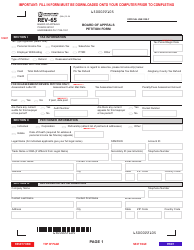

Form REV-638(FO) Official Appeal Waiver - Pennsylvania

What Is Form REV-638(FO)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

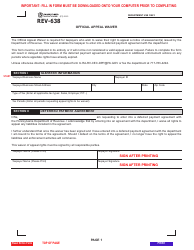

Q: What is Form REV-638(FO)?

A: Form REV-638(FO) is the Official Appeal Waiver form used in Pennsylvania.

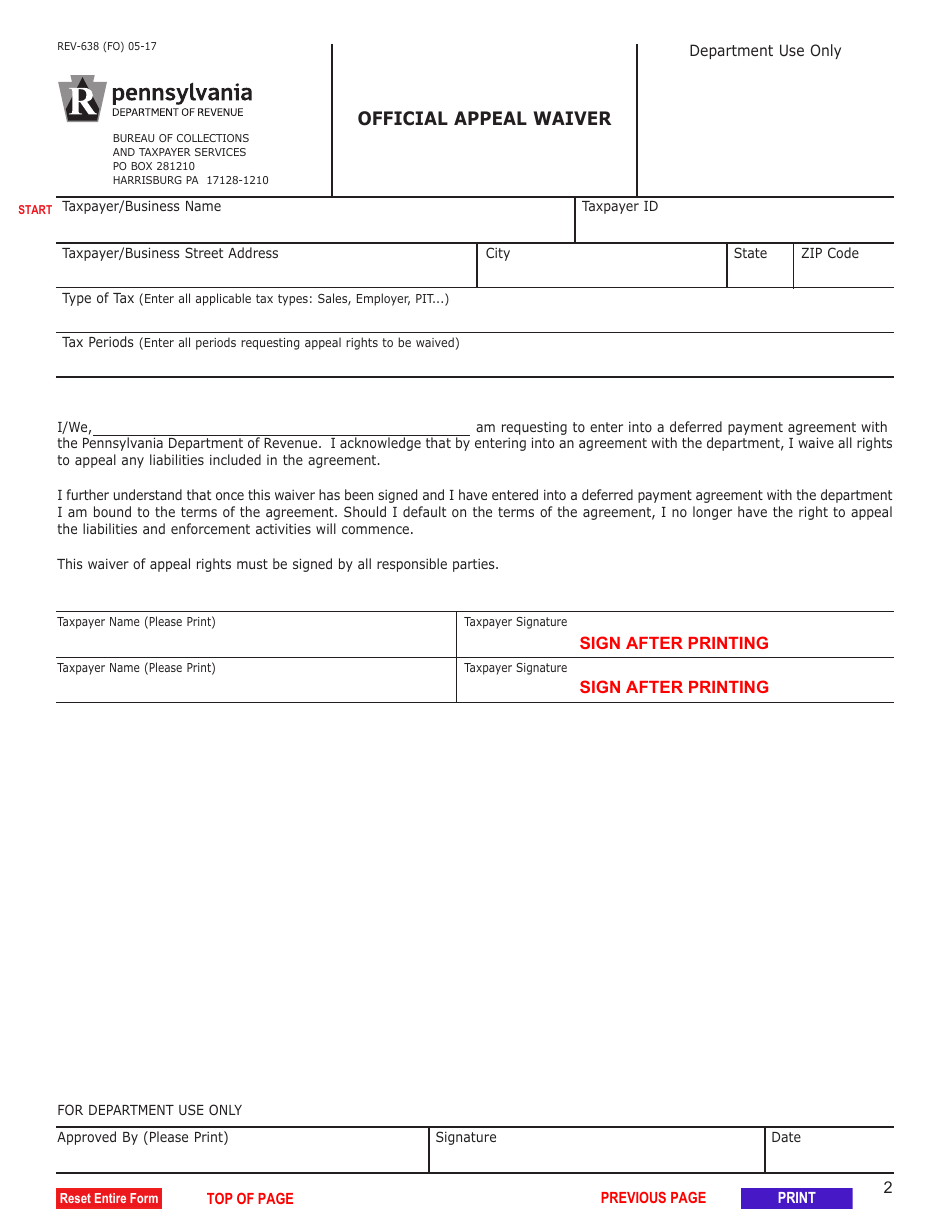

Q: What is the purpose of Form REV-638(FO)?

A: The purpose of Form REV-638(FO) is to waive the right to appeal certain Pennsylvania tax matters.

Q: Who should use Form REV-638(FO)?

A: Individuals or businesses who want to waive their right to appeal a Pennsylvania tax matter should use Form REV-638(FO).

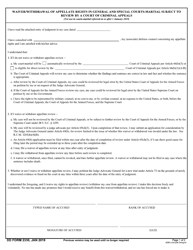

Q: Is Form REV-638(FO) required to be filed?

A: Yes, if you wish to waive your right to appeal a Pennsylvania tax matter, you must file Form REV-638(FO).

Q: What should I do after filling out Form REV-638(FO)?

A: After filling out Form REV-638(FO), you should submit it to the Pennsylvania Department of Revenue.

Q: Can I revoke my waiver after submitting Form REV-638(FO)?

A: No, once you submit Form REV-638(FO), the waiver is final and cannot be revoked.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-638(FO) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.