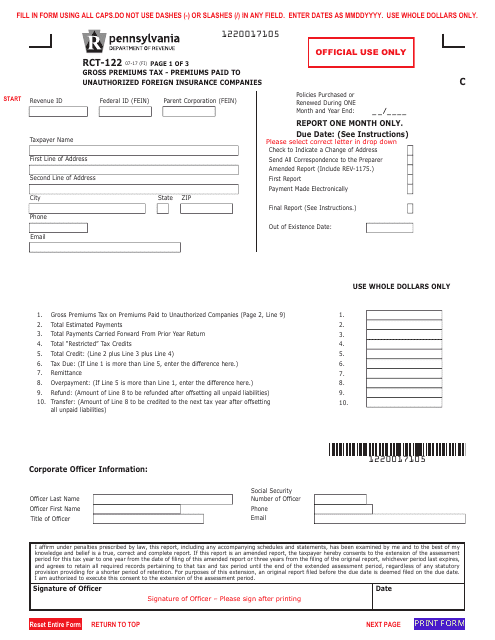

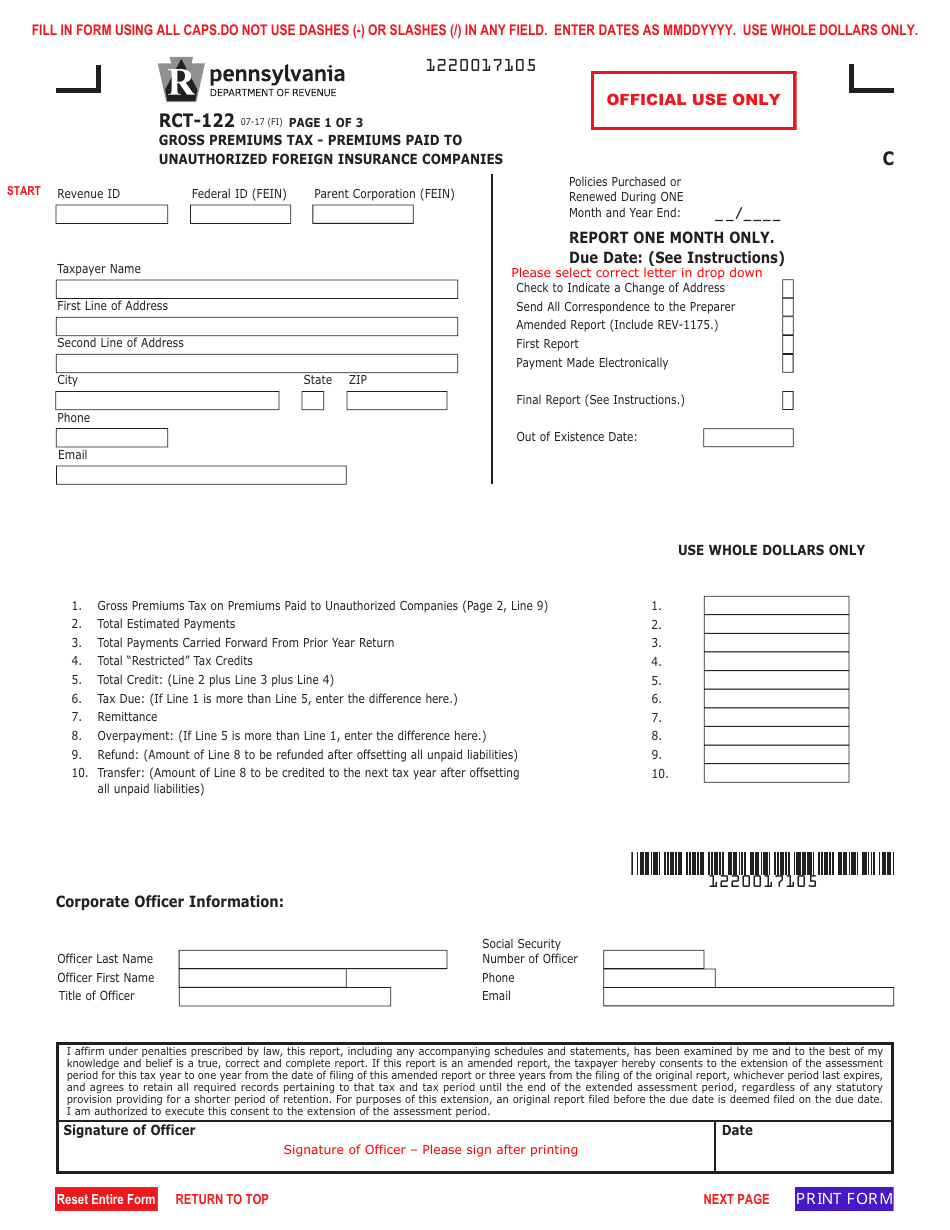

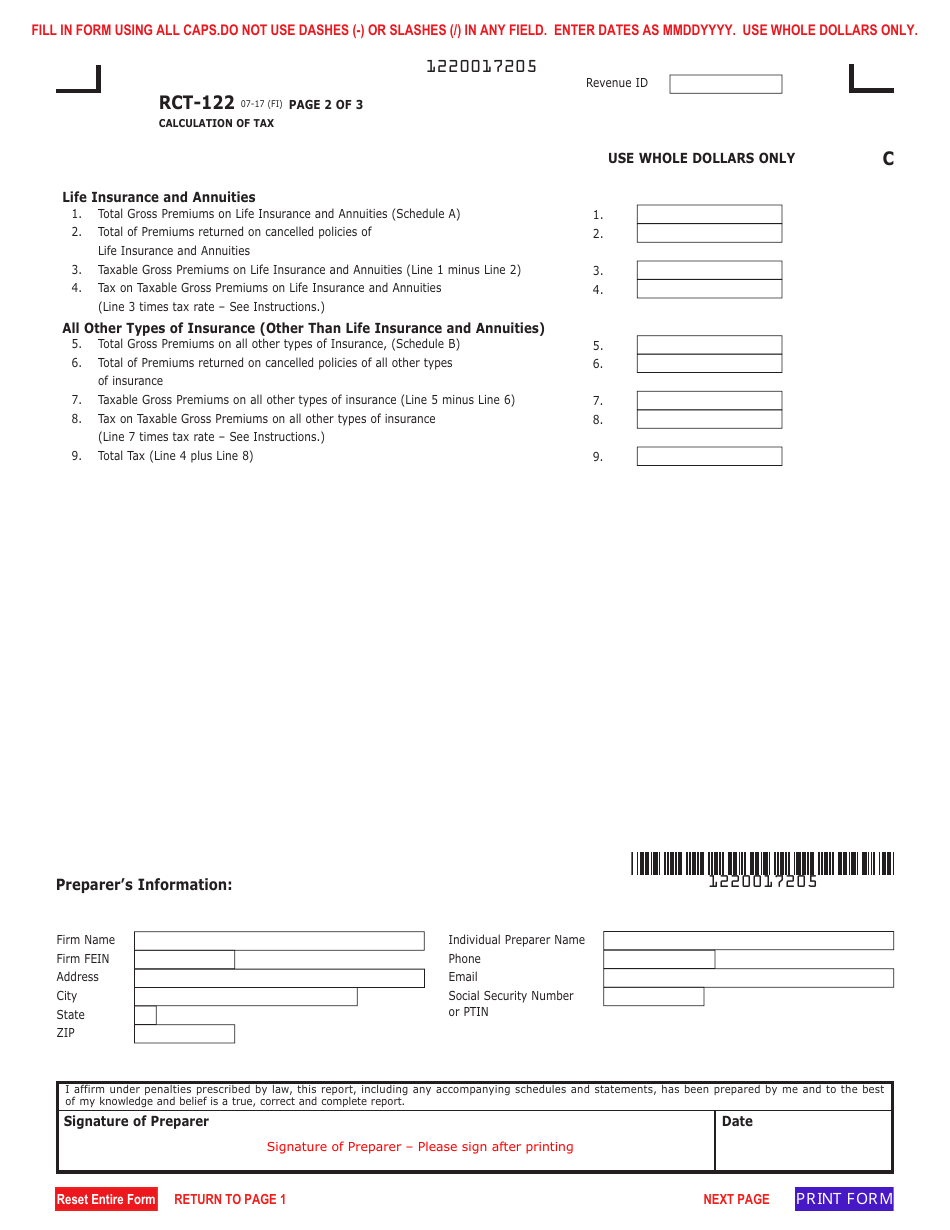

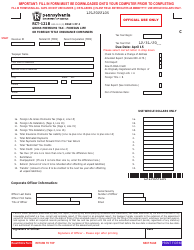

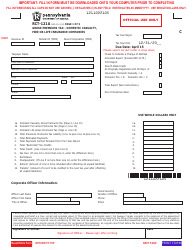

Form RCT-122 Gross Premiums Tax Report - Premiums Paid to Unauthorized Foreign Insurance Companies - Pennsylvania

What Is Form RCT-122?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RCT-122 form?

A: The RCT-122 form is the Gross Premiums Tax Report.

Q: What is the purpose of the RCT-122 form?

A: The RCT-122 form is used to report premiums paid to unauthorized foreign insurance companies in Pennsylvania.

Q: Who needs to file the RCT-122 form?

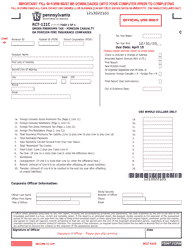

A: Any business in Pennsylvania that paid premiums to unauthorized foreign insurance companies needs to file the RCT-122 form.

Q: When is the deadline to file the RCT-122 form?

A: The deadline to file the RCT-122 form is April 15th of each year.

Q: What are unauthorized foreign insurance companies?

A: Unauthorized foreign insurance companies are insurance providers that are not licensed or authorized to do business in Pennsylvania.

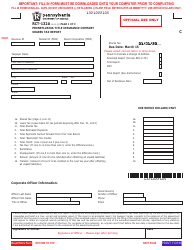

Q: What happens if I don't file the RCT-122 form?

A: Failure to file the RCT-122 form or failure to pay the Gross Premiums Tax can result in penalties, interest, and other enforcement actions.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-122 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.