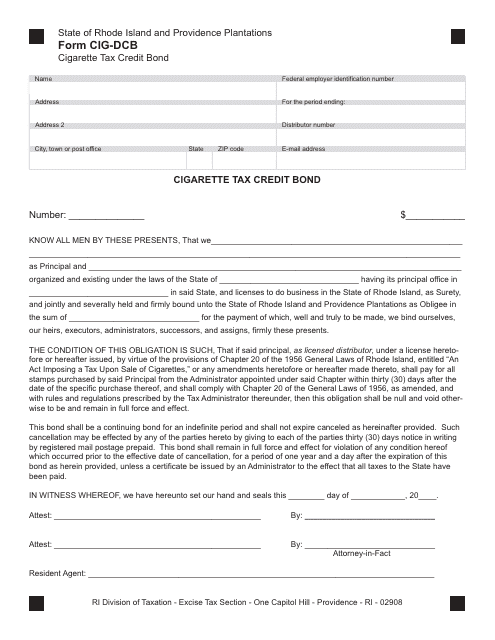

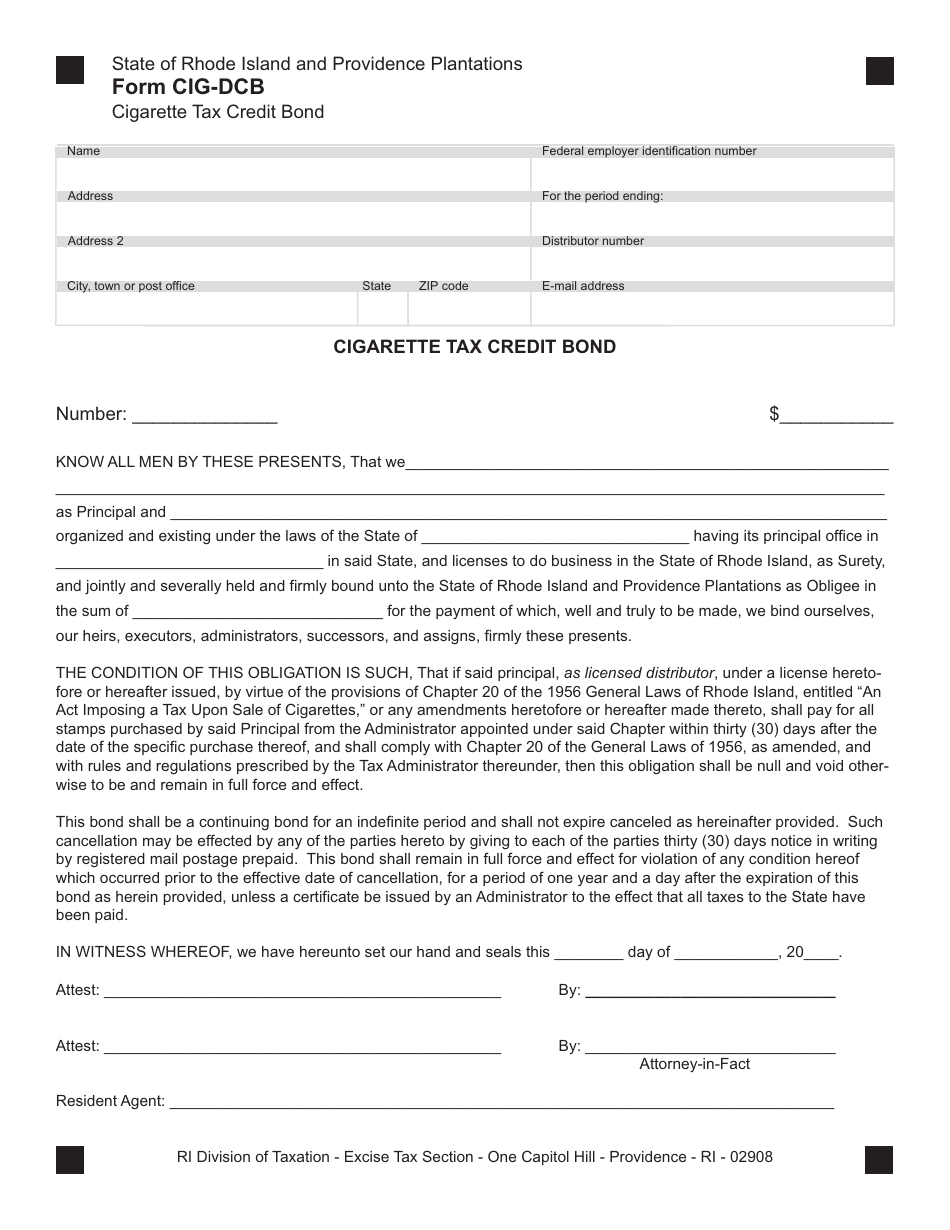

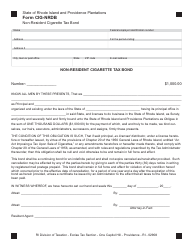

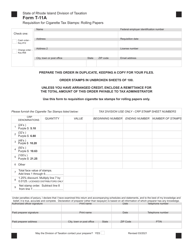

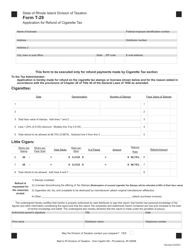

Form CIG-DCB Cigarette Tax Credit Bond - Rhode Island

What Is Form CIG-DCB?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CIG-DCB Cigarette Tax Credit Bond?

A: The CIG-DCB Cigarette Tax Credit Bond is a type of bond issued by the state of Rhode Island to provide tax credits to qualified cigarette manufacturers.

Q: How does the CIG-DCB Cigarette Tax Credit Bond work?

A: The bond is issued to cigarette manufacturers who meet certain eligibility criteria. The manufacturers can then use the bond to receive tax credits against their cigarette tax liabilities.

Q: Who is eligible to receive the CIG-DCB Cigarette Tax Credit Bond?

A: Cigarette manufacturers who meet specific requirements set by the state of Rhode Island are eligible to receive the bond.

Q: What are the benefits of the CIG-DCB Cigarette Tax Credit Bond?

A: The bond allows eligible cigarette manufacturers to reduce their tax liabilities by receiving tax credits.

Q: How can a cigarette manufacturer apply for the CIG-DCB Cigarette Tax Credit Bond?

A: Cigarette manufacturers can apply for the bond by following the application process set by the state of Rhode Island. They may need to provide certain documents and meet specific criteria to be eligible.

Q: Are there any limitations or restrictions associated with the CIG-DCB Cigarette Tax Credit Bond?

A: Yes, there may be certain limitations and restrictions on the use of the bond. These will be outlined in the official guidelines provided by the state of Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIG-DCB by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.