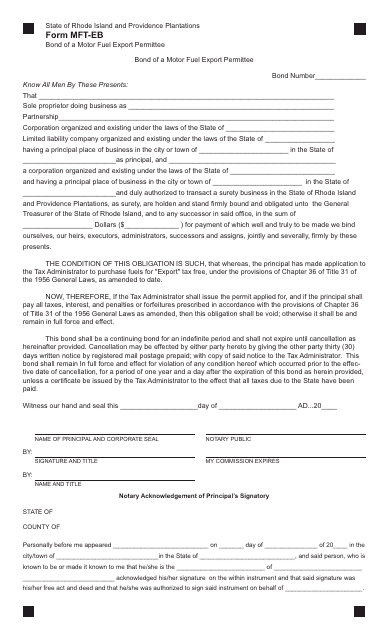

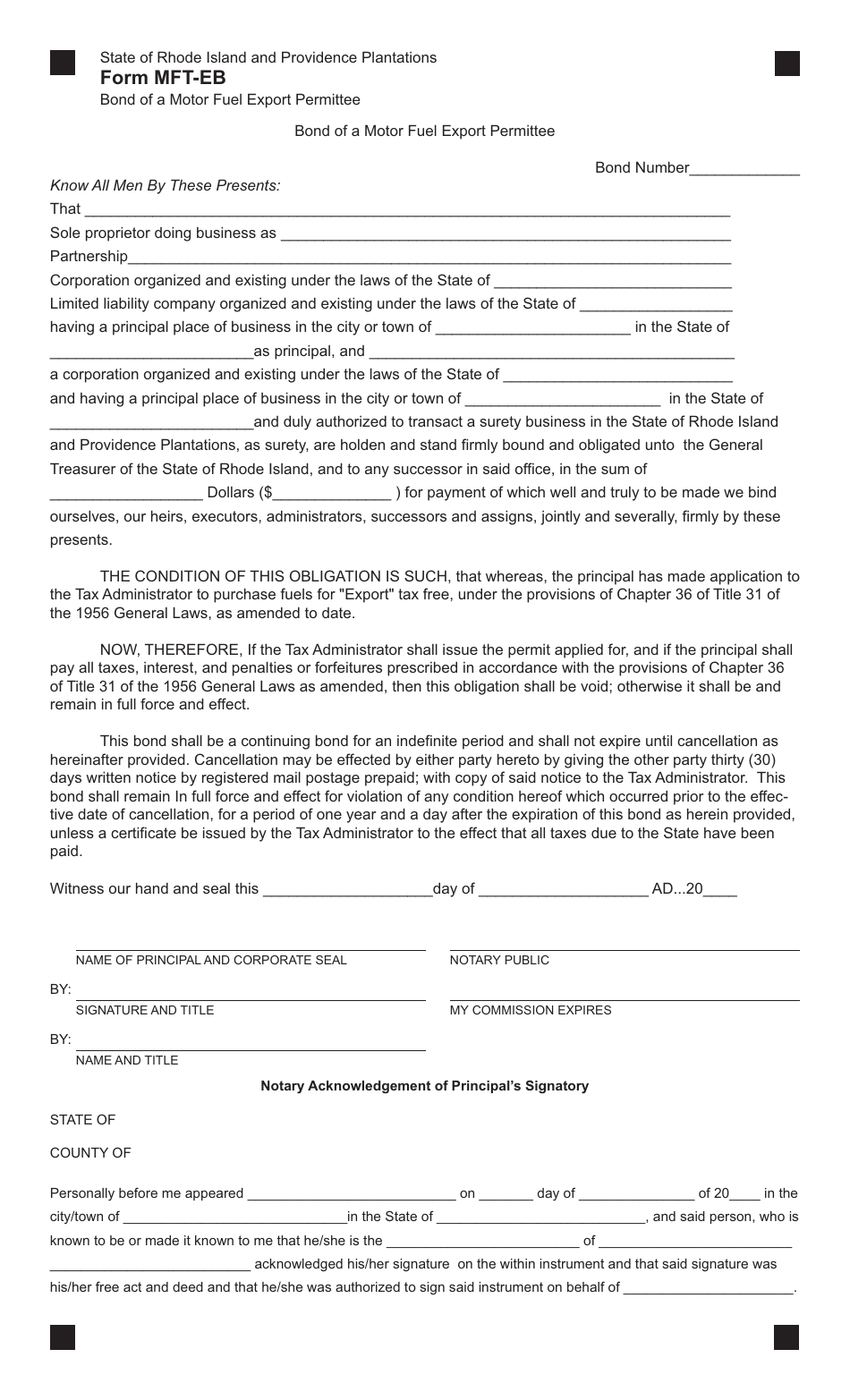

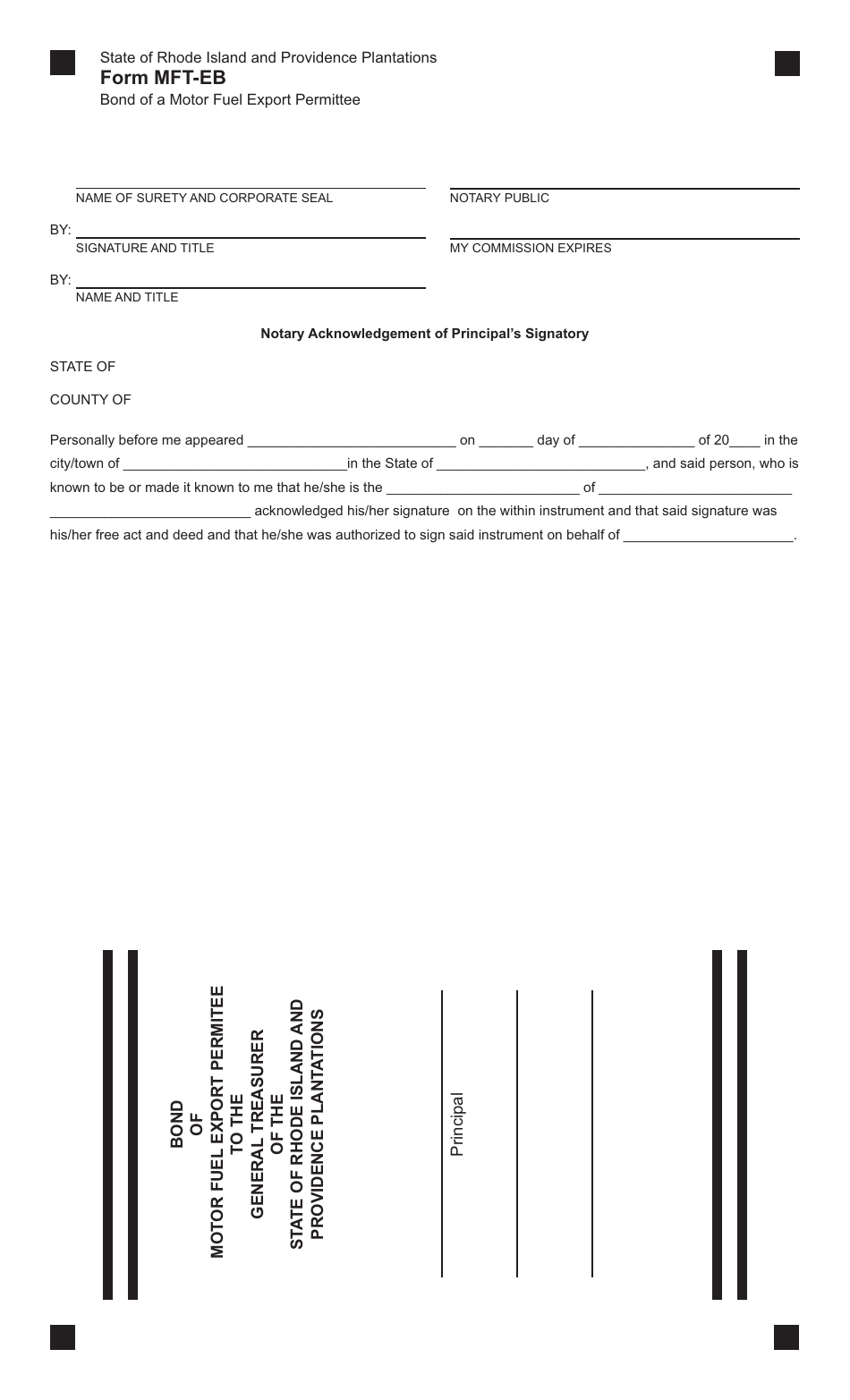

Form MFT-EB Bond of a Motor Fuel Export Permittee - Rhode Island

What Is Form MFT-EB?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFT-EB?

A: Form MFT-EB is a bond that is required for Motor Fuel Export Permittees in Rhode Island.

Q: Who needs to file Form MFT-EB?

A: Motor Fuel Export Permittees in Rhode Island need to file Form MFT-EB.

Q: What is the purpose of Form MFT-EB?

A: The purpose of Form MFT-EB is to provide a bond to guarantee payment of any taxes or penalties that may be due in connection with the export of motor fuel.

Q: Is Form MFT-EB specific to Rhode Island?

A: Yes, Form MFT-EB is specific to Rhode Island.

Q: Are there any fees associated with filing Form MFT-EB?

A: Yes, there may be fees associated with the filing of Form MFT-EB. It is recommended to check with the Rhode Island Division of Taxation for the current fee schedule.

Q: What happens if I fail to file Form MFT-EB?

A: Failure to file Form MFT-EB may result in penalties and interest being assessed by the Rhode Island Division of Taxation.

Q: Are there any exemptions to filing Form MFT-EB?

A: It is recommended to check with the Rhode Island Division of Taxation for any exemptions to filing Form MFT-EB.

Q: Can I submit a paper copy of Form MFT-EB?

A: Yes, you can submit a paper copy of Form MFT-EB to the Rhode Island Division of Taxation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFT-EB by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.