This version of the form is not currently in use and is provided for reference only. Download this version of

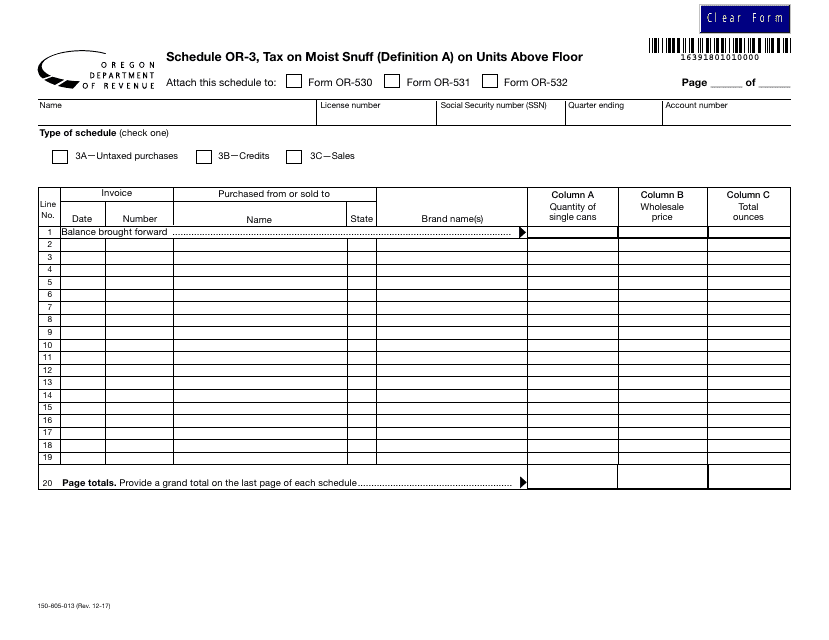

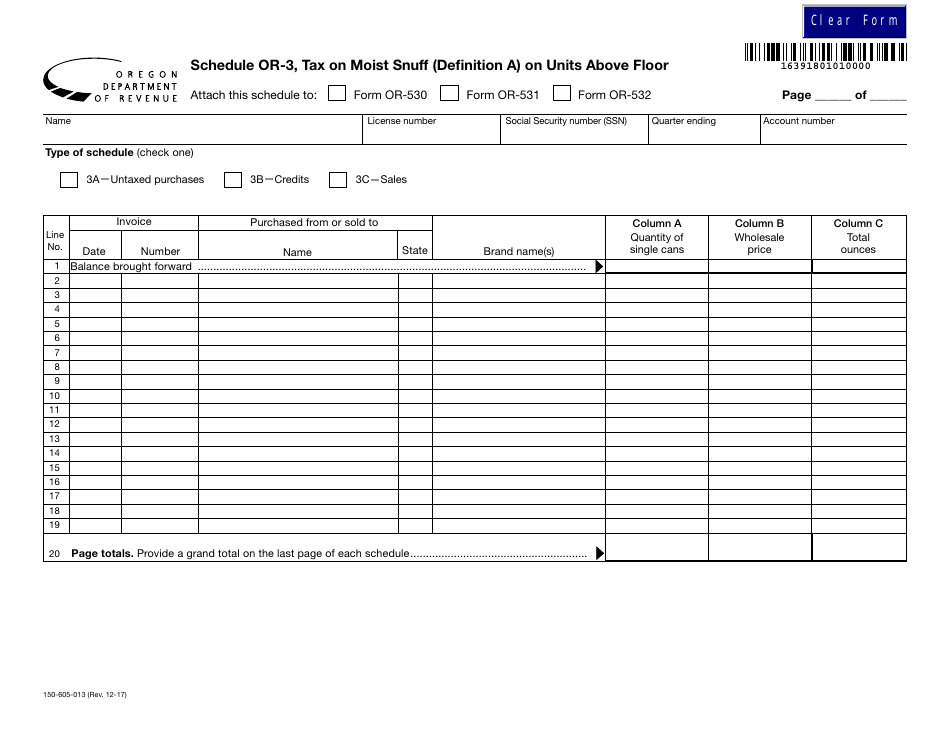

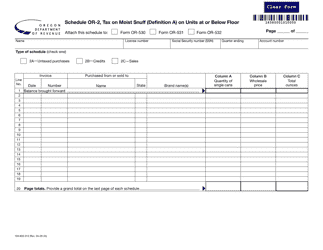

Form 150-605-013 Schedule OR-3

for the current year.

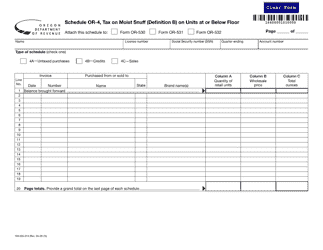

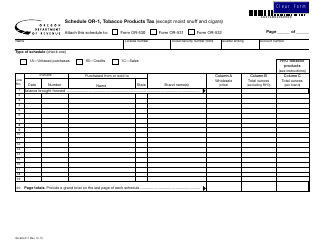

Form 150-605-013 Schedule OR-3 Tax on Moist Snuff (Definition a) on Units Above Floor - Oregon

What Is Form 150-605-013 Schedule OR-3?

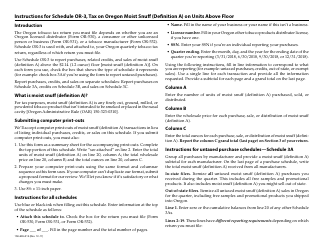

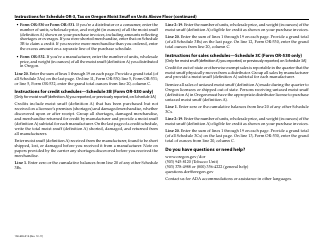

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OR-3?

A: Schedule OR-3 is a tax form used in Oregon to calculate the tax on moist snuff.

Q: What is moist snuff?

A: Moist snuff refers to a specific type of smokeless tobacco product that is moist and typically packaged in small containers.

Q: What does 'Units Above Floor' mean?

A: 'Units Above Floor' is a term used to determine the tax rate on moist snuff based on the number of units sold above a certain threshold.

Q: Why is there a tax on moist snuff?

A: The tax on moist snuff is implemented to generate revenue for the state and discourage the use of tobacco products.

Q: How is the tax on moist snuff calculated?

A: The tax on moist snuff is calculated by multiplying the number of units sold above the threshold by the tax rate and adding it to the base tax amount.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-013 Schedule OR-3 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.