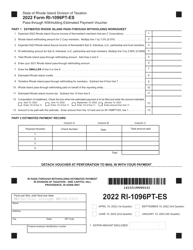

This version of the form is not currently in use and is provided for reference only. Download this version of

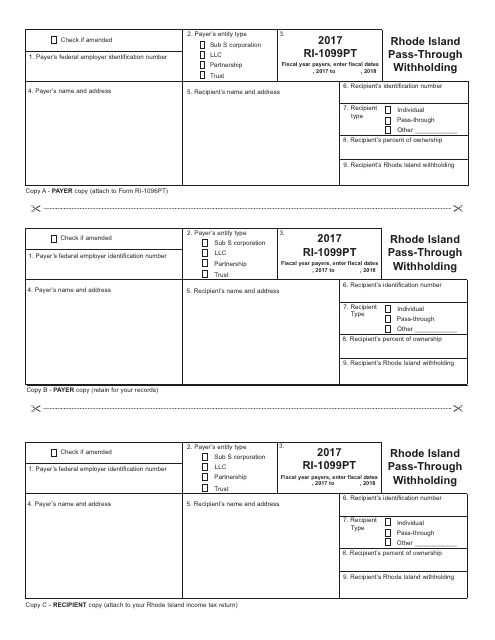

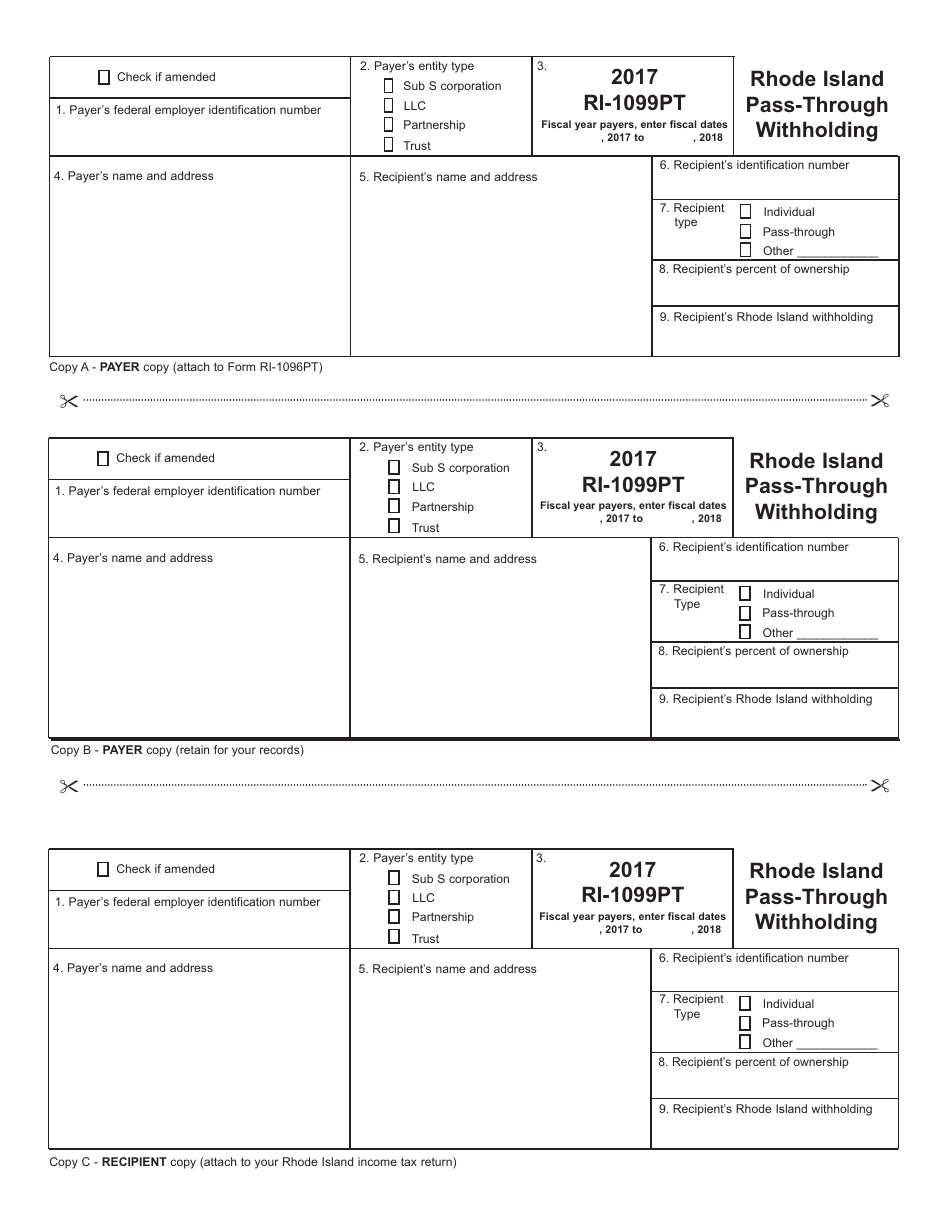

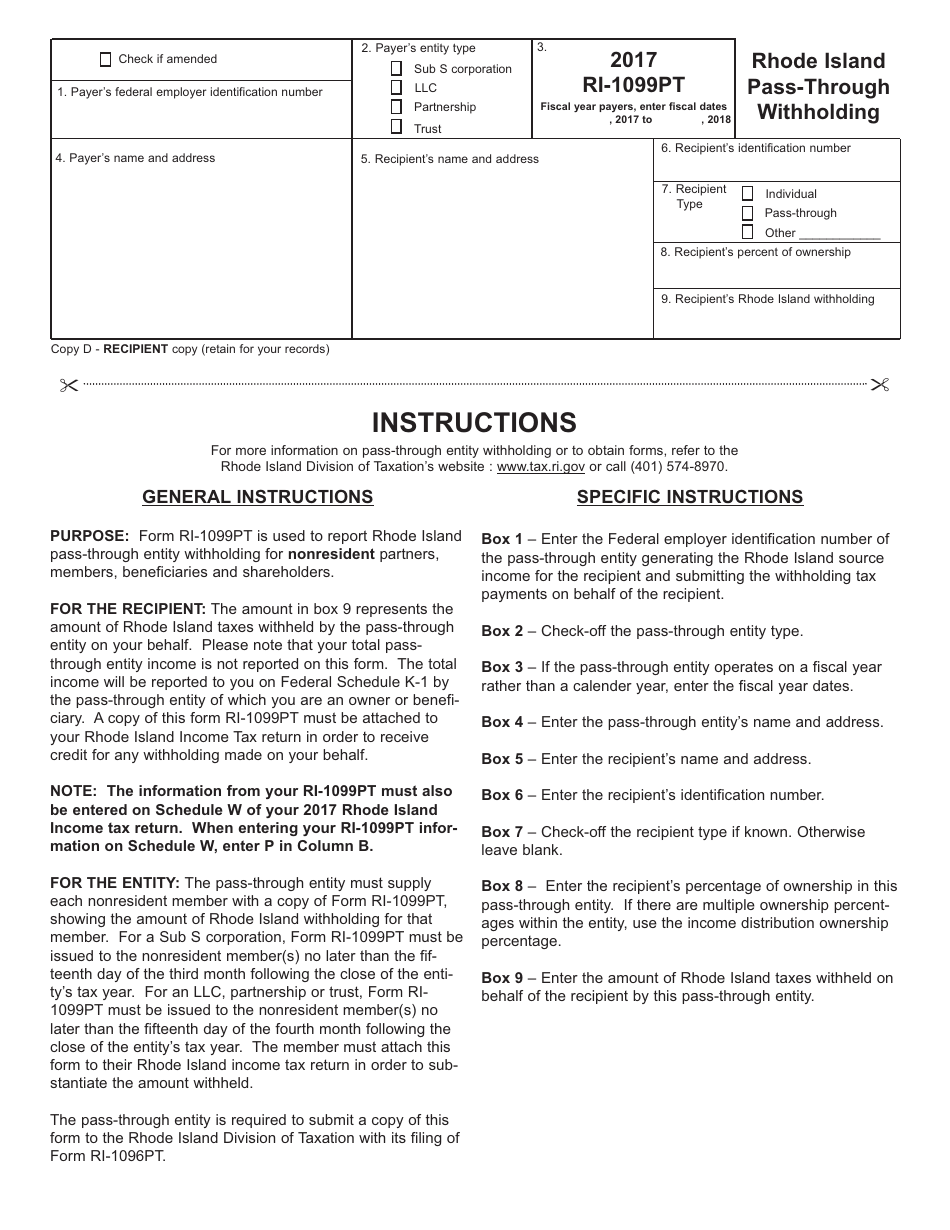

Form RI-1099PT

for the current year.

Form RI-1099PT Rhode Island Pass-Through Withholding - Rhode Island

What Is Form RI-1099PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1099PT?

A: Form RI-1099PT is the Rhode Island Pass-Through Withholding form.

Q: What is Rhode Island Pass-Through Withholding?

A: Rhode Island Pass-Through Withholding is the state's requirement for certain entities to withhold income tax on behalf of nonresident members or partners.

Q: Who needs to file Form RI-1099PT?

A: Entities that are required to withhold Rhode Island income tax for nonresident members or partners need to file Form RI-1099PT.

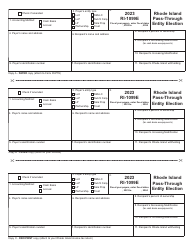

Q: What information is needed to complete Form RI-1099PT?

A: To complete Form RI-1099PT, you will need to provide information about the entity, the nonresident members or partners, and the amount of income subject to withholding.

Q: When is Form RI-1099PT due?

A: Form RI-1099PT is due on or before the last day of February following the calendar year in which the income subject to withholding was paid.

Q: Do I need to submit Form RI-1099PT if there was no income subject to withholding?

A: No, if there was no income subject to withholding, you do not need to submit Form RI-1099PT.

Q: Is there a penalty for late filing of Form RI-1099PT?

A: Yes, there is a penalty for late filing of Form RI-1099PT. The penalty amount is based on the number of days the form is late and the amount of tax required to be withheld.

Q: Can I e-file Form RI-1099PT?

A: No, as of now, Form RI-1099PT cannot be e-filed. It must be filed by mail or in person.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1099PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.