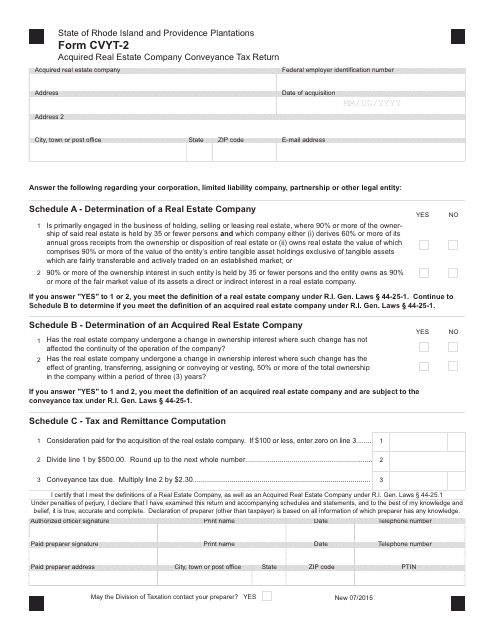

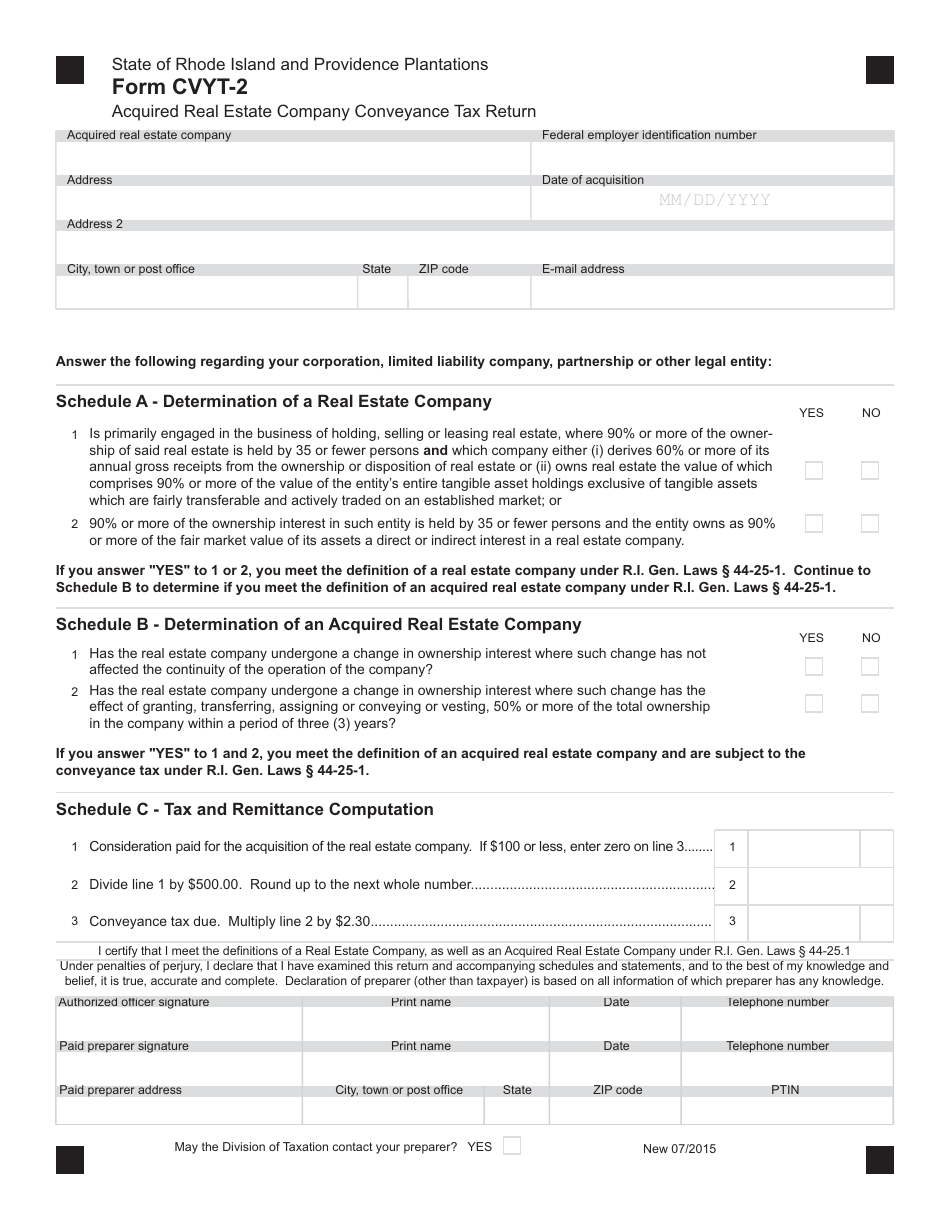

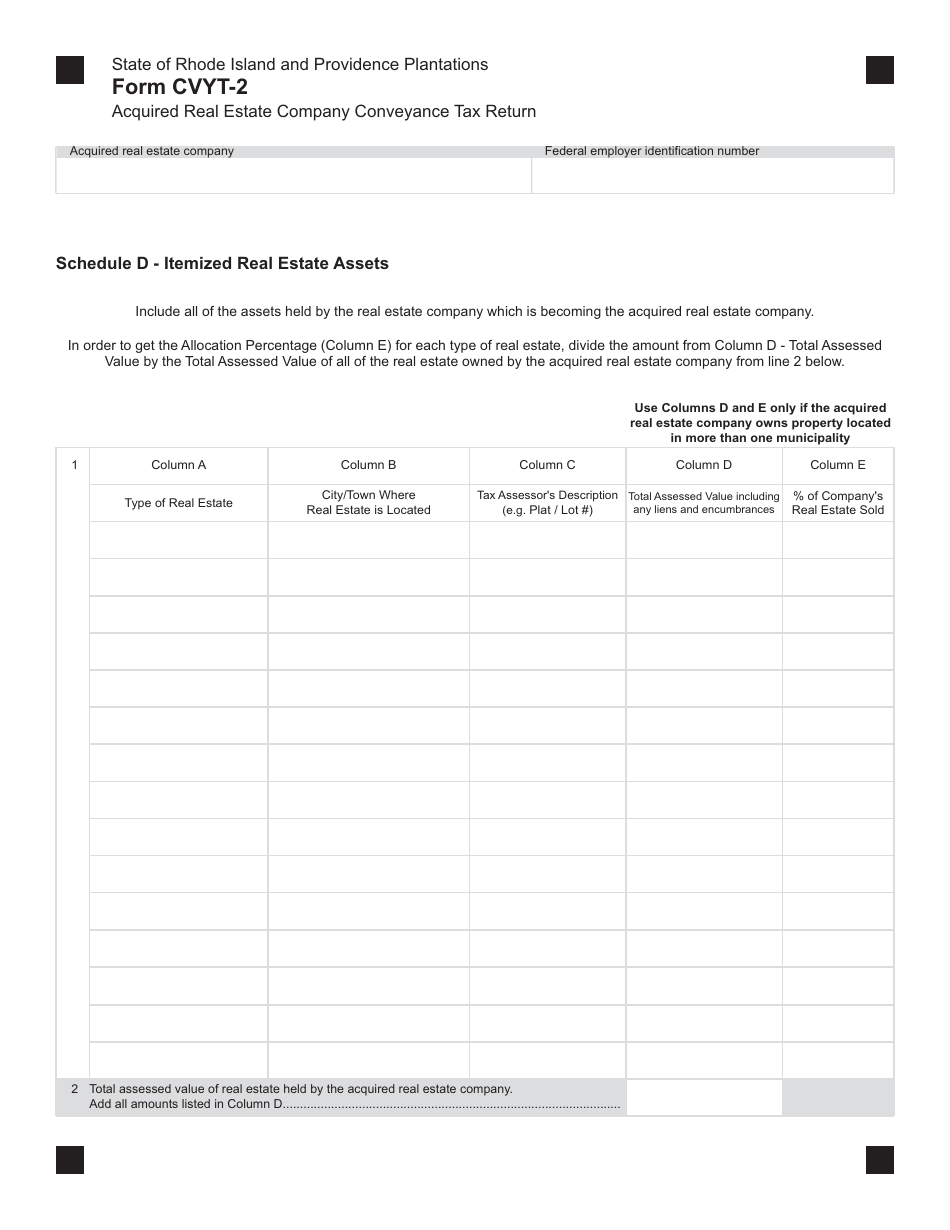

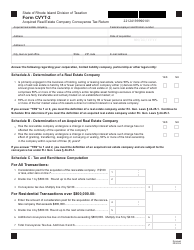

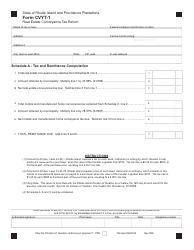

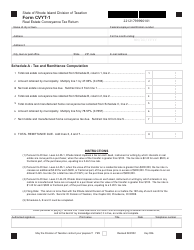

Form CVYT-2 Acquired Real Estate Company Conveyance Tax Return - Rhode Island

What Is Form CVYT-2?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVYT-2?

A: Form CVYT-2 is the Acquired Real Estate Company Conveyance Tax Return.

Q: Which state uses Form CVYT-2?

A: Form CVYT-2 is used in Rhode Island.

Q: What is the purpose of Form CVYT-2?

A: Form CVYT-2 is used to report and pay conveyance tax on the acquisition of real estate company in Rhode Island.

Q: Who needs to file Form CVYT-2?

A: Any person or entity acquiring a real estate company in Rhode Island may need to file Form CVYT-2.

Q: Are there any filing fees associated with Form CVYT-2?

A: Yes, there are filing fees associated with Form CVYT-2. The fee is based on the value of the real estate company being acquired.

Q: When is Form CVYT-2 due?

A: Form CVYT-2 is due within 30 days after the acquisition of the real estate company.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CVYT-2 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.