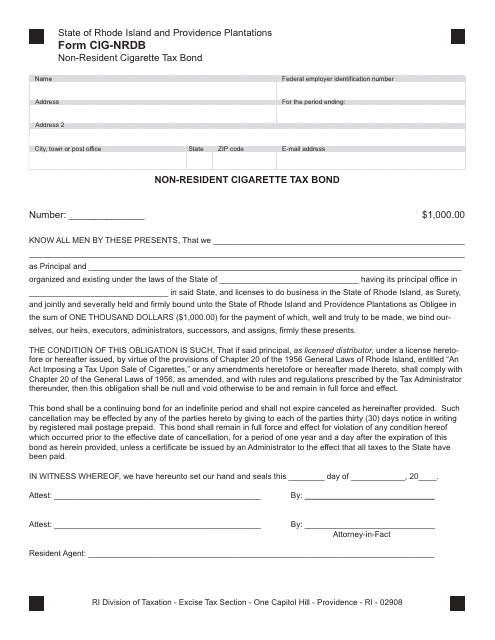

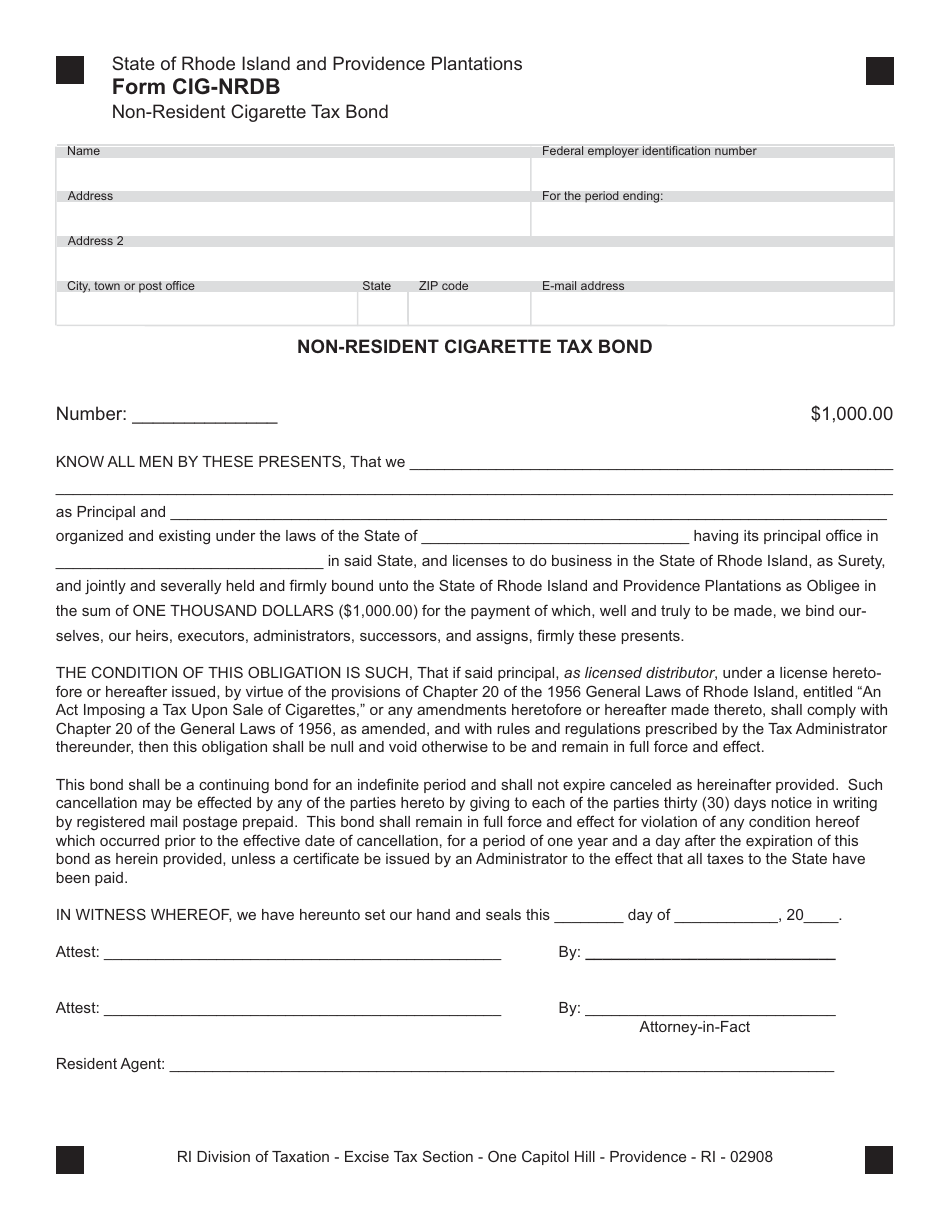

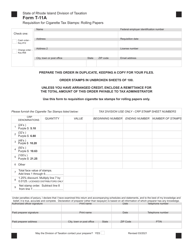

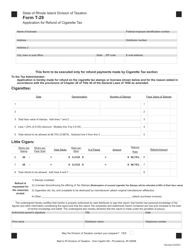

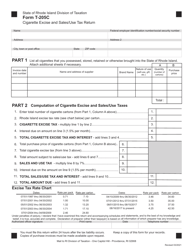

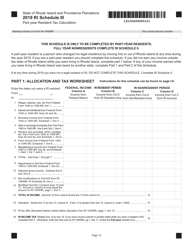

Form CIG-NRDB Non-resident Cigarette Tax Bond - Rhode Island

What Is Form CIG-NRDB?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CIG-NRDB Non-resident Cigarette Tax Bond?

A: The CIG-NRDB Non-resident Cigarette Tax Bond is a bond required by the state of Rhode Island for non-resident cigarette wholesalers.

Q: Who needs to get a CIG-NRDB Non-resident Cigarette Tax Bond?

A: Non-resident cigarette wholesalers operating in Rhode Island need to obtain a CIG-NRDB Non-resident Cigarette Tax Bond.

Q: Why is the CIG-NRDB Non-resident Cigarette Tax Bond required?

A: The bond is required as a guarantee that the non-resident cigarette wholesaler will pay all applicable taxes and comply with the laws and regulations of Rhode Island.

Q: How much does the CIG-NRDB Non-resident Cigarette Tax Bond cost?

A: The cost of the bond varies depending on the specific circumstances of the applicant. It is best to contact a surety bond provider for an accurate quote.

Q: How long does it take to get a CIG-NRDB Non-resident Cigarette Tax Bond?

A: The time it takes to get a CIG-NRDB Non-resident Cigarette Tax Bond can vary. It is best to contact a surety bond provider to get an estimate.

Q: What happens if a non-resident cigarette wholesaler fails to comply with the bond requirements?

A: If a non-resident cigarette wholesaler fails to comply with the bond requirements, the state of Rhode Island can make a claim on the bond to recover any unpaid taxes or other damages.

Q: Can the CIG-NRDB Non-resident Cigarette Tax Bond be canceled?

A: Yes, the CIG-NRDB Non-resident Cigarette Tax Bond can be canceled. However, the surety bond provider may require a notice period and may also require the principal to provide an alternative form of financial security.

Q: Is the CIG-NRDB Non-resident Cigarette Tax Bond the same as insurance?

A: No, the CIG-NRDB Non-resident Cigarette Tax Bond is not the same as insurance. It is a financial guarantee that the bondholder will fulfill their obligations.

Q: Are there any alternatives to the CIG-NRDB Non-resident Cigarette Tax Bond?

A: Yes, the state of Rhode Island may accept alternative forms of financial security, such as cash deposits or letters of credit, in place of the bond.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIG-NRDB by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.