This version of the form is not currently in use and is provided for reference only. Download this version of

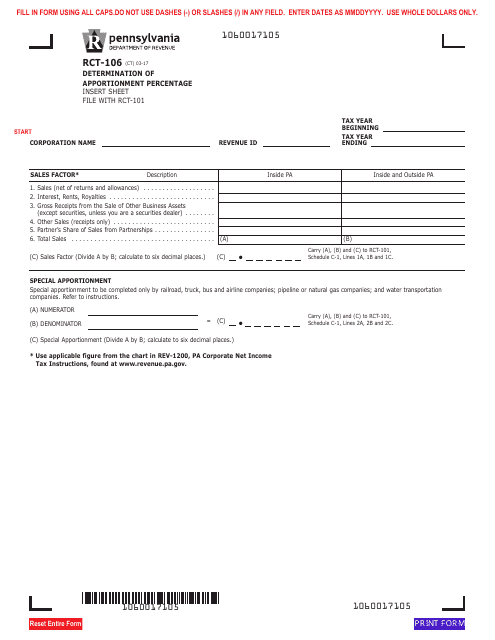

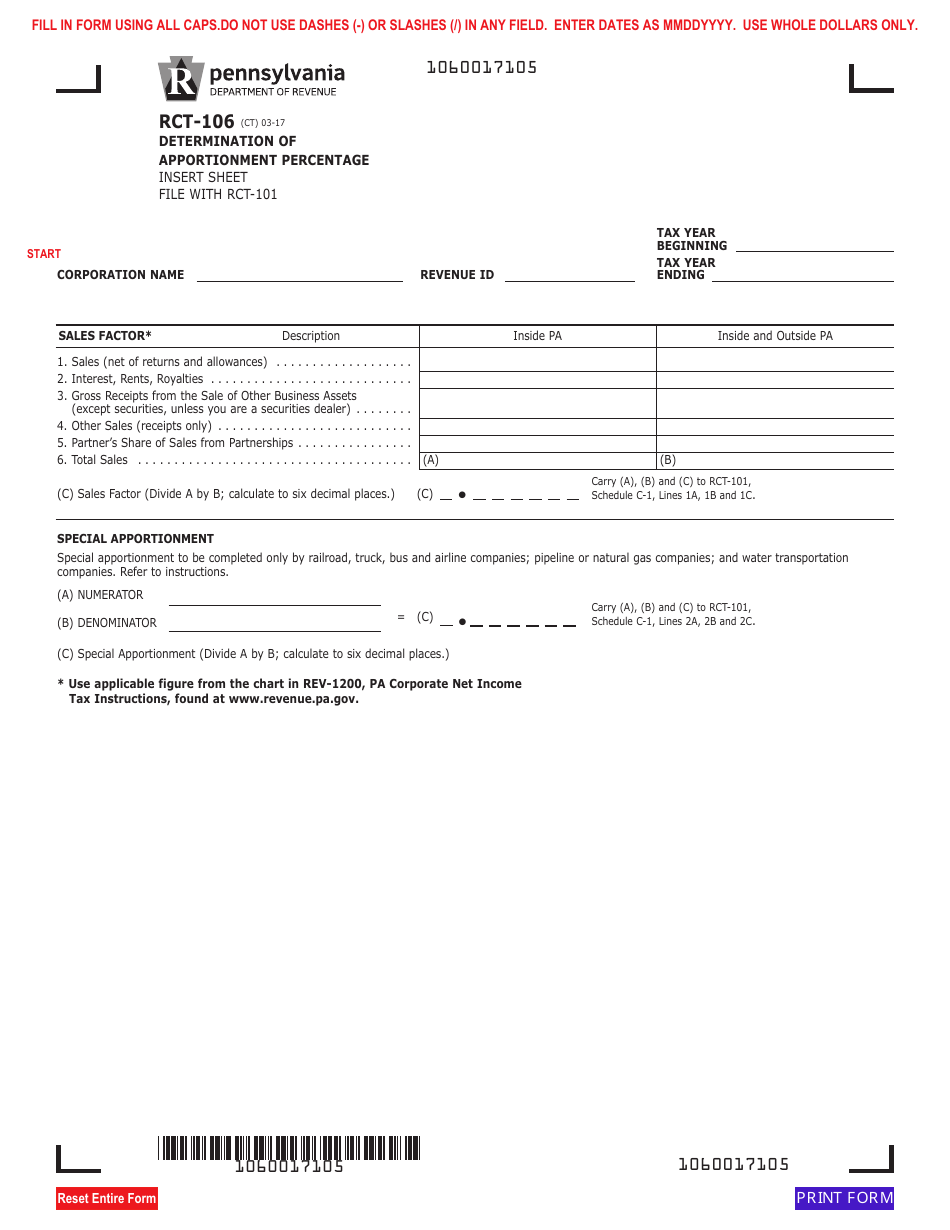

Form RCT-106

for the current year.

Form RCT-106 Determination of Apportionment Percentage - Insert Sheet - File With Rct-101 - Pennsylvania

What Is Form RCT-106?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RCT-106?

A: Form RCT-106 is the Determination of Apportionment Percentage form.

Q: What is the purpose of Form RCT-106?

A: The purpose of Form RCT-106 is to determine the apportionment percentage.

Q: When should I file Form RCT-106?

A: Form RCT-106 should be filed along with the RCT-101 form in Pennsylvania.

Q: What is RCT-101?

A: RCT-101 is a form used for reporting corporate tax returns in Pennsylvania.

Q: What information is required on Form RCT-106?

A: Form RCT-106 requires information to calculate the apportionment percentage, including sales, property, and payroll data.

Q: Is Form RCT-106 applicable in other states?

A: No, Form RCT-106 is specific to filing taxes in Pennsylvania.

Q: Is Form RCT-106 mandatory?

A: Yes, if you are filing a RCT-101 form in Pennsylvania, Form RCT-106 is mandatory.

Q: Are there any filing deadlines for Form RCT-106?

A: Yes, the deadline for filing Form RCT-106 is the same as the deadline for filing the RCT-101 form.

Q: I have more questions about Form RCT-106, who do I contact?

A: For more information regarding Form RCT-106, you can contact the Pennsylvania Department of Revenue.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-106 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.