This version of the form is not currently in use and is provided for reference only. Download this version of

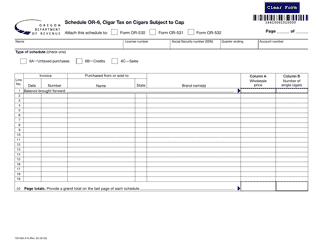

Form 150-605-016 Schedule OR-7

for the current year.

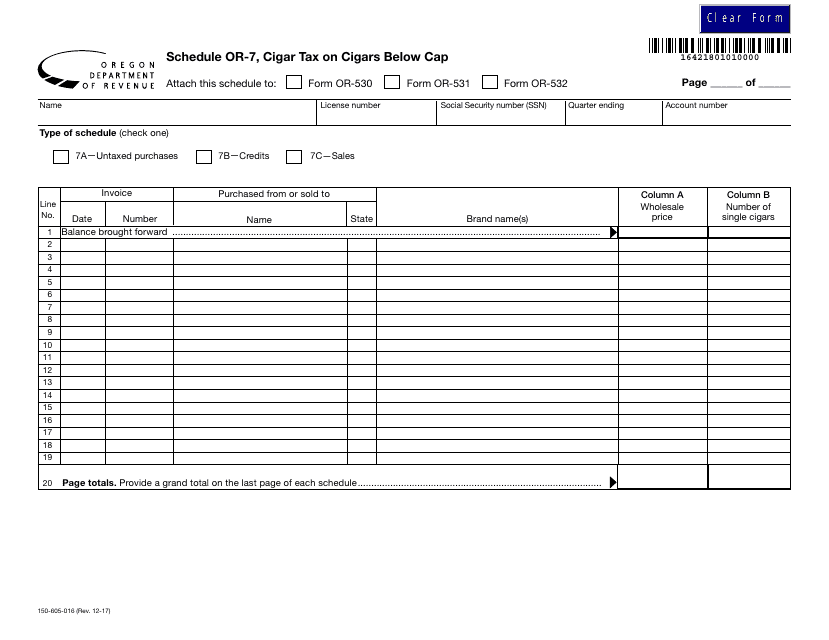

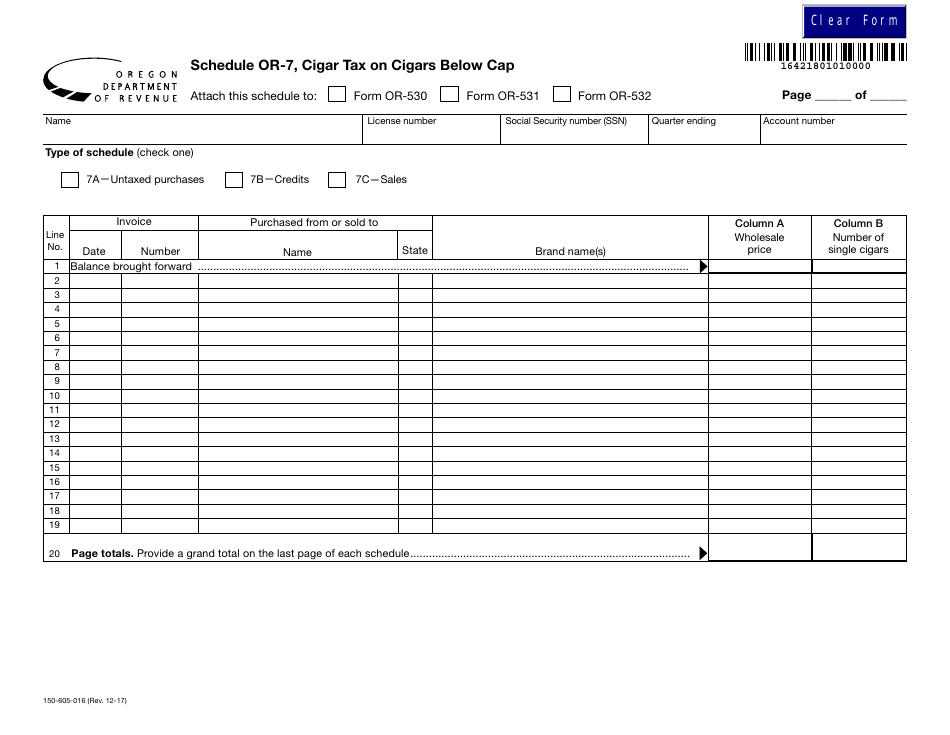

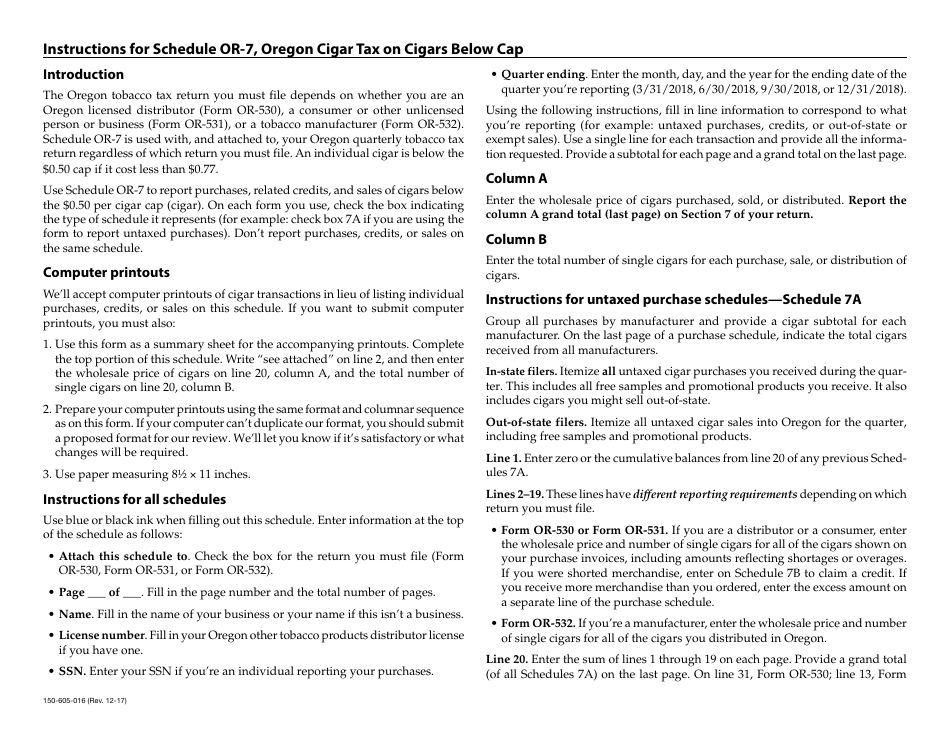

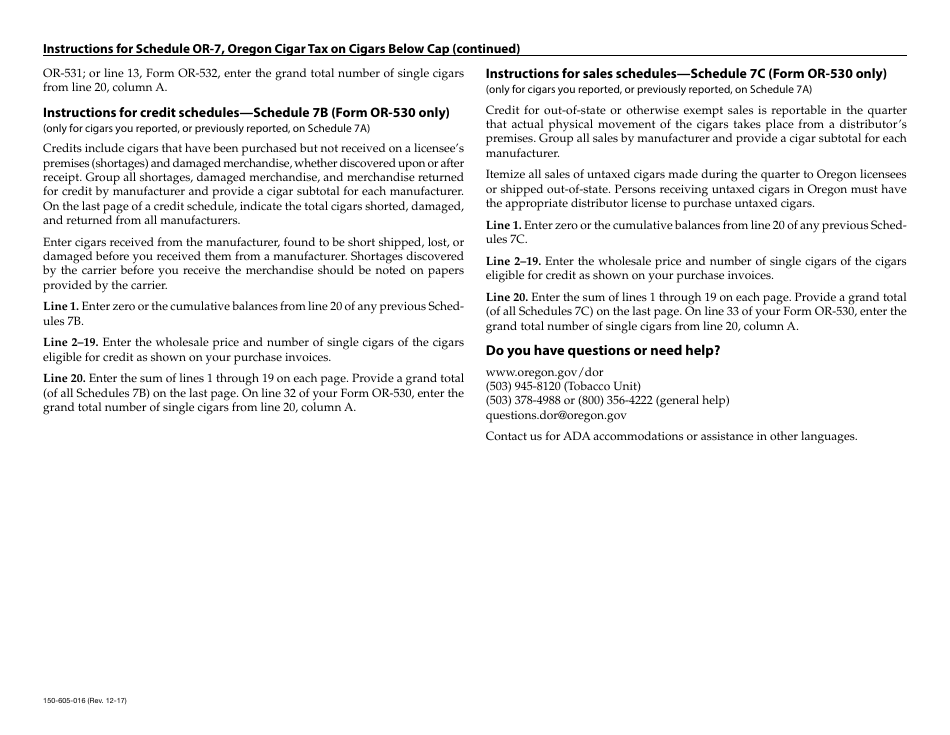

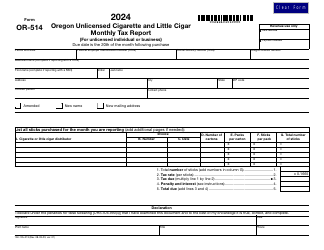

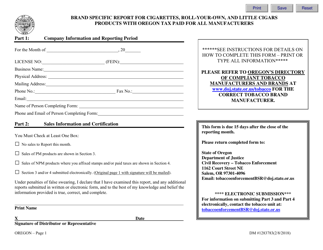

Form 150-605-016 Schedule OR-7 Cigar Tax on Cigars Below Cap - Oregon

What Is Form 150-605-016 Schedule OR-7?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-605-016 Schedule OR-7?

A: Form 150-605-016 Schedule OR-7 is a tax form used in Oregon to report cigar tax on cigars that are below the cap.

Q: What is the purpose of Form 150-605-016 Schedule OR-7?

A: The purpose of Form 150-605-016 Schedule OR-7 is to calculate and report the cigar tax on cigars that are below the cap in Oregon.

Q: Who needs to fill out Form 150-605-016 Schedule OR-7?

A: Any individual or business who sells or distributes cigars below the cap in Oregon needs to fill out Form 150-605-016 Schedule OR-7 to report the cigar tax.

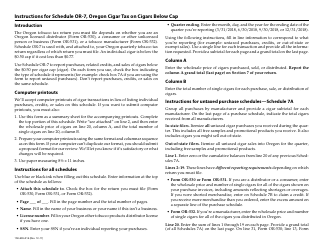

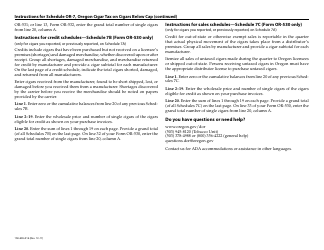

Q: How do I fill out Form 150-605-016 Schedule OR-7?

A: To fill out Form 150-605-016 Schedule OR-7, you need to provide information about the quantity and value of cigars below the cap sold or distributed in Oregon.

Q: When is the deadline for filing Form 150-605-016 Schedule OR-7?

A: The filing deadline for Form 150-605-016 Schedule OR-7 is usually the same as the regular cigar tax return filing deadline, which is April 30th of each year.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-016 Schedule OR-7 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.