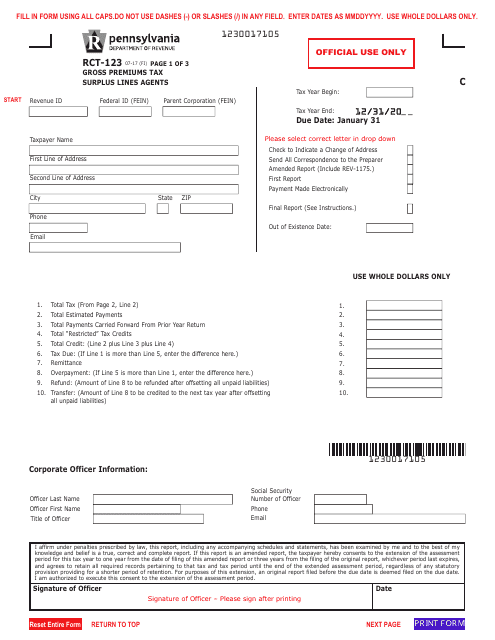

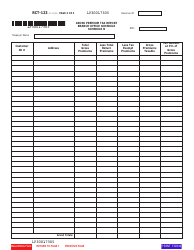

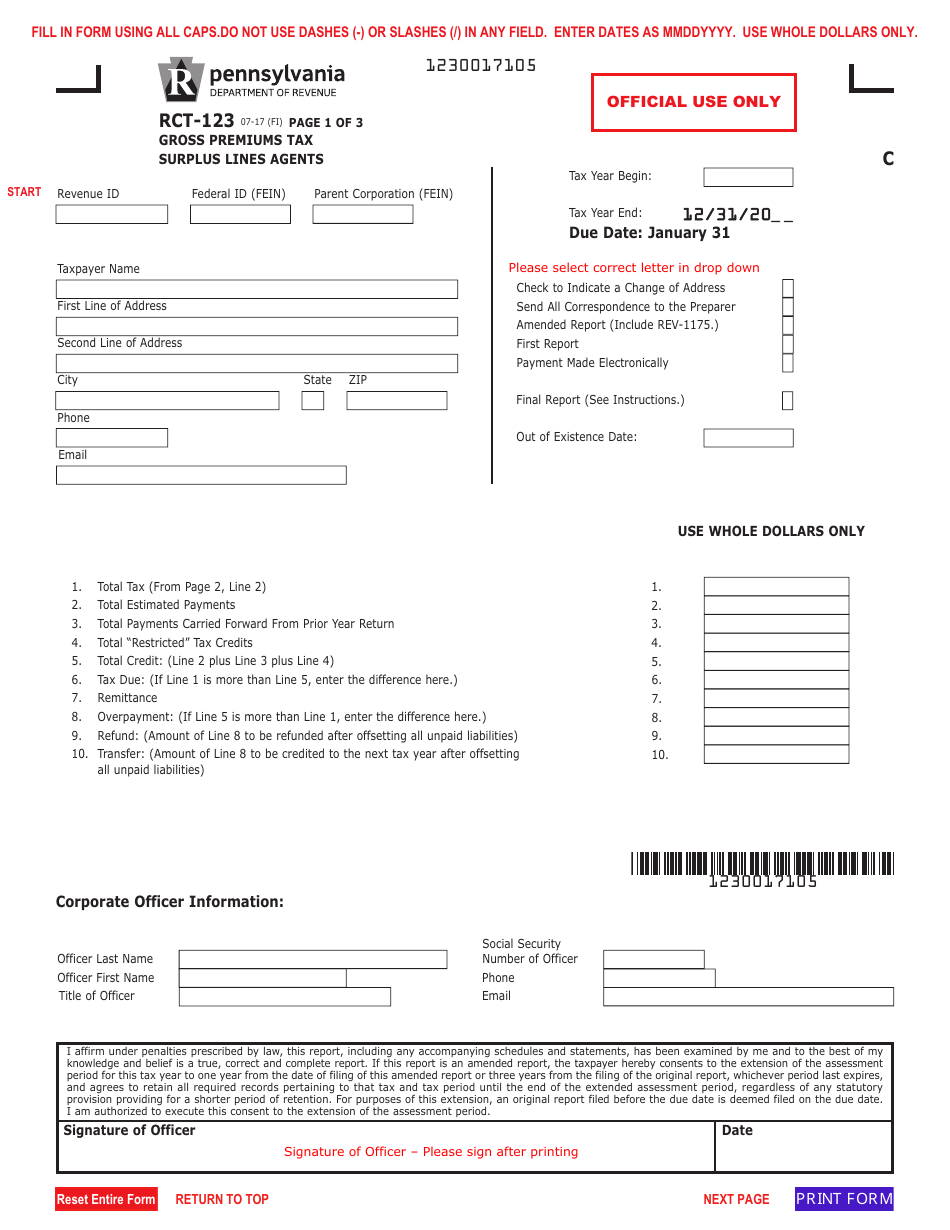

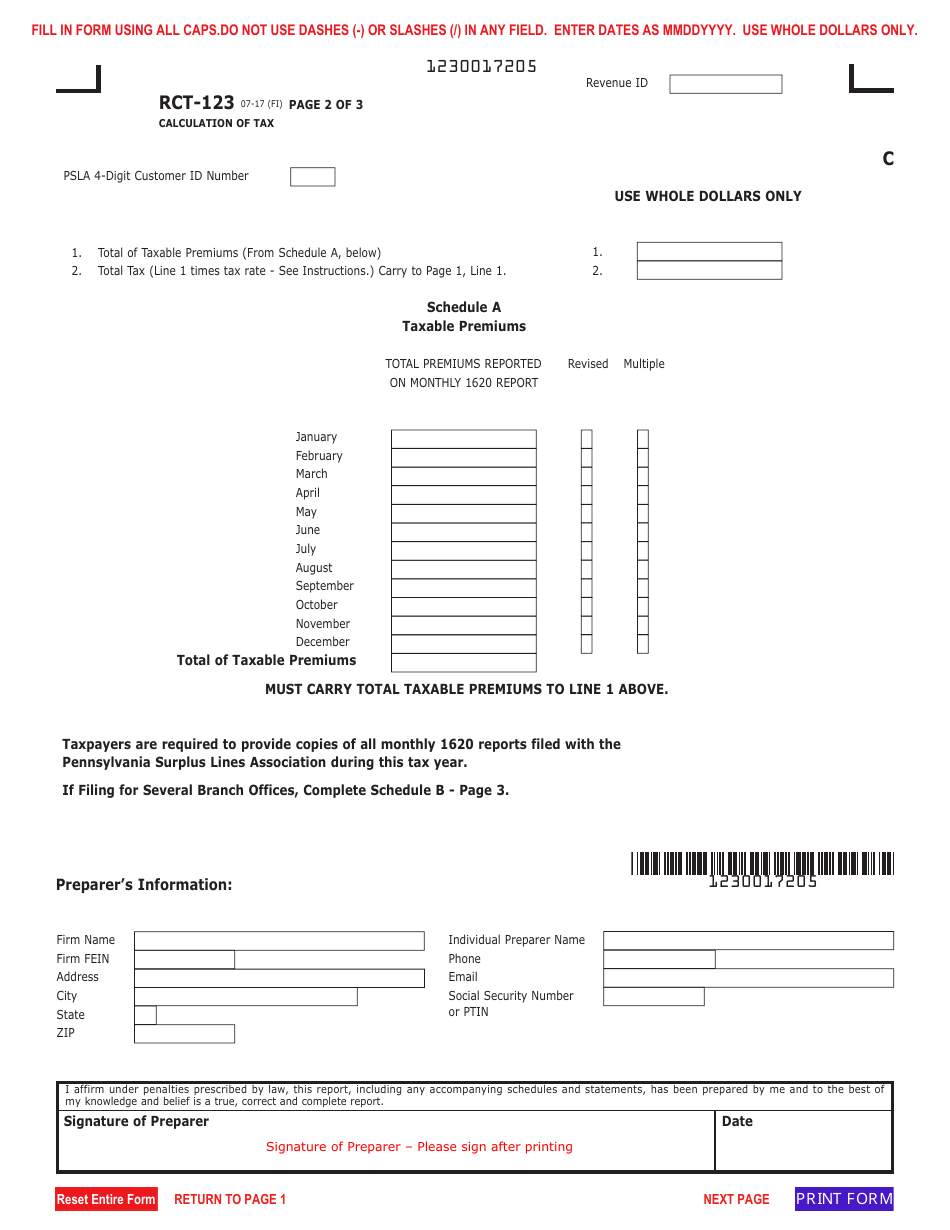

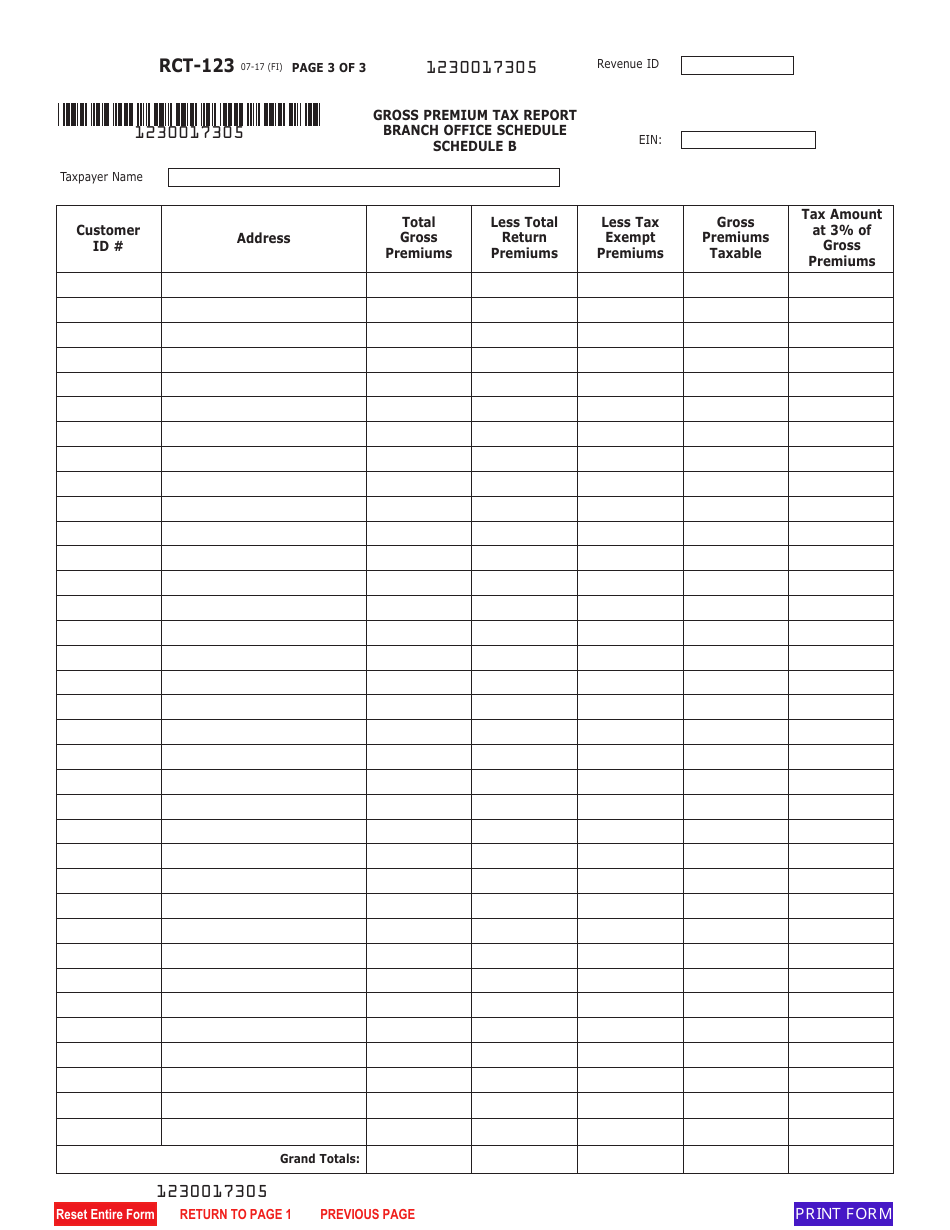

Form RCT-123 Gross Premiums Tax Report - Surplus Lines Agents - Pennsylvania

What Is Form RCT-123?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form RCT-123?

A: The Form RCT-123 is a Gross Premiums Tax Report for Surplus Lines Agents in Pennsylvania.

Q: Who should file the Form RCT-123?

A: Surplus Lines Agents in Pennsylvania should file the Form RCT-123.

Q: What is the purpose of the Form RCT-123?

A: The Form RCT-123 is used to report and pay the Gross Premiums Tax for surplus lines insurance transactions.

Q: What is the Gross Premiums Tax?

A: The Gross Premiums Tax is a tax imposed on the premiums received by surplus lines agents in Pennsylvania.

Q: How often should the Form RCT-123 be filed?

A: The Form RCT-123 should be filed quarterly.

Q: Are there any penalties for late filing of the Form RCT-123?

A: Yes, there are penalties for late filing of the Form RCT-123. It is important to file on time to avoid penalties.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-123 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.