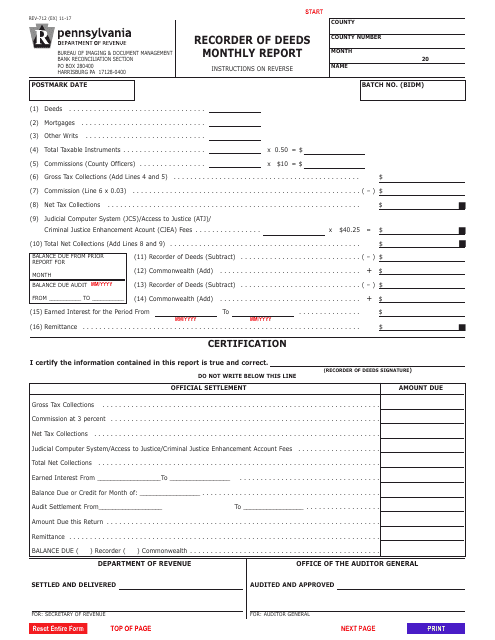

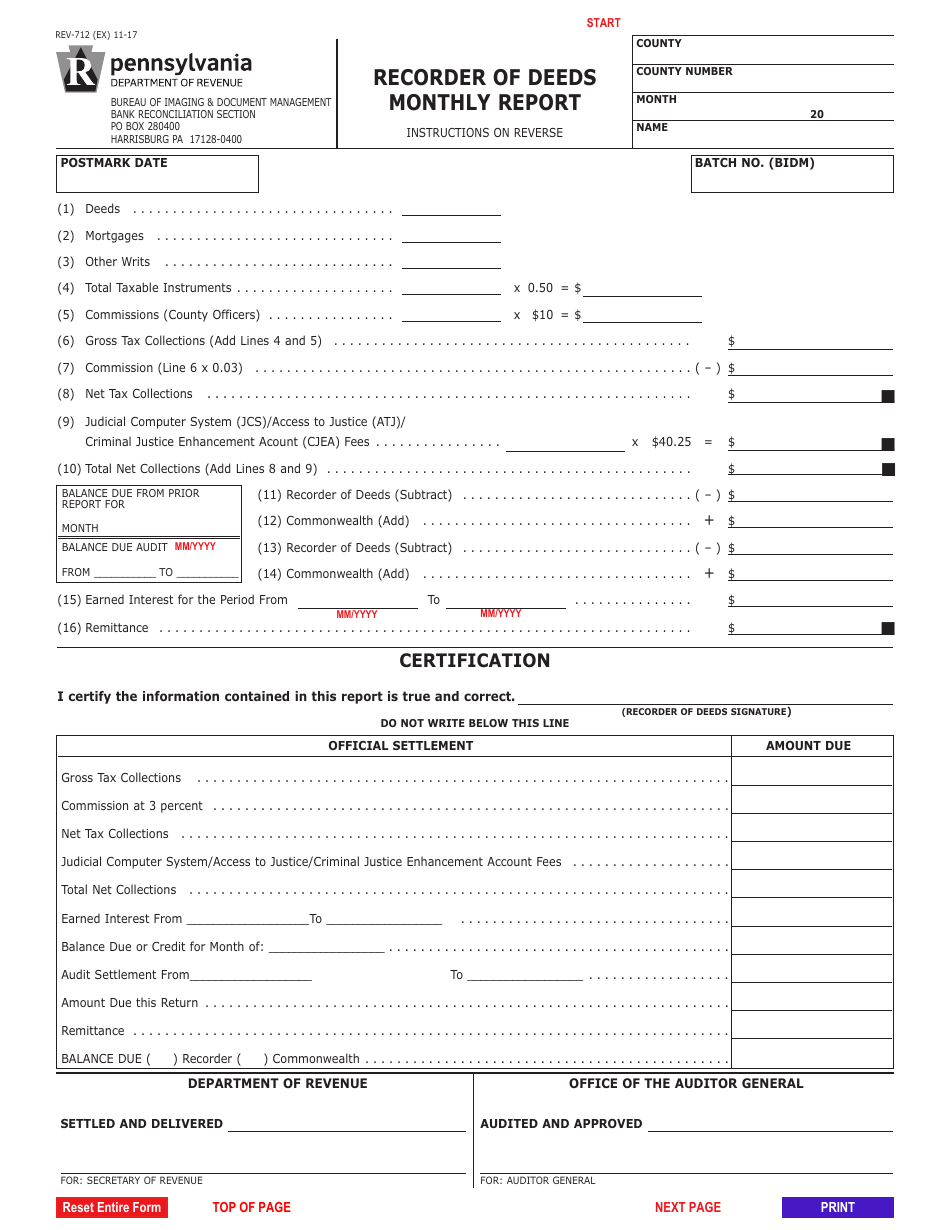

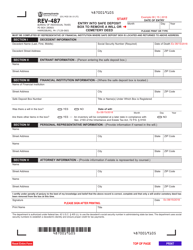

Form REV-712 Recorder of Deeds Monthly Report - Pennsylvania

What Is Form REV-712?

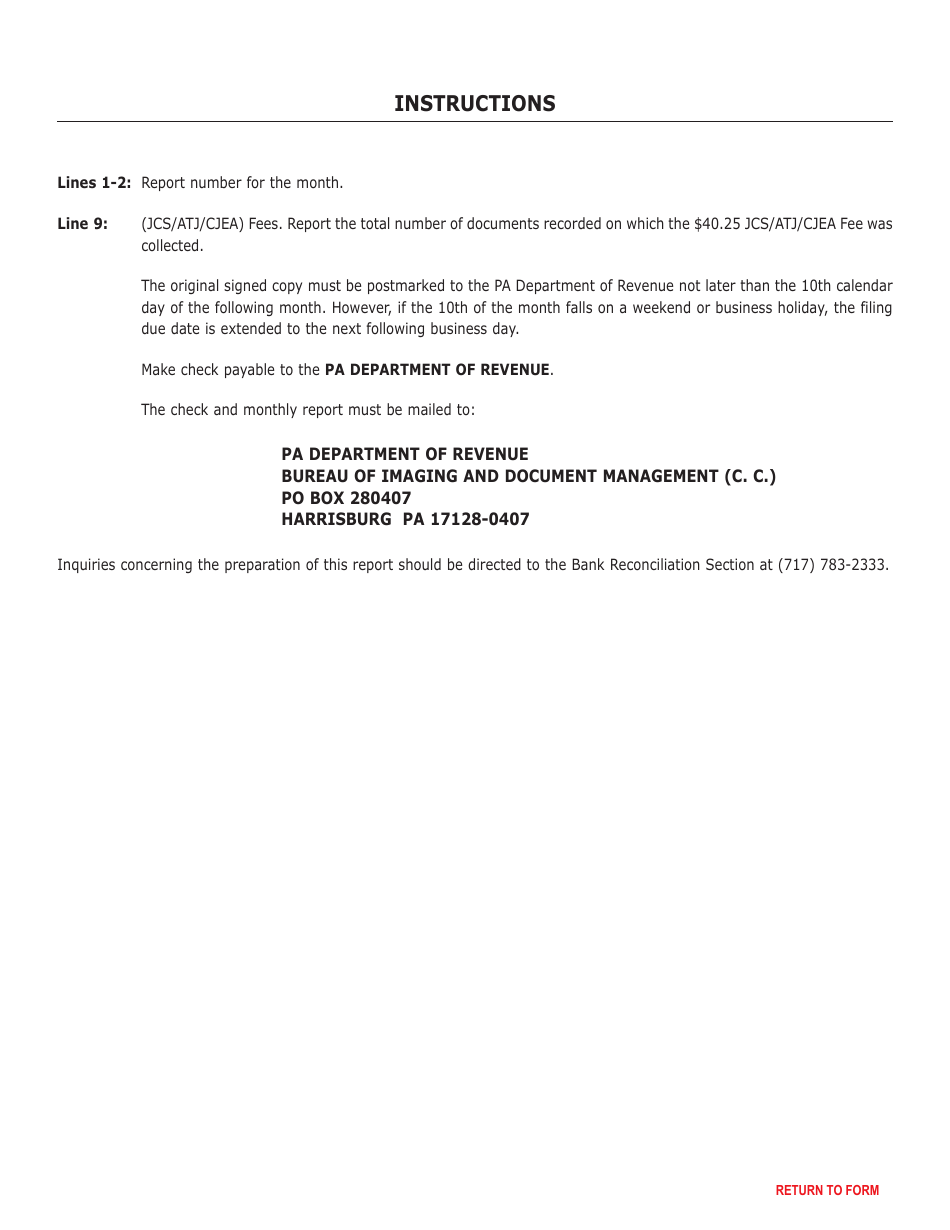

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-712?

A: Form REV-712 is a Recorder of Deeds Monthly Report in Pennsylvania.

Q: Who needs to file Form REV-712?

A: Recorder of Deeds in Pennsylvania need to file Form REV-712.

Q: What is the purpose of Form REV-712?

A: The purpose of Form REV-712 is to report monthly data related to real estate transfers and mortgages.

Q: What information is required on Form REV-712?

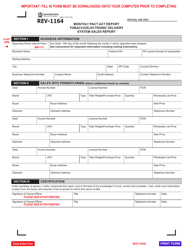

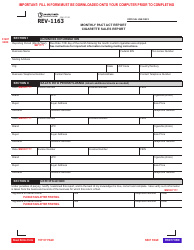

A: Form REV-712 requires information such as names of parties involved in the transfers, property addresses, recording fees, and other relevant details.

Q: When is Form REV-712 due?

A: Form REV-712 is due by the 15th day of the month following the reporting month.

Q: Are there any penalties for late filing of Form REV-712?

A: Yes, there are penalties for late filing of Form REV-712, including potential monetary penalties and interest charges.

Q: Are there any exemptions from filing Form REV-712?

A: There may be exemptions from filing Form REV-712 for certain types of transactions, but it is best to consult with the Pennsylvania Department of Revenue for specific details.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-712 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.