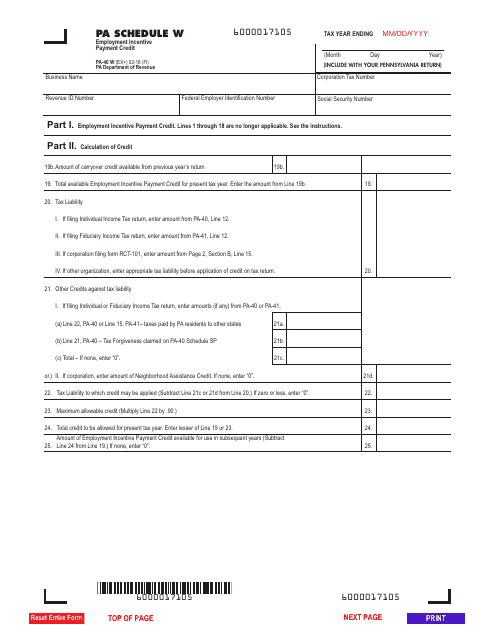

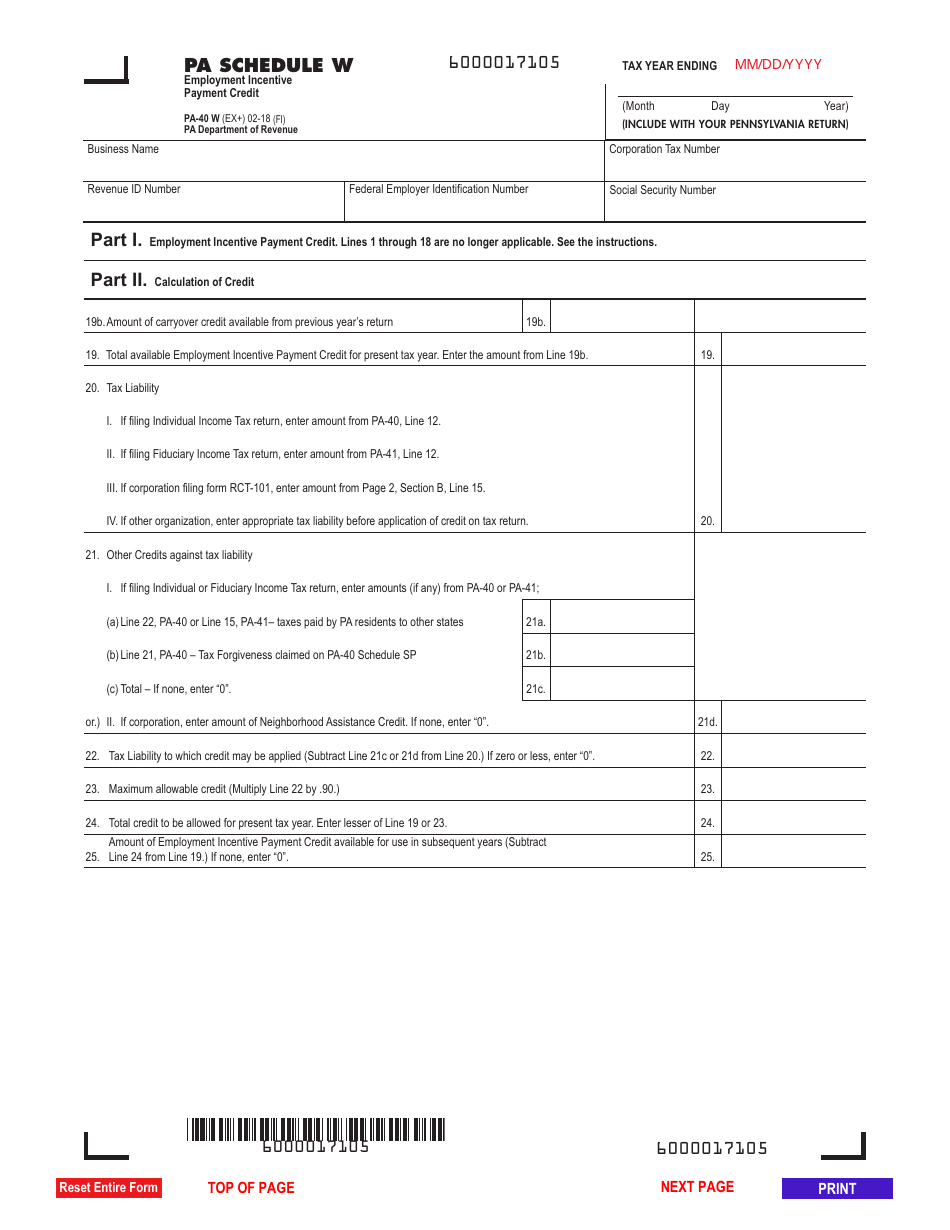

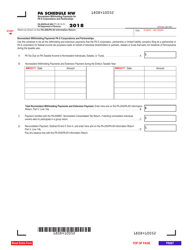

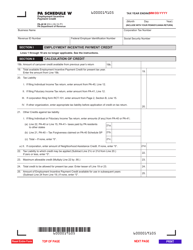

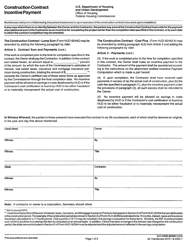

Form PA-40 W Schedule W Employment Incentive Payment Credit - Pennsylvania

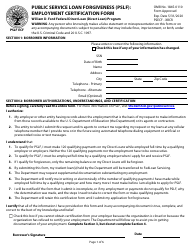

What Is Form PA-40 W Schedule W?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 W?

A: Form PA-40 W is a tax form used in Pennsylvania.

Q: What is Schedule W?

A: Schedule W is a section of Form PA-40 W that is used to claim the Employment Incentive Payment Credit in Pennsylvania.

Q: What is the Employment Incentive Payment Credit?

A: The Employment Incentive Payment Credit is a tax credit available to certain businesses in Pennsylvania.

Q: Who can claim the Employment Incentive Payment Credit?

A: Certain businesses in Pennsylvania may be eligible to claim the Employment Incentive Payment Credit.

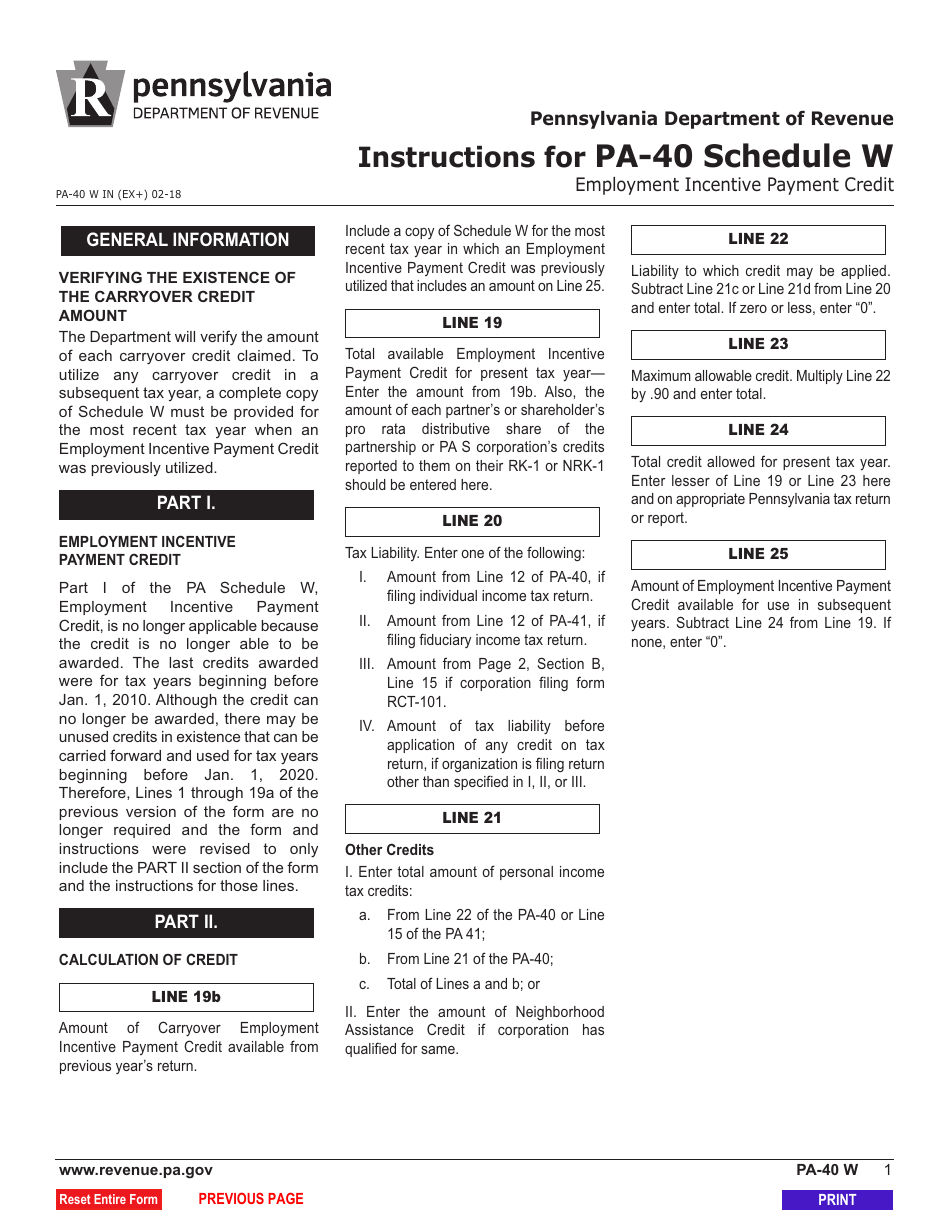

Q: How do I complete Schedule W?

A: You will need to provide information about your business and the employment incentives you are claiming on Schedule W.

Q: Are there any eligibility requirements for the Employment Incentive Payment Credit?

A: Yes, there are certain eligibility requirements that businesses must meet to claim the Employment Incentive Payment Credit. Please refer to the instructions for Form PA-40 W for more details.

Q: What other forms do I need to file along with Form PA-40 W?

A: You may need to file other tax forms, such as Form PA-40, depending on your individual or business tax situation in Pennsylvania. It is always recommended to consult with a tax professional or refer to the official instructions for Form PA-40 W.

Q: When is the deadline to file Form PA-40 W?

A: The deadline to file Form PA-40 W is typically the same as the deadline to file your Pennsylvania income tax return, which is April 15th of each year.

Q: Can I file Form PA-40 W electronically?

A: Yes, you can file Form PA-40 W electronically if you are e-filing your Pennsylvania income tax return.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 W Schedule W by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.