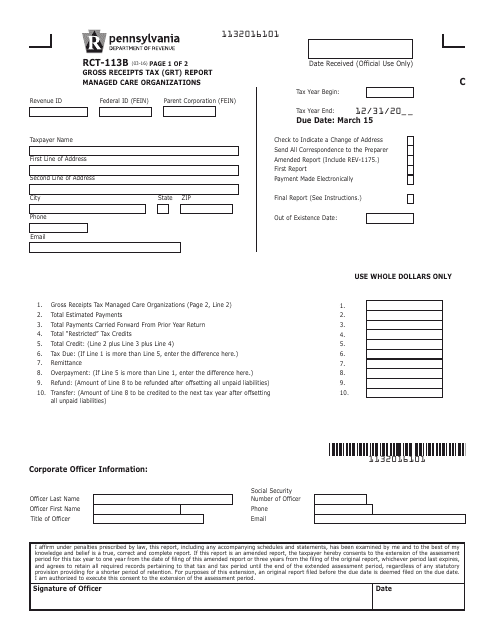

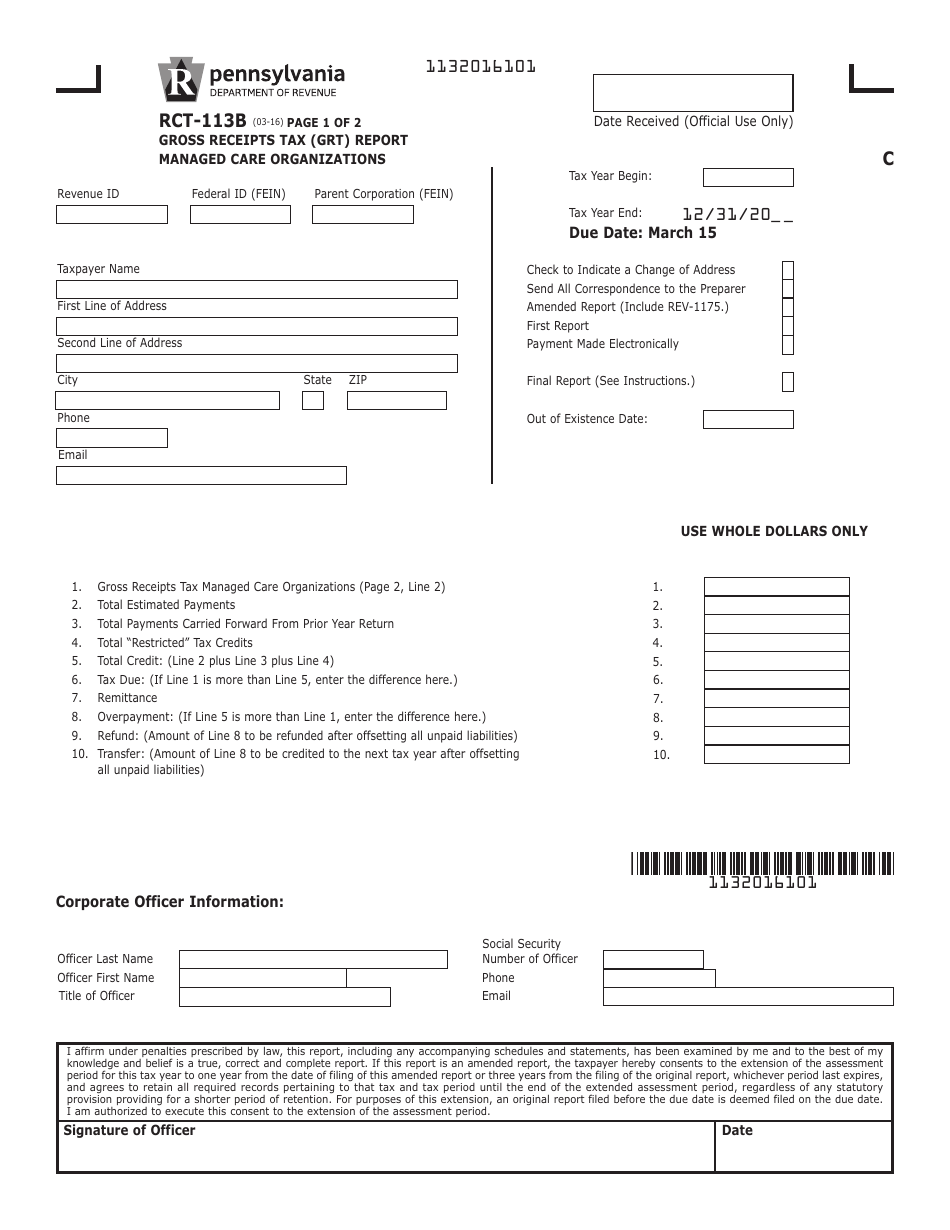

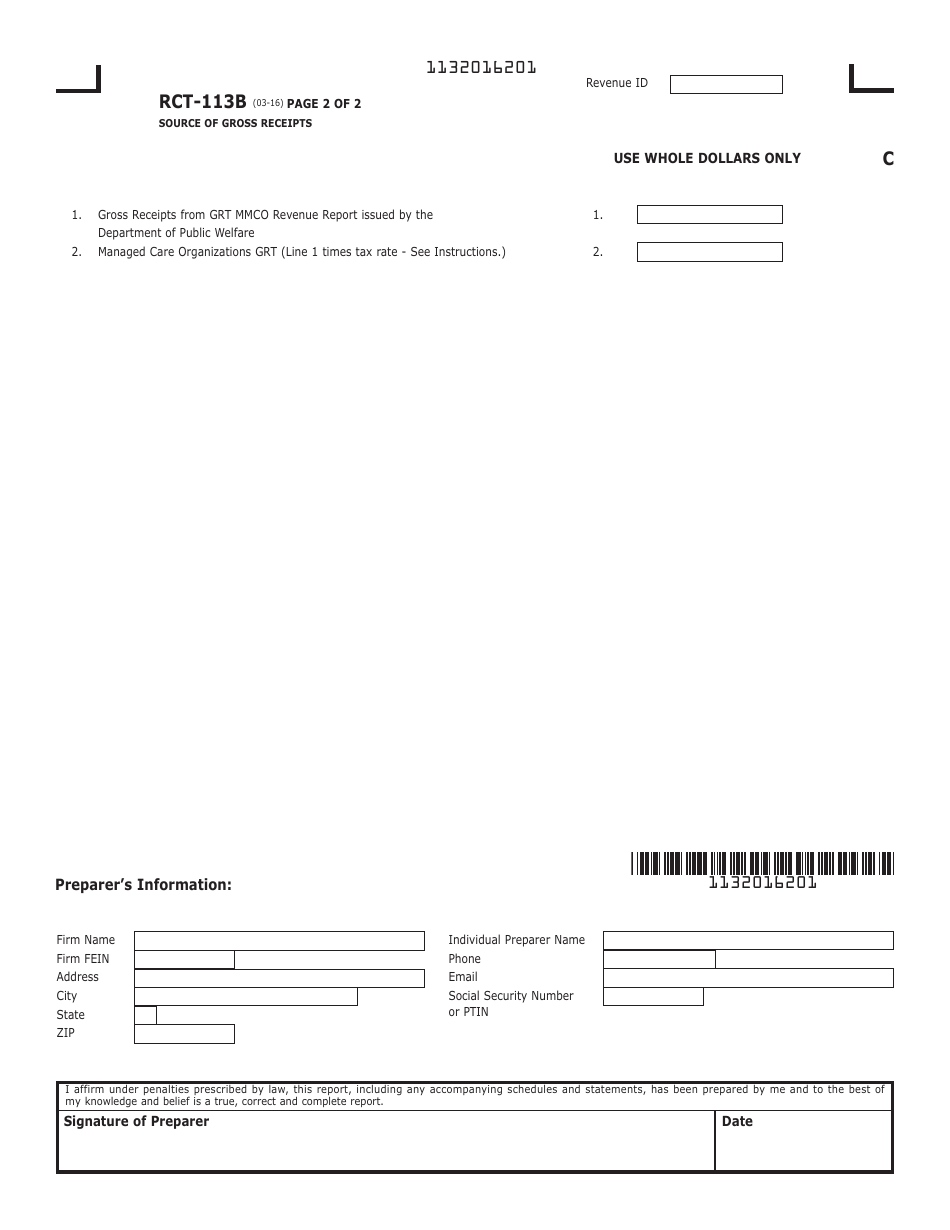

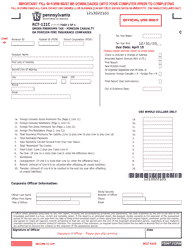

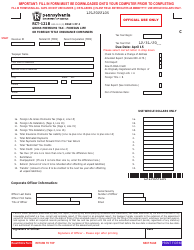

Form RCT-113B Gross Receipts Tax (Grt) Report - Managed Care Organization - Pennsylvania

What Is Form RCT-113B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-113B?

A: Form RCT-113B is a Gross Receipts Tax (Grt) Report specifically for Managed Care Organizations in Pennsylvania.

Q: Who needs to file Form RCT-113B?

A: Managed Care Organizations in Pennsylvania are required to file Form RCT-113B.

Q: What is the purpose of Form RCT-113B?

A: The purpose of Form RCT-113B is to report and pay the Gross Receipts Tax (Grt) for Managed Care Organizations in Pennsylvania.

Q: When is the deadline to file Form RCT-113B?

A: The deadline to file Form RCT-113B is determined by the Pennsylvania Department of Revenue and may vary each year.

Q: What information is required on Form RCT-113B?

A: Form RCT-113B requires information about the Managed Care Organization's gross receipts and other relevant financial details.

Q: Are there any penalties for not filing Form RCT-113B?

A: Yes, there may be penalties for not filing or late filing of Form RCT-113B, as determined by the Pennsylvania Department of Revenue.

Q: Is Form RCT-113B specific to Pennsylvania?

A: Yes, Form RCT-113B is specific to Managed Care Organizations operating in Pennsylvania and reporting their Gross Receipts Tax (Grt).

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RCT-113B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.