This version of the form is not currently in use and is provided for reference only. Download this version of

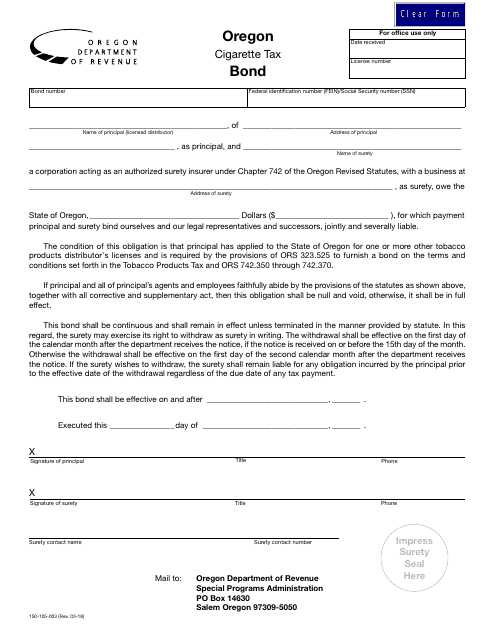

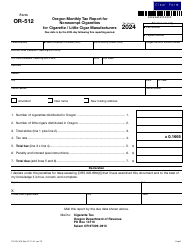

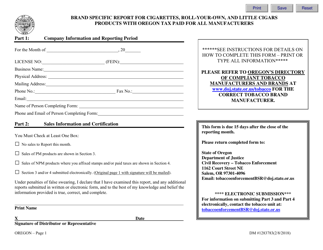

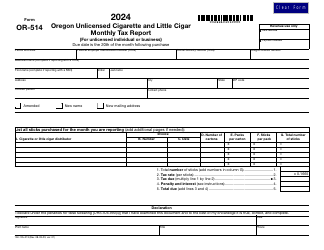

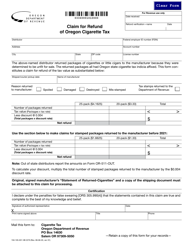

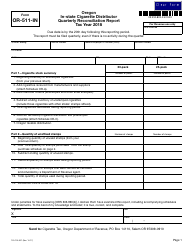

Form 150-105-003

for the current year.

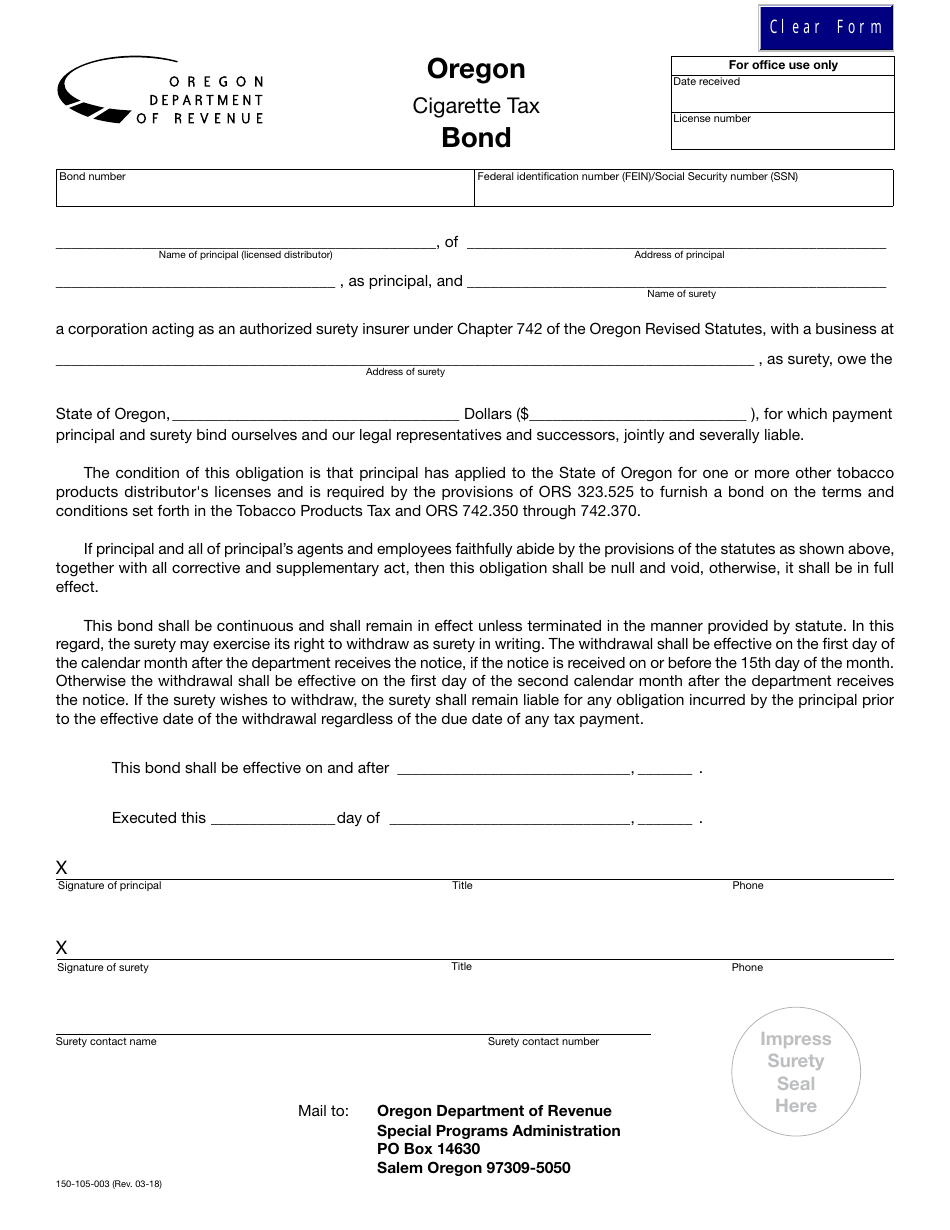

Form 150-105-003 Cigarette Tax Bond - Oregon

What Is Form 150-105-003?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-105-003?

A: Form 150-105-003 is the Cigarette Tax Bond form used in Oregon.

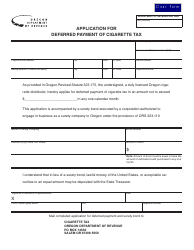

Q: What is a Cigarette Tax Bond?

A: A Cigarette Tax Bond is a type of surety bond that ensures a business will comply with state regulations regarding the payment of cigarette taxes.

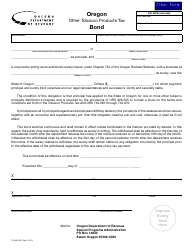

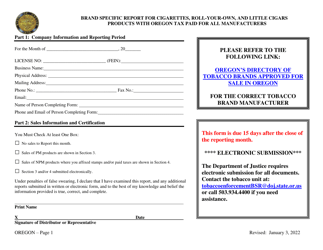

Q: Who needs to file Form 150-105-003?

A: Businesses engaged in the sale or distribution of cigarettes in Oregon need to file Form 150-105-003.

Q: Why is a Cigarette Tax Bond required?

A: A Cigarette Tax Bond is required to protect the state from potential loss of tax revenue if a business fails to pay the required cigarette taxes.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-105-003 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.