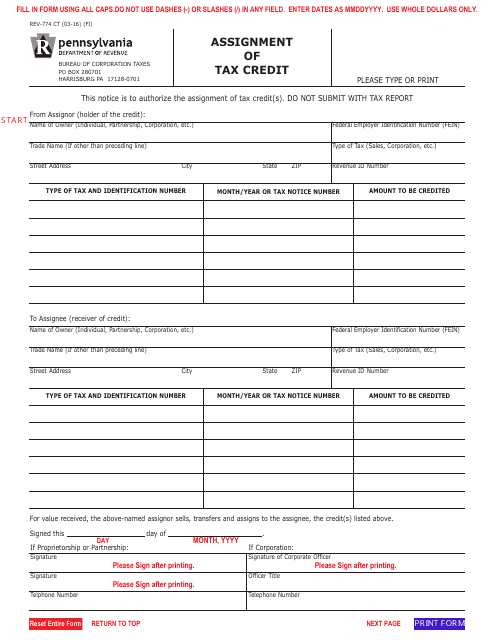

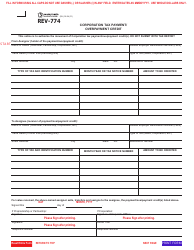

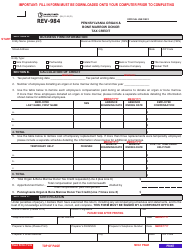

Form REV-774 CT Assignment of Tax Credit - Pennsylvania

What Is Form REV-774 CT?

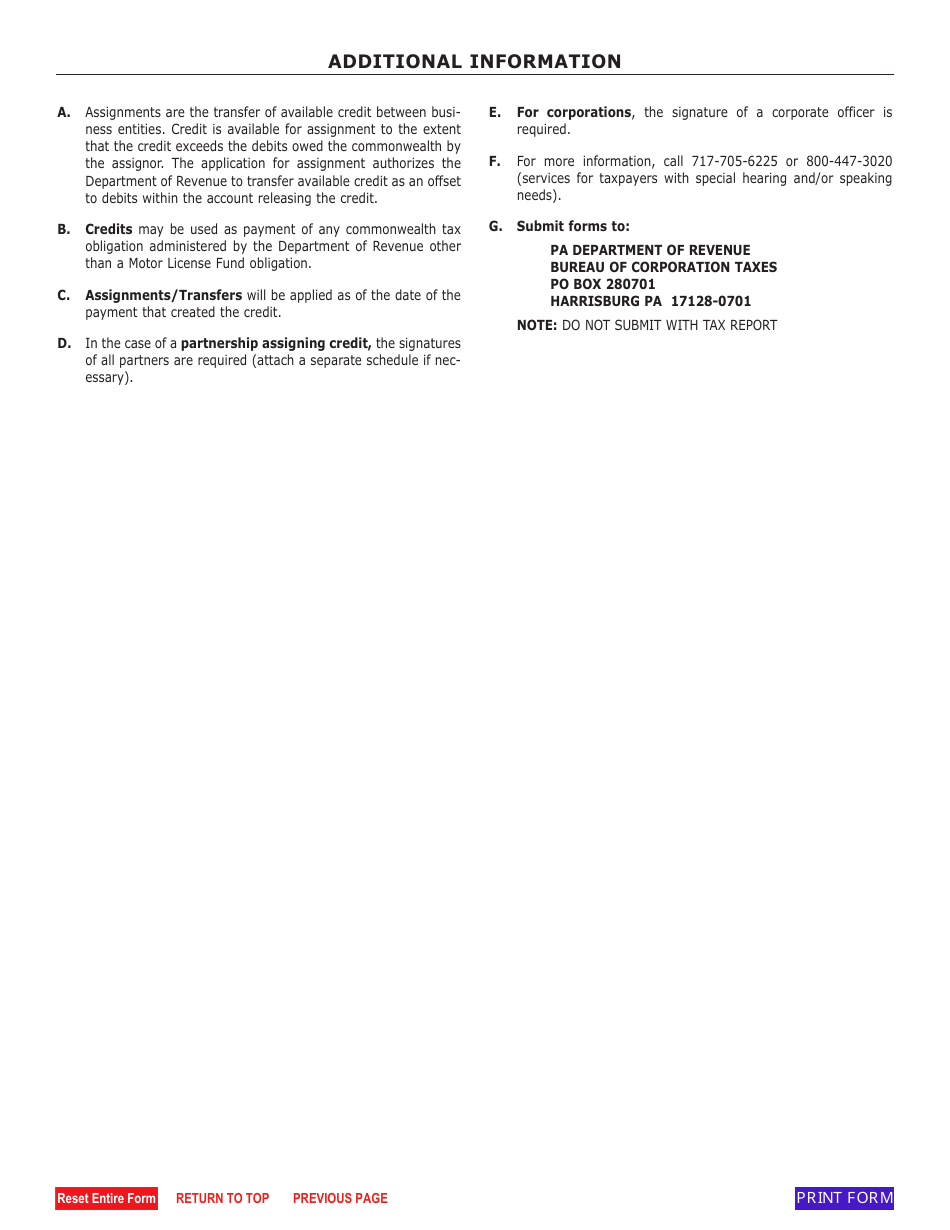

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-774 CT?

A: Form REV-774 CT is the Assignment of Tax Credit form used in Pennsylvania.

Q: What is the purpose of Form REV-774 CT?

A: The purpose of Form REV-774 CT is to assign a tax credit to another entity in Pennsylvania.

Q: Who needs to file Form REV-774 CT?

A: Anyone who wants to assign their tax credit to another entity in Pennsylvania needs to file Form REV-774 CT.

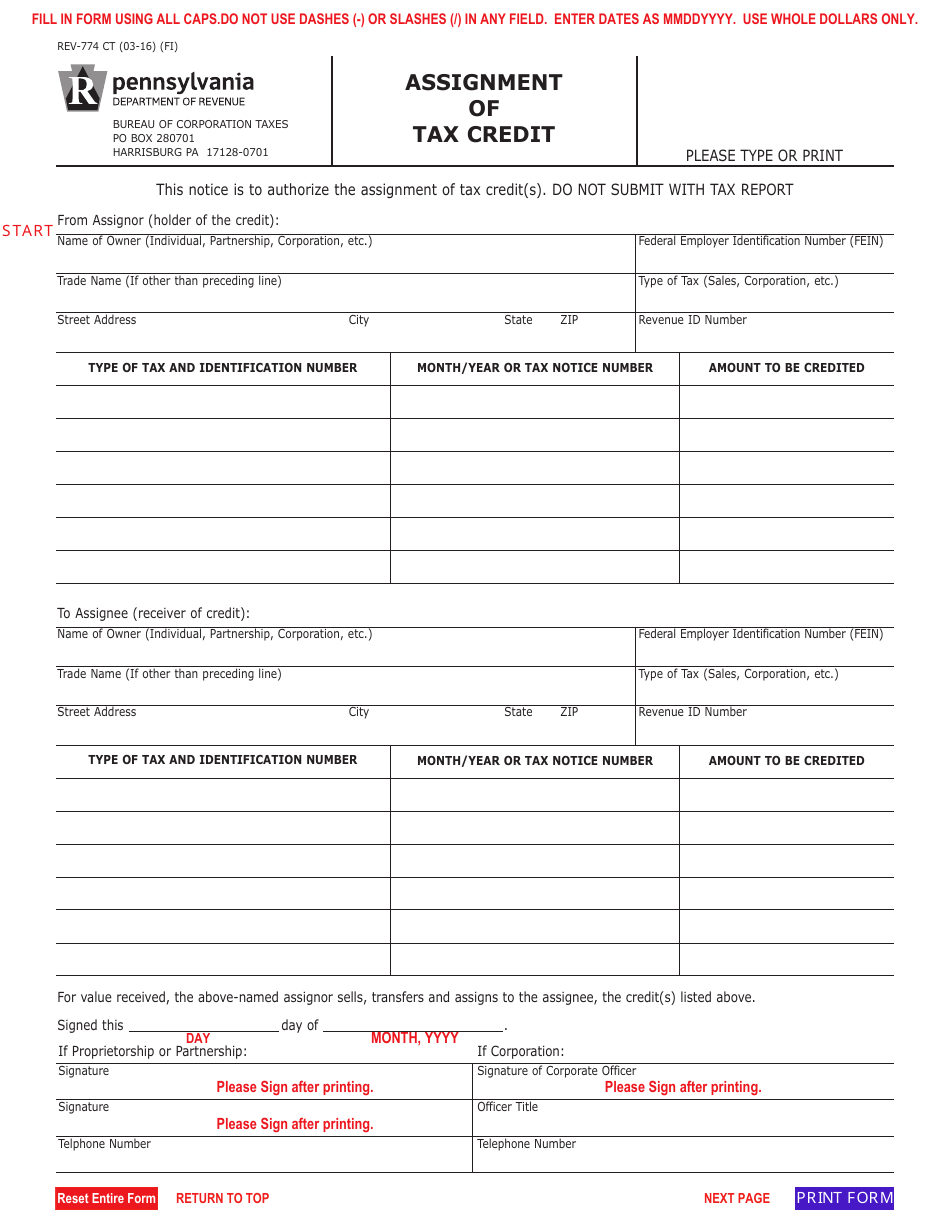

Q: How do I fill out Form REV-774 CT?

A: You need to provide information about the tax credit being assigned, the assignee, and the assignor on the Form REV-774 CT.

Q: Is there a fee to file Form REV-774 CT?

A: There is no fee to file Form REV-774 CT.

Q: When is the deadline to file Form REV-774 CT?

A: The deadline to file Form REV-774 CT is determined by the Pennsylvania Department of Revenue and may vary each year.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-774 CT by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.