This version of the form is not currently in use and is provided for reference only. Download this version of

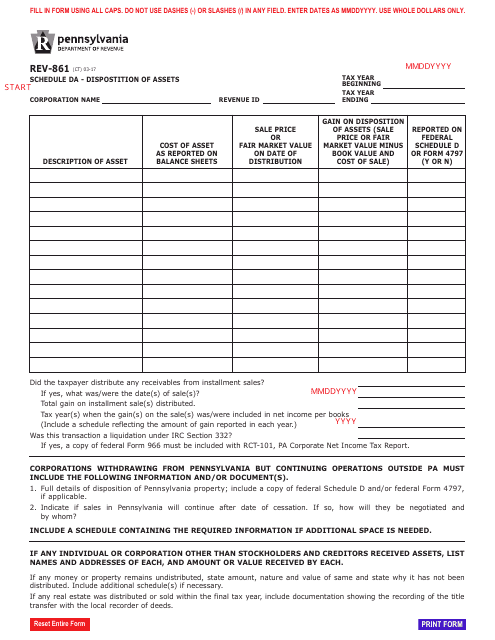

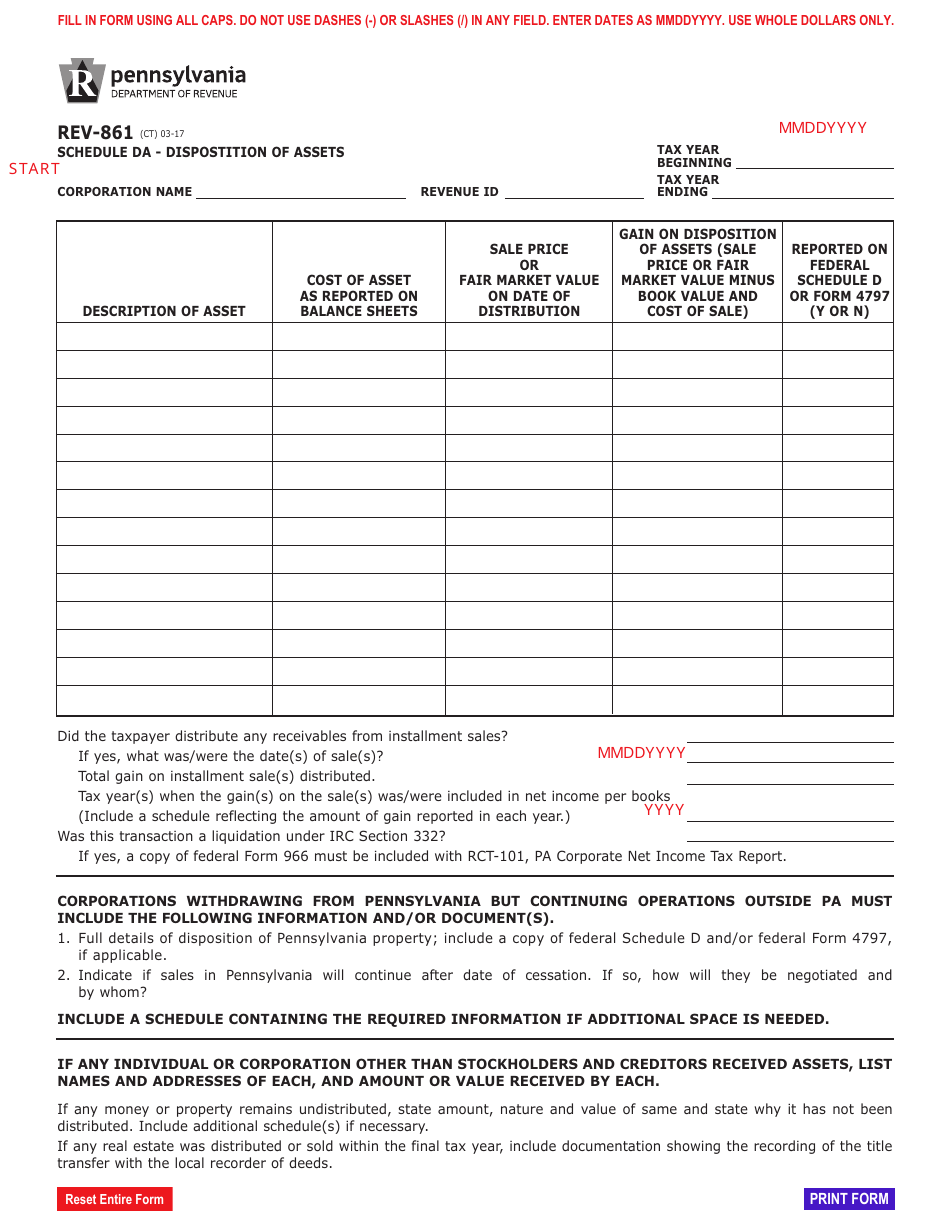

Form REV-861 Schedule DA

for the current year.

Form REV-861 Schedule DA Dispostition of Assets - Pennsylvania

What Is Form REV-861 Schedule DA?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-861 Schedule DA?

A: Form REV-861 Schedule DA is a tax form used in Pennsylvania to report the disposition of assets.

Q: Who needs to file Form REV-861 Schedule DA?

A: Individuals and businesses in Pennsylvania who have disposed of assets may need to file Form REV-861 Schedule DA.

Q: What information is required on Form REV-861 Schedule DA?

A: Form REV-861 Schedule DA requires information about the disposed assets, including the date of disposition, description, and amount.

Q: When is the deadline to file Form REV-861 Schedule DA?

A: The deadline to file Form REV-861 Schedule DA is usually the same as the due date for your Pennsylvania tax return.

Q: Can Form REV-861 Schedule DA be filed electronically?

A: Yes, Form REV-861 Schedule DA can be filed electronically through the Pennsylvania Department of Revenue's e-filing system.

Q: Are there any penalties for not filing Form REV-861 Schedule DA?

A: Failure to file Form REV-861 Schedule DA or filing it late may result in penalties and interest charges.

Q: What should I do if I made an error on Form REV-861 Schedule DA?

A: If you made an error on Form REV-861 Schedule DA, you should file an amended form as soon as possible to correct the mistake.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-861 Schedule DA by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.