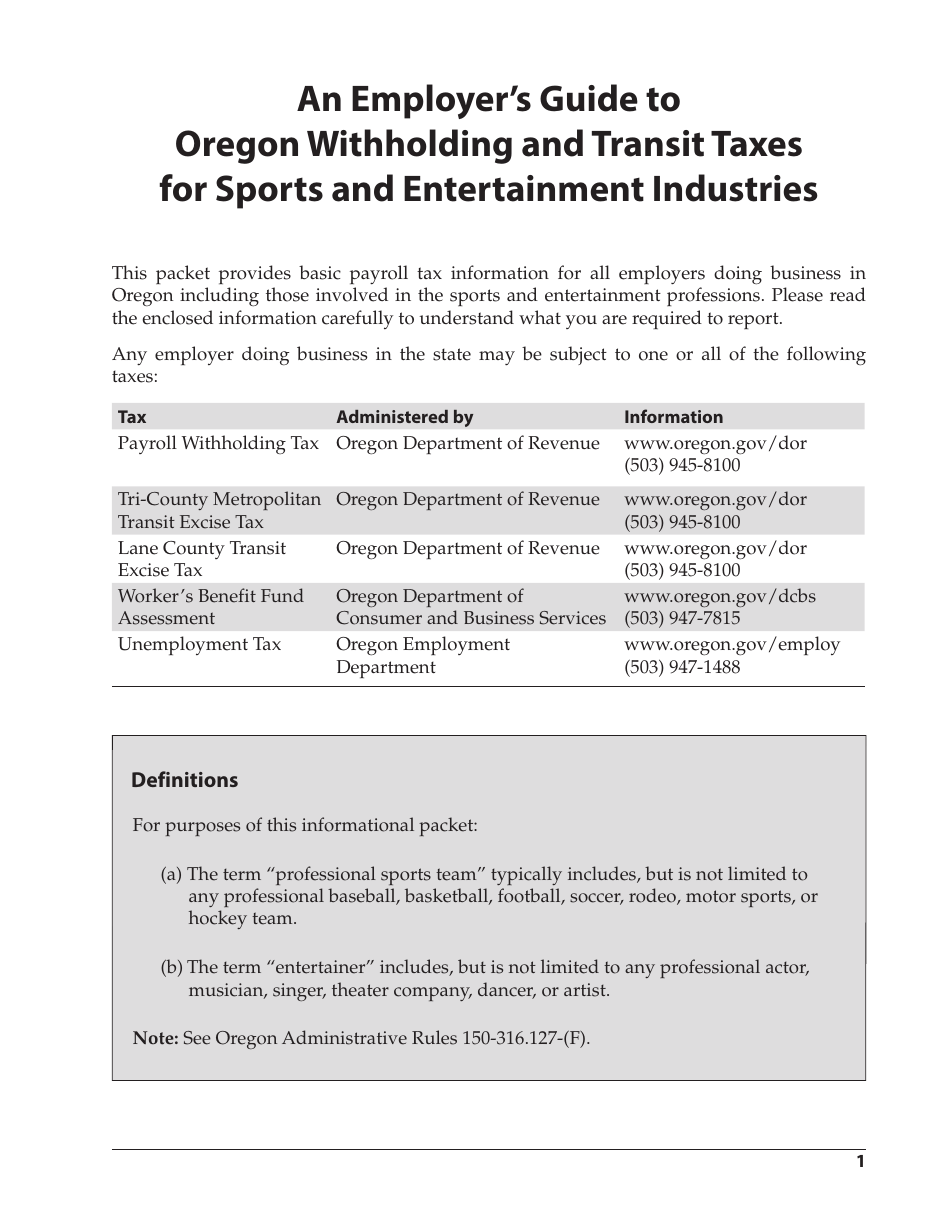

Q: What is Form 150-206-695?

A: Form 150-206-695 is an Employer's Guide to Oregon Withholding and Transit Taxes for Sports and Entertainment Industries.

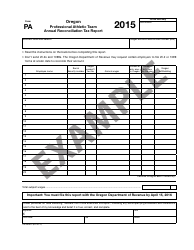

Q: Who is this guide for?

A: This guide is for employers in the sports and entertainment industries in Oregon.

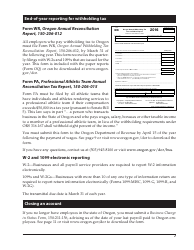

Q: What does this guide cover?

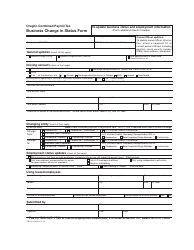

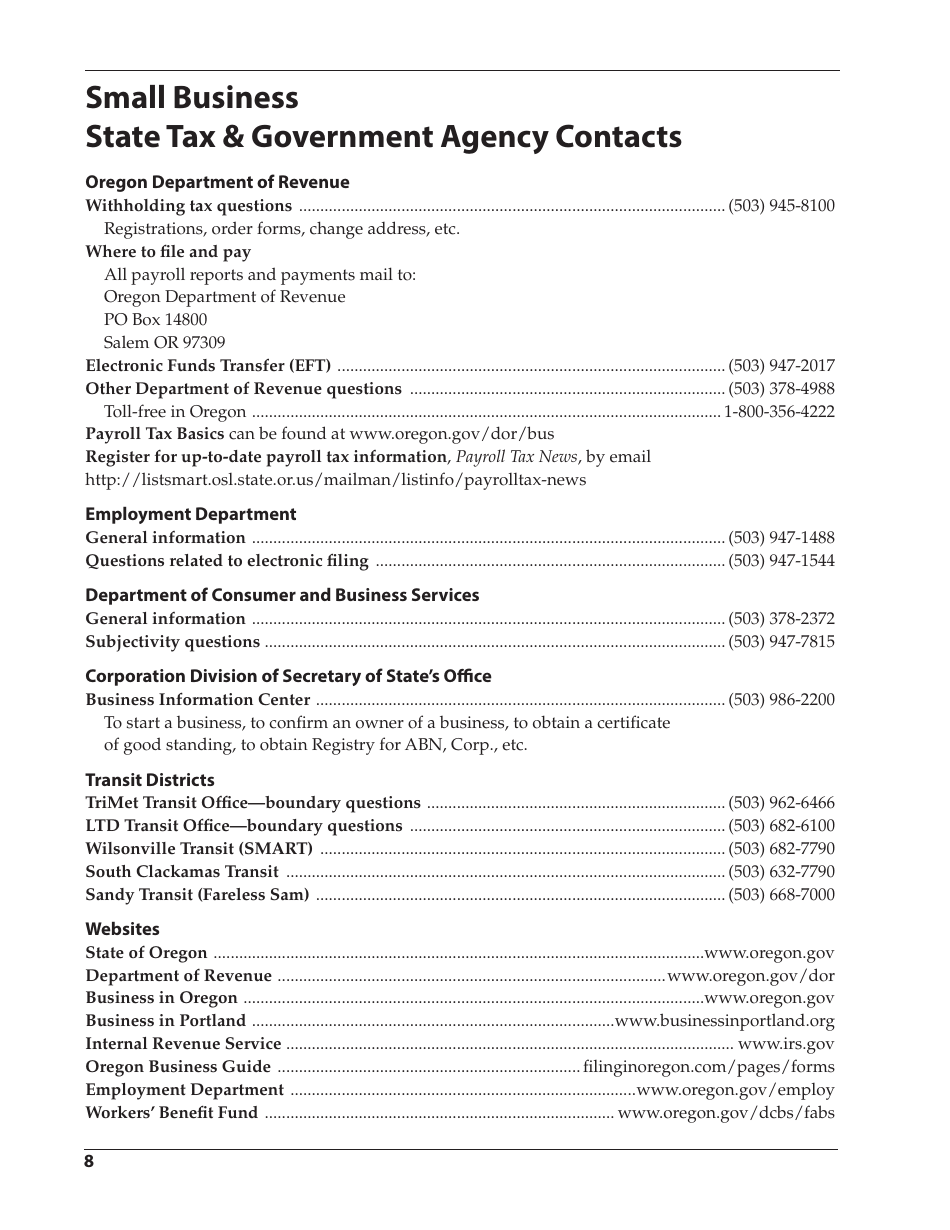

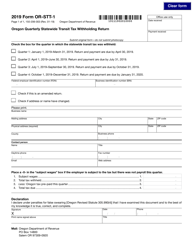

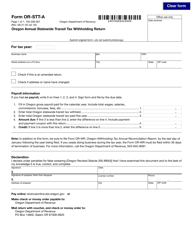

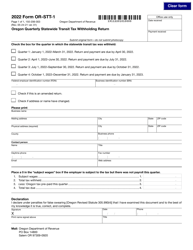

A: This guide covers information about Oregon withholding taxes, transit taxes, and reporting requirements for employers in the sports and entertainment industries.

Q: What are Oregon withholding taxes?

A: Oregon withholding taxes are taxes that employers deduct from their employees' wages to cover the employees' state income tax obligations.

Q: What are Oregon transit taxes?

A: Oregon transit taxes are taxes that employers must collect from their employees to support public transportation systems in the state.

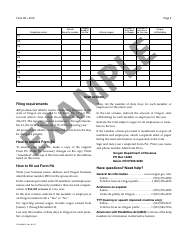

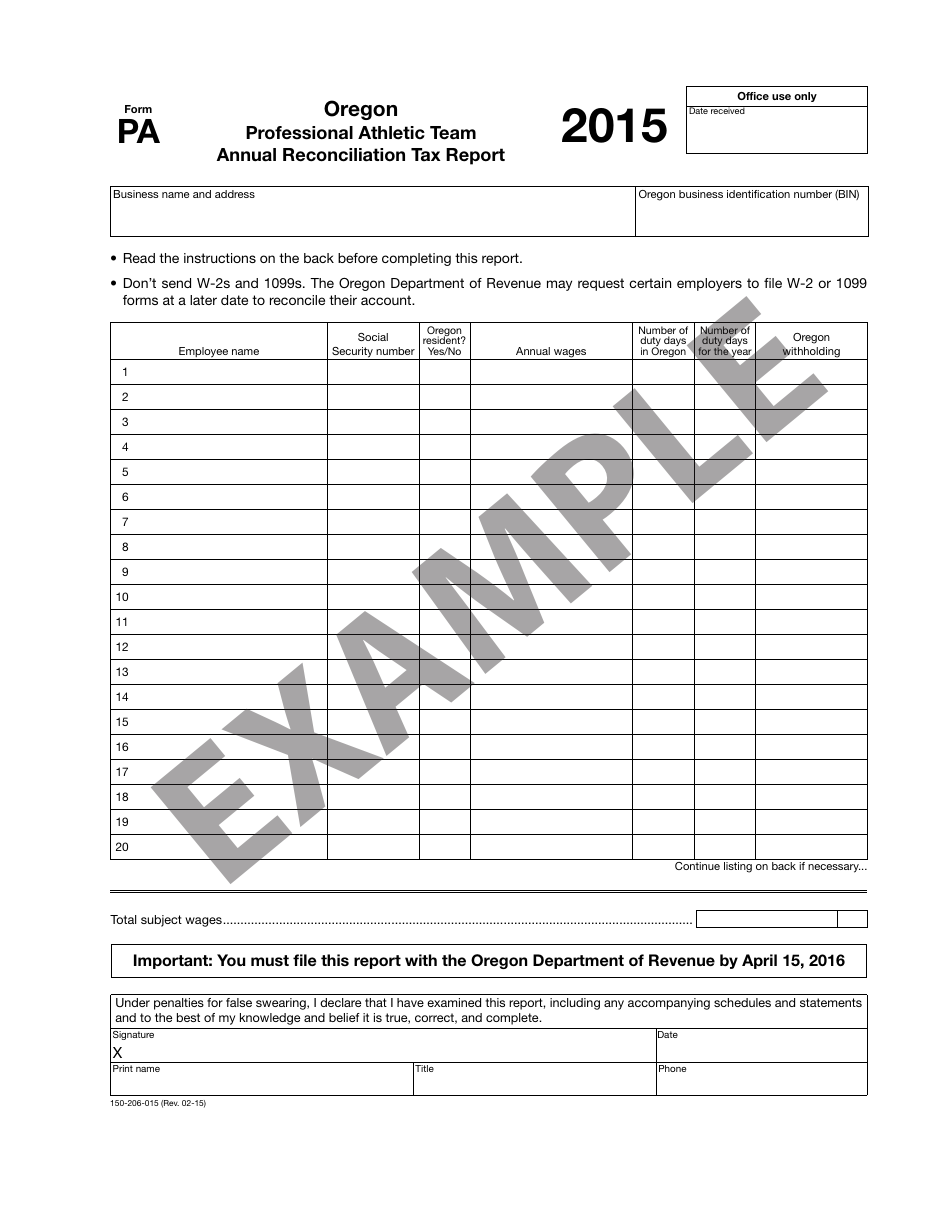

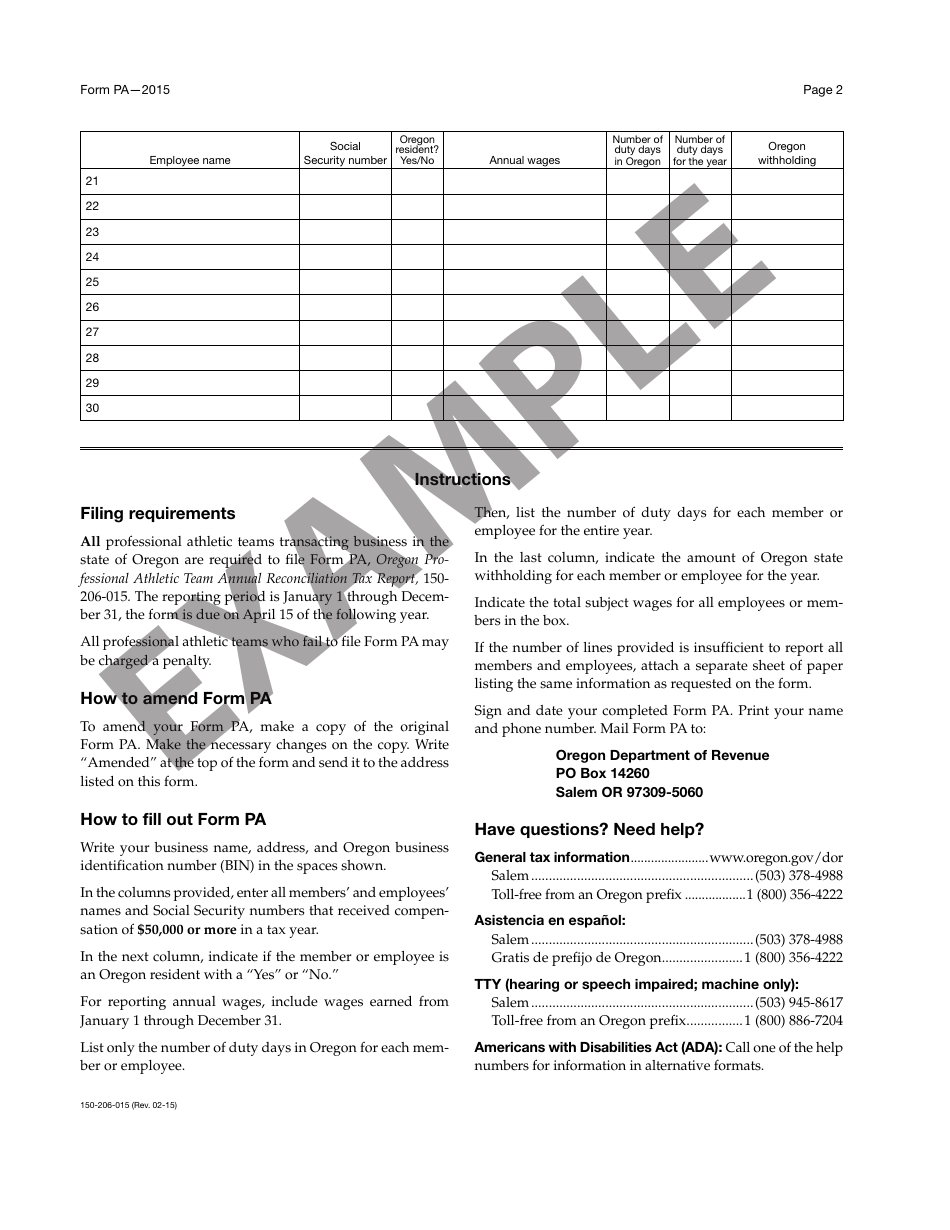

Q: What are the reporting requirements for employers in the sports and entertainment industries?

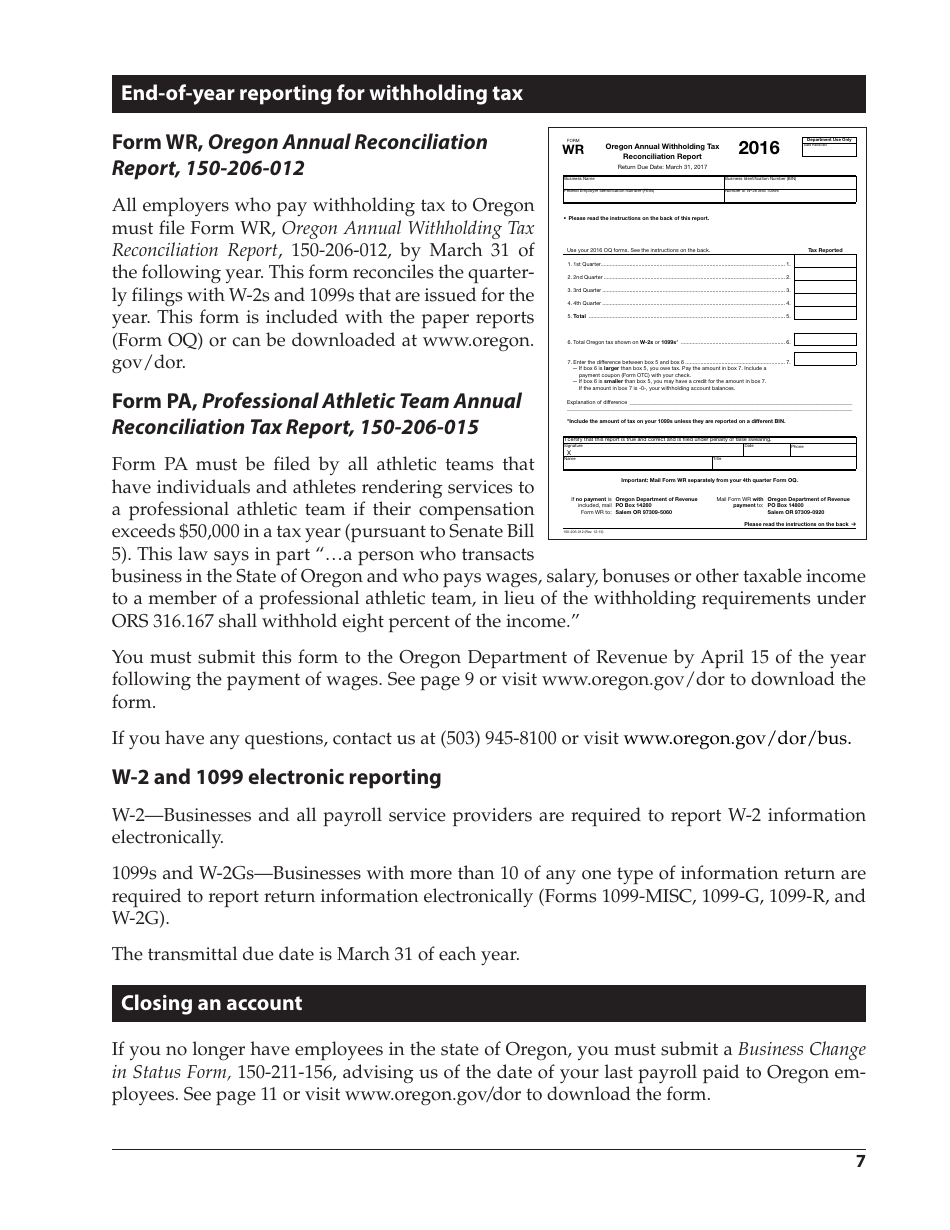

A: Employers in the sports and entertainment industries must file quarterly withholding tax returns and annual information returns, and provide certain tax-related information to their employees.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 150-206-695 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.