This version of the form is not currently in use and is provided for reference only. Download this version of

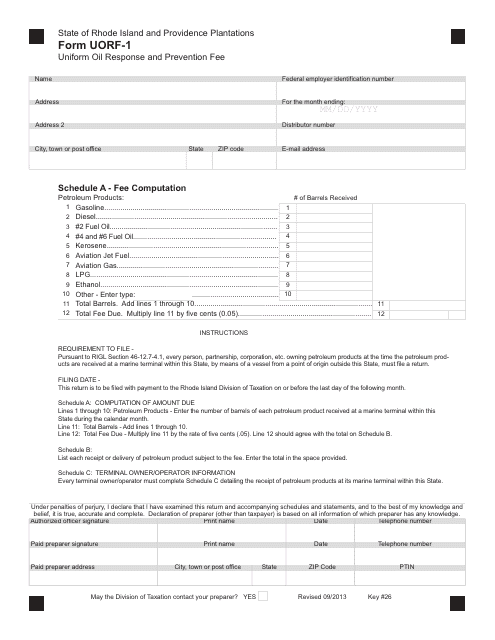

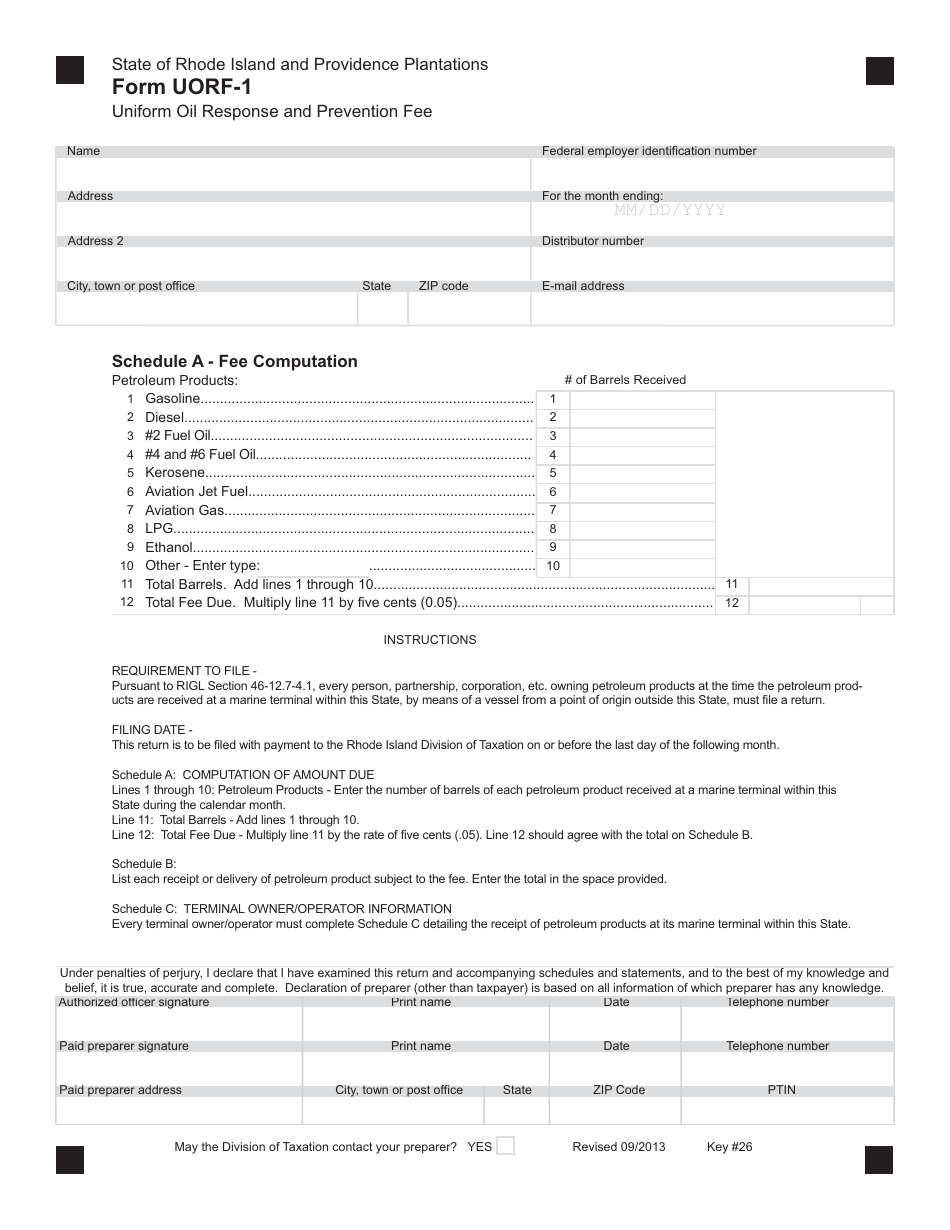

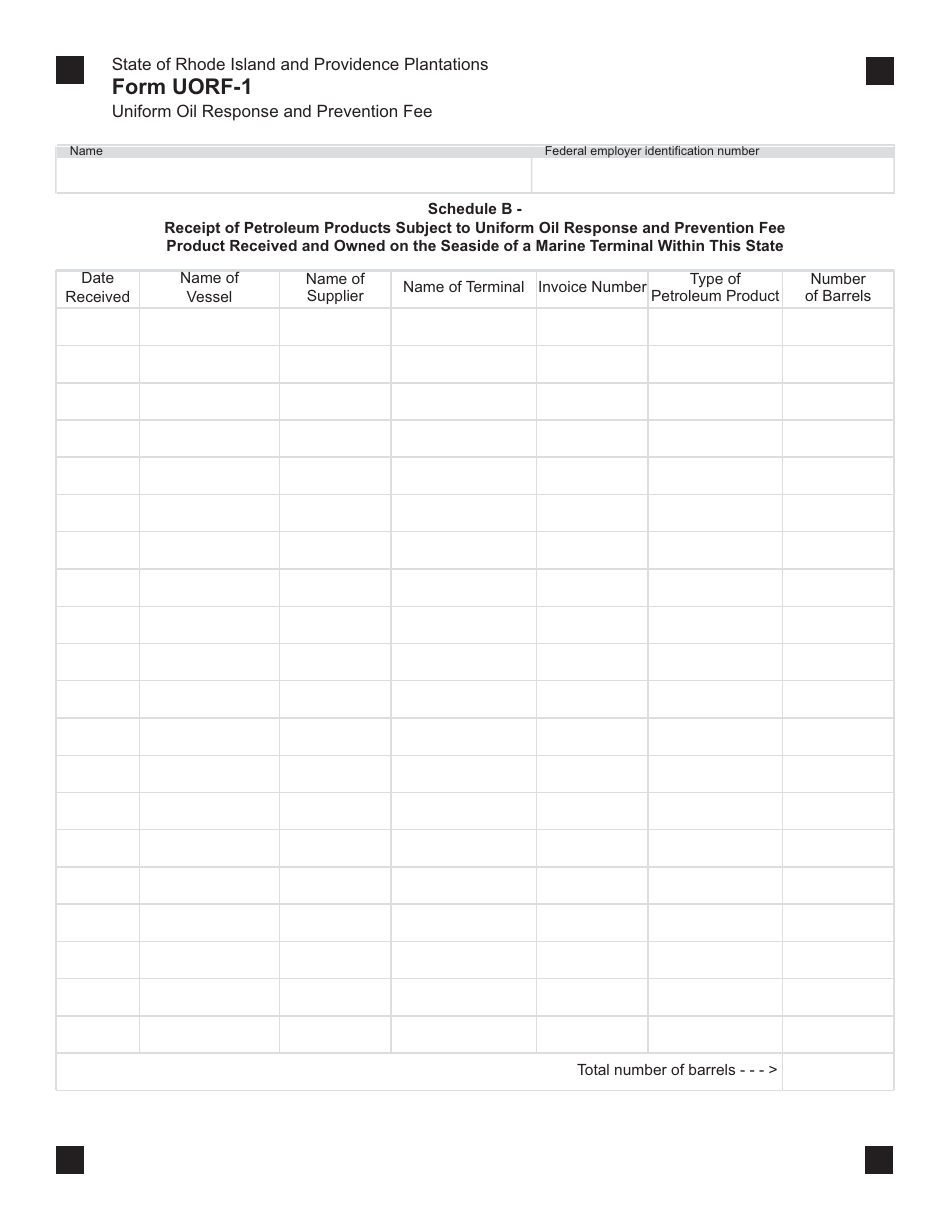

Form UORF-1

for the current year.

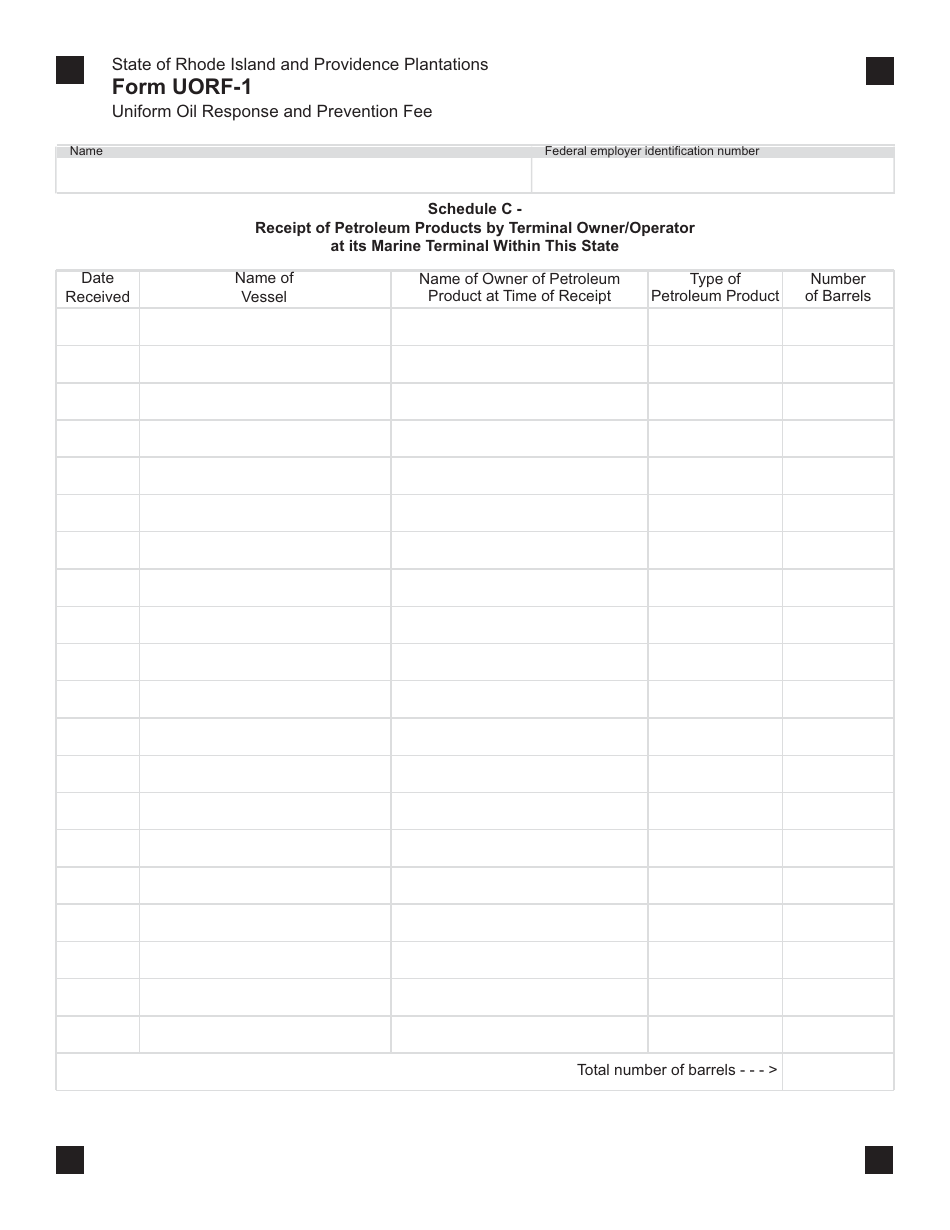

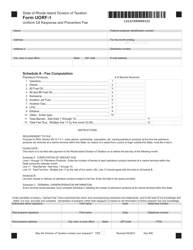

Form UORF-1 Uniform Oil Response and Prevention Fee - Rhode Island

What Is Form UORF-1?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UORF-1?

A: UORF-1 stands for Uniform Oil Response and Prevention Fee.

Q: What does UORF-1 do?

A: UORF-1 is used to fund oil spill response and prevention efforts in Rhode Island.

Q: Who is required to pay UORF-1?

A: Owners or operators of certain oil storage facilities in Rhode Island are required to pay UORF-1.

Q: How is UORF-1 calculated?

A: UORF-1 is calculated based on the number of gallons of oil stored at the facility.

Q: Is UORF-1 tax deductible?

A: No, UORF-1 is not tax deductible.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UORF-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.