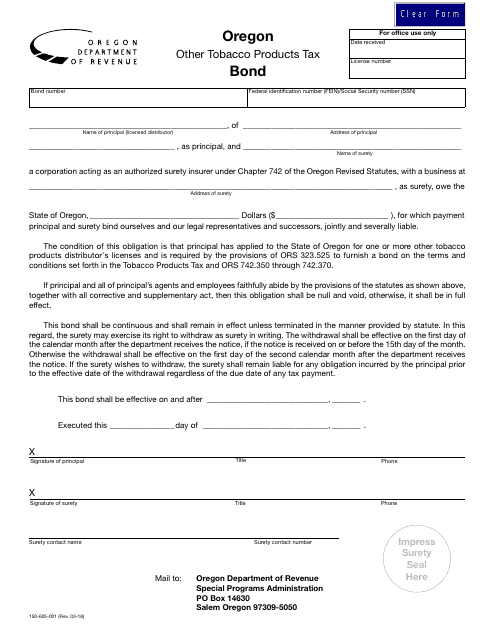

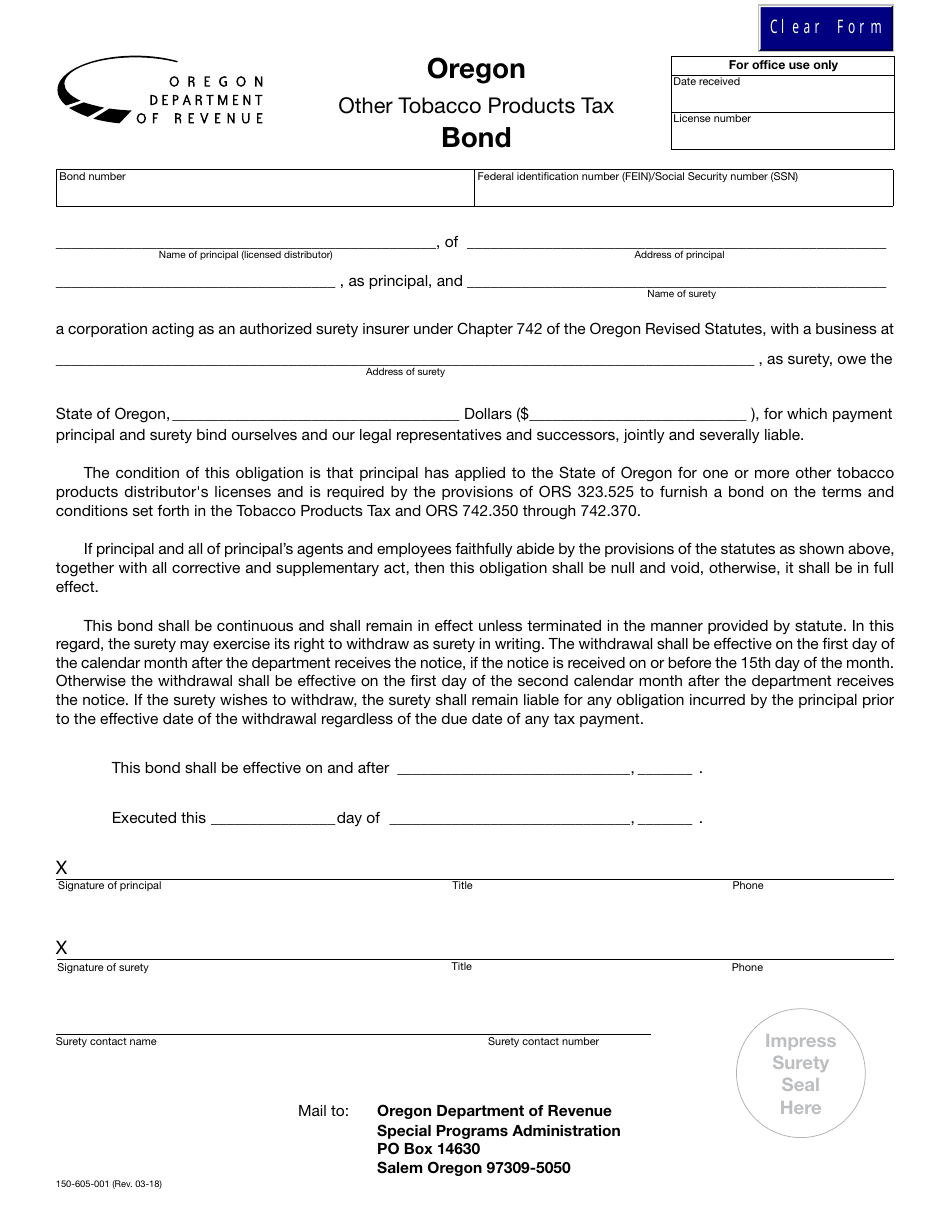

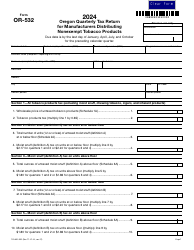

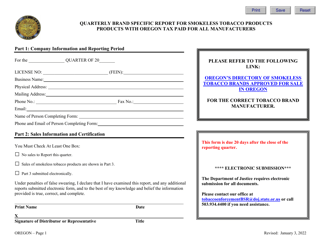

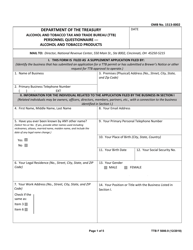

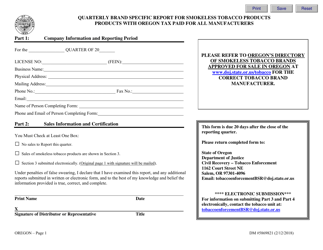

Other Tobacco Products Tax Bond - Oregon

Other Tobacco Products Tax Bond is a legal document that was released by the Oregon Department of Revenue - a government authority operating within Oregon.

FAQ

Q: What is an Other Tobacco Products Tax Bond?

A: An Other Tobacco Products Tax Bond is a type of surety bond required by the state of Oregon for businesses engaged in the sale of tobacco products other than cigarettes.

Q: Why is an Other Tobacco Products Tax Bond required?

A: The bond is required to ensure that businesses comply with all applicable laws and regulations regarding the payment of taxes on tobacco products.

Q: Who needs to get an Other Tobacco Products Tax Bond?

A: Any business in Oregon that sells tobacco products other than cigarettes needs to get an Other Tobacco Products Tax Bond.

Q: How much does an Other Tobacco Products Tax Bond cost?

A: The cost of the bond depends on various factors such as the bond amount required and the applicant's credit history.

Q: How long does an Other Tobacco Products Tax Bond last?

A: The bond is typically valid for one year from the date it is issued, but it may vary depending on the specific requirements of the state.

Q: What happens if I don't get an Other Tobacco Products Tax Bond?

A: Failure to obtain the required bond can result in penalties, fines, and even the suspension or revocation of your business license.

Q: What is the purpose of an Other Tobacco Products Tax?

A: The purpose of the Other Tobacco Products Tax is to generate revenue for the state and to discourage the use of tobacco products by making them more expensive.

Form Details:

- Released on March 1, 2018;

- The latest edition currently provided by the Oregon Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.