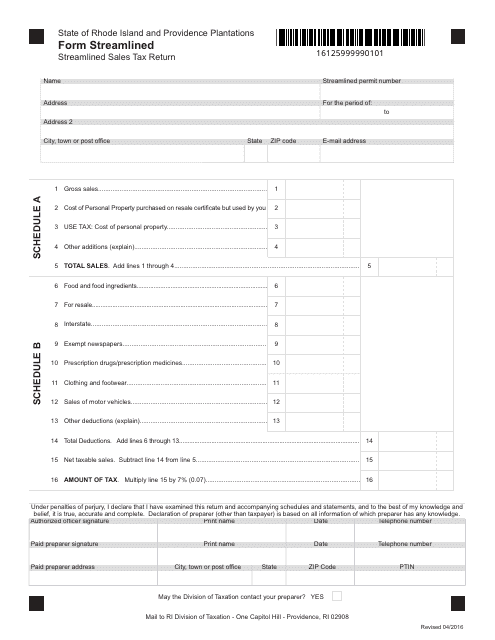

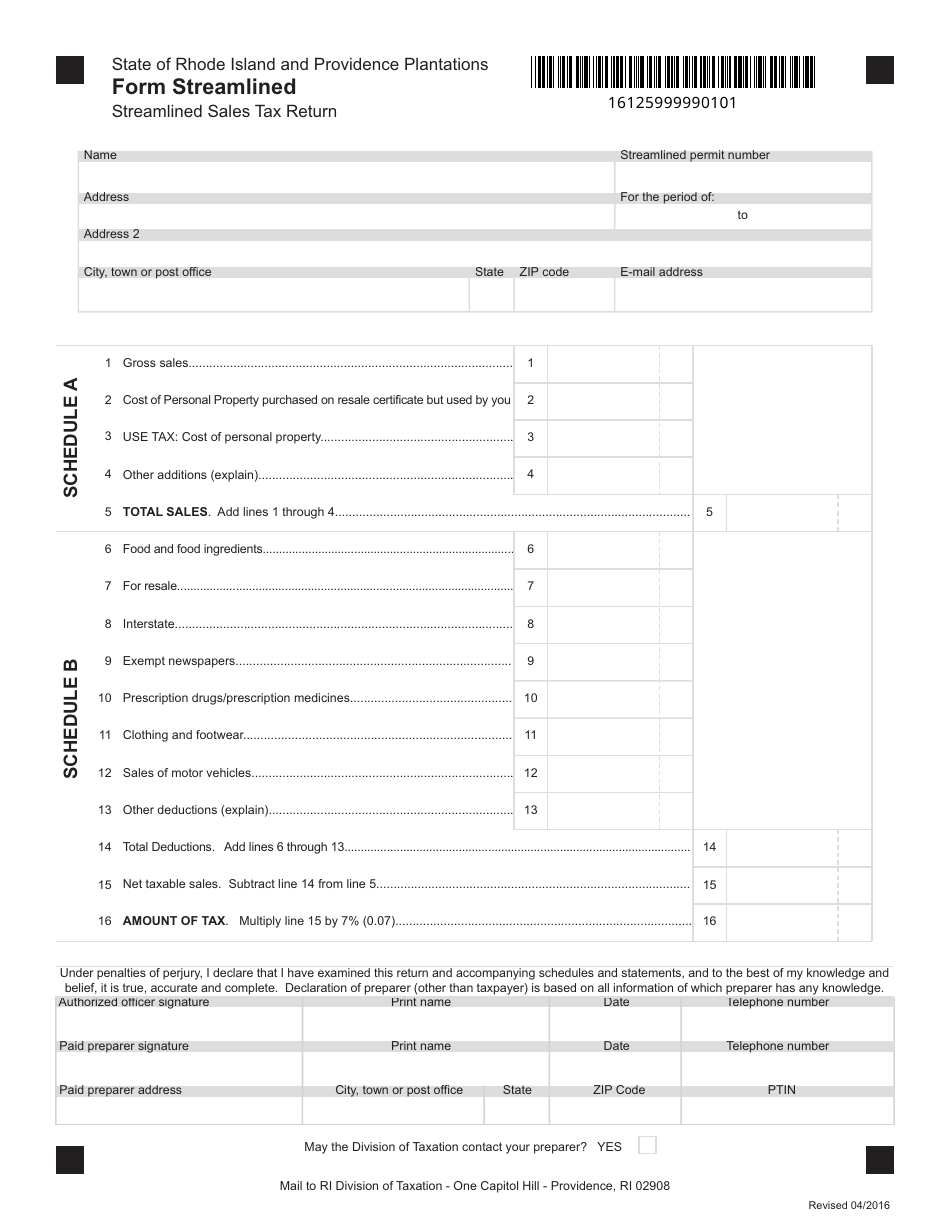

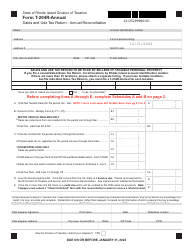

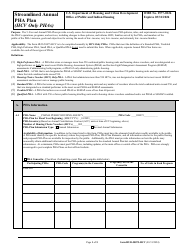

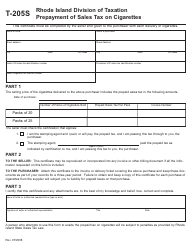

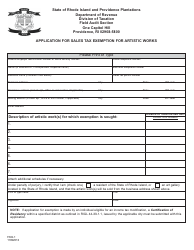

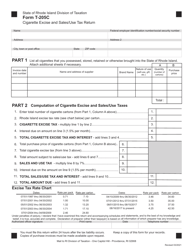

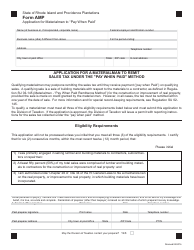

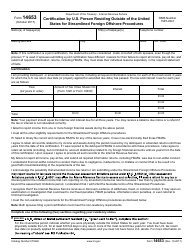

Form STREAMLINED Streamlined Sales Tax Return - Rhode Island

What Is Form STREAMLINED?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Streamlined Sales Tax Return?

A: The Streamlined Sales Tax Return is a form used to report sales tax in Rhode Island.

Q: Who needs to file the Streamlined Sales Tax Return?

A: Retailers and other businesses that sell taxable goods or services in Rhode Island need to file the Streamlined Sales Tax Return.

Q: What is the purpose of the Streamlined Sales Tax Return?

A: The purpose of the Streamlined Sales Tax Return is to collect and report sales tax on behalf of the state.

Q: How often do I need to file the Streamlined Sales Tax Return?

A: The frequency of filing the Streamlined Sales Tax Return depends on the amount of sales tax you collect. It can be filed monthly, quarterly, or annually.

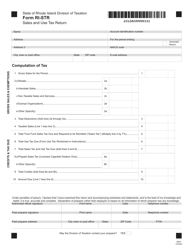

Q: What information do I need to provide on the Streamlined Sales Tax Return?

A: You will need to provide information about your sales, sales tax collected, and any exemptions or deductions you are claiming.

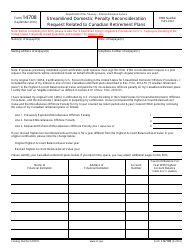

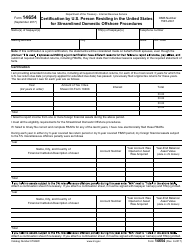

Q: Are there any penalties for not filing the Streamlined Sales Tax Return?

A: Yes, there can be penalties for not filing the Streamlined Sales Tax Return, including late filing penalties and interest on unpaid taxes.

Q: Is there any assistance available for completing the Streamlined Sales Tax Return?

A: Yes, the Rhode Island Division of Taxation provides assistance and resources for businesses to help them complete the Streamlined Sales Tax Return.

Q: Do I need to keep records of my sales and sales tax for the Streamlined Sales Tax Return?

A: Yes, you should keep records of your sales and sales tax information for at least three years in case of an audit.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STREAMLINED by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.