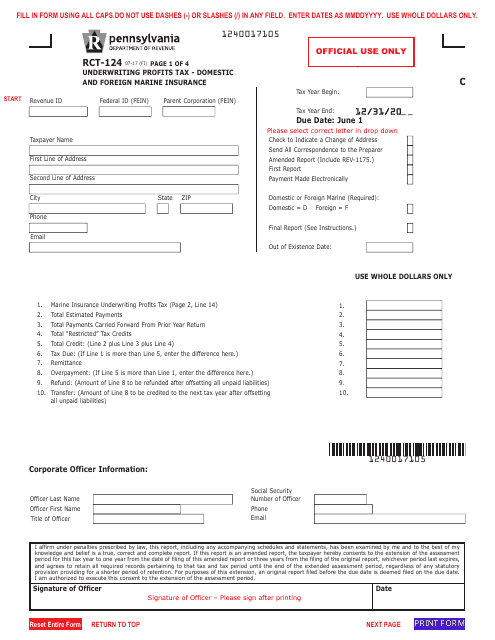

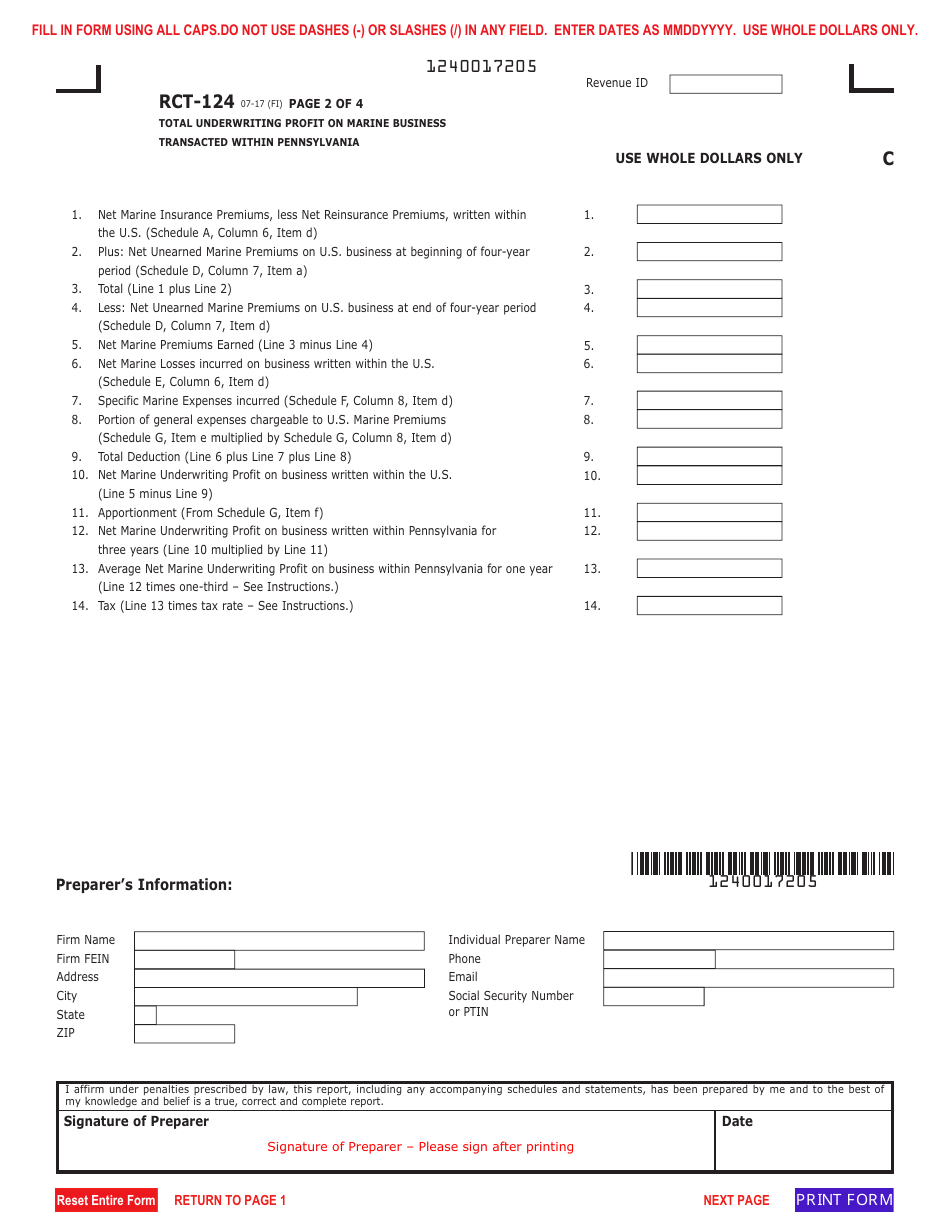

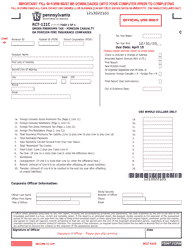

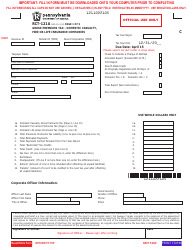

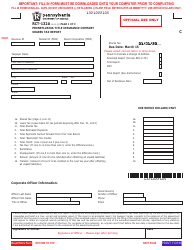

Form RCT-124 Underwriting Profits Tax - Domestic and Foreign Marine Insurance - Pennsylvania

What Is Form RCT-124?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is RCT-124?

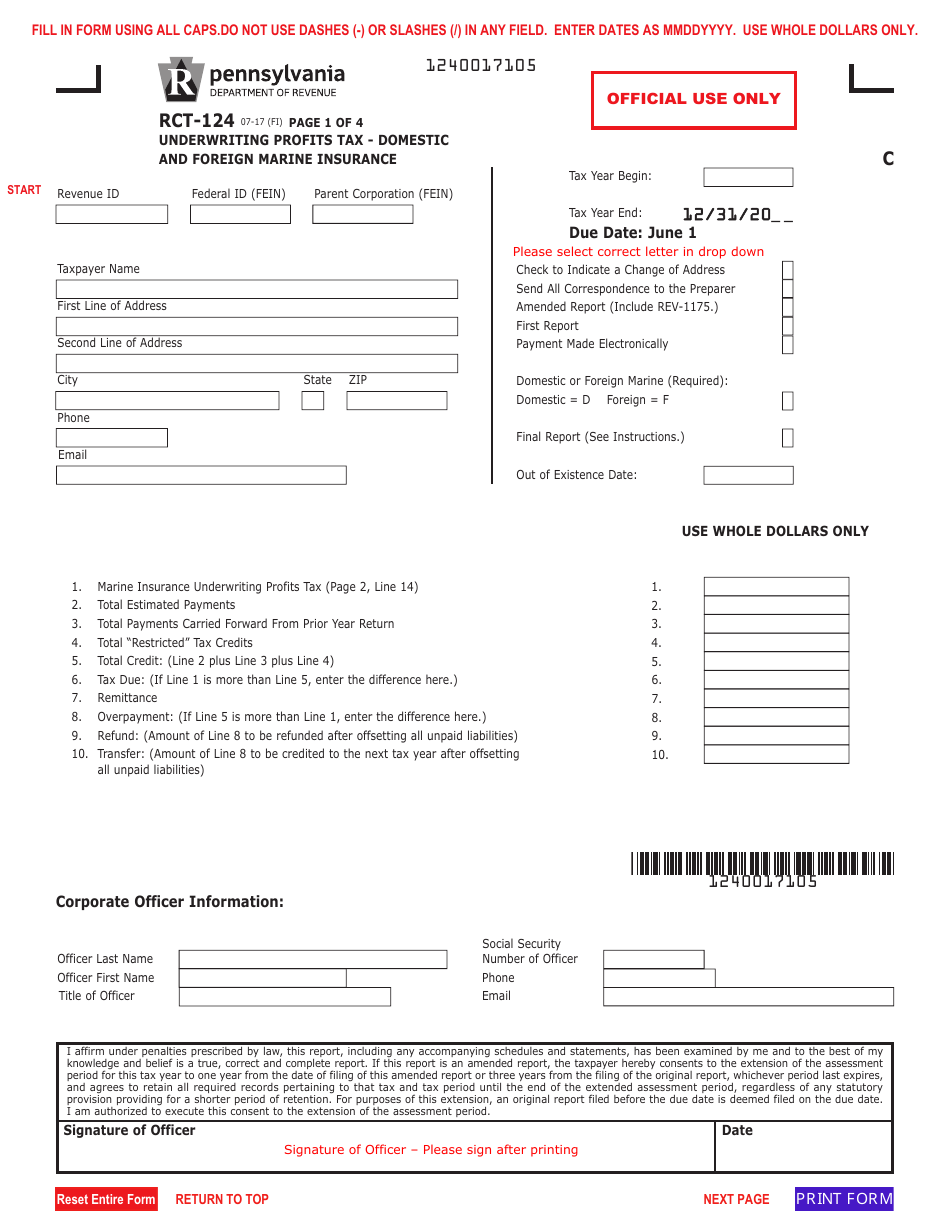

A: RCT-124 is a form for reporting Underwriting Profits Tax for Domestic and Foreign Marine Insurance in Pennsylvania.

Q: What is Underwriting Profits Tax?

A: Underwriting Profits Tax is a tax imposed on insurance companies for the premiums they collect from policyholders in Pennsylvania.

Q: Who needs to file RCT-124?

A: Insurance companies engaged in the business of Domestic and Foreign Marine Insurance in Pennsylvania need to file RCT-124.

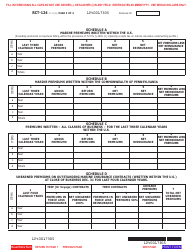

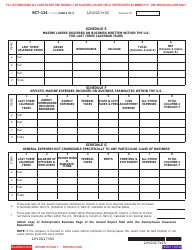

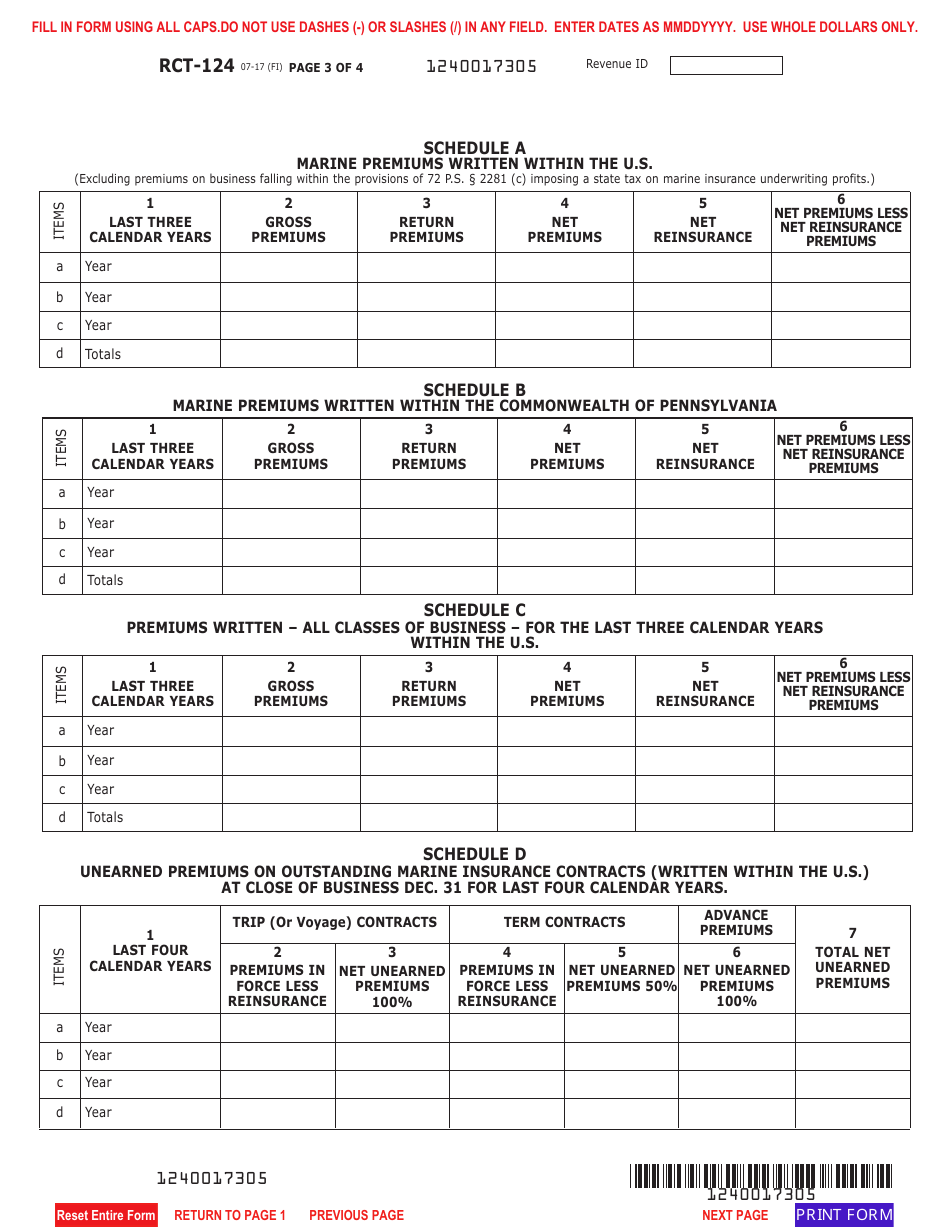

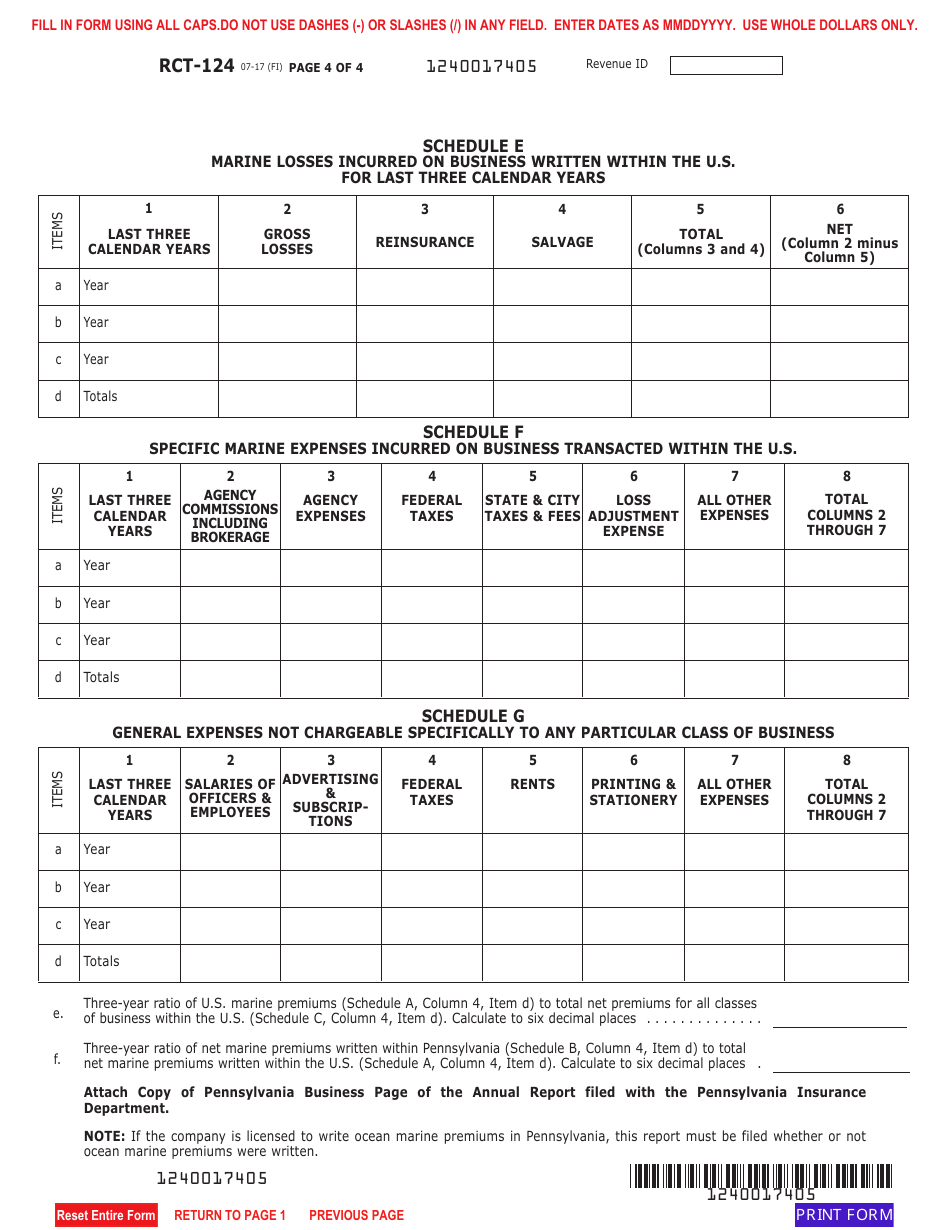

Q: What information is required in RCT-124?

A: RCT-124 requires information such as underwriting and investment income, premiums written, losses incurred, and other related financial data.

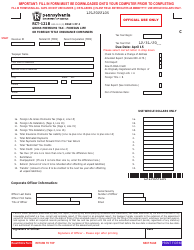

Q: Are there any deadlines for filing RCT-124?

A: Yes, RCT-124 must be filed on or before April 15th of each year.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-124 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.