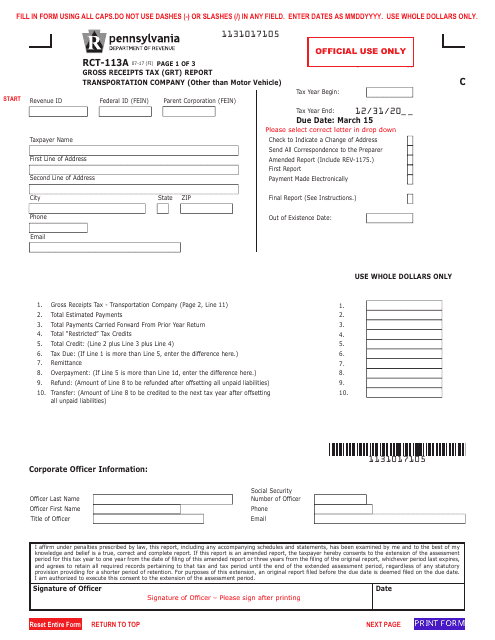

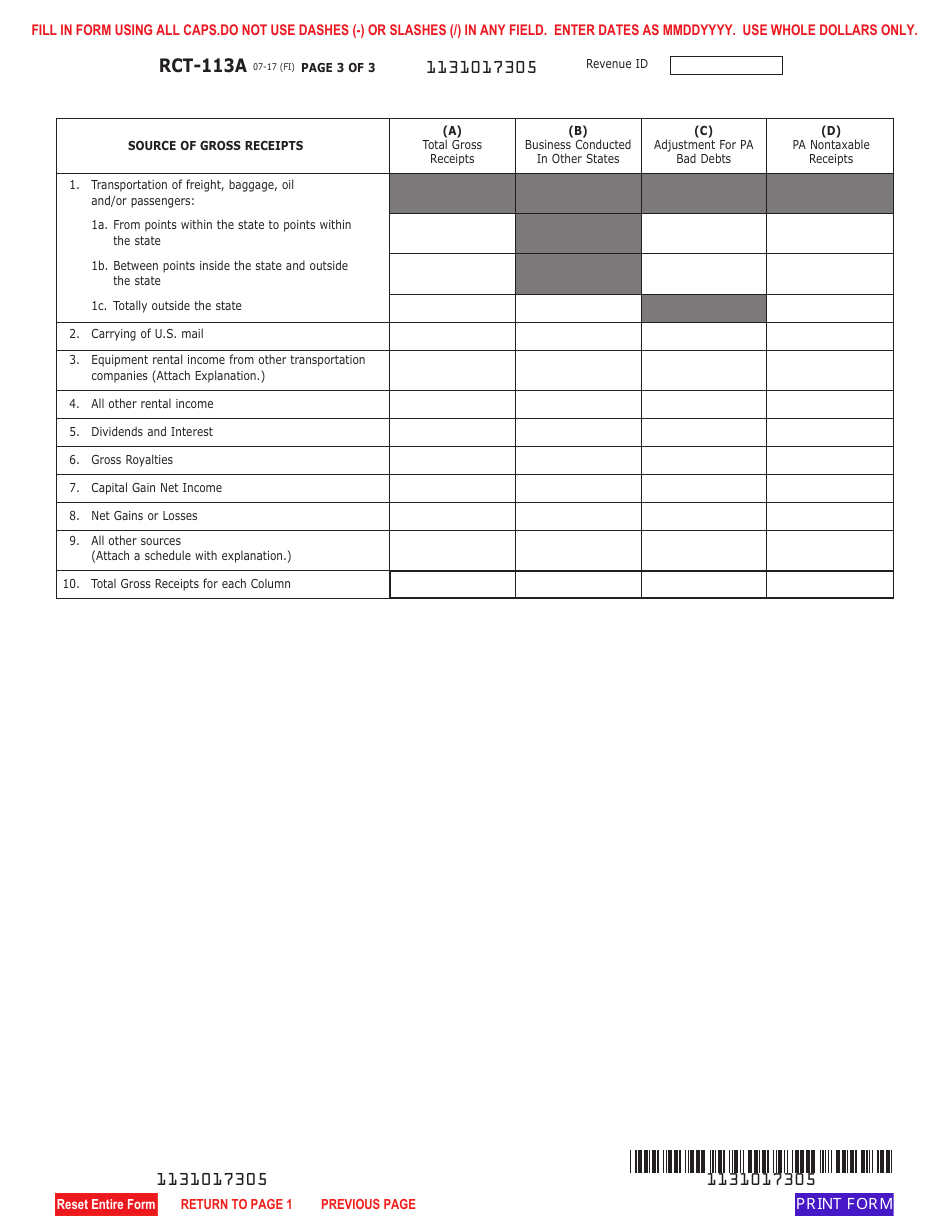

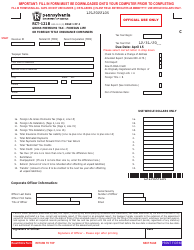

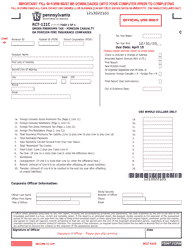

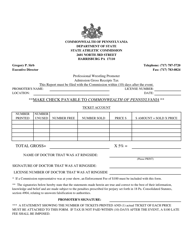

Form RCT-113A Gross Receipts Tax (Grt) Report - Transportation Company (Other Than Motor Vehicle) - Pennsylvania

What Is Form RCT-113A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-113A?

A: Form RCT-113A is the Gross Receipts Tax (GRT) Report specifically designed for transportation companies (other than motor vehicles) in Pennsylvania.

Q: Who needs to file Form RCT-113A?

A: Transportation companies (other than motor vehicles) operating in Pennsylvania are required to file Form RCT-113A.

Q: What is the purpose of Form RCT-113A?

A: The purpose of Form RCT-113A is to report and pay the Gross Receipts Tax (GRT) for transportation companies (other than motor vehicles) in Pennsylvania.

Q: What is the Gross Receipts Tax (GRT)?

A: The Gross Receipts Tax (GRT) is a tax imposed on certain businesses in Pennsylvania based on their gross receipts.

Q: Is Form RCT-113A specific to transportation companies?

A: Yes, Form RCT-113A is specifically designed for transportation companies (other than motor vehicles).

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-113A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.