This version of the form is not currently in use and is provided for reference only. Download this version of

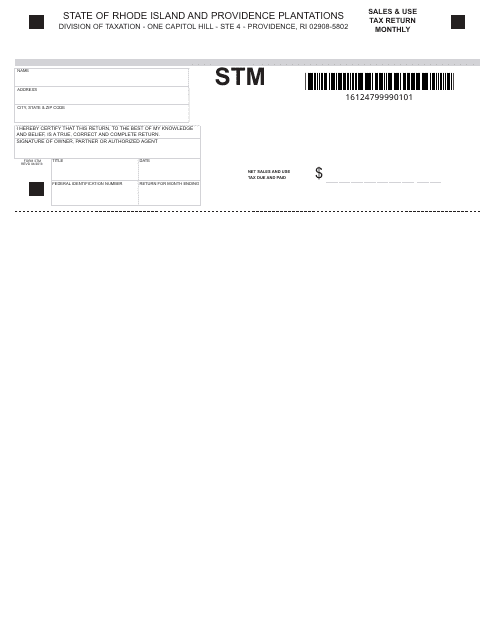

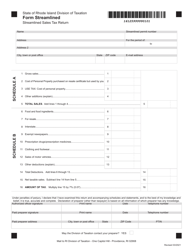

Form STM

for the current year.

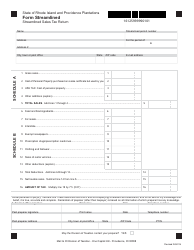

Form STM Sales & Use Tax Return - Monthly - Rhode Island

What Is Form STM?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the STM Sales & Use Tax Return?

A: The STM Sales & Use Tax Return is a form used by businesses in Rhode Island to report and pay sales and use tax.

Q: Who needs to file the STM Sales & Use Tax Return?

A: Businesses that sell taxable goods or services in Rhode Island are generally required to file the STM Sales & Use Tax Return.

Q: How often do I need to file the STM Sales & Use Tax Return?

A: The STM Sales & Use Tax Return is filed on a monthly basis.

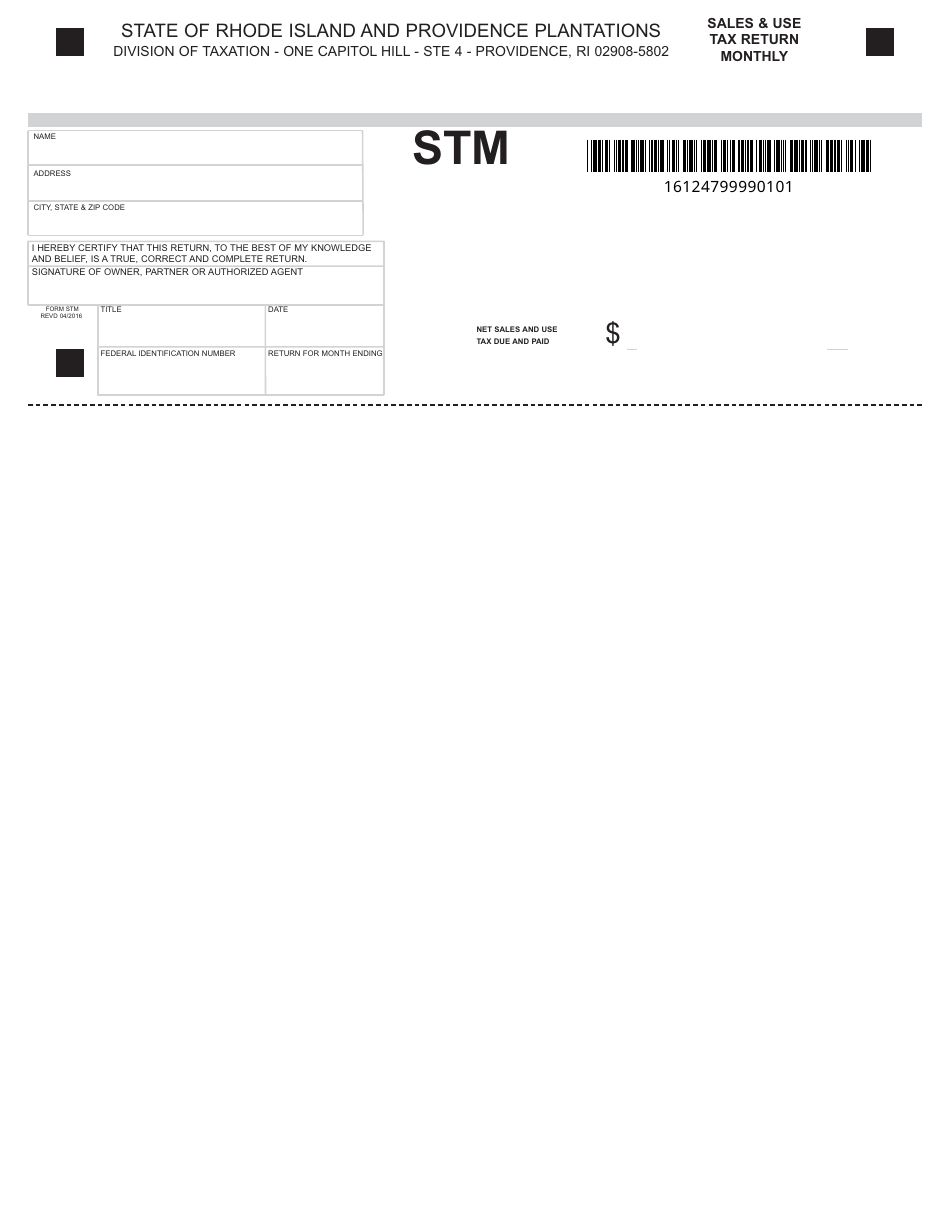

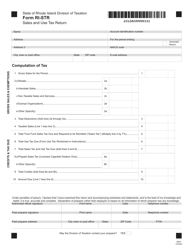

Q: What information is required to complete the STM Sales & Use Tax Return?

A: You will need to provide information about your business, total sales made during the reporting period, and the amount of sales and use tax owed.

Q: When is the deadline for filing the STM Sales & Use Tax Return?

A: The STM Sales & Use Tax Return is due by the 20th day of the following month.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and possible fines.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STM by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.