This version of the form is not currently in use and is provided for reference only. Download this version of

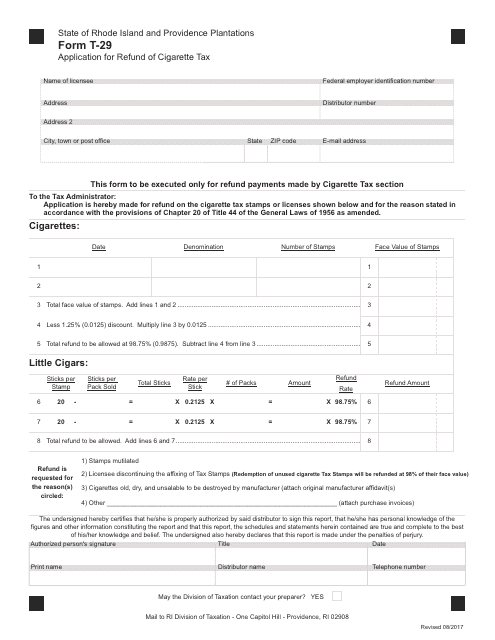

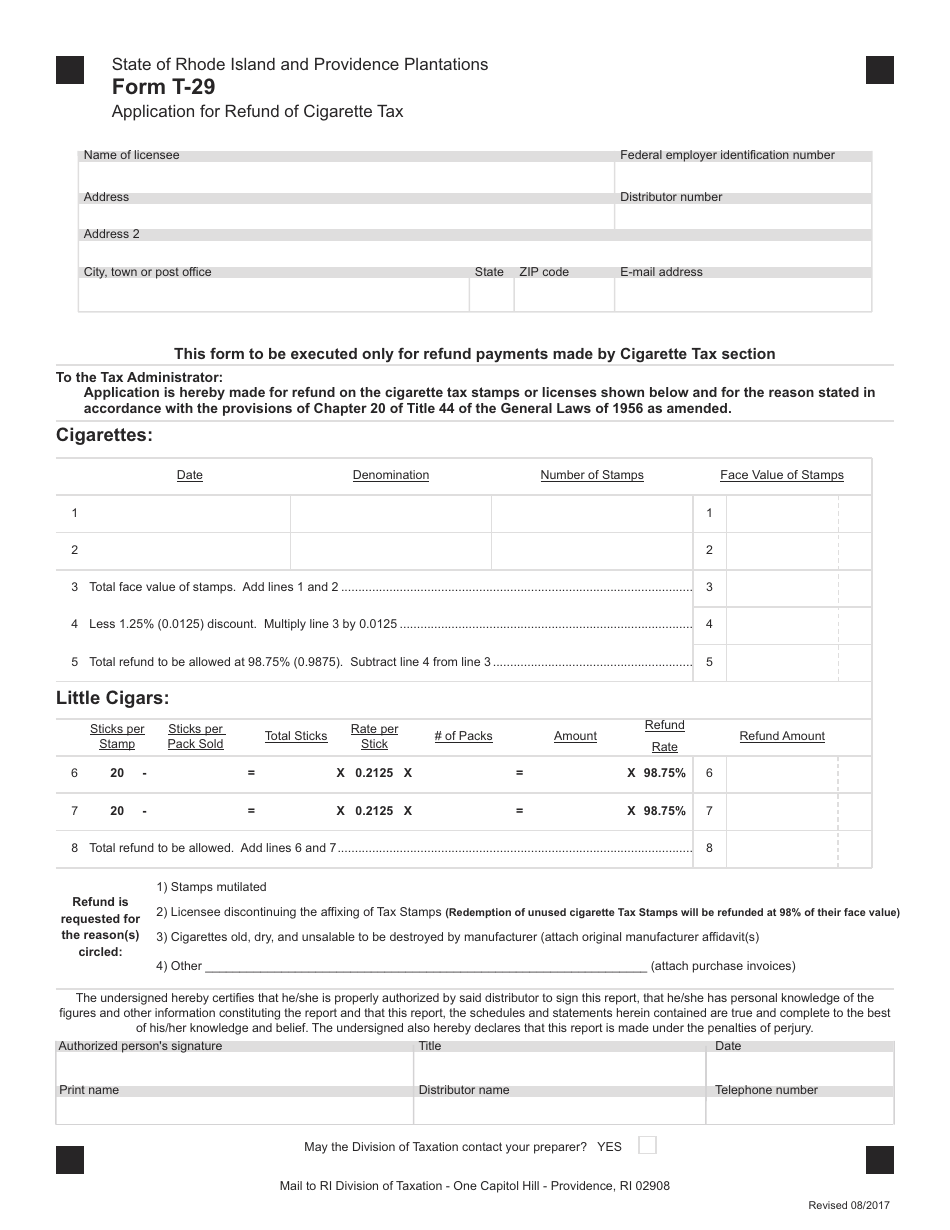

Form T-29

for the current year.

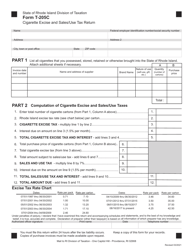

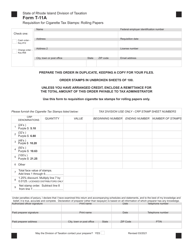

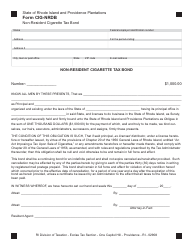

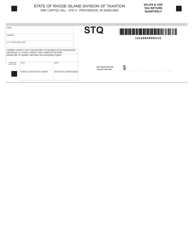

Form T-29 Application for Refund of Cigarette Tax - Rhode Island

What Is Form T-29?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-29?

A: Form T-29 is an application for refund of cigarette tax in Rhode Island.

Q: Who can use Form T-29?

A: Anyone who has paid cigarette tax in Rhode Island and is seeking a refund can use Form T-29.

Q: What is the purpose of Form T-29?

A: The purpose of Form T-29 is to request a refund of cigarette tax paid in Rhode Island.

Q: What supporting documents are required with Form T-29?

A: You may need to include copies of invoices, bills of lading, or other documentation that proves the purchase and shipment of the cigarettes.

Q: Is there a deadline for submitting Form T-29?

A: Yes, you must submit Form T-29 within one year from the date of purchase of the cigarettes.

Q: How long does it take to process a refund through Form T-29?

A: The processing time for a refund through Form T-29 can vary, but it generally takes several weeks to a few months.

Q: Is there a fee to file Form T-29?

A: No, there is no fee to file Form T-29.

Q: Can I amend my Form T-29 after submission?

A: No, once you have submitted Form T-29, you cannot amend it. You will need to file a new application if necessary.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-29 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.