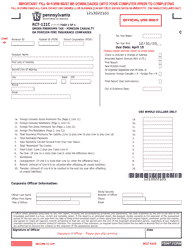

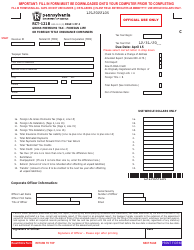

Instructions for Form RCT-131 Gross Receipts Tax - Private Bankers - Pennsylvania

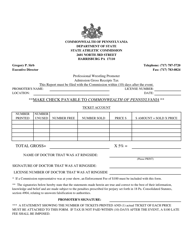

This document contains official instructions for Form RCT-131 , Gross Receipts Tax - Private Bankers - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form RCT-131 is available for download through this link.

FAQ

Q: What is Form RCT-131?

A: Form RCT-131 is a tax form used by private bankers in Pennsylvania to report and pay their gross receipts tax.

Q: Who needs to file Form RCT-131?

A: Private bankers in Pennsylvania who are subject to the gross receipts tax need to file Form RCT-131.

Q: What is the gross receipts tax?

A: The gross receipts tax is a tax imposed on the total gross receipts of certain businesses in Pennsylvania, including private bankers.

Q: What information is required on Form RCT-131?

A: Form RCT-131 requires private bankers to provide information about their gross receipts, deductions, and other relevant financial details.

Q: When is the deadline for filing Form RCT-131?

A: The deadline for filing Form RCT-131 is typically on or before April 15th of each year.

Q: Are there any penalties for not filing Form RCT-131?

A: Yes, there are penalties for not filing Form RCT-131 or for filing it late, including the assessment of interest and penalties on unpaid taxes.

Q: Can I request an extension to file Form RCT-131?

A: Yes, you can request an extension to file Form RCT-131, but you must do so before the original filing deadline.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.