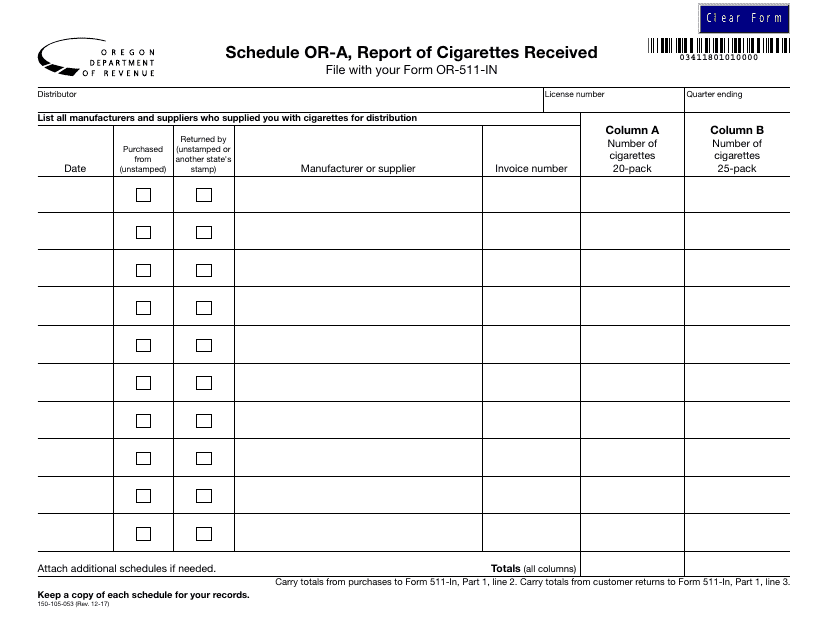

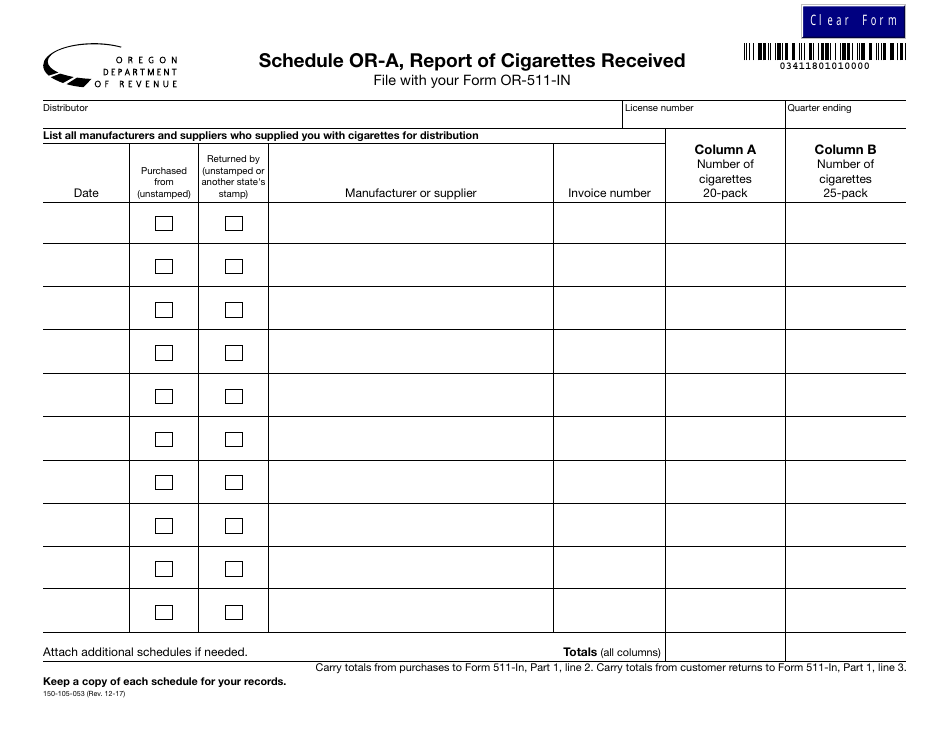

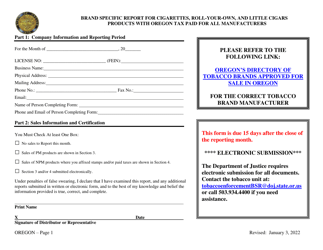

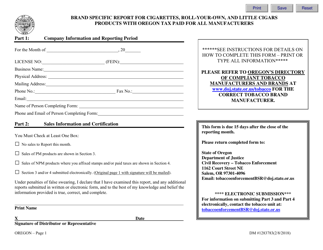

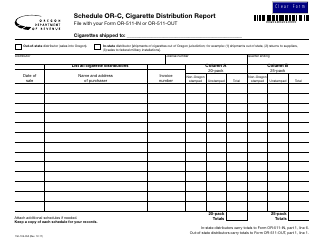

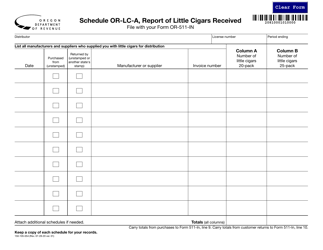

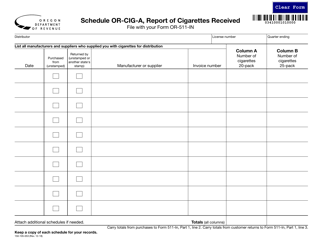

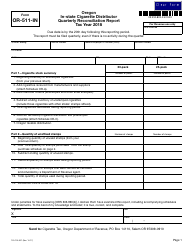

Form 150-105-053 Schedule OR-A Report of Cigarettes Received - Oregon

What Is Form 150-105-053 Schedule OR-A?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 150-105-053?

A: Form 150-105-053 is the Schedule OR-A Report of Cigarettes Received in Oregon.

Q: Who needs to fill out Form 150-105-053?

A: Any person, business, or entity that receives cigarettes in Oregon needs to fill out this form.

Q: What is the purpose of Form 150-105-053?

A: The purpose of this form is to report the receipt of cigarettes in Oregon and ensure compliance with state laws.

Q: How often should Form 150-105-053 be filed?

A: Form 150-105-053 should be filed monthly.

Q: What information is required on Form 150-105-053?

A: The form requires information about the receiver, sender, and the cigarettes received, including quantity and brand.

Q: Are there any penalties for not filing Form 150-105-053?

A: Yes, failure to file or filing a false form may result in penalties, including fines and potential legal consequences.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-105-053 Schedule OR-A by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.