This version of the form is not currently in use and is provided for reference only. Download this version of

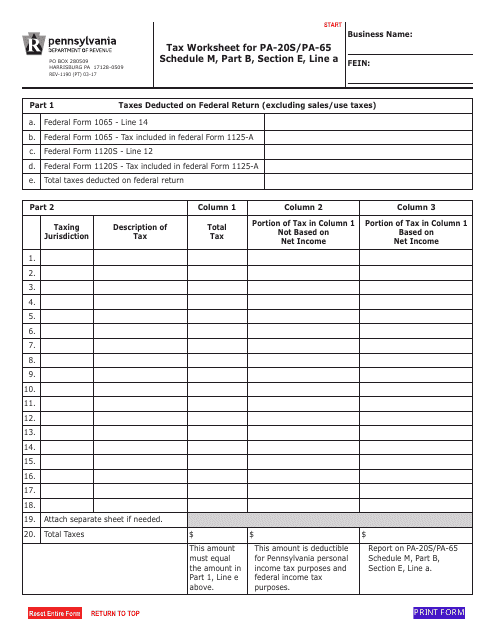

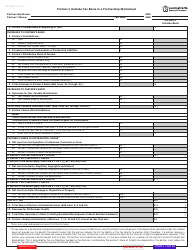

Form REV-1190

for the current year.

Form REV-1190 Tax Worksheet for Pa-20s / Pa-65 Schedule M, Part B, Section E, Line a - Pennsylvania

What Is Form REV-1190?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-1190 Tax Worksheet?

A: The REV-1190 Tax Worksheet is a tax form used in Pennsylvania.

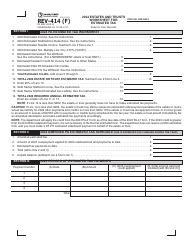

Q: What is Pa-20s/Pa-65 Schedule M?

A: Pa-20s/Pa-65 Schedule M is a tax form for partnerships and S corporations in Pennsylvania.

Q: What is Part B, Section E, Line a of the REV-1190 Tax Worksheet?

A: Part B, Section E, Line a of the REV-1190 Tax Worksheet is a specific line on the form that requires information to calculate a certain tax amount for Pennsylvania.

Q: What is the purpose of the REV-1190 Tax Worksheet?

A: The purpose of the REV-1190 Tax Worksheet is to calculate the tax liability for partnerships and S corporations in Pennsylvania.

Q: Why do I need to fill out the REV-1190 Tax Worksheet for Pa-20s/Pa-65 Schedule M, Part B, Section E, Line a?

A: You need to fill out the REV-1190 Tax Worksheet for Pa-20s/Pa-65 Schedule M to ensure accurate calculation of your tax liability in Pennsylvania.

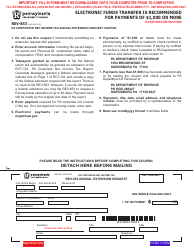

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1190 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.