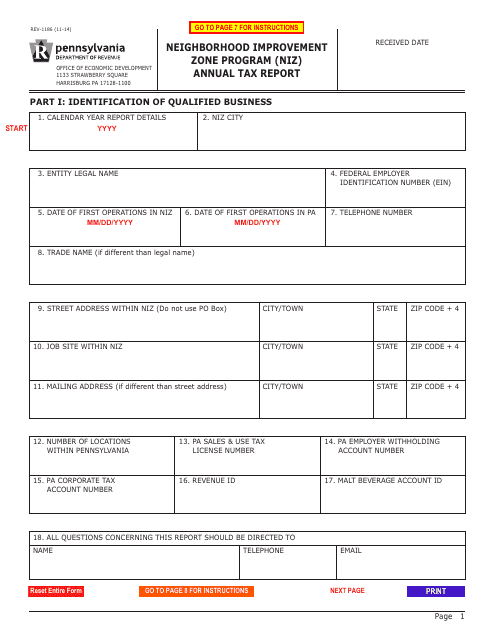

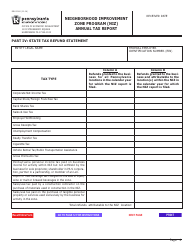

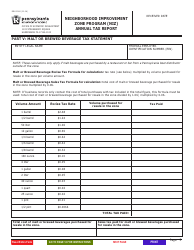

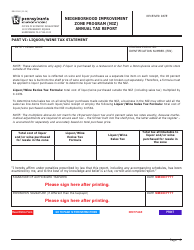

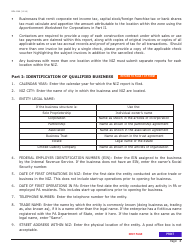

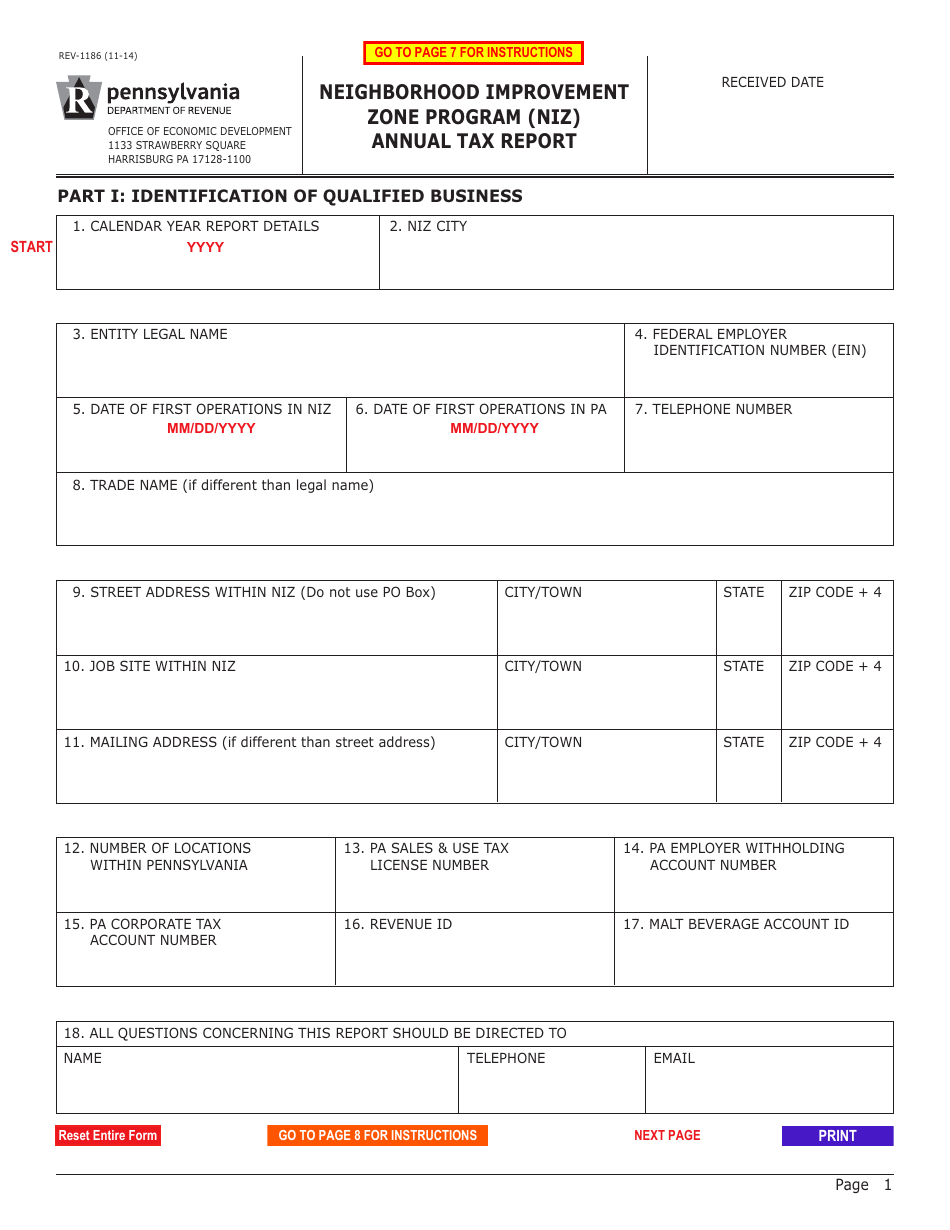

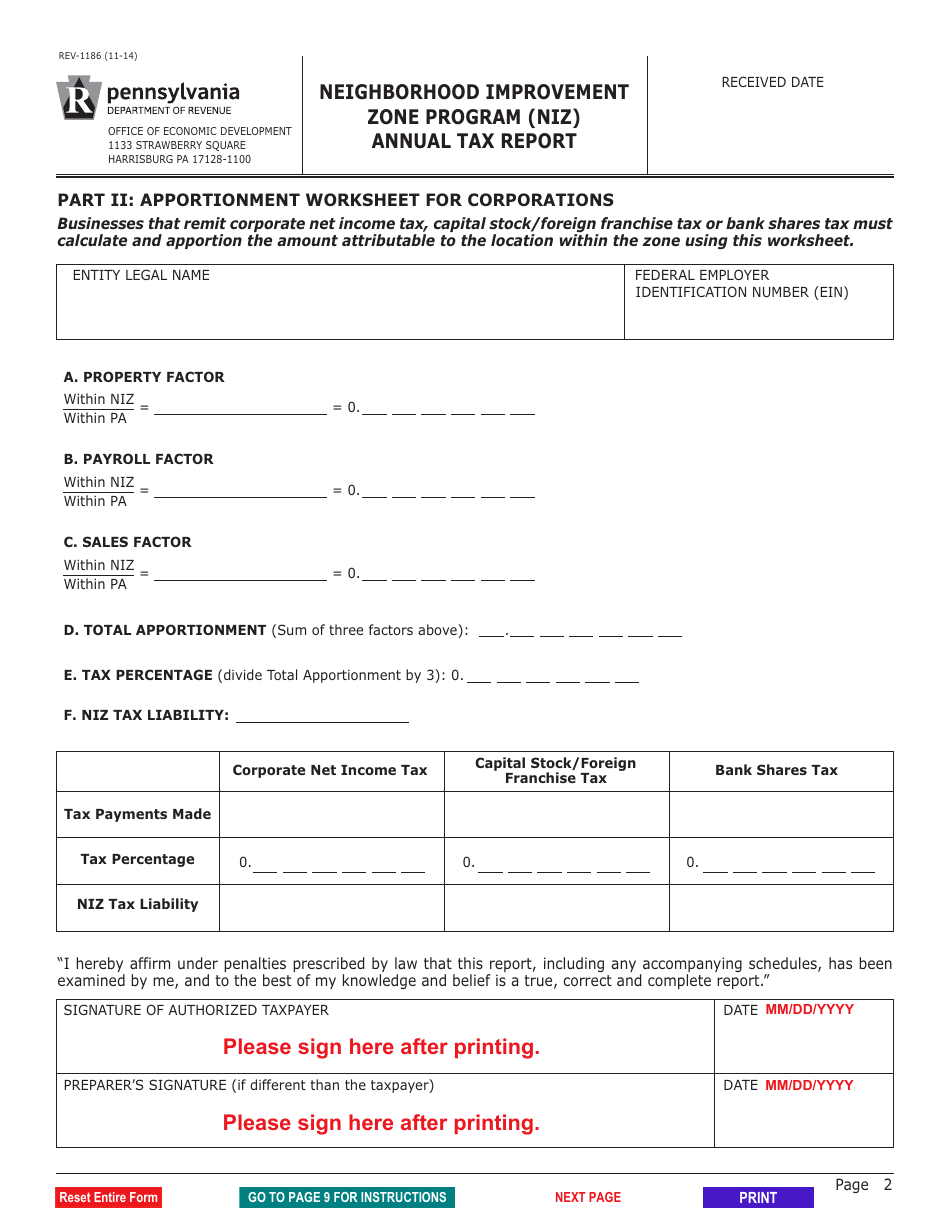

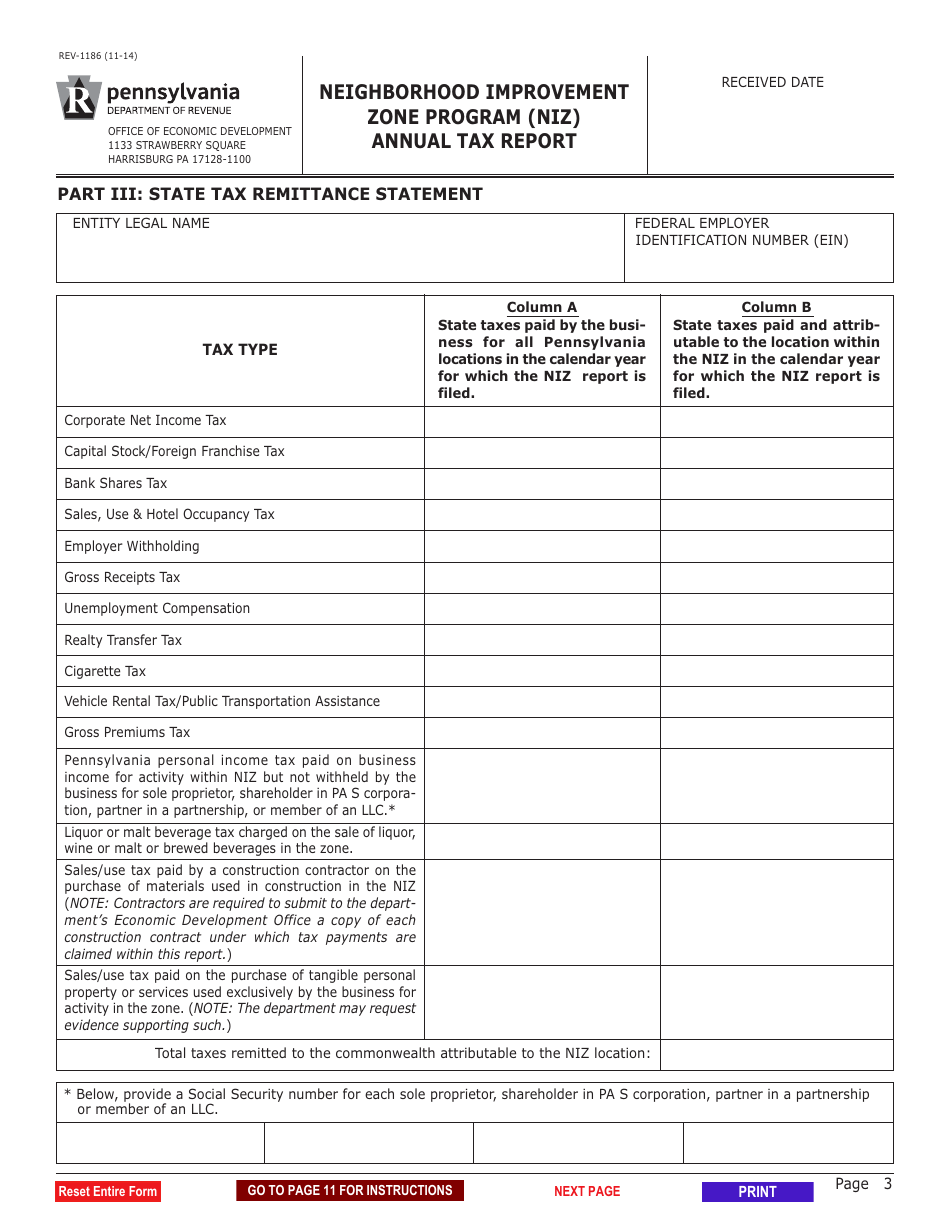

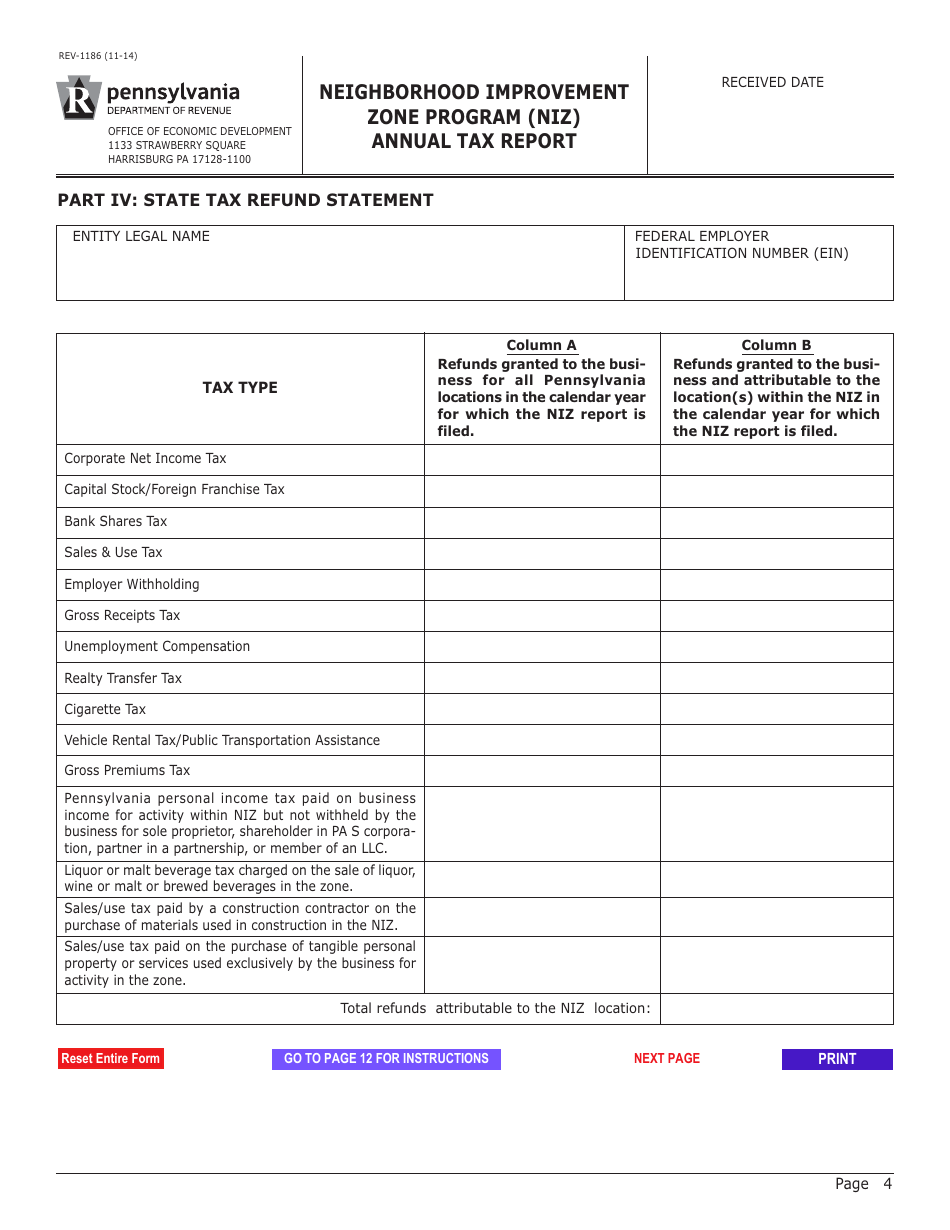

Form REV-1186 Neighborhood Improvement Zone Program (Niz) Annual Tax Report - Pennsylvania

What Is Form REV-1186?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

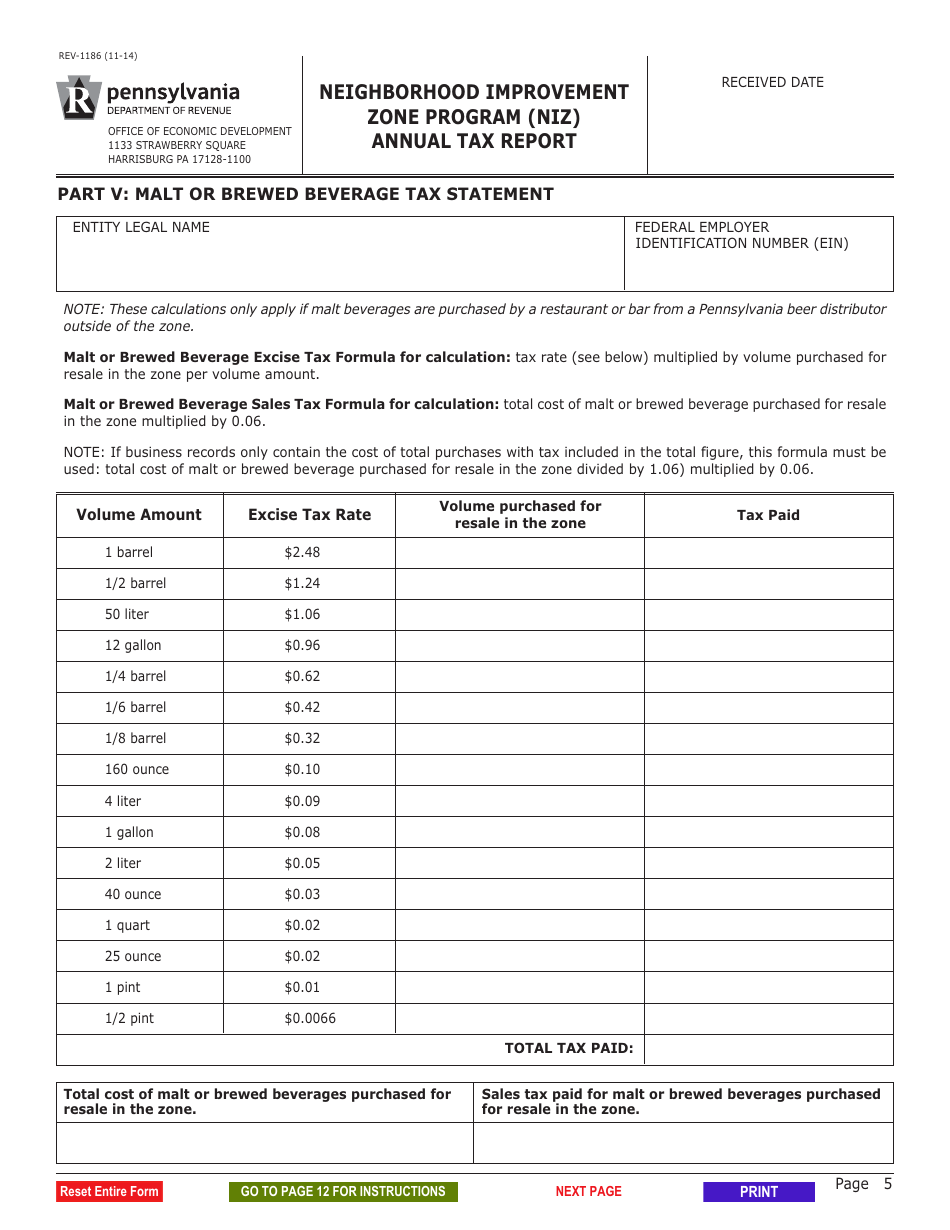

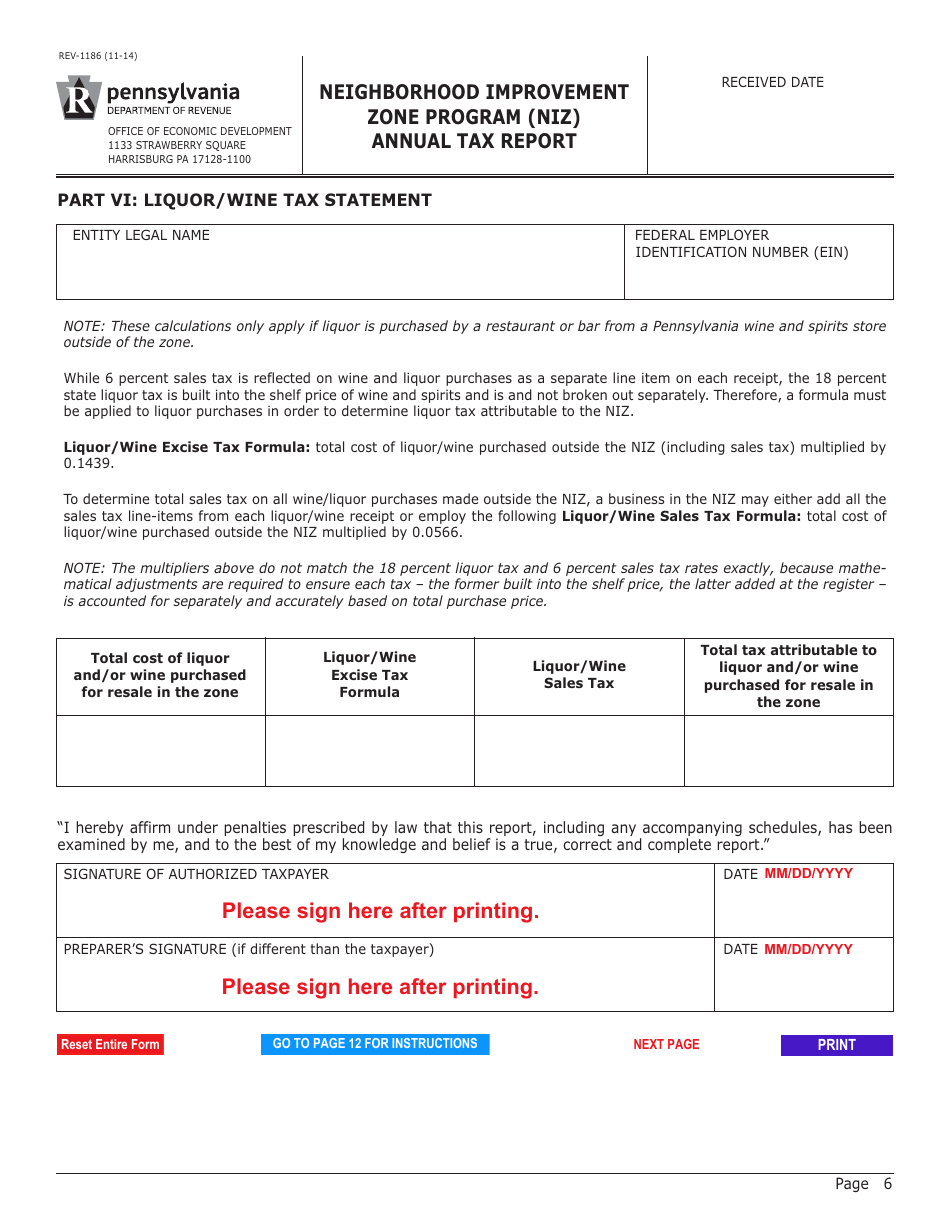

Q: What is Form REV-1186?

A: Form REV-1186 is the Neighborhood Improvement Zone (NIZ) Program Annual Tax Report in Pennsylvania.

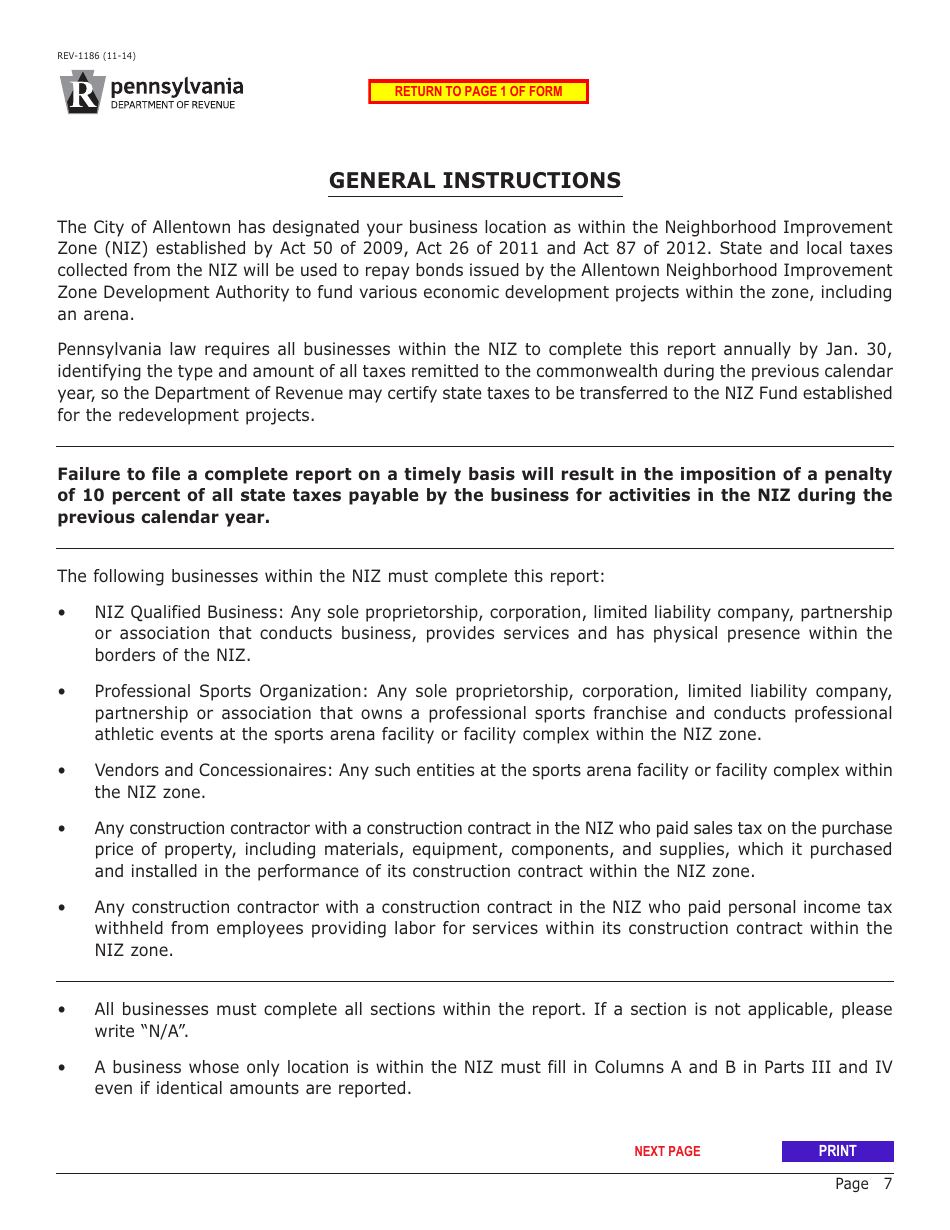

Q: What is the Neighborhood Improvement Zone (NIZ) Program?

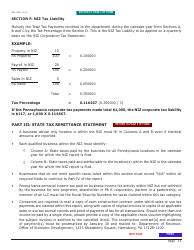

A: The Neighborhood Improvement Zone (NIZ) Program is a state program in Pennsylvania that provides tax incentives for development projects in designated areas.

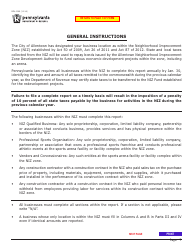

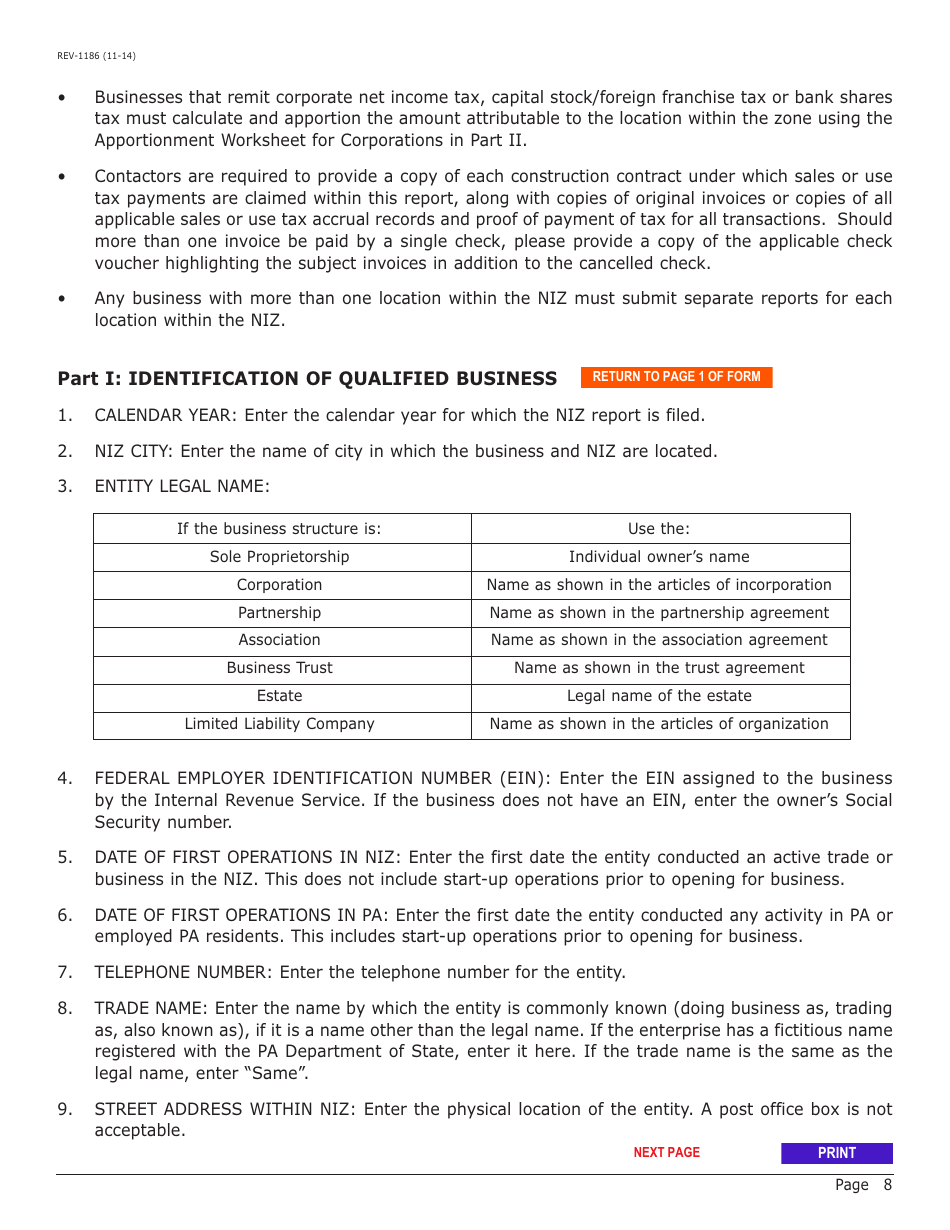

Q: Who needs to file Form REV-1186?

A: Businesses or entities participating in the Neighborhood Improvement Zone (NIZ) Program in Pennsylvania need to file Form REV-1186.

Q: What is the purpose of filing Form REV-1186?

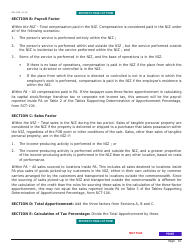

A: The purpose of filing Form REV-1186 is to report the annual tax information related to the Neighborhood Improvement Zone (NIZ) Program in Pennsylvania.

Q: When is the deadline to file Form REV-1186?

A: The deadline to file Form REV-1186 is usually on or before March 15th of each year.

Q: Are there any penalties for not filing Form REV-1186 on time?

A: Yes, there may be penalties for not filing Form REV-1186 on time. It is important to file the form by the deadline to avoid any penalties.

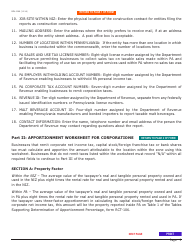

Q: What information do I need to complete Form REV-1186?

A: You will need to provide information about your business or entity, as well as the tax information related to the Neighborhood Improvement Zone (NIZ) Program.

Q: Can I file Form REV-1186 electronically?

A: Yes, you can file Form REV-1186 electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1186 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.