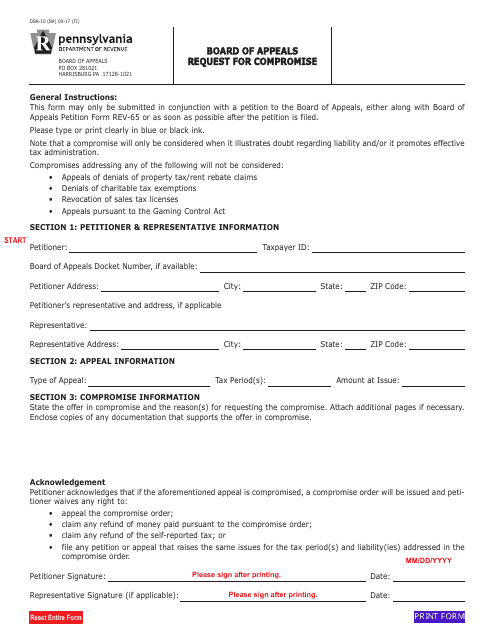

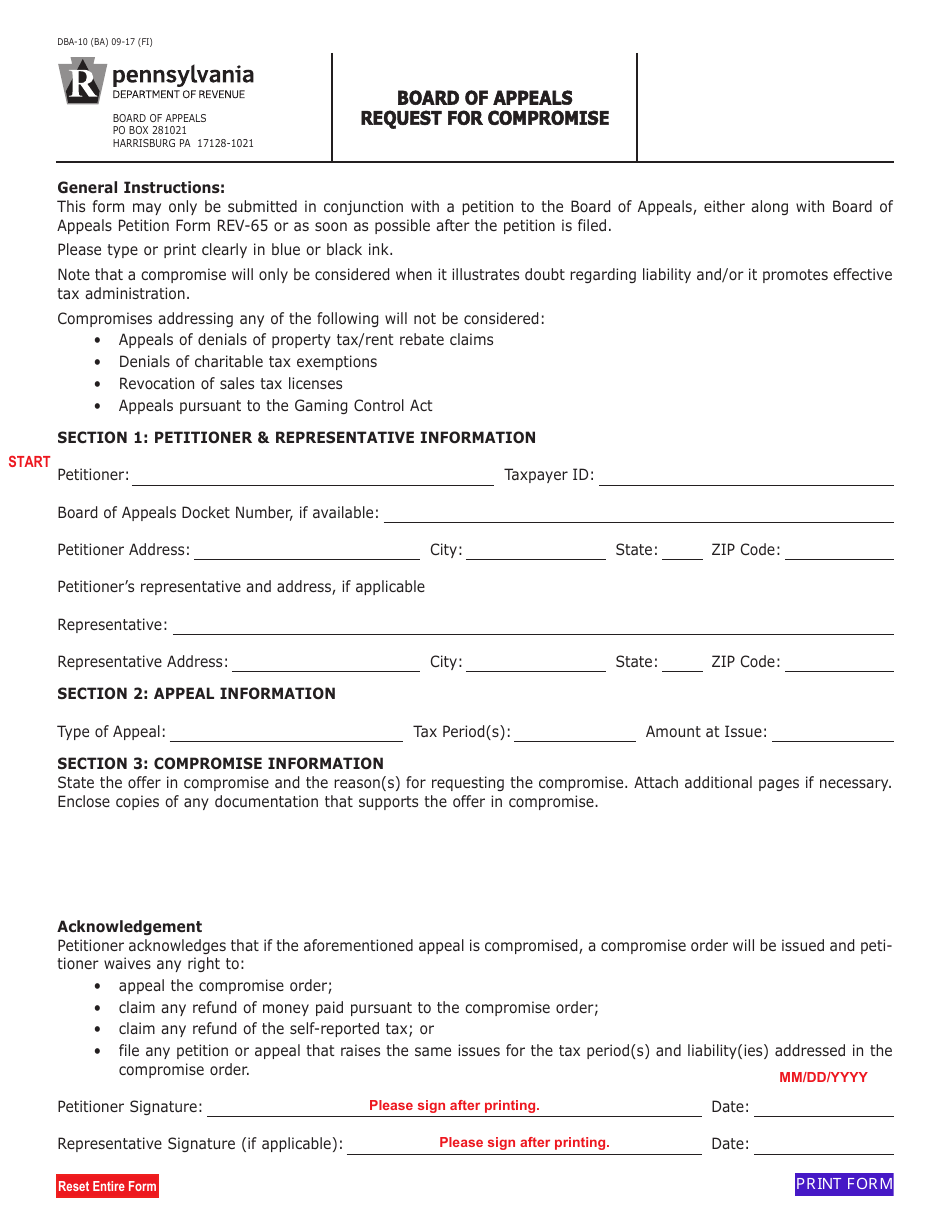

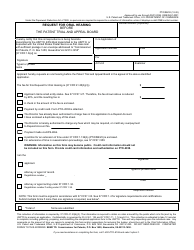

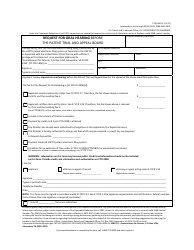

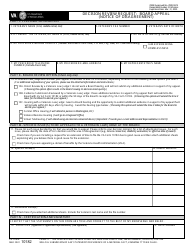

Form DBA-10 (BA) Board(of(appeals Request for Compromise - Pennsylvania

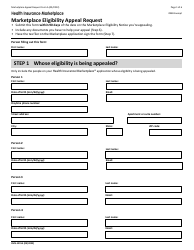

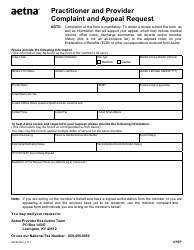

What Is Form DBA-10 (BA)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DBA-10 (BA) Board of Appeals Request for Compromise?

A: DBA-10 (BA) is a form used to request a compromise with the Pennsylvania Board of Appeals.

Q: What is the purpose of DBA-10 (BA) Board of Appeals Request for Compromise?

A: The purpose of DBA-10 (BA) is to request a compromise when you owe taxes to the Pennsylvania Board of Appeals.

Q: What information do I need to provide in DBA-10 (BA) Board of Appeals Request for Compromise?

A: You need to provide your personal information, tax details, reasons for requesting a compromise, and supporting documentation.

Q: Are there any fees for submitting DBA-10 (BA) Board of Appeals Request for Compromise?

A: There is no fee for submitting the DBA-10 (BA) form to the Pennsylvania Board of Appeals.

Q: What happens after I submit DBA-10 (BA) Board of Appeals Request for Compromise?

A: After submitting the form, the Pennsylvania Board of Appeals will review your request and determine if a compromise can be granted.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBA-10 (BA) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.