This version of the form is not currently in use and is provided for reference only. Download this version of

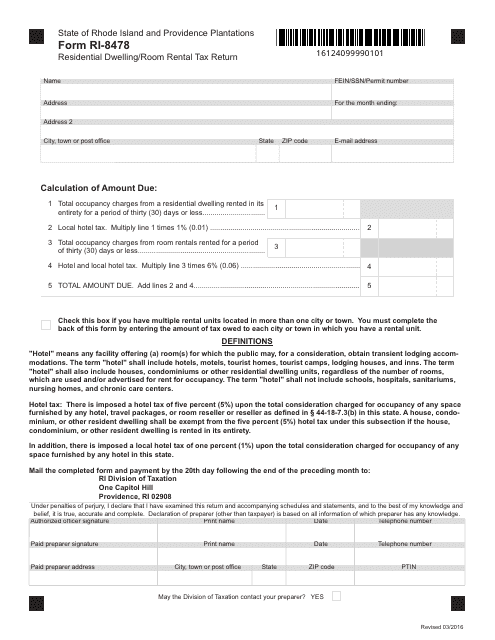

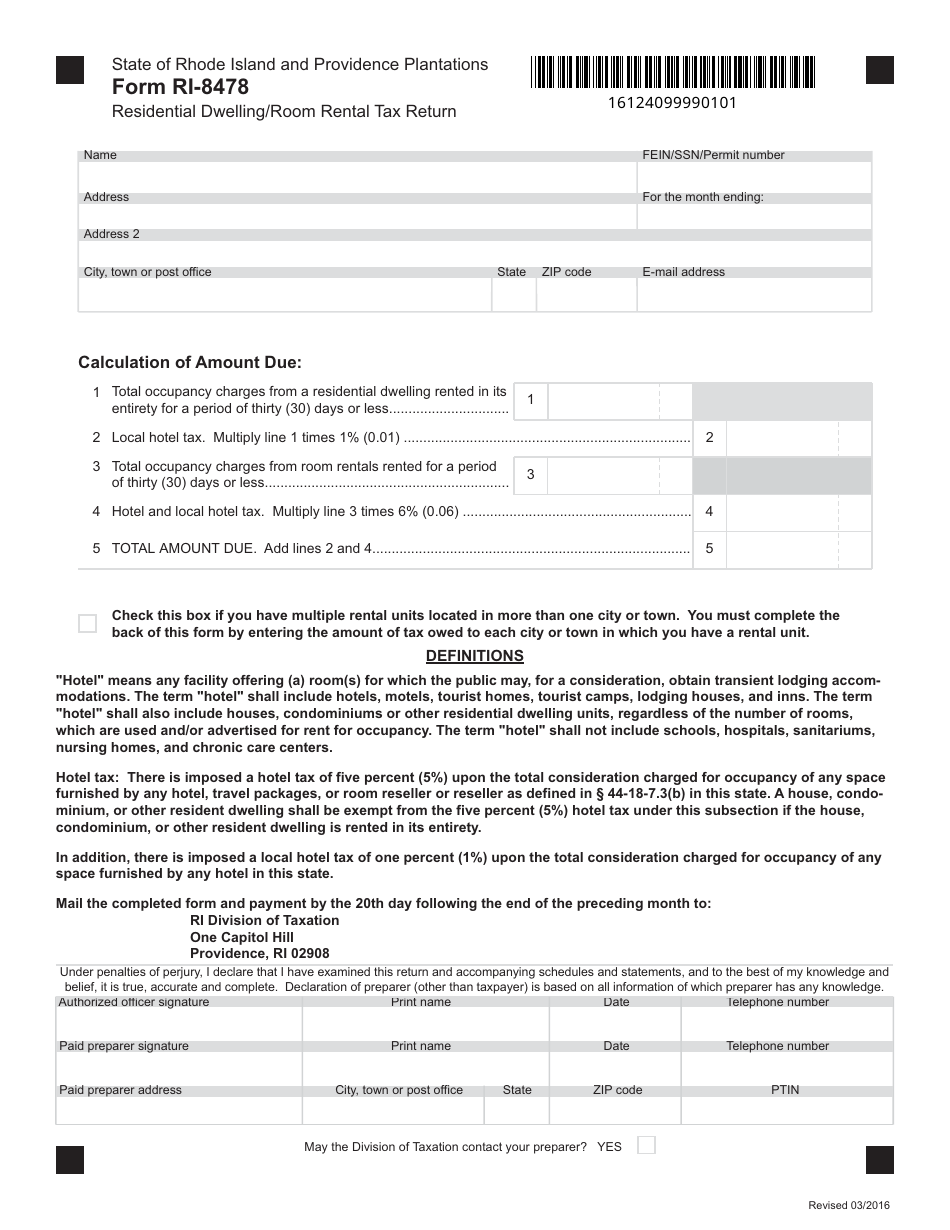

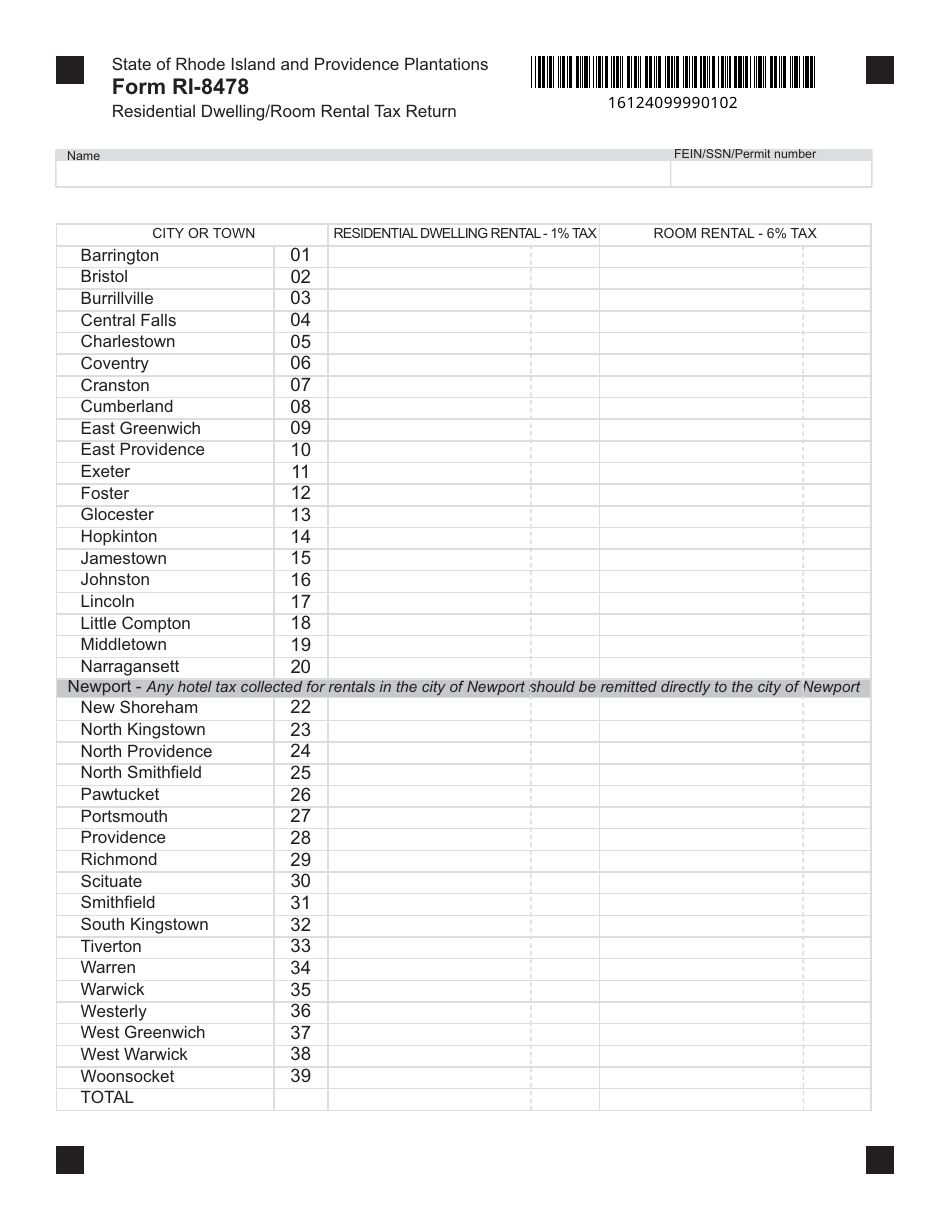

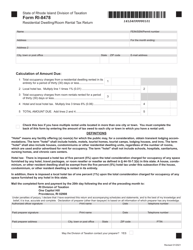

Form RI-8478

for the current year.

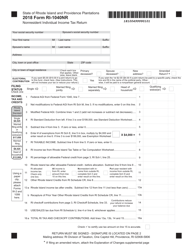

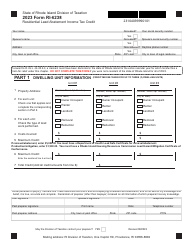

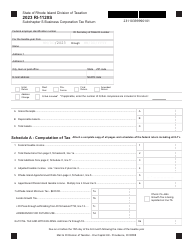

Form RI-8478 Residential Dwelling / Room Rental Tax Return - Rhode Island

What Is Form RI-8478?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-8478?

A: Form RI-8478 is the Residential Dwelling/Room Rental Tax Return in Rhode Island.

Q: Who needs to file Form RI-8478?

A: Individuals who rent out residential dwellings or rooms in Rhode Island need to file Form RI-8478.

Q: What information is required on Form RI-8478?

A: Form RI-8478 requires information about the rental property, income from rentals, expenses, and other related details.

Q: When is Form RI-8478 due?

A: Form RI-8478 is due on or before April 15th of the following year.

Q: Is there a penalty for late filing of Form RI-8478?

A: Yes, there is a penalty for late filing of Form RI-8478. The penalty amount varies depending on the number of days the return is late.

Q: Can I e-file Form RI-8478?

A: No, Form RI-8478 cannot be e-filed. It must be filed by mail with the Rhode Island Division of Taxation.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-8478 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.