This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-2210PT

for the current year.

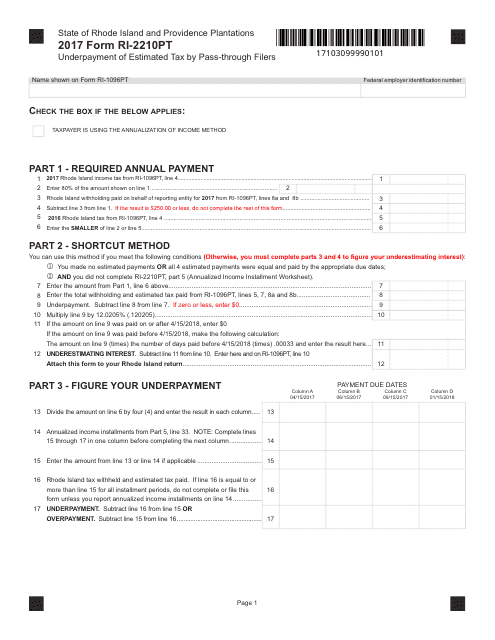

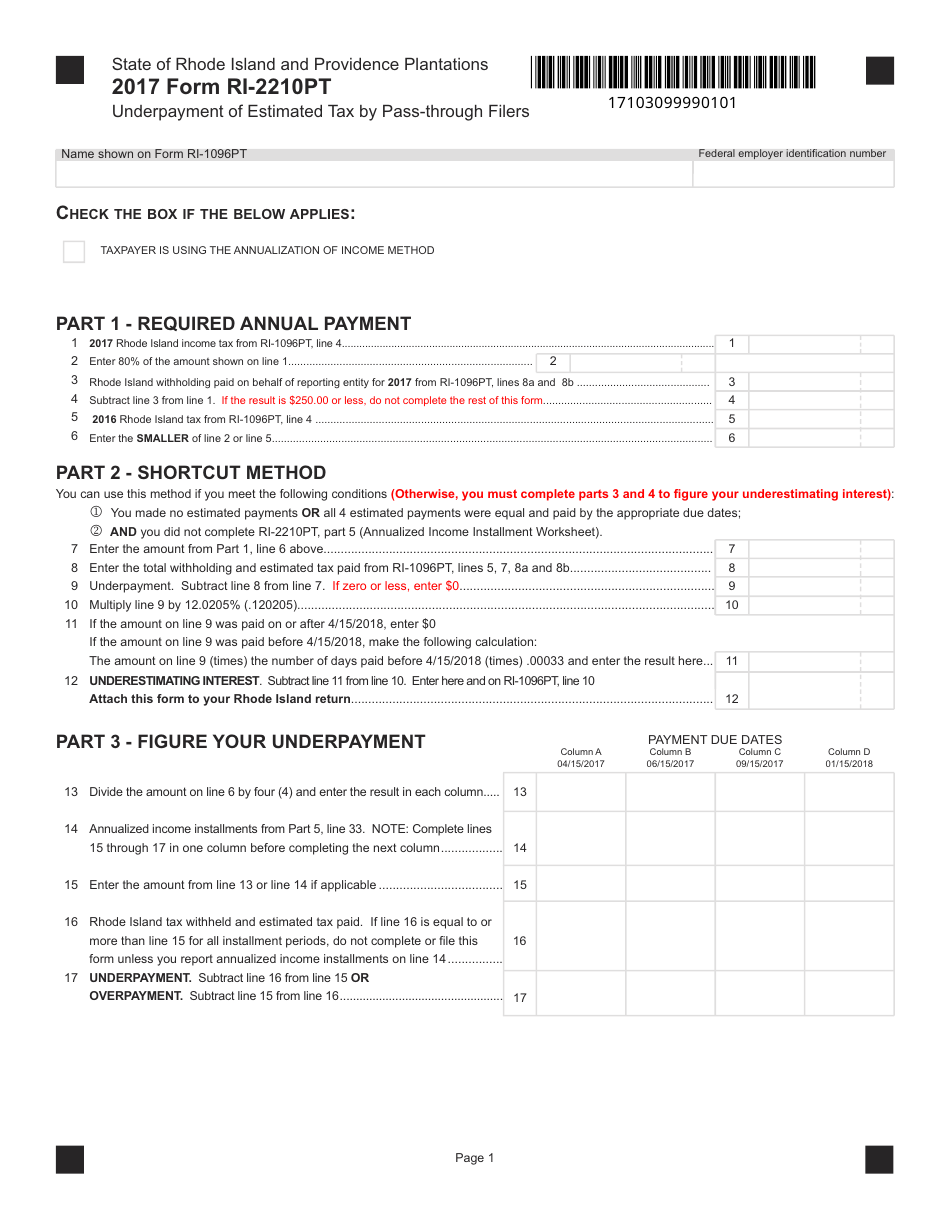

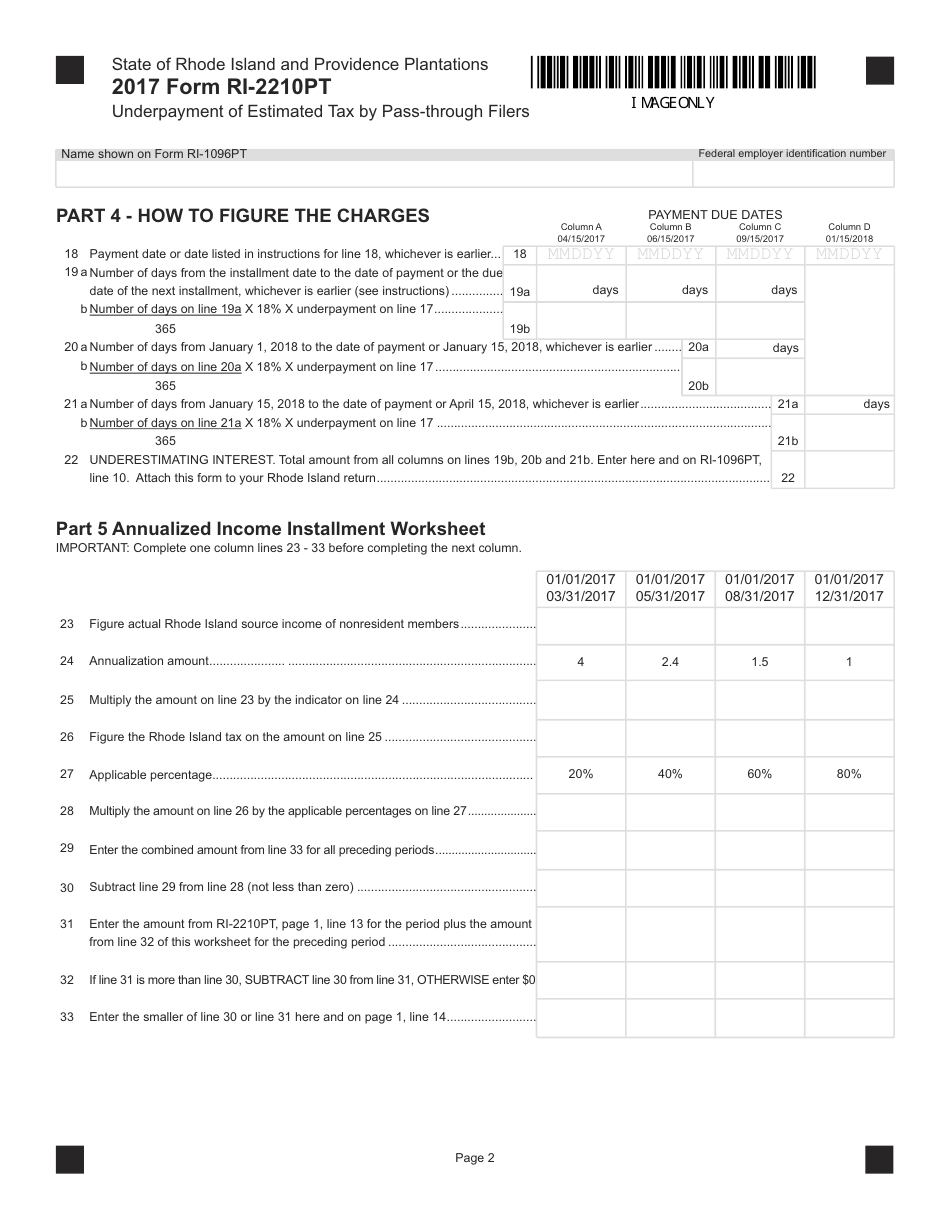

Form RI-2210PT Underpayment of Estimated Tax by Pass-Through Filers - Rhode Island

What Is Form RI-2210PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2210PT?

A: Form RI-2210PT is used to calculate and report the underpayment of estimated tax by pass-through filers in Rhode Island.

Q: Who needs to file Form RI-2210PT?

A: Pass-through filers in Rhode Island who have underpaid their estimated tax are required to file Form RI-2210PT.

Q: What is the purpose of Form RI-2210PT?

A: The purpose of Form RI-2210PT is to calculate and determine any penalties owed for underpayment of estimated tax by pass-through filers in Rhode Island.

Q: When should Form RI-2210PT be filed?

A: Form RI-2210PT should be filed by pass-through filers in Rhode Island when they have underpaid their estimated tax.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.