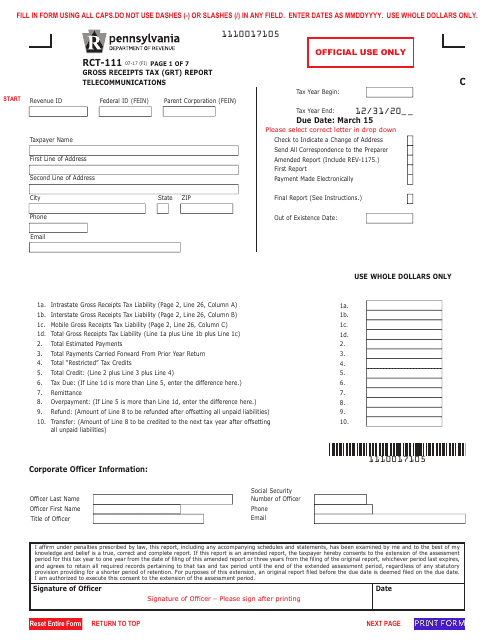

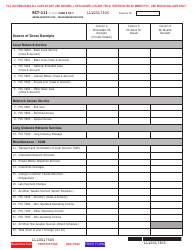

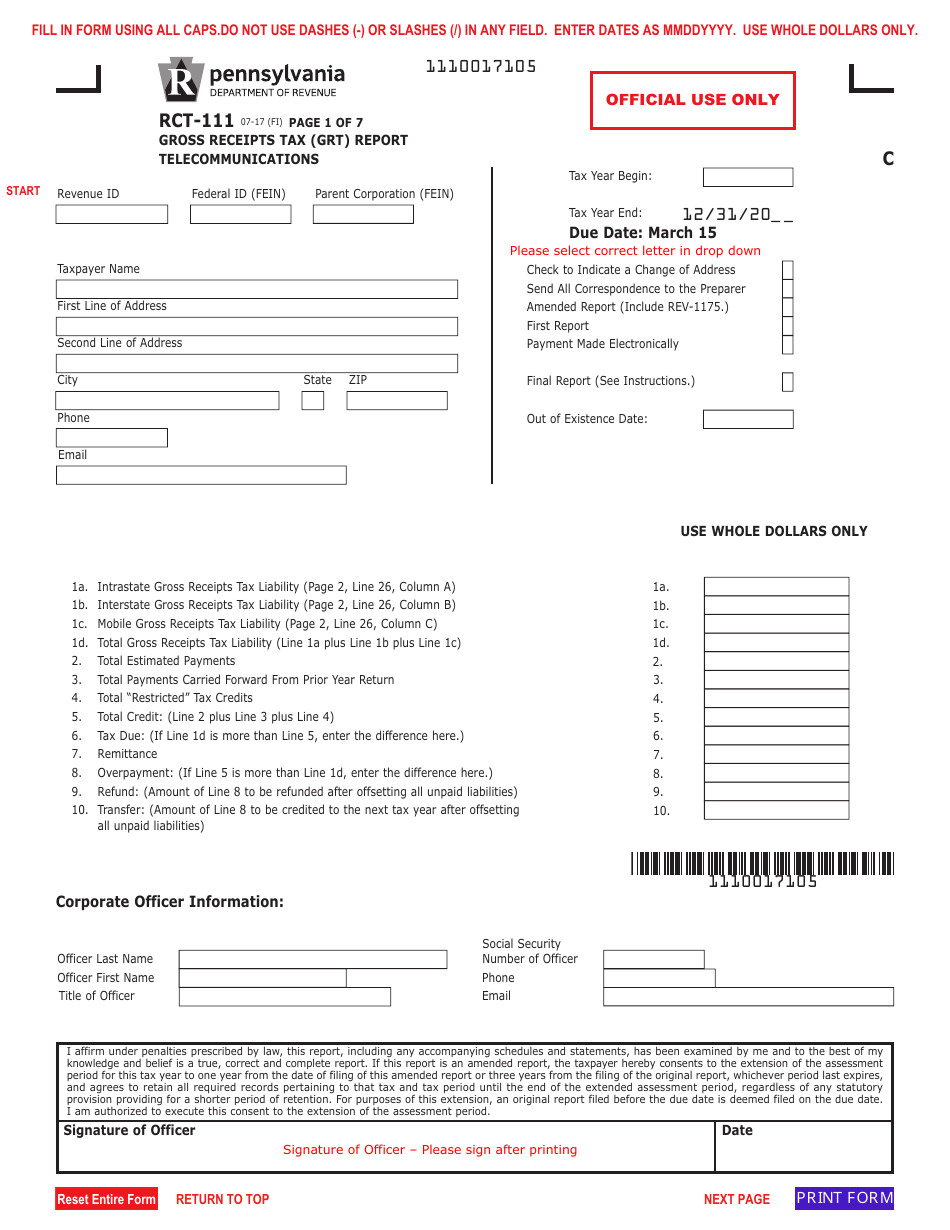

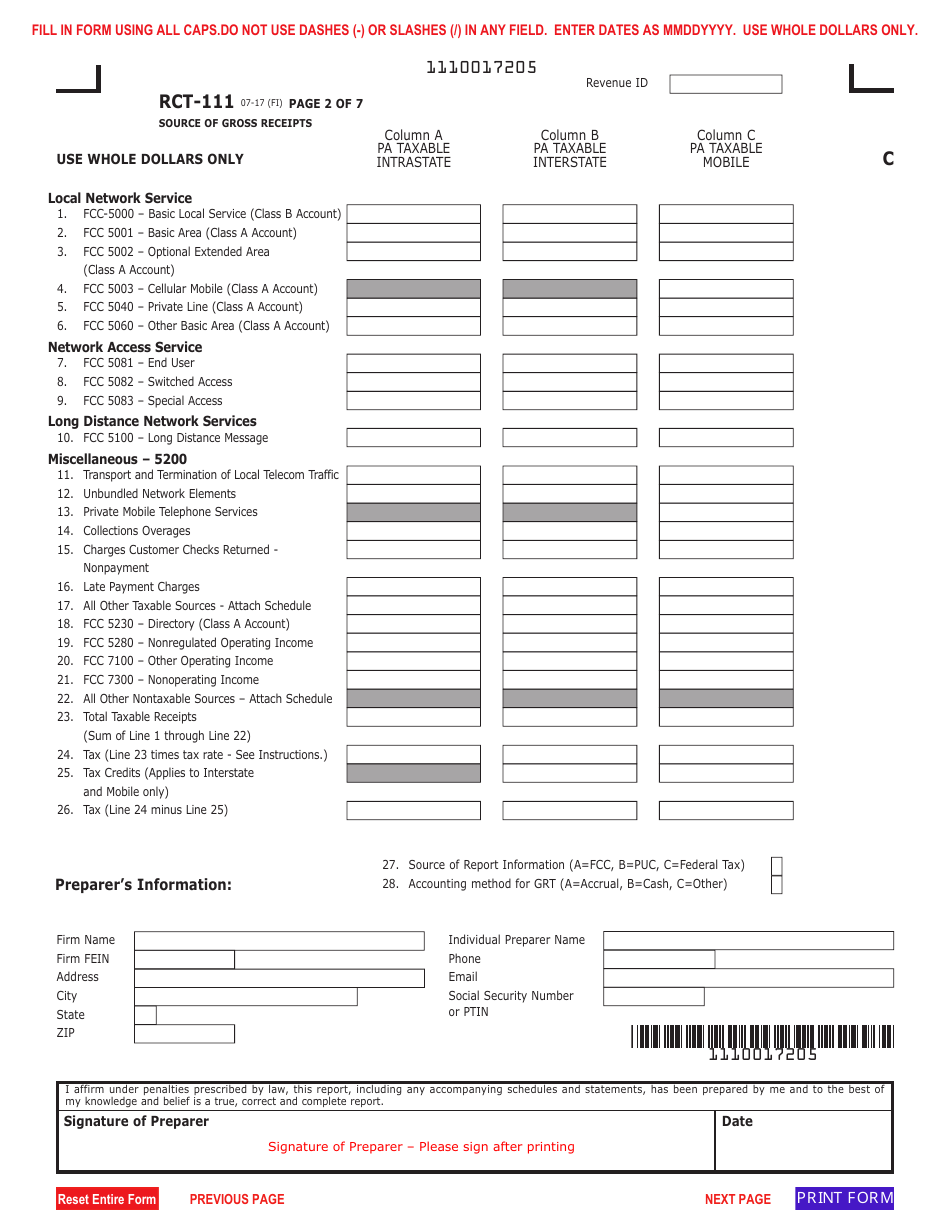

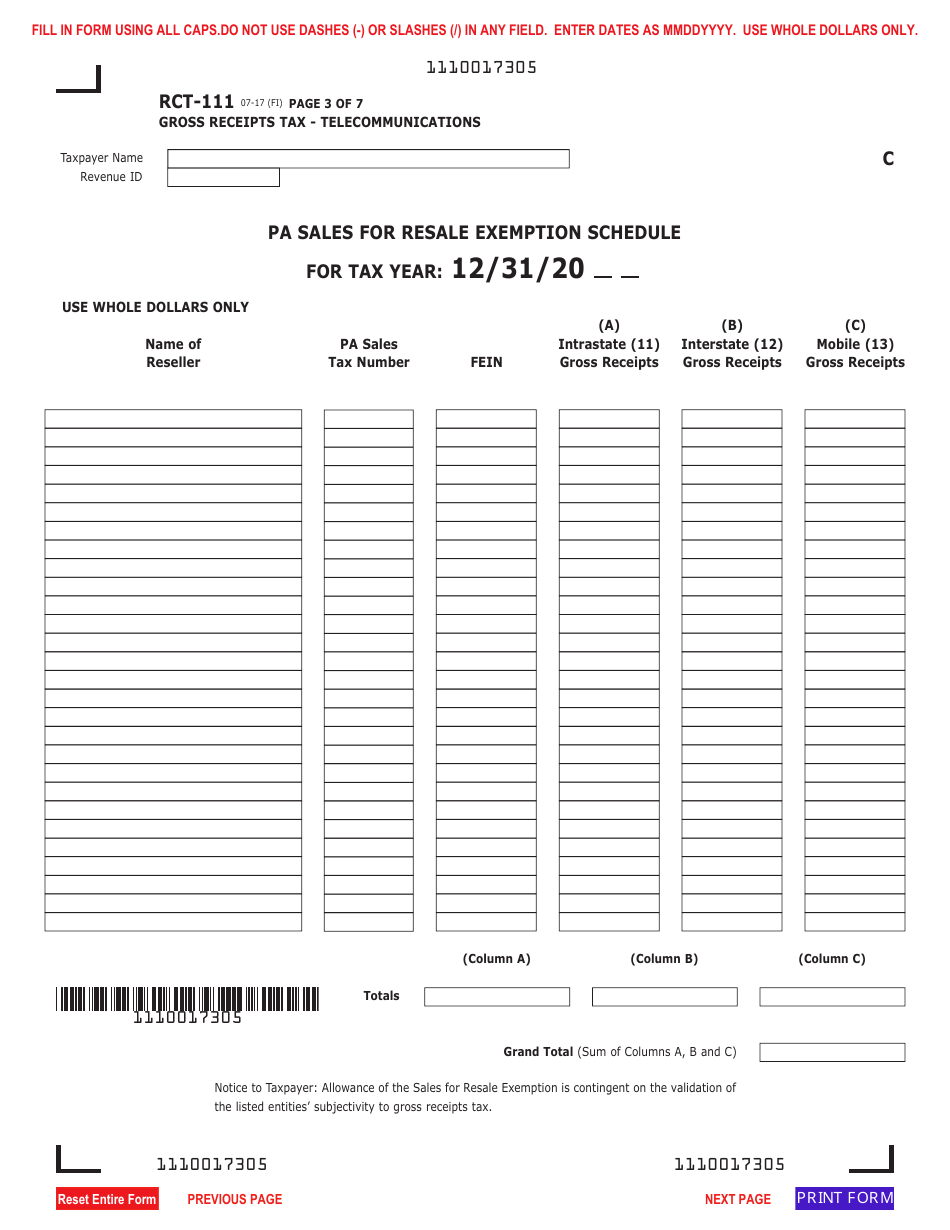

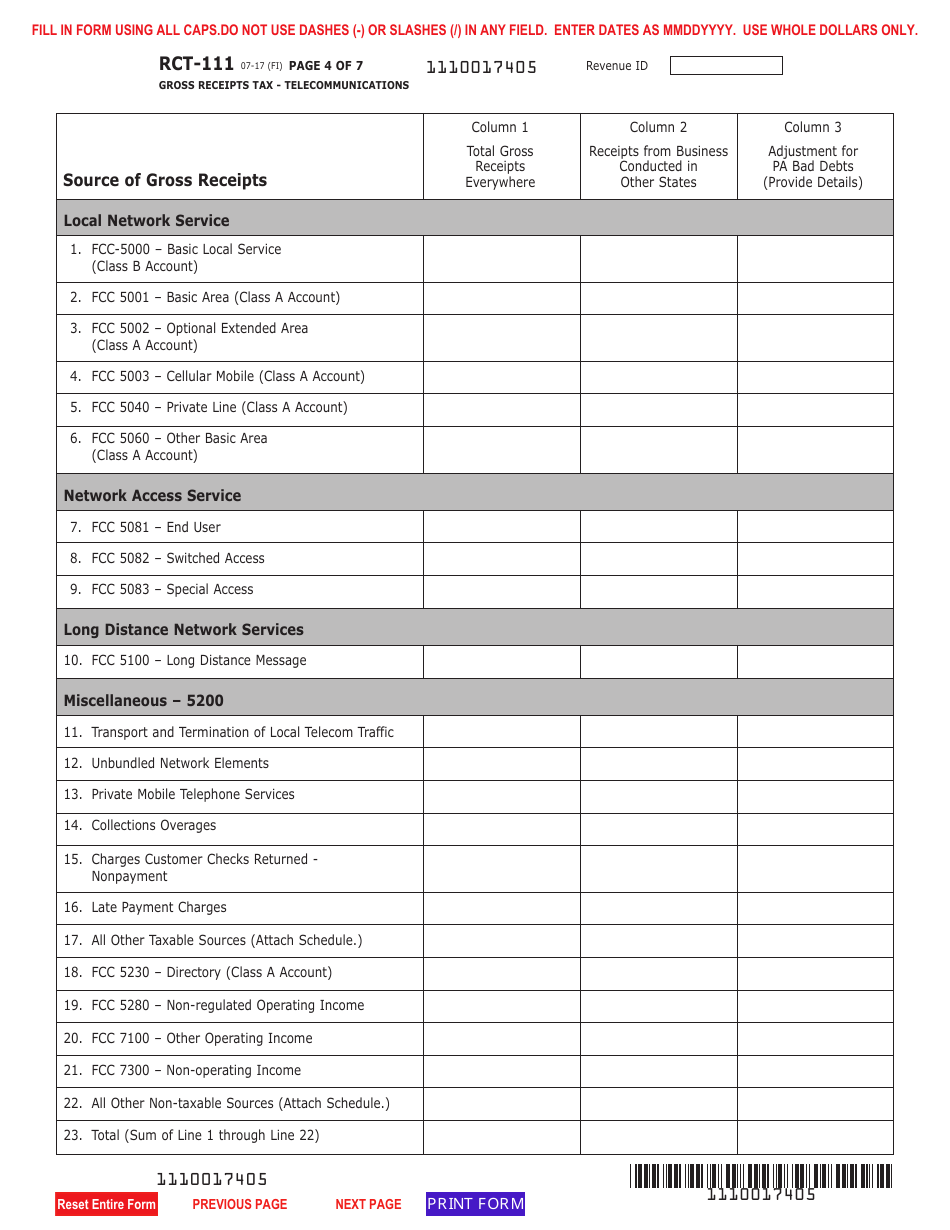

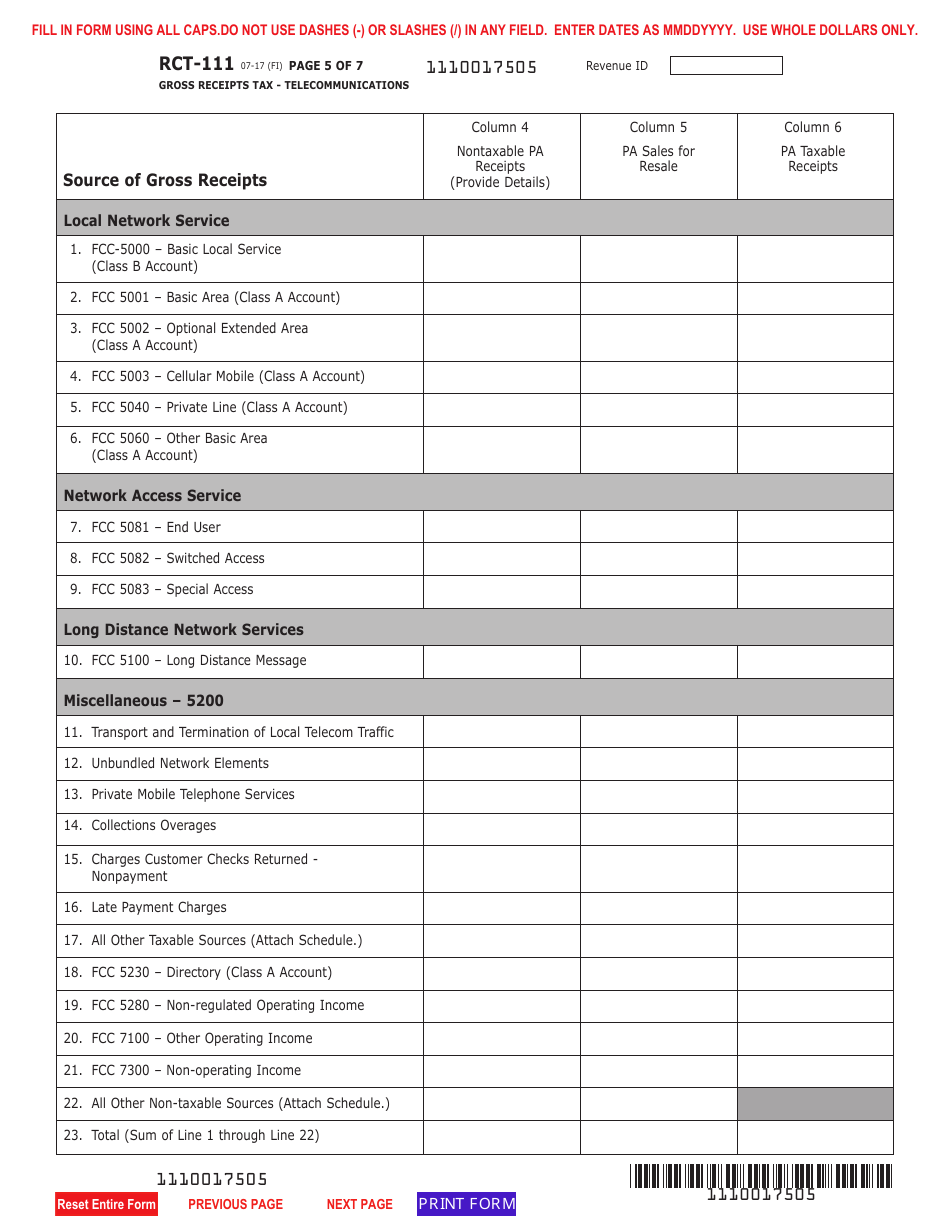

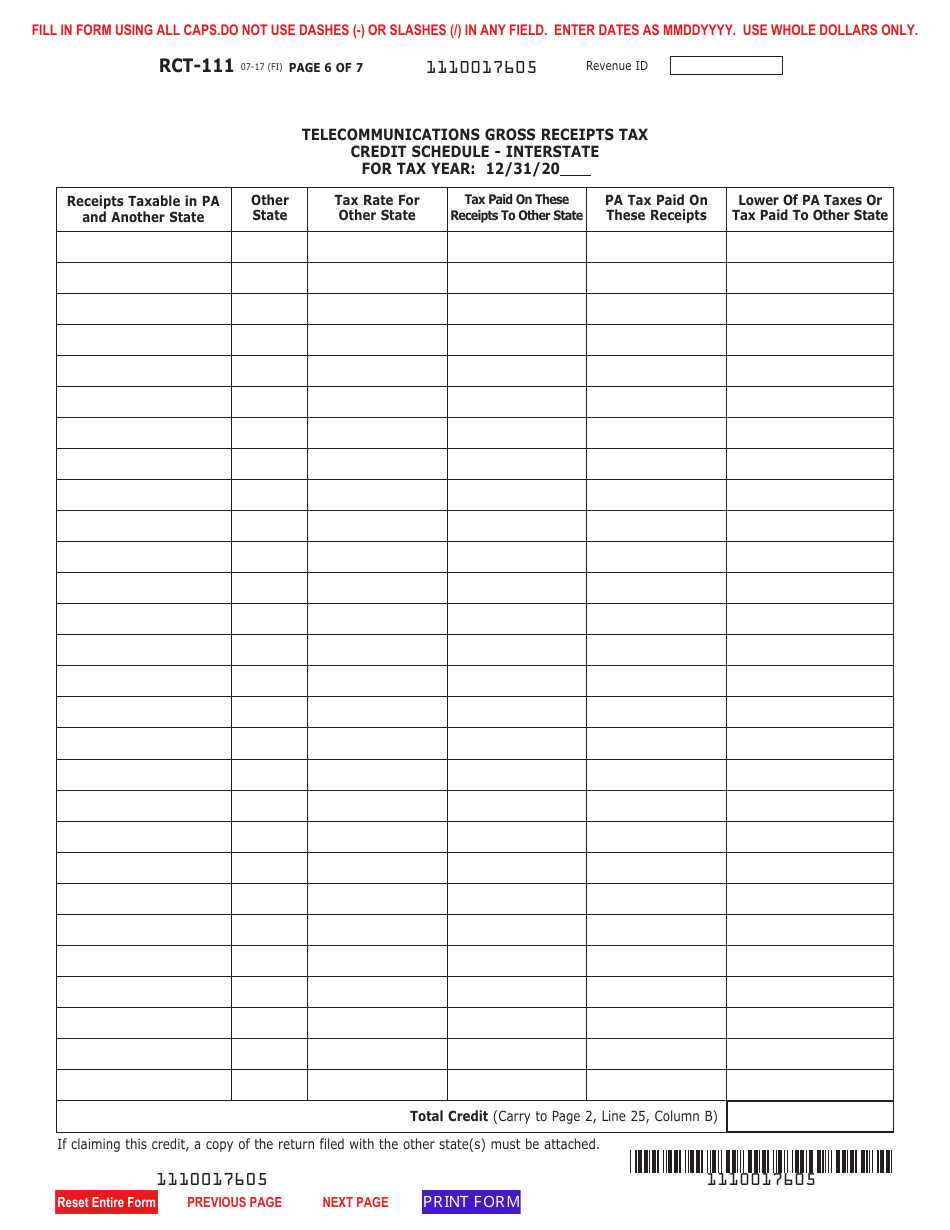

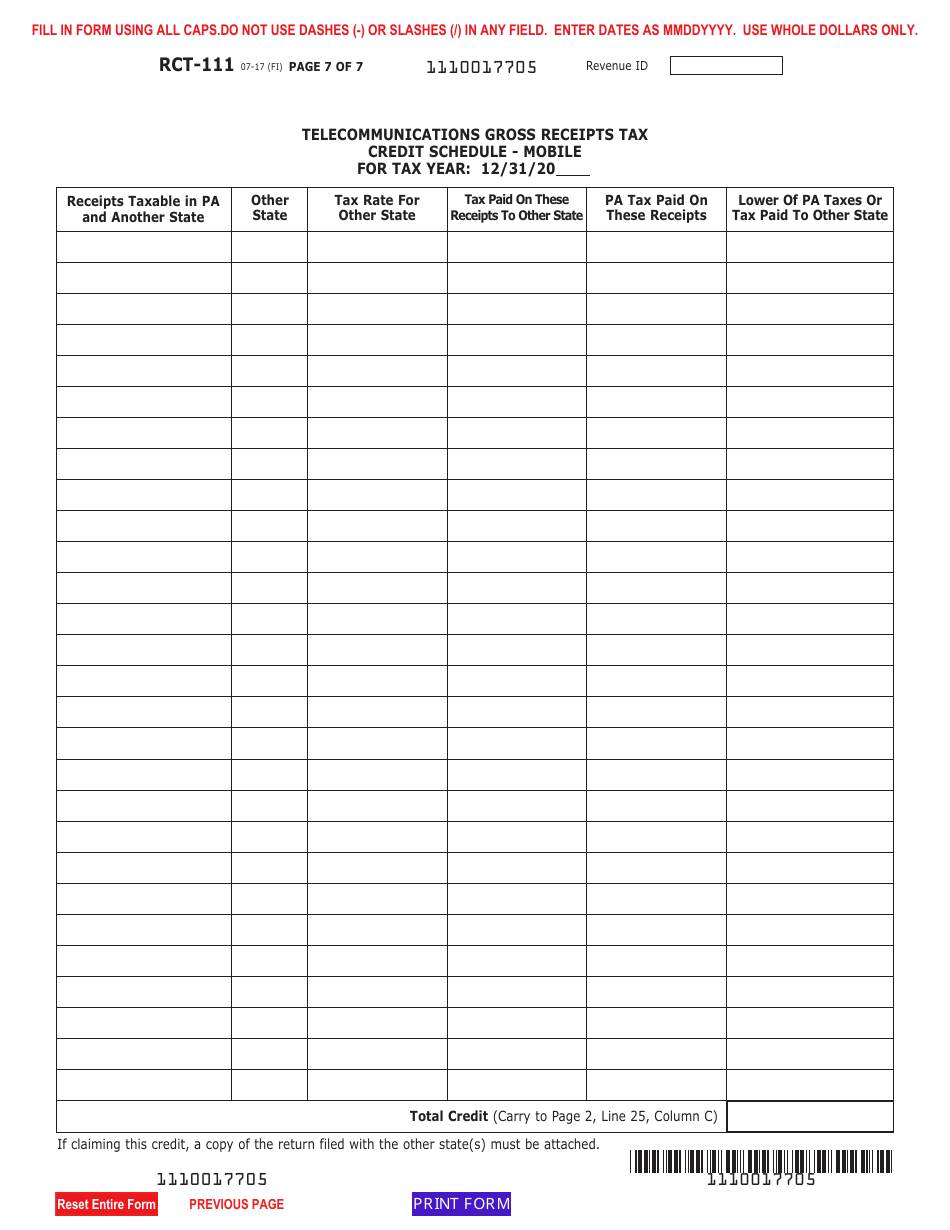

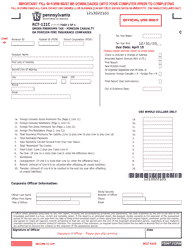

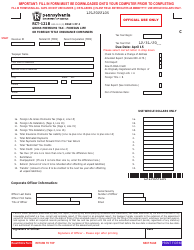

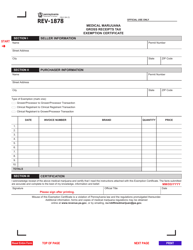

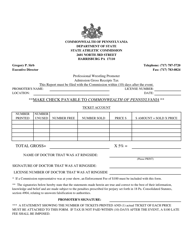

Form RCT-111 Gross Receipts Tax (Grt) Report - Telecommunications - Pennsylvania

What Is Form RCT-111?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RCT-111?

A: Form RCT-111 is the Gross Receipts Tax (GRT) Report for the telecommunications industry in Pennsylvania.

Q: Who needs to file Form RCT-111?

A: Telecommunications companies operating in Pennsylvania are required to file Form RCT-111.

Q: What is the purpose of Form RCT-111?

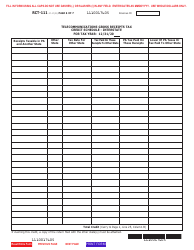

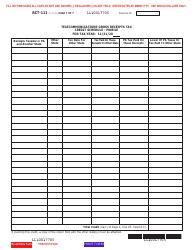

A: The purpose of Form RCT-111 is to report gross receipts for the telecommunications sector in Pennsylvania and calculate the corresponding Gross Receipts Tax.

Q: How often should Form RCT-111 be filed?

A: Form RCT-111 should be filed on a quarterly basis.

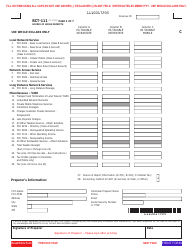

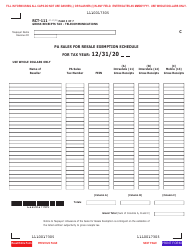

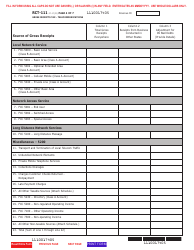

Q: What information is required on Form RCT-111?

A: Form RCT-111 requires telecommunications companies to provide details of their gross receipts, deductions, and calculate the Gross Receipts Tax.

Q: Are there any deadlines for filing Form RCT-111?

A: Yes, Form RCT-111 must be filed by the last day of the month following the end of the calendar quarter.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-111 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.