This version of the form is not currently in use and is provided for reference only. Download this version of

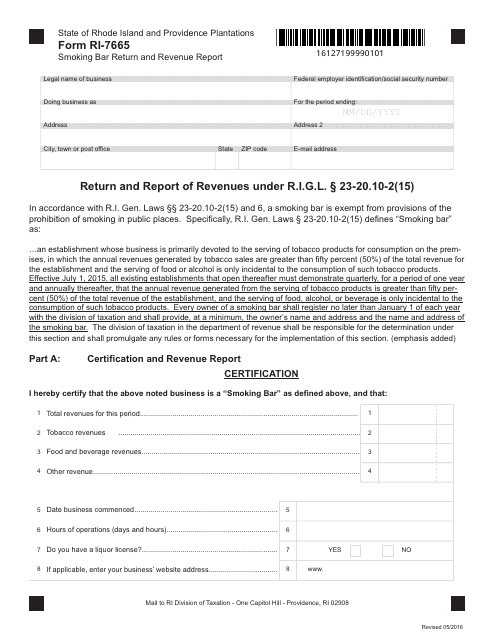

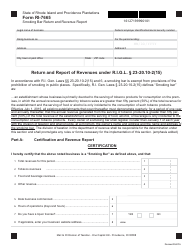

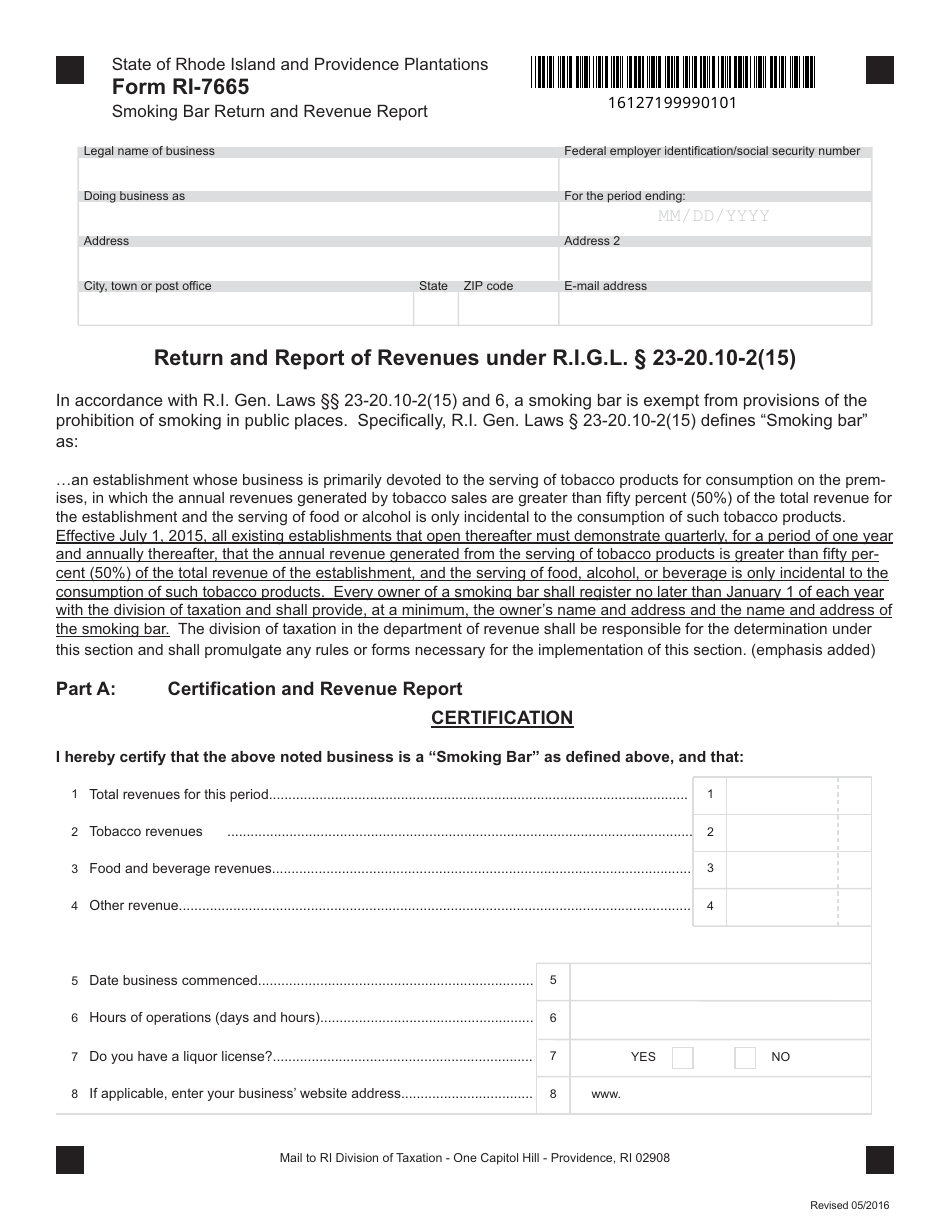

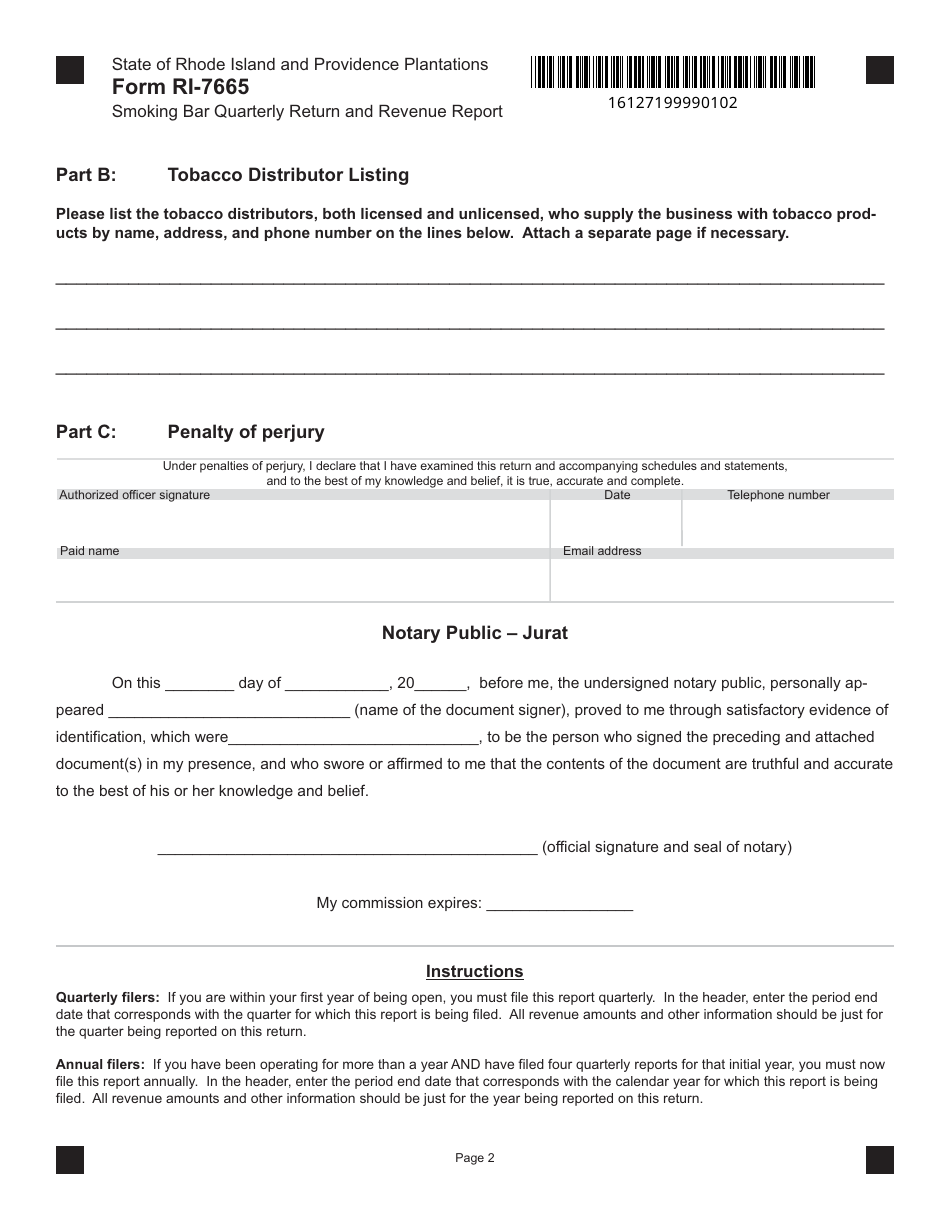

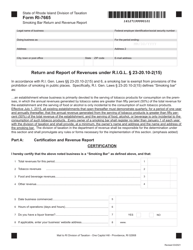

Form RI-7665

for the current year.

Form RI-7665 Smoking Bar Return and Revenue Report - Rhode Island

What Is Form RI-7665?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-7665?

A: The Form RI-7665 is a Smoking Bar Return and Revenue Report.

Q: What is the purpose of the Form RI-7665?

A: The purpose of the Form RI-7665 is to report revenue and taxes collected from smoking bars in Rhode Island.

Q: Who needs to file the Form RI-7665?

A: Smoking bars in Rhode Island need to file the Form RI-7665.

Q: What information is required on the Form RI-7665?

A: The Form RI-7665 requires information about the amount of tobacco products sold and the corresponding revenue.

Q: When is the due date for the Form RI-7665?

A: The due date for filing the Form RI-7665 is the 20th day of each month.

Q: What happens if I don't file the Form RI-7665?

A: Failure to file the Form RI-7665 may result in penalties and interest.

Q: Are there any exemptions from filing the Form RI-7665?

A: No, smoking bars in Rhode Island are required to file the Form RI-7665 regardless of revenue or sales volume.

Q: How often do I need to file the Form RI-7665?

A: The Form RI-7665 needs to be filed on a monthly basis.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-7665 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.