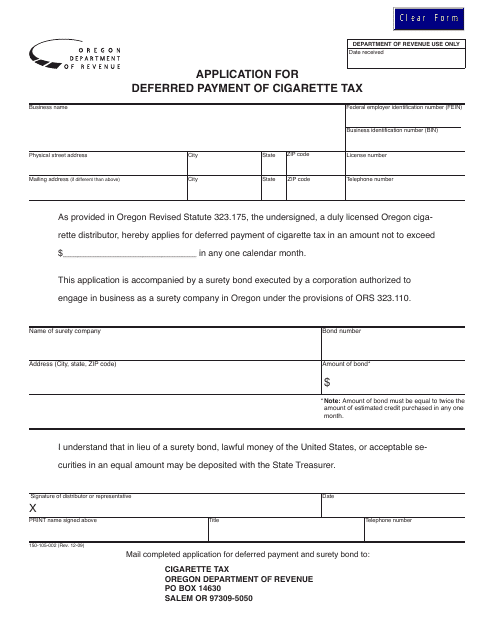

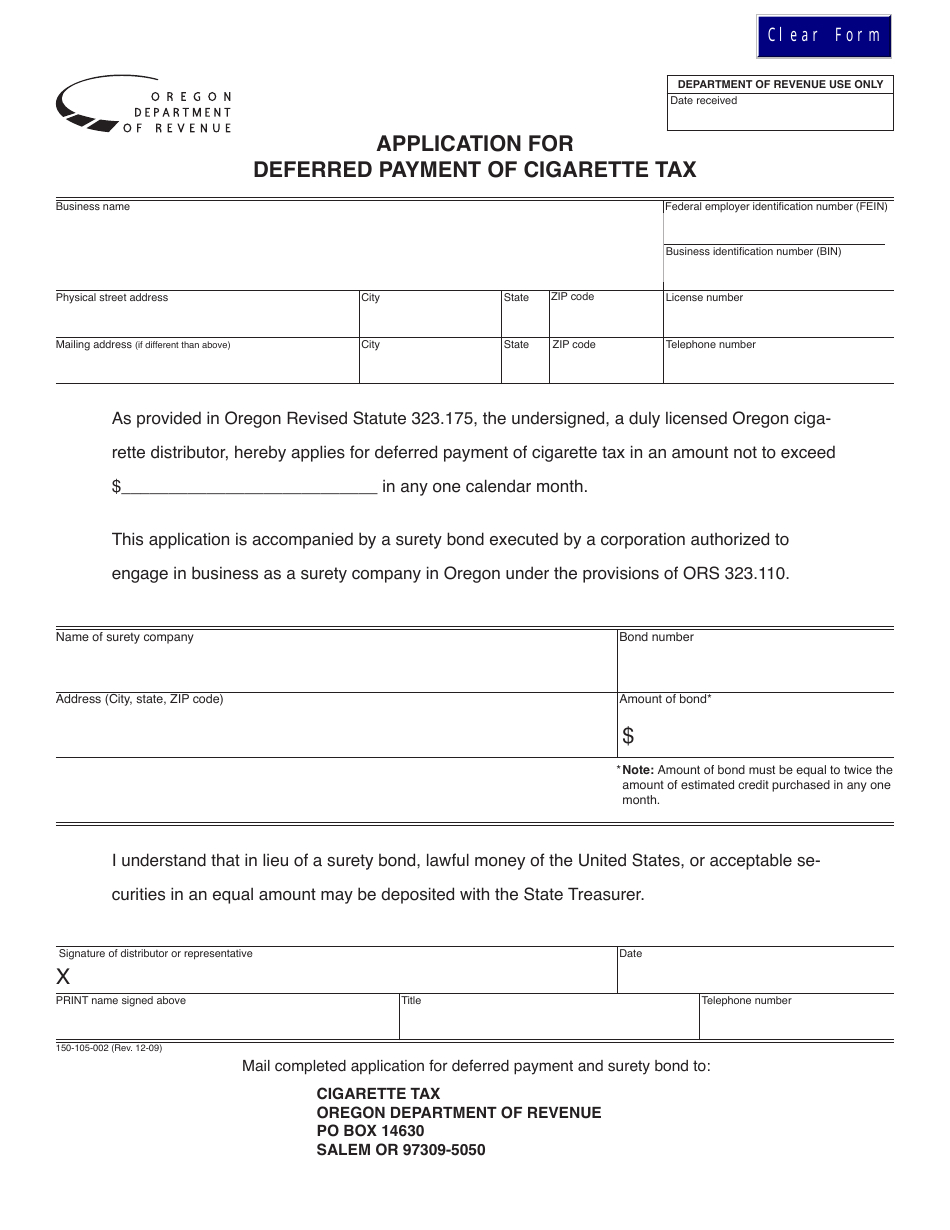

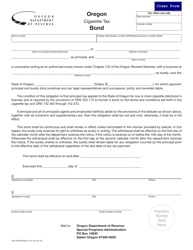

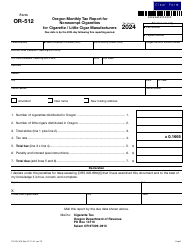

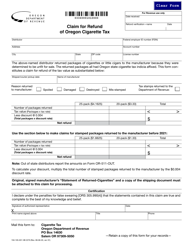

Form 150-105-002 Application for Deferred Payment of Cigarette Tax - Oregon

What Is Form 150-105-002?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-105-002?

A: Form 150-105-002 is the Application for Deferred Payment of Cigarette Tax in Oregon.

Q: Who needs to fill out this form?

A: This form needs to be filled out by businesses or individuals that want to pay their cigarette tax later.

Q: What is the purpose of deferred payment of cigarette tax?

A: Deferred payment allows businesses or individuals to delay paying the cigarette tax until a later date.

Q: Are there any eligibility requirements for deferred payment?

A: Yes, there are specific eligibility requirements outlined in the instructions for Form 150-105-002. It is advisable to review the instructions for detailed information.

Q: What should I do after filling out the form?

A: After filling out the form, you need to submit it to the Oregon Department of Revenue along with any required documentation and payment.

Q: Is there a deadline for submitting this form?

A: Yes, there is a deadline specified in the instructions for Form 150-105-002. It is important to submit the form before the deadline to avoid penalties.

Q: Can I request an extension for the payment deadline?

A: It is possible to request an extension for the payment deadline, but it is subject to approval by the Oregon Department of Revenue. You should contact the department for further guidance.

Q: What happens if I don't pay the cigarette tax on time?

A: If you don't pay the cigarette tax on time, you may be subject to penalties and interest charges as specified by the Oregon Department of Revenue.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-105-002 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.