This version of the form is not currently in use and is provided for reference only. Download this version of

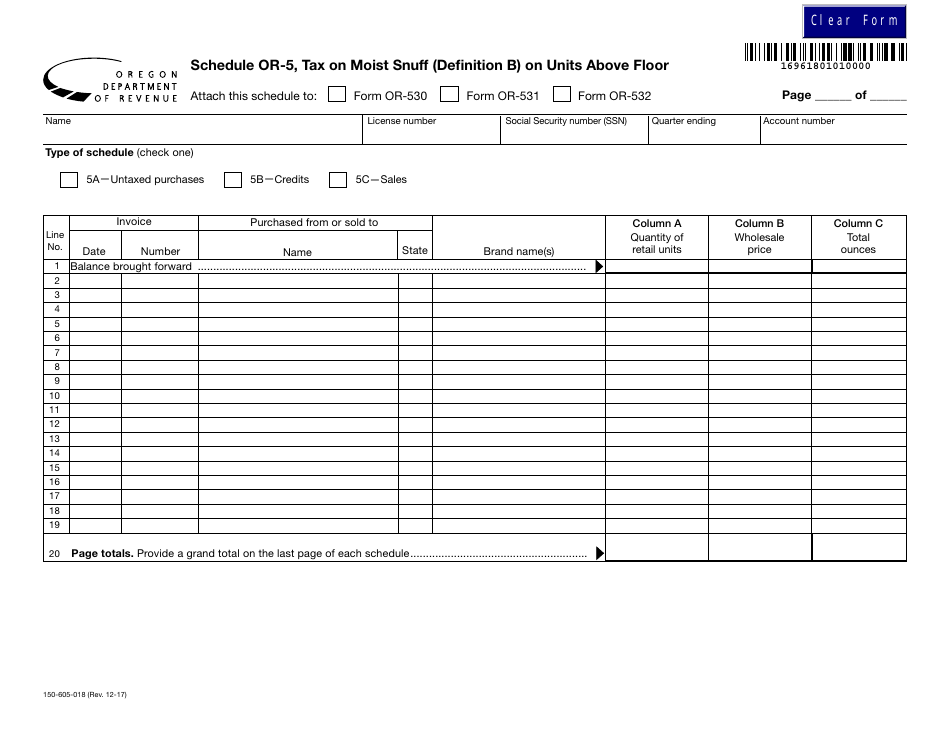

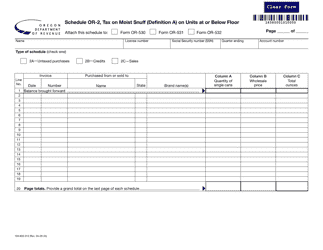

Form 150-605-018 Schedule OR-5

for the current year.

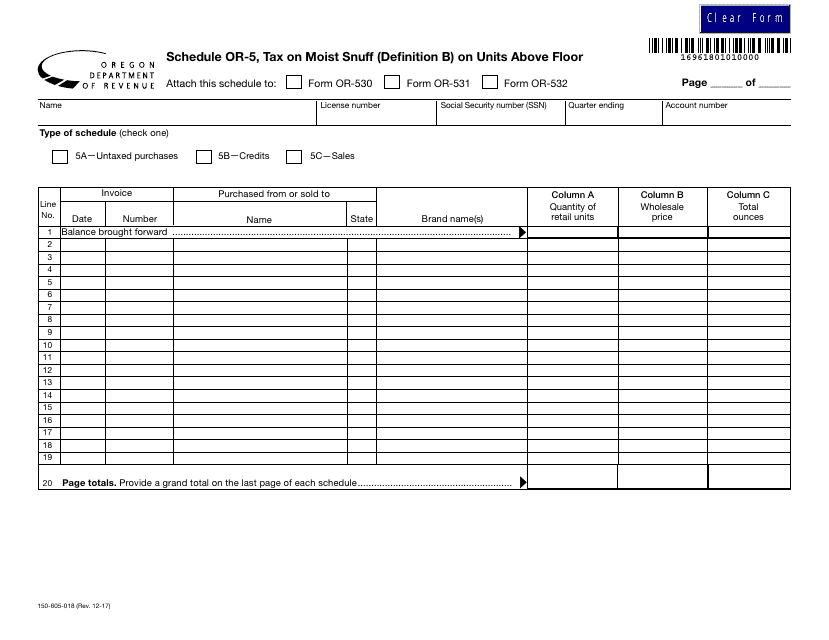

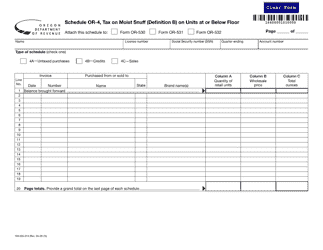

Form 150-605-018 Schedule OR-5 Tax on Moist Snuff (Definition B) on Units Above Floor - Oregon

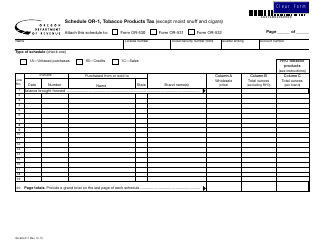

What Is Form 150-605-018 Schedule OR-5?

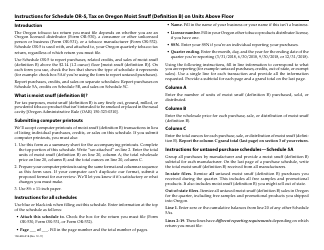

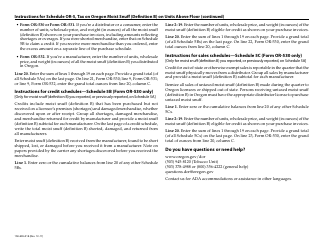

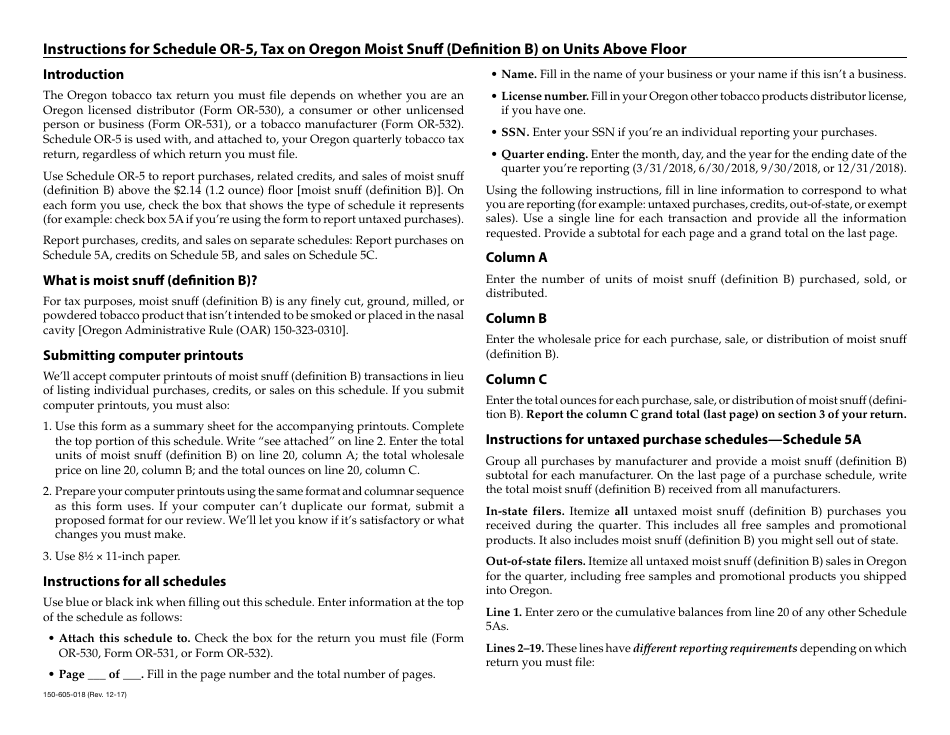

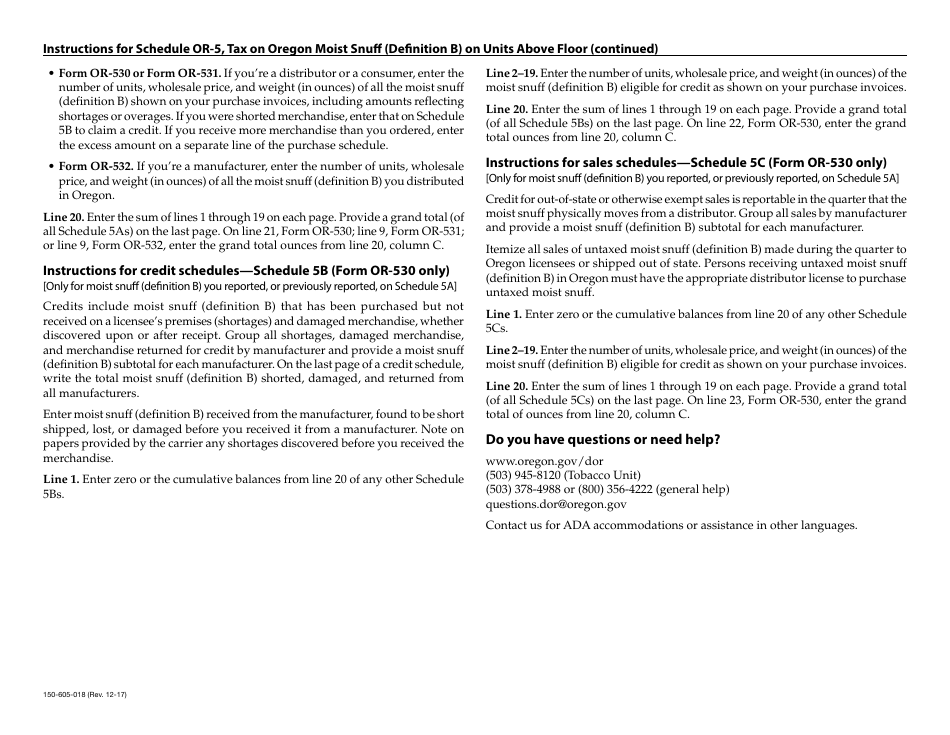

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-605-018?

A: Form 150-605-018 is a schedule for reporting tax on moist snuff in Oregon.

Q: What does Schedule OR-5 refer to?

A: Schedule OR-5 refers to the specific schedule for tax calculation on moist snuff.

Q: What does 'Definition B' mean in this context?

A: 'Definition B' in this context refers to a specific category or type of moist snuff.

Q: What is the tax on units above floor?

A: The tax on units above floor is the tax imposed on units of moist snuff that are not on the sales floor of a business.

Q: Is this tax specific to Oregon?

A: Yes, this tax is specific to Oregon and applies to moist snuff products sold in the state.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-018 Schedule OR-5 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.