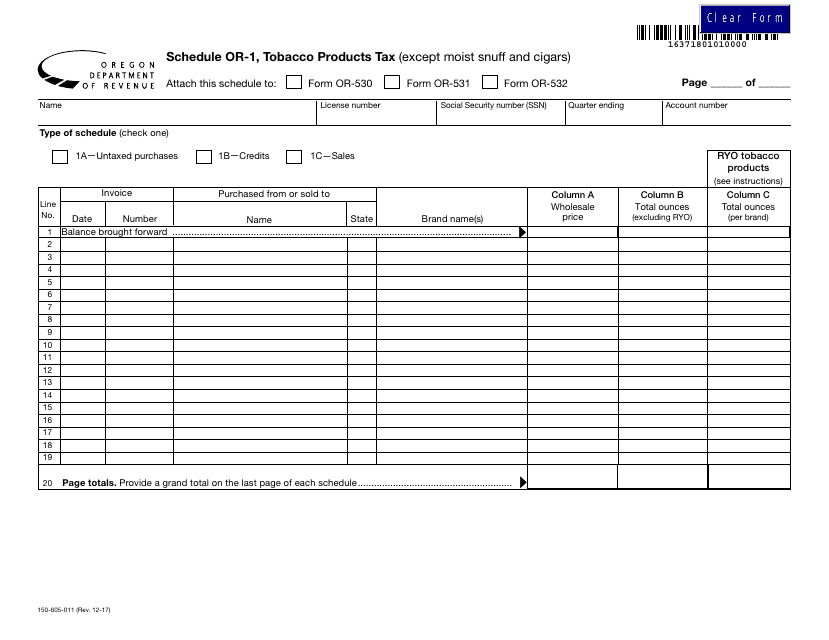

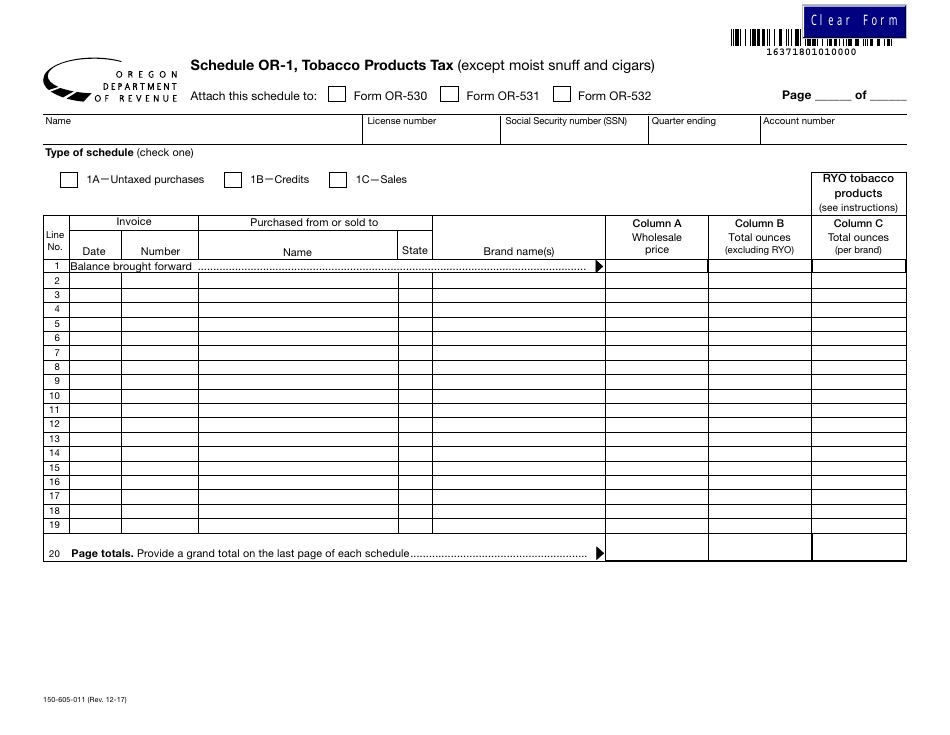

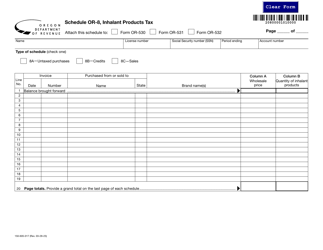

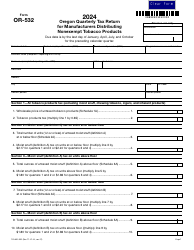

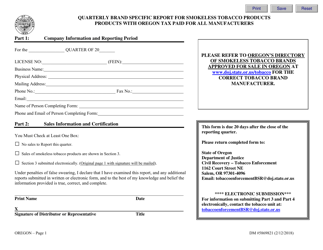

Form 150-605-011 Schedule OR-1 Tobacco Products Tax (Except Moist Snuff and Cigars) - Oregon

What Is Form 150-605-011 Schedule OR-1?

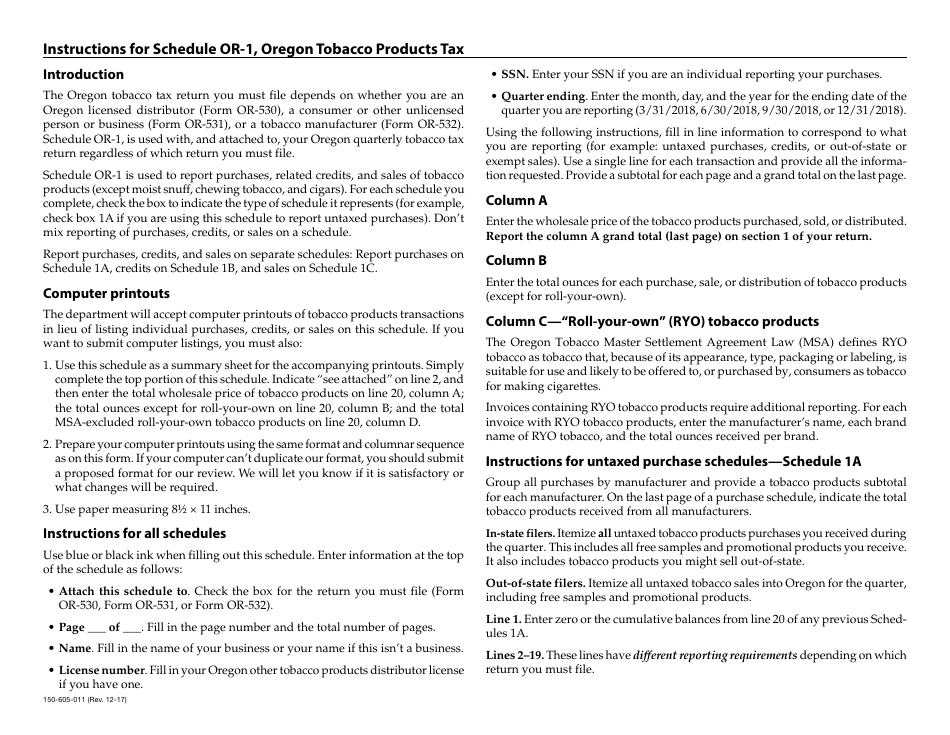

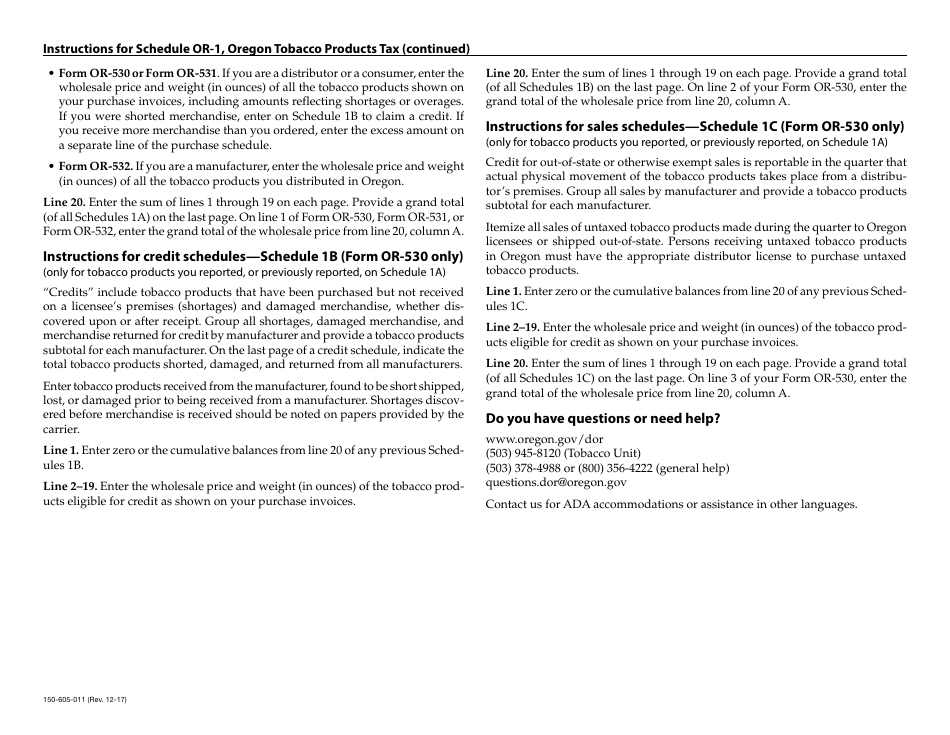

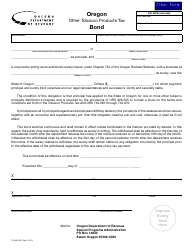

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-605-011 Schedule OR-1?

A: Form 150-605-011 Schedule OR-1 is a form used for reporting tobacco products tax in Oregon, except for moist snuff and cigars.

Q: Who needs to file Form 150-605-011 Schedule OR-1?

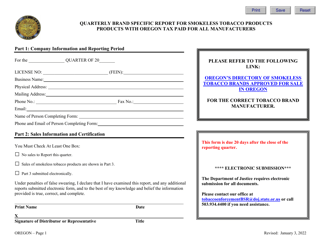

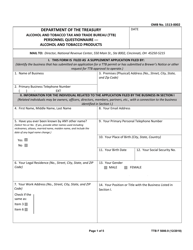

A: Any individual or entity engaged in the sale or distribution of tobacco products in Oregon, excluding moist snuff and cigars, needs to file this form.

Q: What information is required on Form 150-605-011 Schedule OR-1?

A: The form requires information such as the name and address of the seller, details of tobacco products sold or distributed, quantities, and the amount of tax due.

Q: When is the due date for filing Form 150-605-011 Schedule OR-1?

A: The due date for filing this form is the last day of the month following the reporting period. For example, if the reporting period is January, the form is due by the last day of February.

Q: Are there any penalties for late filing of Form 150-605-011 Schedule OR-1?

A: Yes, there are penalties for late filing. The penalty amount depends on the number of days the form is past due and can range from $50 to $1,000.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-011 Schedule OR-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.