This version of the form is not currently in use and is provided for reference only. Download this version of

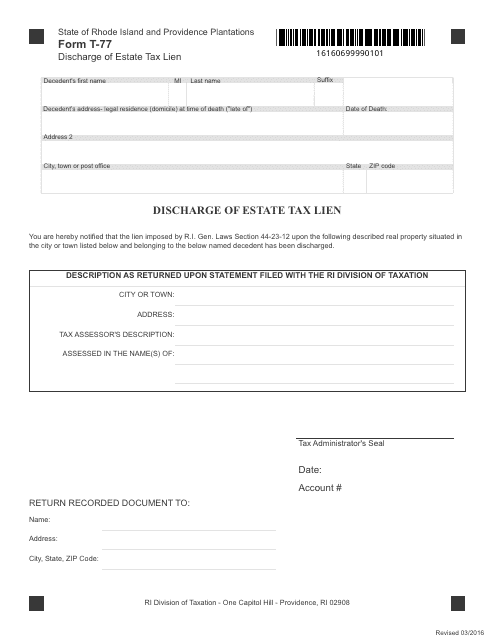

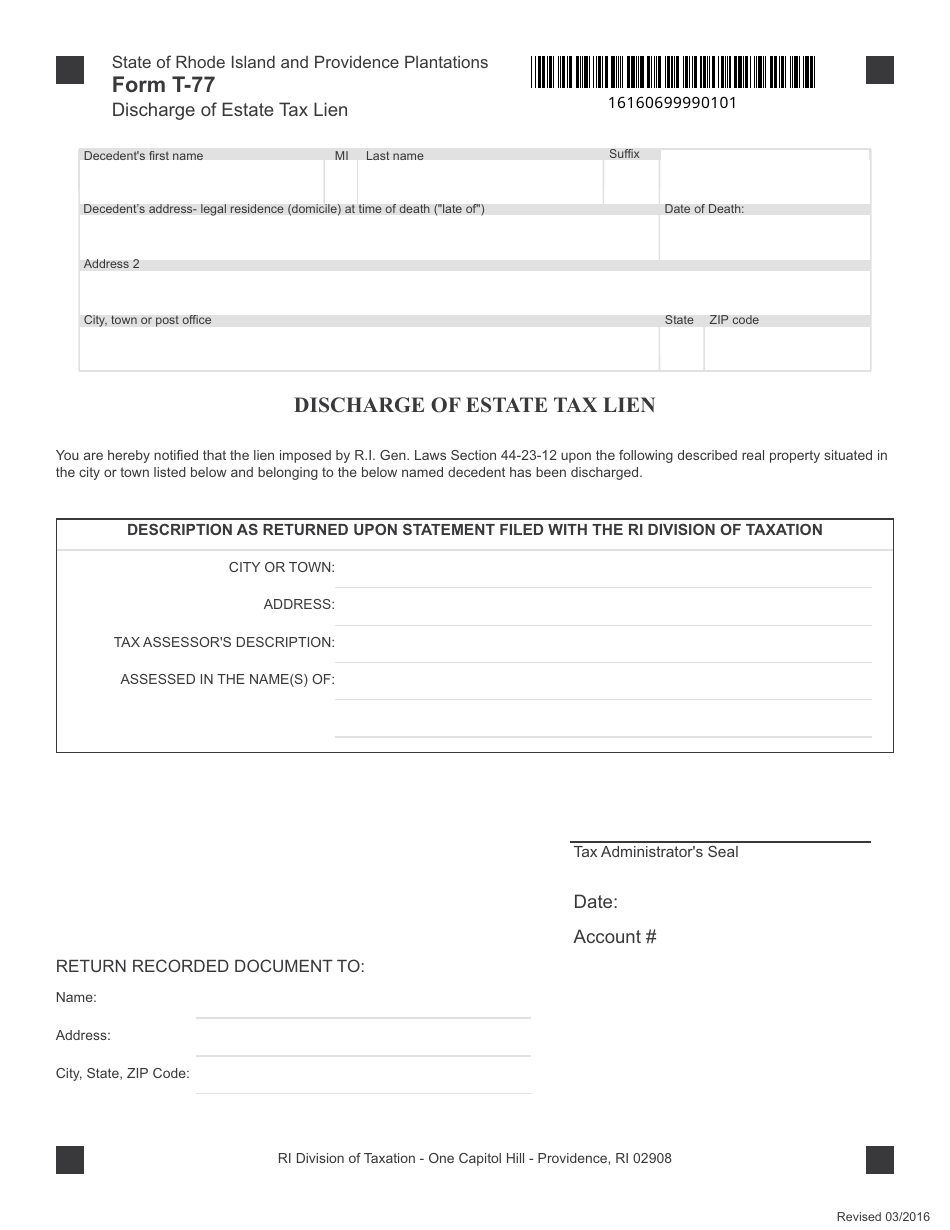

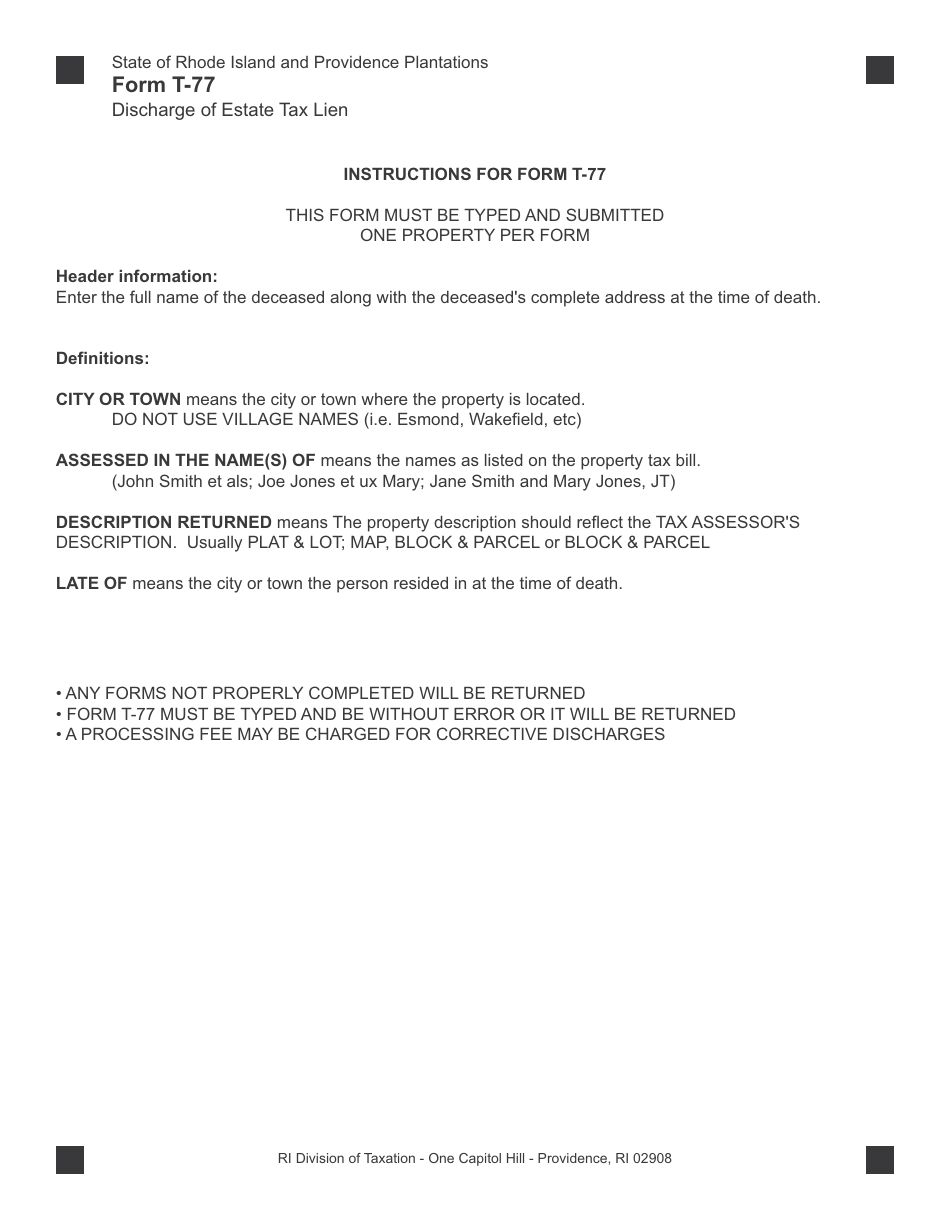

Form T-77

for the current year.

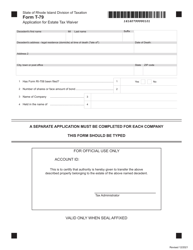

Form T-77 Discharge of Estate Tax Lien - Rhode Island

What Is Form T-77?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-77?

A: Form T-77 is a document used in Rhode Island to discharge an estate tax lien.

Q: What is an estate tax lien?

A: An estate tax lien is a legal claim against the property of a deceased person in order to collect unpaid estate taxes.

Q: When is Form T-77 used?

A: Form T-77 is used when the estate tax lien has been satisfied and needs to be released.

Q: Who should fill out Form T-77?

A: The executor or administrator of the estate should fill out Form T-77.

Q: What supporting documents are required with Form T-77?

A: Supporting documents such as a certificate of discharge from the Rhode Island Division of Taxation may be required with Form T-77.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-77 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.